1/ Onchain stable yield benchmarks have dropped significantly:

• sUSDe: ~4.5%

• Aave aUSDC: ~2.8%

• Sky Savings Rate (SSR): 4.5%

While these yields currently don't outperform risk-free treasury rates—they offer a unique opportunity to speculate on future yield movements:

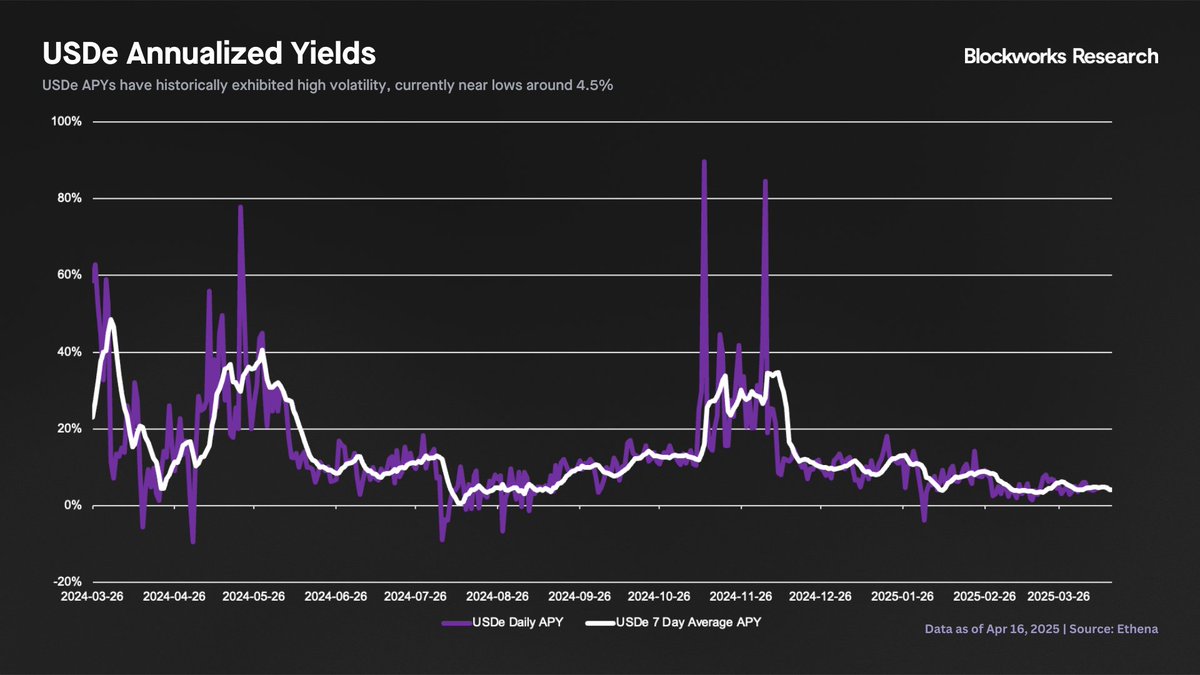

2/ USDe was one of 2024's breakout stablecoins, growing from $100M to $5.8B in supply.

Its yield—generated from delta-neutral ETH funding—has historically been volatile but attractive, averaging ~13.6% APY with sustained periods above 20%.

