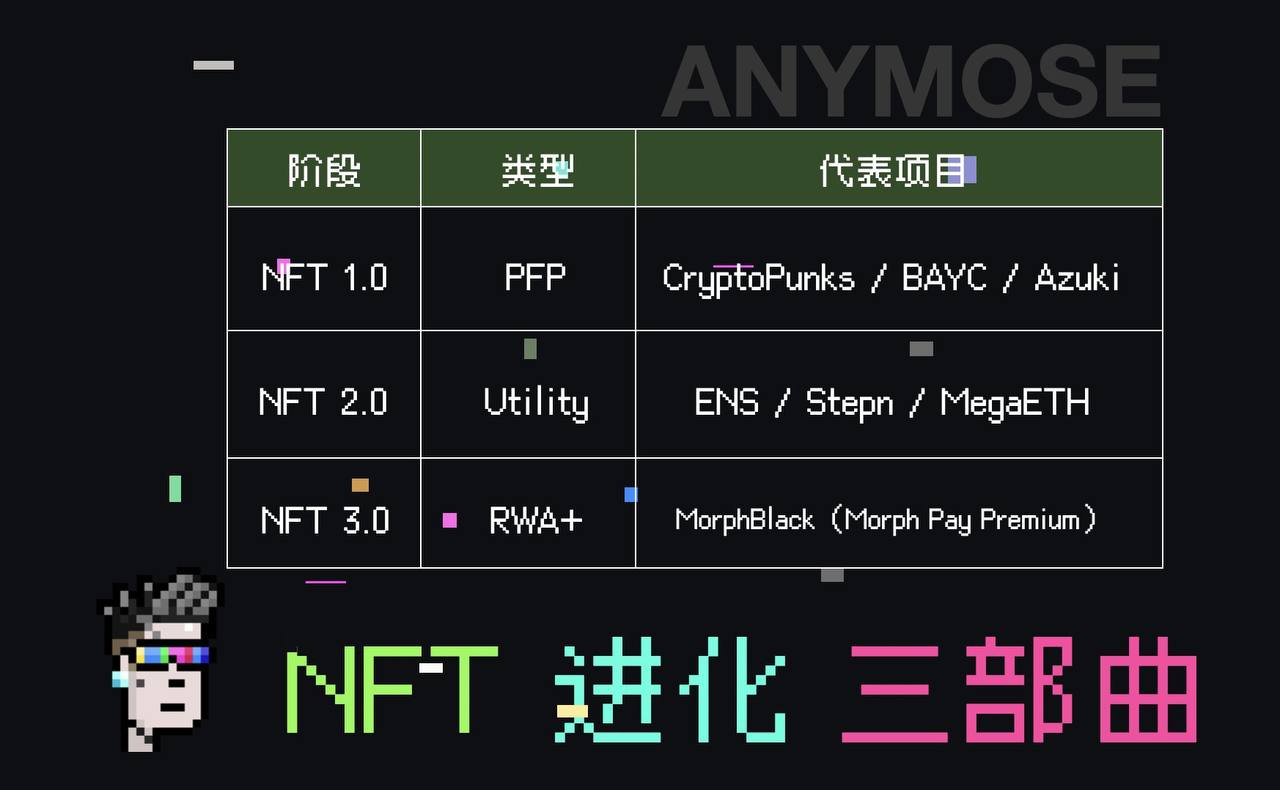

Each Crypto cycle contains a narrative of decentralization, from the early ICO to the DeFi Summer of 2021, and to the on-chain narrative of this cycle. Different asset issuance methods and changes in financial rights are profoundly influencing the development of Web3. At the Crypto Native level, Non-Fungible Token has officially entered the 3.0 era; at the Web2 traffic entry level, PayFi, which connects traditional finance with the Web3 world, is the next billion-dollar track that will change the world.

On February 25th, Morph, a global consumer-grade public chain dedicated to promoting Web3 mass adoption, officially launched Morph Pay, a comprehensive financial ecosystem that integrates Web2 banking infrastructure with Web3 decentralized financial earning capabilities. Morph Pay is not just a traditional pay card, but a product of the era under the RWA+Non-Fungible Token 3.0 wave.

