Ethereum has recently been "not doing well".

From the unusual position adjustments of multiple established crypto institutions to long-dormant whales awakening and choosing to reduce positions, the ETH market seems to be permeated with a cold wind.

VX: TZ7971

More worryingly, this is not an isolated incident: some institutions' ETH on-chain holdings are approaching zero, spot ETF funds are continuously flowing out, and on-chain activity has experienced a cliff-like drop... Are these signals indicating that the Ethereum ecosystem is experiencing a more profound transformation?

Clearing Out, Selling, Leaving at a Loss: Is ETH Facing a "Selling Wave"?

Ethereum is perhaps quietly facing a "smart money" reduction wave. Multiple established institutions have recently shown unusual position adjustment actions. Well-known crypto VCs like Galaxy Digital, Polychain Capital, B2C2, and Spartan Group have successively deposited thousands to tens of thousands of ETH into exchanges.

Long-dormant Ethereum whales are also gradually "reviving". Some addresses have been inactive for 3 years, or even as long as 10 years, yet have recently started moving, transferring large amounts of ETH to trading platforms. Some whales have chosen to exit at a loss, with some even directly clearing out without hesitation.

Below is a set of data compiled by ChainCatcher, counting the amount of ETH deposited into exchanges by some institutions and whales recently (not a complete count)

By examining the remaining ETH amount in institutional on-chain addresses, it's clearly visible that many mainstream VCs have relatively low on-chain ETH holdings, such as Dragonfly, GSR, Spartan Group, and others, with current holdings of only a few hundred ETH. More notably, some institutions' holdings are approaching "empty" status, with the remaining ETH on their on-chain addresses even as low as single digits.

Below is a statistical table of ETH holdings for some institutions' on-chain addresses (Note: Data may have certain errors due to incomplete address recording or attribution determination, for reference only)

Although VC on-chain holding data may have uncertainties, those real on-chain transfers and sales are too clear to ignore. Has ETH truly disappointed them? Is this a strategic position adjustment, or a loosening of sentiment and belief?

Let's look at some reference data.

Network Activity Plummets, Capital Outflow Intensifies

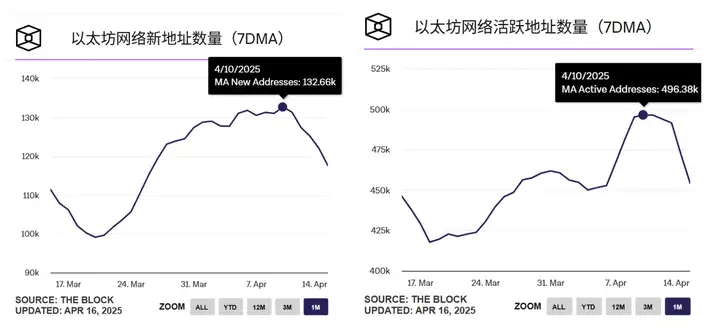

According to The Block data, since April 10th, the number of new addresses and active addresses on the Ethereum network have both sharply dropped, while the average Ethereum transaction fee has also declined from $0.86 to $0.63, with network activity dramatically contracting.

Looking at Ethereum's capital flow on CEX and spot ETF performance, the overall trend is equally unsatisfactory. The Ethereum spot ETF has been almost in net outflow for 30 consecutive days, with market funds continuously withdrawing. Meanwhile, in the past 14 days, Ethereum's inflow on CEX has been significantly higher than outflow, with large amounts of ETH being transferred into exchanges, releasing selling pressure signals.

On-chain analyst ali_charts' data shows that in the past week, Ethereum whales have collectively sold as high as 143,000 ETH, further confirming the market's selling trend.

The market's cold wind is quietly blowing towards Ethereum's heart. Depressed sentiment is spreading like a plague, and investors' confidence is beginning to waver, as if a storm is unavoidable.

Facing this "bitterly cold" market, will ETH truly sink? Can it turn the tide and reignite hope? At this critical moment, what can ETH use to save itself and win back lost trust?