Recently, the cryptocurrency market has been showing a narrow range of oscillation, with BTC price continuously fluctuating between $70,000 and $90,000. In the absence of significant positive catalysts, the community has shifted its focus to some projects yet to undergo TGE. After more than a year of ecosystem building cycle, the TGE time for some top Bitcoin ecosystem protocol projects is approaching the critical point.

Recently, Bitlayer Co-founder Kevin He made concentrated responses to community concerns about project TGE, high on-chain gas fees, weak official asset helmet empowerment, and ecosystem wealth creation effects, and specifically disclosed the technical progress and future plans of BitVM.

Additionally, to better collect community feedback, the Bitlayer team initiated a community development proposal collection. Participants can provide effective suggestions by filling out the questionnaire survey (specific link: https://bit.ly/bitlayercomm), with users offering valuable suggestions having the opportunity to receive rewards.

The following is content organized based on Kevin's replies to recent Bitlayer community hot topics:

About TGE and Community Incentives

Question 1: Bitlayer completed seed round financing as early as March 2024, then successfully completed Series A and A+ rounds with a total of $25 million in financing. The team also early on used BTR as airdrop rewards in operational activities. Does the team have a clear timeline for the project's TGE? What stage is it currently in?

Kevin: We are indeed in the final stage before TGE. The TGE phase involves multi-dimensional systematic work including finalizing token economic model, adapting global compliance framework, and communicating with exchanges and market makers. However, due to confidentiality agreements with partners, we cannot publicly disclose specific timelines at this stage.

What can be confirmed is that we have made positive progress on all fronts. Once all necessary procedures are completed and final confirmation is obtained, we will synchronize progress through official announcements and community channels at the first opportunity. Please wait patiently for good news.

Question 2: When does the team plan to announce the token economic model? How will token allocation ratio be set? What is the utility of the BTR Token?

Kevin: The design of the token ecosystem is a key pillar of the project's long-term ecological value. The team has been advancing related work with rigor and sustainability as core principles. Currently, details such as token allocation ratio, release rules, and utility scenarios are in the final verification stage.

We understand the community's expectations for TGE, but we cannot disclose specific details at this moment. We promise to fully publish the token economic model through official channels at an appropriate stage before TGE and reserve sufficient time for the community to interpret the rules. Latest information can be found in official articles later.

Question 3: Are there lock-up rules for BTR rewards obtained through head mining nodes, BTCFI carnival, and other activities? How will the team prevent massive market sell-offs after token listing?

Kevin: The lock-up rules for BTR rewards from these activities are related to specific activities. For example, airdrops in the 3rd head mining node and racing card draw activities in the user center correspond to non-locked BTR rewards. More details can be confirmed by checking the respective activity announcements.

Overall, we strictly follow the principle of binding contribution and long-term value in designing airdrop rewards. All reward distribution processes will set differentiated release cycles based on on-chain behavior and ecosystem participation. Specific rules and details will be fully disclosed through official announcements before TGE and open for community Q&A.

Question 4: Lucky Helmet is the first official Non-Fungible Token issued by Bitlayer. Will there be other empowerment measures in the future?

Kevin: The helmet is Bitlayer's first official Non-Fungible Token, and its holders are the first batch of Bitlayer users. Previously, we provided point bonuses and exclusive BTR Token airdrops to helmet holders during head mining nodes. Regarding helmet empowerment, the team has no reason to give up. We promise to provide more empowerment in various activities in the future. If holders have better suggestions, they can contact the Bitlayer team for feedback.

About Ecosystem Development and Operational Strategy

Question 5: Some people have noticed that some Bitlayer ecosystem projects have suspended operations. Does Bitlayer not have a review mechanism when cooperating with ecosystem projects? Additionally, the entire Bitlayer ecosystem lacks wealth creation effect and attention. How do you view this issue?