This article will explore Morph Pay's breakthrough in the PayFi track and the iterative logic of Non-Fungible Token from 1.0 to 3.0.

PayFi, But Not Just PayFi

PayFi creates new financial primitives and product experiences based on the time value of money, creatively constructing the capital circulation in financial markets. Estimated market size in the payment sector alone exceeds 40 trillion dollars, with PayFi currently expanding in only a small portion of this market. Conservatively, if PayFi could capture 10% of global digital payment transaction volume, the PayFi market size is estimated to reach 1.8 trillion dollars by 2030.

One-Click Payment Tool with 30% APY Integration

The pain point in the payment track is the complex multi-party review and manual processes in traditional finance and capital supply chains. Simple remittance not only requires filling out complicated application forms but also waiting for bank manual approval, with high cross-border fees and processing costs that traditional payment cannot offset for consumers.

Observing from this era's perspective, Morph Pay solves the difficulties of traditional payment for users. Leveraging platform-level advantages, Morph Pay will support multi-currency payment functions and Google Pay and Apple Pay, enabling convenient cross-border payments with just a password input.

As a payment product launched by the consumer-grade public chain Morph, Morph Pay will not only create a one-stop DeFi yield aggregation solution for users, supporting up to 30% annual yield on crypto asset deposits, but also allow users to automatically use DeFi yields for daily payments through smart contracts, achieving seamless asset appreciation and payment scenarios. Additionally, users will be able to participate in exclusive ecosystem airdrops and incentive activities from Morph and its ecosystem partners, such as the currently booming BulbaSwap and Momodrome.

Buy Now Pay Never is no longer an empty check and industry slogan drawn on a PPT.

