Source: Binance, Initia Official Website, Whitepaper, Initia, 4 Pillars Research Report Compiled by Jinse Finance

On April 17, 2025, Binance announced that Binance Launchpool has launched its 68th project - Initia (INIT), an L1 blockchain that connects application chains through intertwined infrastructure and coordinated economic mechanisms, unleashing their full value.

Users can deposit BNB, FDUSD, and USDC into the INIT reward pool on the Launchpool website to obtain INIT after 08:00 (UTC+8) on April 18, 2025, with the activity lasting a total of 6 days.

New Token Listing

Binance will list Initia (INIT) on April 24, 2025, at 19:00 (UTC+8), opening INIT/USDT, INIT/USDC, INIT/BNB, INIT/FDUSD, and INIT/TRY trading markets, subject to seed tag trading rules.

I. Project Details:

Token Name: Initia (INIT)

Total Token Supply: 1,000,000,000 INIT

Maximum Token Supply: 1,000,000,000 INIT

Initial Circulating Supply: 148,750,000 INIT (approximately 14.88% of total token supply)

Launchpool Total: 30,000,000 INIT (3.0% of maximum token supply)

An additional 10,000,000 INIT will be distributed in batches to marketing activities after spot listing. Detailed rules will be announced separately.

An additional 20,000,000 INIT will be distributed in batches to marketing activities 6 months after spot listing. Detailed rules will be announced separately.

Smart Contract Details: INIT Network Explorer (to be launched upon public release)

Listing Fee: 0

Restriction Clause: KYC Required

Personal Hourly Reward Hard Cap:

BNB Pool: 17,708.33 INIT

FDUSD Pool: 1,041.66 INIT

USDC Pool: 2,088.33 INIT

Reward Pools:

BNB Pool (website to be updated within twelve hours of this announcement before the activity opens): Total Reward 25,500,000 INIT (85%)

FDUSD Pool (website to be updated within twelve hours of this announcement before the activity opens): Total Reward 1,500,000 INIT (5%)

USDC Pool (website to be updated within twelve hours of this announcement before the activity opens): Total Reward 3,000,000 INIT (10%)

Activity Time: From 08:00 (UTC+8) on April 18, 2025, to 07:59 (UTC+8) on April 24, 2025

INIT Reward Allocation Stages:

II. Initia (INIT) Project Overview

Basic Information

Initia is a full-chain Rollup network built by merging a novel L1 with an application-specific L2 infrastructure system. The Initia platform provides product-ready Rollups, enabling teams to build scalable sovereign systems while eliminating the user experience complexity faced by end-users when interacting with a modular multi-chain universe. Initia has a complete technology stack that implements a set of chain-level mechanisms to align economic interests between users, developers, L2 application chains, and L1.

Initia's L1 is like a shopping mall, and each L2 is like a store in the mall. Initia provides unified, modular facilities for these stores, making it easy for developers to build applications on Initia. Users can enjoy a simple multi-chain experience like shopping in a mall, without worrying about complex cross-chain token swapping.

Team Introduction

The Initia team members have rich development experience, with core members including Zon from Canada and Stan Liu from South Korea. Zon is a former Terraform Labs smart contract developer. Stan Liu is a former Terraform Labs MEV researcher. According to LinkedIn information and community-collected information, the Initia team is led by Stan in Korea, with Zon working remotely from the US, and their active DC times can confirm this.

Funding Situation

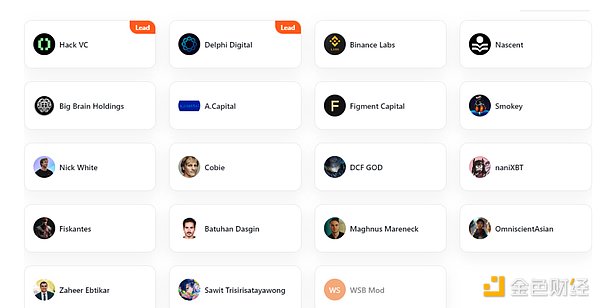

Initia received an undisclosed investment from Binance on October 12, 2023, and on February 27, 2024, secured a $7.5 million seed round led by Hack VC and Delphi Digital. Among individual investors are experienced angel investors such as DCF GOD, naniXBT, and BOSS Yan Xiong from Bear Chain.

III. Tokenomics

Initia is designed with a close connection to Minitia L2, and thus introduced the VIP (Vested Interest Program) mechanism to achieve economic linkage. The goal of VIP is to make $INIT the base currency of the Initia ecosystem and a key component of all L2s. Through this mechanism, $INIT is used as an economic bond connecting Initia and Minitia, continuously expanding the use cases of $INIT. The VIP process can be divided into three main steps: 1) Allocation, 2) Distribution, 3) Unlocking.

1) Allocation

Source: Introducing VIP

First, 10% of the $INIT genesis supply is designated for the VIP fund. These funds are allocated every two weeks to Minitia and users who meet the VIP reward conditions. VIP rewards are distributed through two pools: the Balance Pool and the Weight Pool. Rewards in the Balance Pool are proportionally distributed based on the amount of $INIT held by Minitia. The Weight Pool rewards are distributed to Minitia based on weights set through metered voting in L1 governance. In other words, L1 stakers determine the reward share for each Minitia through metered voting. Thus, the Balance Pool encourages Minitia to hold more $INIT and expand its use cases, while the Weight Pool creates new use cases for the $INIT token and incentivizes validators, users, or bribery protocols like Votium and Hidden Hand to actively participate in L1 governance.

2) Distribution

Source: Introducing VIP

Rewards allocated to Minitia are issued in the form of $esINIT (escrowed INIT), which is initially non-transferable. The $esINIT recipients are divided into operators and users. Operators refer to the project teams responsible for running Minitia. These teams can utilize $esINIT in various ways, such as using it as development funding to support Minitia's development, redistributing it to active users in Minitia, or staking it on Initia L1 to vote for themselves in future metered voting.

On the other hand, $esINIT issued as user rewards is directly provided based on the user's VIP score. The VIP score is calculated based on various key performance indicators (KPIs) set by Minitia, aimed at encouraging user interaction. For example, Minitia can set VIP score standards to incentivize specific user actions, such as the number of transactions, transaction volume, or lending scale generated through Minitia within a specific period.

3) Unlocking

Source: Introducing VIP

As mentioned earlier, when rewards are issued to users based on VIP scores, $esINIT is distributed as a non-transferable escrowed token. Therefore, users need to go through an unlocking process to monetize their obtained $esINIT. In this process, users can choose two ways to maximize their returns. The first is to maintain their VIP score over multiple periods to unlock $esINIT into circulating $INIT. During the period of maintaining the VIP score, users can accumulate more points in Minitia, which helps improve user retention for Minitia. The other method is to deposit $esINIT as liquidity into Enshrined Liquidity to receive deposit rewards.