Kevin: As a public chain operator, Bitlayer welcomes more project parties to build and actively provides various infrastructure support. However, the chain ecosystem construction is currently in its early stages, and ecosystem maturity requires a long-term process of technical verification, developer accumulation, and market cognition iteration. Inevitably, there will be many projects of varying quality, but we must also see that innovative products have emerged in the ecosystem.

As for the lack of wealth creation effect, I understand this is an industry-wide issue, not just a Bitlayer problem. We believe that as BTCFi and the entire chain continue to develop, ecosystem projects will usher in a prosperous phase.

Question 6: Many ecosystem projects collaborated in Bitlayer's head mining nodes, but the final redeemable rewards are not enough to cover the gas fees for interaction.

Kevin: Over the past year, Bitlayer has actively collaborated with ecosystem projects and attracted users through points and Token incentives. Regarding the issue of low project redemption rewards, one important reason is the current general market conditions, and price performance may not meet everyone's expectations. We believe that as the market improves, the overall performance will change.

Regarding the community feedback about difficult-to-exchange ecosystem project airdrop rewards, the team is currently developing the Quick Jump solution based on the demands of cooperation partners and users. This will help users cross-chain airdrop rewards obtained from Bitlayer ecosystem project interactions at near-zero cost. This function is expected to be implemented in 2 weeks. Additionally, for the overall chain's gas interaction cost issue, we are actively promoting solution implementation and believe we will soon have an answer that satisfies everyone.

Question 7: The current Bitlayer ecosystem is not very prosperous. What can users do after cross-chaining BTC into the Bitlayer ecosystem?

Kevin: First, ecosystem prosperity is indeed a process. Considering user actual needs, the team has launched the BTCFi Yield entrance (https://www.bitlayer.org/btcfi), integrating currently high-yield DeFi products for user experience. Currently, the market still has high demand for high APR products. For instance, the first 600 BTC quota of BLBTC was fully subscribed in just 47 hours. Additionally, based on these BTCFi products, we also hope to work with partners to solve various BTC asset management needs and truly realize the on-chain business environment.

About Technology and User Experience

Question 8: Users generally feedback that on-chain gas fees are high. When can significant optimization be expected?

Kevin: With the recent mainnet push of the BitVM bridge and the upcoming V2 mainnet iteration, the team will soon provide an answer that satisfies users and further enhances user experience.

Question 9: What positions do Layer 2 and BitVM Bridge occupy in Bitlayer's planning? What will be the future business focus?

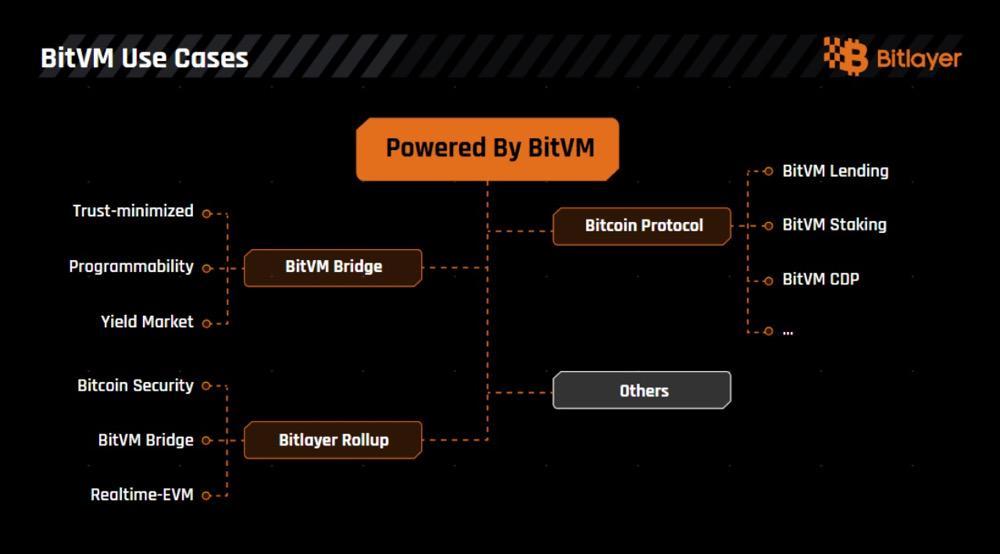

Kevin: Layer 2 and BitVM Bridge are two important and parallel business modules of Bitlayer, working together through technical coupling and scenario collaboration. As the foundation of Bitlayer, Layer 2 will next improve user and developer experience through V2 upgrade, gas fee reduction, and continuous ecosystem support.