Luxury Black Card with Web2 Large-Scale Application

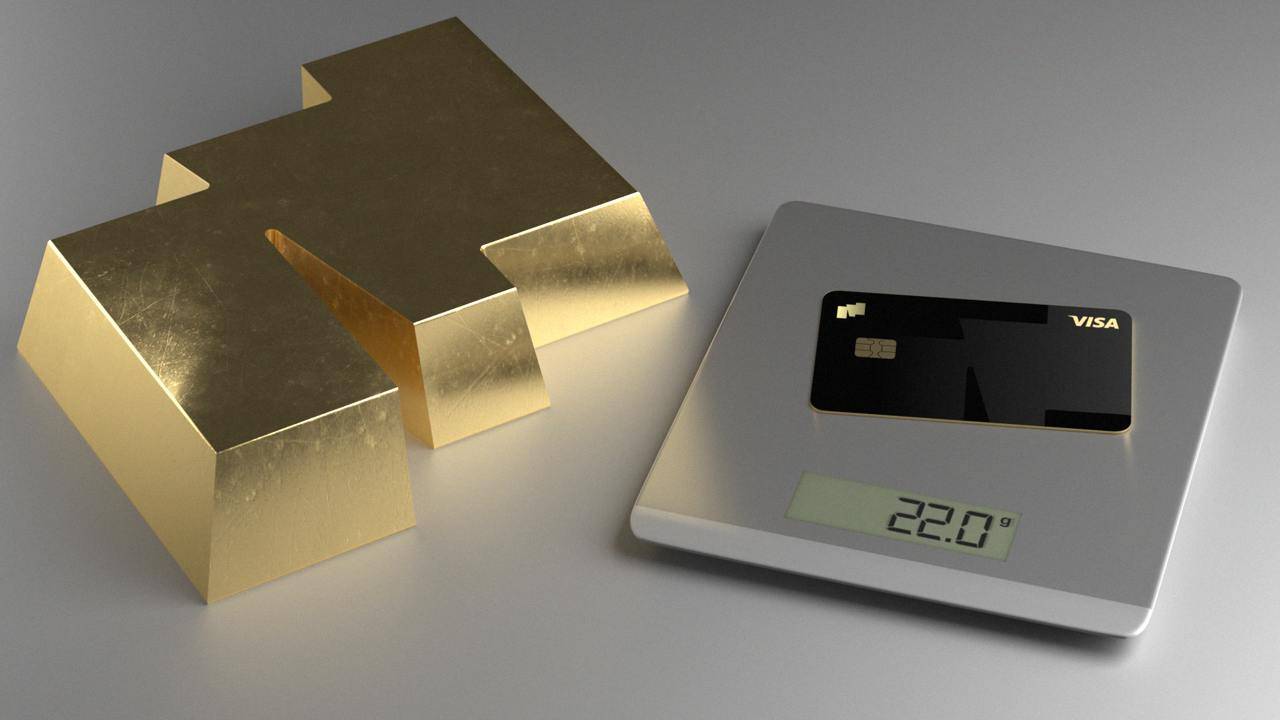

MorphBlack, as the flagship version of Morph Pay, is crafted from 22-gram black gold material, combining financial tools and luxury attributes.

In traditional finance, black cards are often seen as symbols of wealth and identity, representing the cardholder's extremely high economic power and social status. For example, American Express Centurion Black Card holders are often national leaders, billionaires, and social elites. In China, black card holders are also viewed as top-tier bank customers. The first black card for young people, Morph Black, has "boldly" launched high-end financial services in the crypto world: cardholders can enjoy global airport lounges, high-end hotel discounts, and other hidden privileges. With lifetime fee waiver, no lock-up restrictions, instant fiat conversion, and other services, it provides users with a friction-free experience, truly realizing "crypto assets available instantly".

However, Morph Pay is not limited to reinventing PayFi. While providing users with a better payment experience, the emergence of MorphBlack announces the official arrival of the Non-Fungible Token 3.0 era with a single physical card.

Initiating Financial Infrastructure from Non-Fungible Token 3.0

In 2022, the Non-Fungible Token market experienced an unprecedented bubble burst. The dramatic fall of high-priced Non-Fungible Tokens like BAYC and Azuki led many to proclaim "Non-Fungible Token is dead", but the truth is far from the surface. Just as Google and Amazon were born after the internet bubble, Non-Fungible Token's evolution never stopped. It is moving from "bubble carnival" to "virtual-real symbiosis", and Non-Fungible Token has never died; it has only shed its flashy exterior and evolved into a more resilient form. When MorphBlack materializes Non-Fungible Token into a bank card, it changes not just the payment method, but the financial structure of digital and physical worlds.

[The translation continues in the same manner for the rest of the text.]From a horizontal perspective, Morph Black has pioneered a comprehensive financial ecosystem that integrates Web2 banking infrastructure with Web3 DeFi earning capabilities. Morph Pay supports withdrawals of up to 1 million USDT without review, completely solving the difficulties of large asset liquidation. Meanwhile, the Morph Pay team has also created an extreme rate and cashback system. The cryptocurrency exchange rate is as low as 0.3%, and cross-border consumption enjoys a 1% cash rebate, releasing the real purchasing power of digital assets in daily scenarios without fear of withdrawal challenges. Morph Black is among the first to truly map Real World Assets (RWA) to on-chain equity and implement it in the Web2 world, marking the acceleration of Non-Fungible Token 3.0.

Summary

In the current PayFi track, traditional U cards essentially draw traffic from Web2 to Web3, fundamentally being savings cards that attract external traffic with high Crypto APY. Morph Pay is the first actual Web3 U card that combines on-chain equity and the Morph ecosystem, thoroughly connecting Crypto Native to real-world Web2 scenarios from the inside out.

As a global consumer-level public chain that has not yet launched TGE and with the Morph ecosystem continuously improving, it will subsequently collaborate with more projects, financial institutions, and payment solutions to expand the integration depth between Morph Pay and the Morph ecosystem, constructing broader application scenarios. Morph Pay's journey from PayFi to Non-Fungible Token 3.0 intervention is just the beginning, and everything is still early. Here, every consumption is "Buy Now Pay Never"; here, every payment is a push towards the NFT equity era. In this era of profound transformation, Morph Pay will reshape the future Web3 financial landscape with 22 grams of "soul weight".