Written by: Wenser (@wenser 2010)

At the end of March, according to Fortune, stablecoin issuer Circle has hired an investment bank to prepare for IPO and plans to publicly submit a listing application to the SEC in late April; on April 1st, Circle officially submitted an S-1 prospectus to the US SEC, planning to list on the New York Stock Exchange with the stock code CRCL. Just as the market believed there was no suspense about the "first crypto IPO after Trump takes office", within a few days, with the official launch of Trump's tariff trade war, market sources suggested that Circle would delay its IPO process. Thus, the suspense continues about which crypto IPO will ultimately emerge after Trump's commitment to establishing a crypto-friendly government.

Odaily will analyze and compare Circle's IPO in the context of the stablecoin market, US crypto regulatory trends, and Circle's valuation system with other potential crypto IPO projects.

Mystery One: Can Circle Claim the Crown of the "First Stablecoin Concept Stock"?

To conclude, Circle is highly likely to claim the crown of the "first stablecoin concept stock".

Reasons:

1. Main competitors have no intention of taking the "IPO development route". After Circle submitted its IPO application, Tether CEO Paolo Ardoino stated that Tether does not need to go public. (Odaily notes: It's worth mentioning that Paolo's tweet photo features him with the Wall Street bronze bull, somewhat implying "Wall Street investment banks need me, not the other way around")

Tether CEO's confident statement

2. Circle firmly holds the second position among stablecoin issuers. According to Coingecko, USDC currently has a market cap of $60.14 billion, second only to USDT's $144 billion, ranking 6th in crypto market cap.

3. Circle's compliance system is comprehensive, arguably the "most compliant stablecoin issuer". Circle is registered as a Money Services Business (MSB) in the US, complying with regulations like the Bank Secrecy Act (BSA); it has money transmission licenses in 49 US states, Puerto Rico, and DC; in 2023, it obtained a major payment institution license from Singapore's MAS; in 2024, it received an Electronic Money Institution (EMI) license from France's ACPR, enabling USDC and EURC issuance under the EU's MiCA regulation.

Therefore, based on the current IPO application progress, USDC's market position, and competitors' attitudes, Circle is likely to secure the "first stablecoin concept stock".

The next question is: Can Circle's core business support its market value after the IPO? The answer needs to be found in Circle's IPO prospectus.

Mystery Two: Is Circle's USDC Stablecoin a Guaranteed Profitable Business?

To conclude, Circle's current operational status is not particularly optimistic.

Circle's IPO prospectus reveals significant differences from Tether:

Revenue: In 2024, Circle reported $1.68 billion in revenue, up from $1.45 billion the previous year, a 16.5% increase; however, net profit dropped from $268 million to $156 million, a 42% decrease. Partly due to $908 million in distribution costs paid to partners like Coinbase and Binance.

Reserve funds: About 85% of USDC reserves are invested in US Treasury bonds, around 20% in US bank cash deposits. In contrast, USDT's reserves are more diversified, including 5.47% BTC.

Management costs: Circle spends over $260 million annually on employee compensation and nearly $140 million in administrative expenses; depreciation and amortization costs are $50.85 million, IT infrastructure costs are $27.1 million, and marketing expenses are around $17.32 million.

Notably, 99% of Circle's income comes from reserve interest, approximately $1.661 billion, with transaction fees and other income at just $15.169 million.

In other words, Circle currently operates a "deposit and earn interest" business, unlike Tether's model of earning from both reserve interest and service fees.

Mystery Three: Will the Ambiguous Relationship with Coinbase Continue?

Circle Internet Financial, Inc. was founded in 2013 by Jeremy Allaire and Sean Neville. USDC governance was initially managed by the Centre Consortium, jointly established by Circle and Coinbase. In August 2023, Circle acquired Coinbase's shares in the consortium for $210 million, fully taking over USDC issuance and governance, while maintaining the 50%:50% revenue-sharing agreement.

In 2024, of the $908 million distribution costs paid to Coinbase, $224 million was awarded to users as staking rewards, with the remaining $686 million going to Coinbase.

This approach might be seen as a strategy by Circle and Coinbase to expand USDC's circulation and market share, though the high stablecoin interest rates raise questions about whether this is a preparatory move for the IPO.

The prospectus information shows that in November 2024, Bit became the first approved participant under Circle's stablecoin ecosystem protocol. According to the cooperation agreement, Bit needs to promote USDC on its platform and hold a certain amount of USDC in its financial reserves; Circle will pay Bit a one-time prepaid fee of $60.25 million and agree to pay monthly incentive fees based on the USDC balance held by Bit. Incentive fees are only paid when Bit holds at least 1.5 billion USDC, and Bit commits to holding 3 billion USDC (with exceptions in specific situations). The cooperation is divided into market promotion and financial reserve parts, both of which are two-year terms. If Bit terminates the market promotion agreement early, it still needs to fulfill one year of reduced-rate payments and promotion obligations. Both parties can terminate the agreement early under specific circumstances.