Today, however, due to lower ETH

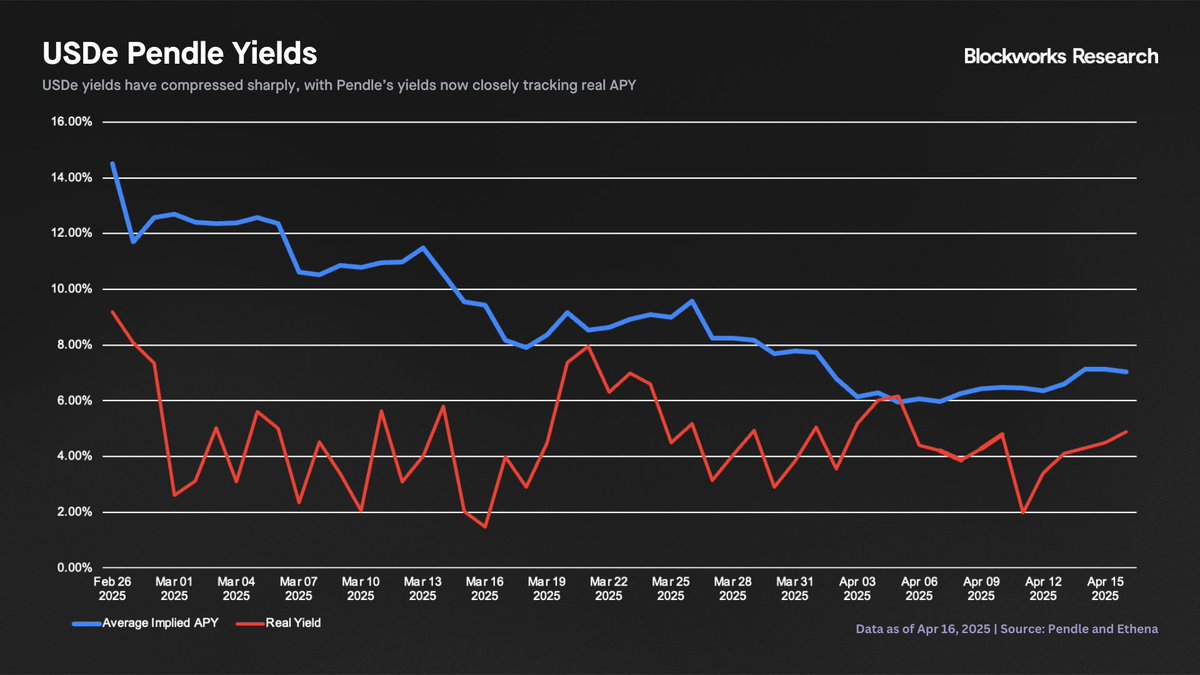

3/ Pendle, a yield marketplace allowing users to swap fixed and variable yields, offers opportunities to trade these APRs.

Currently, real yields and PT-implied APRs have nearly converged, with the PT discount pricing future yields at 7%.

Historically, USDe yields were below 7%

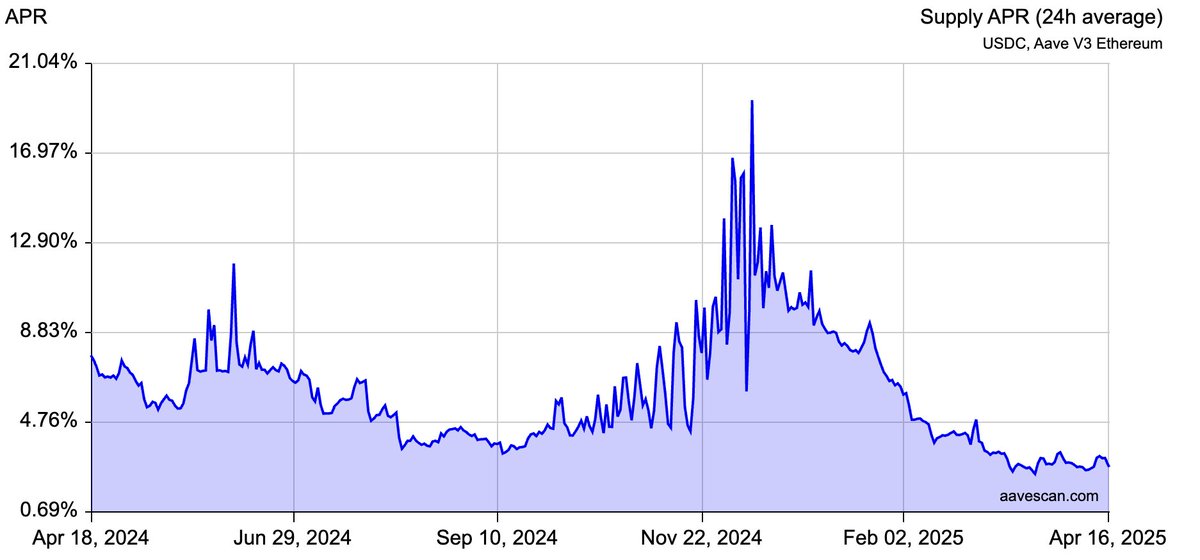

4/ Aave's aUSDC is in a similar position.