Moreover, Bitlayer, as a member of the BitVM Alliance, has made significant contributions to the implementation of BitVM. The core of the BitVM Bridge lies in achieving the so-called "1-of-N" trust model - as long as one participant remains honest, the entire system can function normally. This is fundamentally different from models that require "most participants to be honest". Of course, the planning of BitVM Bridge goes far beyond asset cross-chain transfer functionality, with the goal of connecting Bitcoin liquidity providers (including whales, retail investors, and institutions) with asset management protocols. In the future, the team plans to open-source this technology and package it as an API service. For more information about BitVM implementation and application scenarios, please refer to the following video explanation: https://youtu.be/XzyYI6Kohd4?si=GHunGP6yOVZ7n8oZ

Whether it's building a Layer 2 ecosystem or bridge business, these are the ongoing works of Bitlayer: developing BTCFi infrastructure.

Question 10: As a project based on the BitVM paradigm, how does Bitlayer balance usability and decentralization?

Kevin: To answer this question, I believe we must return to the real needs of token holders.

From compliance-focused institutional holders and whales (such as national reserves/BTC ETF issuers/listed companies/family offices) to retail investors seeking efficient interaction, the diversity of their specific needs determines that we must provide differentiated solutions for them. For institutions and high-net-worth holders, asset sovereignty control and compliance transparency are their primary needs. We hope to solve counterparty risks and ensure verifiability through the trust-minimized BitVM Bridge solution. For ordinary users, many enter this field not necessarily to pursue the technological ideals of decentralization, but to conveniently use on-chain services or products. Therefore, we need to develop with a pragmatic attitude, and beyond technology, focus on business expansion and market adaptability.

Regarding Roadmap and Strategic Planning

Question 11: What are the core objectives of Bitlayer's 2025 technical roadmap?

Kevin: From the project's inception to now, facing the market and solving industry pain points has always been our work's North Star. After more than a year of technical accumulation, we are gradually beginning to implement our R&D results. What can be expected is that we will have the following technical advancements and implementations: first, the BitVM Bridge is currently in the testnet phase, and we will soon welcome its mainnet launch; second, V2 is being launched, with related functions currently being perfected. Additionally, we are conducting a series of R&D to improve user experience, such as reducing gas fees and supporting high-frequency trading functions mentioned earlier. All of these are in our clear goals and plans. Bitlayer's ultimate goal is to build a commercial closed loop that creates and releases value, operate profitable businesses, and become an enterprise that spans cycles.

Question 12: What differentiated strategy will the team adopt in global operations? How will you expand ecological influence?

Kevin: Since Bitlayer's establishment, the team has adhered to an operational strategy of being rooted in Asia while facing the global market. The Asian market is our foundation, and we have built excellent local communities in multiple Asian countries. Simultaneously, we are actively expanding into North American, Middle Eastern, and European markets. Through our efforts, Bitlayer's development achievements and potential have gained significant institutional recognition in North America, with more collaborations in progress.

Regarding the ecosystem, we must clearly recognize that blockchain ecosystem construction requires time and the joint efforts of official teams, developers, and communities. We firmly acknowledge the Bitcoin DeFi direction, investing in 2 core technologies (BitVM + high-frequency chain) and creating 2 products (BitVM Bridge and Layer 2) to meet the asset management needs of various Bitcoin token holders. As infrastructure gradually improves and external conditions become increasingly favorable, we believe a thriving Bitcoin DeFi will emerge in the Bitlayer ecosystem.