It can be seen that in terms of attracting allies to expand the market base, Circle is well-versed in the essence of high-profile strategies.

Additionally, within the past year, Circle has been active in the Solana and Base ecosystems. In the Solana ecosystem alone, according to Odaily's incomplete statistics, over 3.25 billion USDC have been issued since 2025, with a total of 13 issuances, with a single issuance volume reaching up to 250 million.

Incomplete statistics

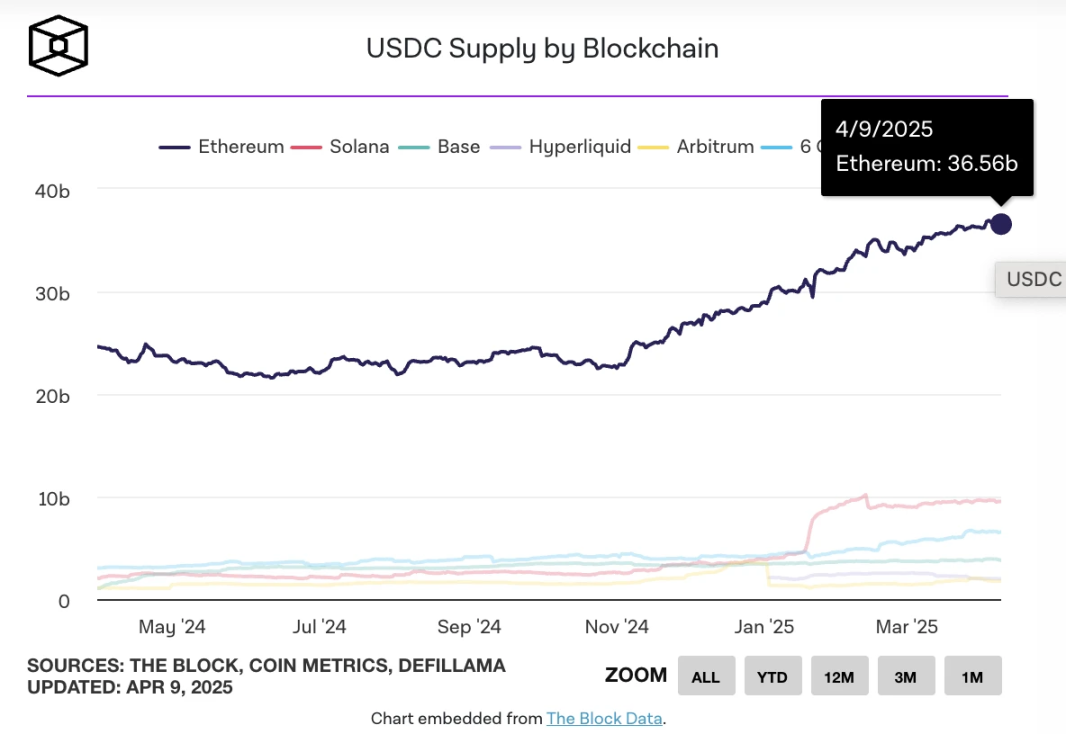

On March 26th, when the USDC on-chain issuance volume broke through $60 billion, according to TheBlock:

Ethereum issuance is approximately 36 billion;

Solana is about 10 billion;

Base is about 3.7 billion;

Hyperliquid is about 2.2 billion;

Arbitrum is about 1.8 billion;

Berachain is about 1 billion.

TheBlock's statistics on USDC issuance across different chains

Currently, the USDC circulation remains around $60 billion. According to defillama data, the total stablecoin market value is approximately $233.535 billion, with a 7-day decline of about 0.58%; USDC's market share is about 26%.

Therefore, we can temporarily conclude that Circle's subsequent development still cannot be separated from Coinbase's support, and it will likely continue to "supply" around 50% of its distribution revenue to Coinbase.

Suspense Four: Will Circle be affected by the US stablecoin regulatory bill?