aUSDC represents a receipt token for USDC supplied in Aave lending markets, accruing interest from borrowers.

Current yields are significantly dampened, at sub-3%, a stark contrast to periods when yields reached ~10% APY.

Over the past

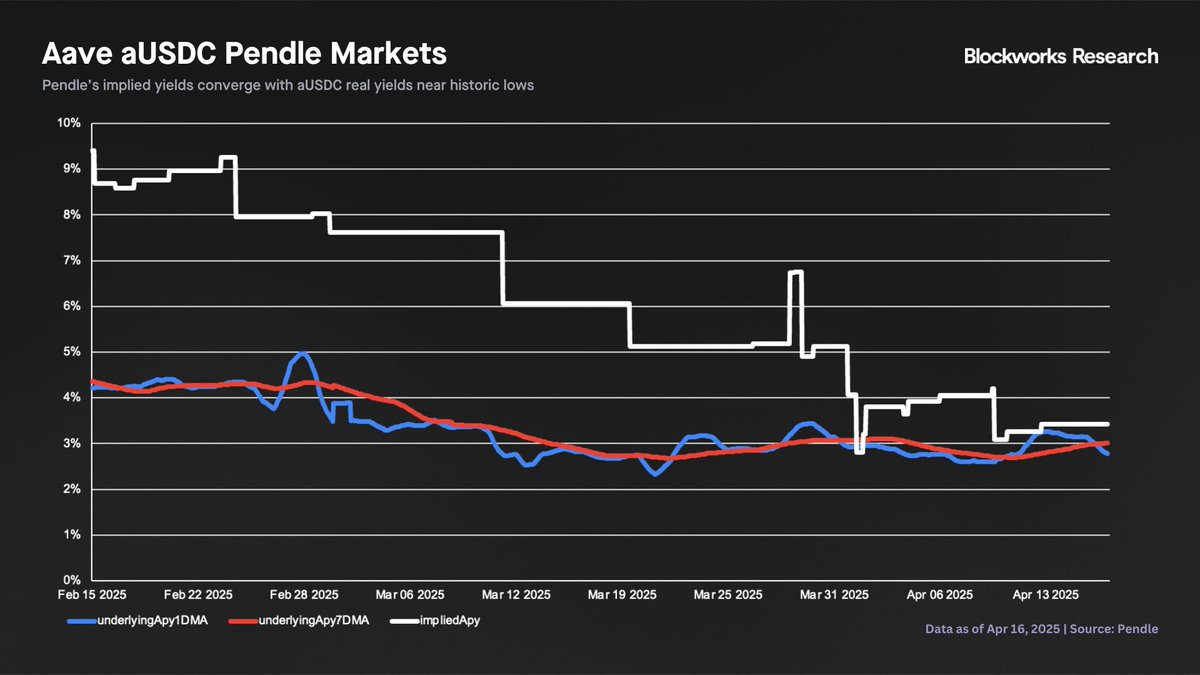

5/ On Pendle, traders can buy future yields of aUSDC at ~3% implied rate, gaining exposure to potential upside.

Interestingly, the premium of PT-implied APY over underlying APY has also drastically decreased, and YT tokens are cheap relative to historic premiums.

6/ Overall, significant yield compression offers unique entry points.

With both yields and PT premiums converging to historic lows, traders can gain exposure to future yields at favorable rates—particularly appealing if yields revert toward historical averages.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content