Author: Asher, Odaily

The butterfly effect of tariff policies has triggered a hurricane in the crypto market. At 4 am this morning, US President Trump officially announced a 10% "minimum baseline tariff" on most imported goods globally and implemented retaliatory tariffs on dozens of countries and regions, causing another heavy blow to the cryptocurrency market (for detailed tariff information, refer to: White House Launches Tariff War 2.0).

OKX market data shows that around 4:15 am, BTC first "lured more" by touching $88,500 and then continued to decline, falling below $82,500 around 8 am (lowest at $82,169), with a short-term drop of over 5%, temporarily reporting at $83,600 around 11:30 am;

Besides BTC, ETH briefly dropped from around $1,960 to below $1,800, currently reporting at $1,824, with a 24-hour decline of 3.03%; SOL dropped from around $136 to below $117, currently reporting at $119, with a 24-hour decline of 4.04%;

In the US stock market, the three major stock index futures plummeted after-hours, with Dow Jones Industrial Average futures plunging 1,007 points (a 2.3% drop), S&P 500 futures falling 3.4%, and Nasdaq 100 futures crashing 4.2%;

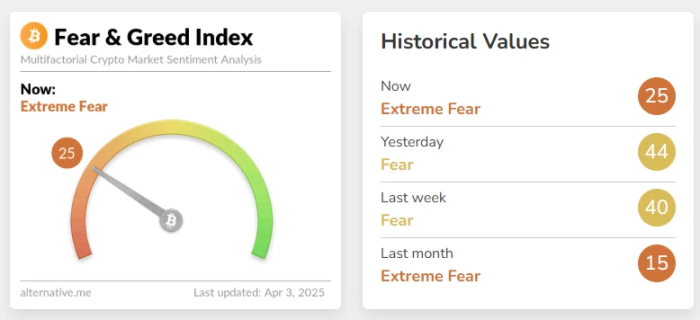

Affected by the overall market downturn, the total cryptocurrency market value also rapidly declined. CoinGecko data shows that the current crypto total market value has fallen below $2.8 trillion, down 4% in 24 hours, temporarily reporting at $2.78 billion. Additionally, Alternative data indicates that today's Fear and Greed Index dropped from 44 to 25, once again entering an "extreme fear" state.

Fear and Greed Index

In derivatives trading, Coinglass data shows that $396 million was liquidated across the network in the past 12 hours. By cryptocurrency, BTC liquidations were $151 million, and ETH liquidations were $75.25 million.

BTC's price had just rebounded for two days. Will it continue to decline due to US tariff policies? Do Altcoins still have a "day to rise"? Below, Odaily will sort out the perspectives of industry leaders/institutions on this morning's tariff policies.

What do various leaders/institutions think?

Arthur Hayes: If BTC can hold $76,500 until April 15 tax day, it will "escape danger"

BitMEX co-founder Arthur Hayes wrote that the market's reaction to "Liberation Day" was poor, "If Bitcoin can hold $76,500 between now and the US tax day (April 15), we will have escaped danger." He also warned investors "not to be cut by volatile market movements".

Analyst Ali Martinez: BTC is currently in a critical range between $84,800 and $86,900

Crypto analyst Ali Martinez wrote that after the tariff policy was introduced, BTC is currently in a critical range between $84,800 and $86,900. The hourly chart suggests that whichever side breaks through/falls first may determine the next big move.

Chris Burniske: Not taking aggressive action, will focus on specific assets and opportunistically buy if further decline occurs

Placeholder partner Chris Burniske wrote that he expects today to be a positive turning point, and will not take aggressive action currently. If the market maintains its current range, he will continue holding; if the tariff policy leads to further market decline, he will focus on specific assets and opportunistically buy.

Santiment: Crypto market's response to tariff policy is low, with safe-haven funds still flowing to gold

Blockchain analysis platform Santiment's analyst stated that after Trump announced the new tariff policy at the White House, market sentiment quickly heated up, but the crypto market's performance was relatively low. Currently, investors' safe-haven funds are mainly flowing to gold, with gold prices rising 20% in the past three months, breaking through $3,190/ounce, while Bitcoin remains highly correlated with the S&P 500 index.

On social media, market views are divergent: Some analysts believe this situation is similar to the market volatility caused by the 2018 trade war and may be beneficial to the crypto market in the long term. However, others point out that the US economic structure can hardly bear high tariffs, and the market may face greater fluctuations. In the short term, the crypto market sentiment is cautious, and the true market reaction will be further revealed after US stock market opens.

Grayscale Research: The impact of tariffs on cryptocurrencies may have been "priced in", and the worst may have passed

Grayscale Research's Zach Pandl stated, "The impact of tariffs on cryptocurrencies may have been 'priced in', and the worst may have passed. I believe tariffs will weaken the US dollar's dominant position and create space for competitors, including Bitcoin. There may be short-term price declines. However, the first few months of the Trump administration have further enhanced my long-term confidence in Bitcoin as a global monetary asset."