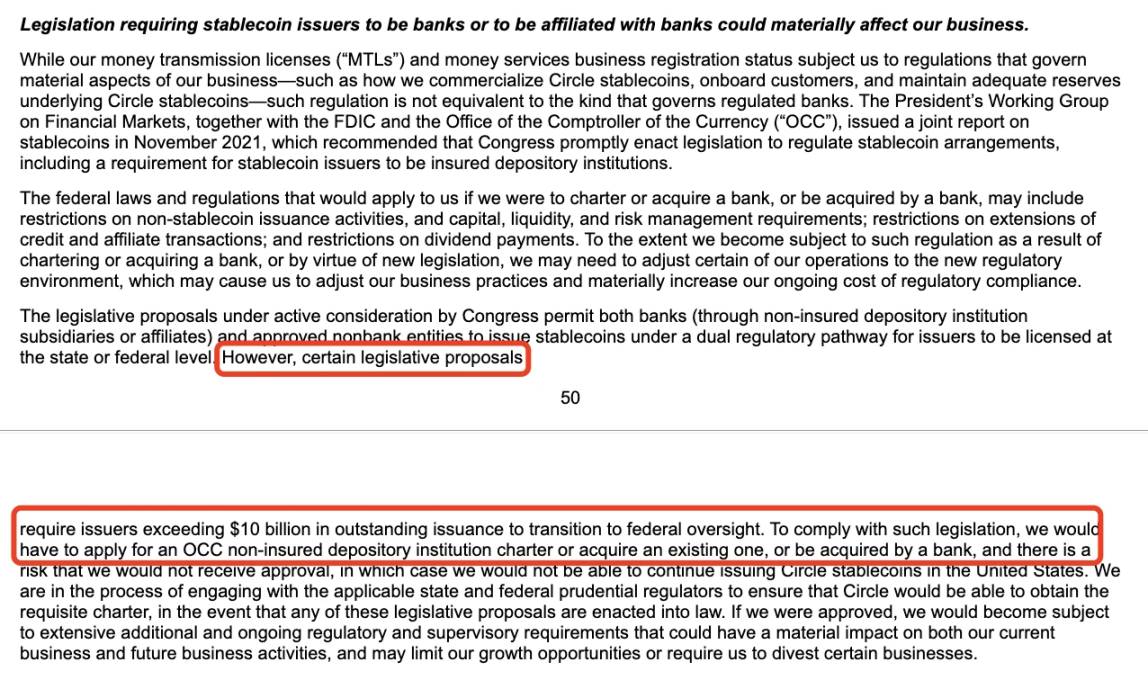

In the prospectus, Circle mentioned potential regulatory legislation risks, such as US regulatory agencies or legislation requiring stablecoin issuers with an issuance volume exceeding $10 billion to be banks or affiliated with banks.

Risk disclosure section of the prospectus

Based on current information, the latest progress of the US stablecoin regulatory bill is as follows:

In February 2025, US Senator Bill Hagerty and others proposed the GENIUS Act, aimed at establishing a federal regulatory framework for payment stablecoins. The bill stipulates that stablecoin issuers with a market value exceeding $10 billion will be regulated by the Federal Reserve (FED), while smaller issuers can choose to operate under state-level regulation; all issuers must support their stablecoin issuance 1:1 with high-quality liquid assets (such as US dollars, Treasury bonds), and the issuance of algorithmic stablecoins is prohibited.

At the same time, US Representative Maxine Waters proposed the STABLE Act, requiring all stablecoin issuers to obtain federal licenses and be supervised by the Federal Reserve; the bill emphasizes consumer protection, requiring issuers to hold reserve assets equal to the issuance volume and comply with AML and KYC regulations.

As a stablecoin compliance pioneer, it is only natural for Circle to make necessary risk disclosures. Although there were previous reports that "Tether is collaborating with US legislators to influence US regulation of legal currency," Circle, under the protection of allies like Coinbase and BlackRock, should have no major issues dealing with regulatory pressure.

Therefore, the risks in this aspect are relatively controllable.

Suspense Five: What is Circle's valuation?

Although the S-1 file does not provide a specific IPO fundraising price, based on secondary market transactions, its current valuation is around $4-5 billion, with share structures divided into Class A (1 vote/share), Class B (5 votes/share, with a 30% upper limit), and Class C (no voting rights), with founders retaining control. The listing will also provide liquidity for early investors and employees.

Compared to the previous round of financing's peak valuation of $9 billion, limited by the stablecoin market share and recent market downturn, this figure has been halved but still has some profit potential.

In comparison, Coinbase's stock price is currently $151.47, with a market value of $38.455 billion, approximately 8-9 times that of Circle.

Additionally, the trade war initiated by the Trump administration and the Federal Reserve's interest rate cut expectations may affect Circle's revenue, which should also be taken into consideration.

Whether Circle's diversified business can support its corresponding valuation remains to be verified by time.

Personally, I believe that compared to the more flexible use scenario of USDT, USDC can only achieve greater development space by combining with US banking-related businesses. Previously, US banks Custodia Bank and Vantage Bank jointly issued the first US bank-backed stablecoin Avit on the Ethereum network, which may signal the increasingly white-hot competition in the next round of stablecoins.

If Circle wants to ensure its position as the "stablecoin number two," it may need to learn from Tether's revenue experiences in BTC reserves, redemption fees, and other aspects.

Lastly, a "Easter egg" from Circle's IPO prospectus - Circle officially mentioned that it is a "primarily remote-working company" with higher operational and network security risks. Considering the Bybit case of $1.5 billion asset theft in February and various security incidents caused by hacker groups like Lazarus Group, this risk warning may not be groundless but a risk factor that many crypto projects need to consider in advance.

Circle's official disclosure of remote work risks

Finally, Odaily's author personally predicts that Circle will still go public earlier than Kraken, Chainalysis, and other crypto companies, as for stablecoin companies with high operating costs and single narratives, reaching "outsiders" through IPO is more urgent.