From the invitation system, guarantee, proof, slashing mechanism to the quantification of credibility, the core design of the Ethos reputation system is explained in detail.

Written by KarenZ, Foresight News

The crypto world is often compared to the "Wild West", full of chaos and disorder. Trust issues have always been a key obstacle to further popularization and maturity of the industry. In response to this pain point, Ethos Network is committed to measuring credibility and reputation on the blockchain to create a more trustworthy environment for the crypto ecosystem.

As Ethos said, in the real world, reputation is everywhere. Resumes determine job opportunities, scores screen doctors, and five-star drivers are given priority in receiving orders. However, the reputation system in the Crypto world is almost blank. There is a lack of an easy-to-reference and clear reputation system, which leads to high trust costs, zero costs for evil, and frequent fraud.

Ethos will fill this gap. Ethos' solution is an on-chain reputation protocol, which generates a credibility score through a decentralized mechanism, just like a "credit report" in the crypto world, but is completely based on open protocols and on-chain records, pushing the crypto ecosystem towards a more orderly and mature direction.

Ethos Core Design

The Ethos protocol uses a series of innovative mechanisms, combined with social proof of stake (Social PoS), to ensure the reliability, decentralization and Sybil attack resistance of its reputation system. The following are its main functions and mechanisms:

1. Invitation System and Sybil Attack Protection

In order to ensure the network's ability to resist Sybil attacks (i.e., to avoid manipulating the system by creating a large number of false identities), Ethos adopts a strict invitation system. Users must be invited by existing Ethos account holders to create their own Ethos Profile. This effectively limits the proliferation of malicious accounts.

The invitation mechanism also introduces a "reputation binding" design: the inviter and the invitee form a binding relationship within 90 days of the invitation, and the inviter will receive 20% of the invitee's reputation score, whether it is a positive increase or a negative decrease. This means that if the invitee gets a high score due to honest behavior, the inviter can share 20% of his score; conversely, if the invitee loses points due to malicious behavior, the inviter will also lose accordingly. This mechanism encourages the inviter to carefully select the invitees and enhance the overall credibility of the network.

2. On-chain credibility score

The core function of Ethos is to generate a Credibility Score, a numerical indicator that quantifies the trust of users on the chain. The score is based on the following on-chain activities and social interactions:

- Review mechanism : Only people with an Ethos Profile can post reviews, and can leave simple positive, neutral, or negative reviews for others. Although a single review has a small impact, the cumulative effect of a large number of reviews can significantly change a user's reputation score. For example, consistent positive reviews from multiple high-reputation users can significantly increase the target user's credibility.

- Vouching: Allows Ethos users to endorse other users by staking Ethereum (other assets will be supported in the future), indicating trust in their reputation. Vouching directly affects the target user's reputation score. Key features of the vouching mechanism include:

- The guarantor needs to pledge a certain amount of ETH. The higher the pledge amount, the greater the positive impact on the target user's credit score.

- The pledged ETH will be locked as a financial endorsement of the guarantor's creditworthiness of the guaranteed party.

- The guarantor can withdraw the guarantee at any time. If the guarantor is found to have behaved inappropriately, the withdrawal will cause the target user's credit score to drop.

- When user A and user B guarantee each other, the system recognizes it as a mutual guarantee relationship, which has a more significant effect on improving the credit scores of both parties.

- Slashing : Aims to curb bad behavior through a community-driven penalty mechanism. This mechanism is not yet online.

- Any Ethos participant can act as a "whistleblower", who is required to provide a certain amount of reward to the verifier in order to request manual verification.

- The validator will receive the same reward regardless of the voting results, which can avoid the validator's default to a certain extent.

- If the validator supports the whistleblower's allegations, a portion of the whistleblower's staked funds will be deducted to reward the whistleblower. A single slash does not exceed 10% of the total Ethos stake. If the whistleblower's allegations are not established, he will be punished.

- Slashed funds are deducted directly from the staked amount of the person being reported and transferred to the reporter. This penalty is the only mechanism that can forcibly remove a staker's funds without their consent, but is designed to happen very rarely (usually handled first by negative reviews or unbonding, etc.).

- The punished person will not be punished again for the same type of report within 72 hours, giving him a certain buffer time and preventing malicious continuous attacks.

- Ethos users can also initiate “social slashings,” which do not involve financial risk but affect the credibility score of participants.

- Attest mechanism : allows participants to link other digital identities, social network profiles, and on-chain wallets, thereby reflecting authority, reputation, and influence from other channels. The attestation itself is free, and users only need to pay the required gas fee. The authenticated accounts and wallets are permanently recorded on the chain. If users make fraudulent attestations (such as linking social accounts that do not belong to them), they will face severe penalties:

- Financial penalties: Staked ETH (if any) may be confiscated.

- Social Penalty: A significant drop in credibility score, which may trigger a social cut.

3. Ethos Profile Display

The user's Profile can provide a transparent and verifiable trust reference for the community and other dApps. Users can also remain anonymous or use a pseudonym without revealing their true identity. Ethos Profile includes a credibility center and credibility score, and integrates data on proofs, guarantees, comments, and slashing mechanisms. Among them, the Profile credibility center shows a summary of relevant credibility clues derived from on-chain activities of the Ethos protocol or associated wallets, highlighting the most influential Ethos elements, such as large guarantees, high-profile reviews, and major financial asset holdings.

4. How is the credibility score calculated?

By analyzing the social interaction data generated by the above mechanisms, Ethos will generate a numerical Credibility Score and display it in the Ethos Profile.

As for the calculation method of credibility score, the scoring algorithm will comprehensively consider a variety of weighted indicators, which cover various on-chain actions. For example, guarantee-related indicators include the number of guarantees, mutual guarantees, guarantee amounts, mutual guarantee duration and defaults; there are also the credibility scores of commentators or guarantors, the average rating of users' contributions on Ethos, the length of time to prove the account, etc. The weights of each indicator are not linear, and the indicators and weights will be adjusted, increased or decreased according to the credibility consensus to ensure scientificity and adaptability.

In terms of the scoring range and level, the scoring range is 0 - 2800, divided into 5 levels. 0 - 799 points represent untrustworthiness; 800 - 1199 points represent doubt; 1200 - 1599 points represent neutrality; 1600 - 1999 points represent good reputation; 2000 - 2800 points represent excellent. The initial default score for all wallets and proofs is 1200 points (neutral).

In terms of governance, given the importance of credibility scoring, Ethos Labs plans to transfer control of the scoring algorithm to participants to avoid the drawbacks of centralized influence.

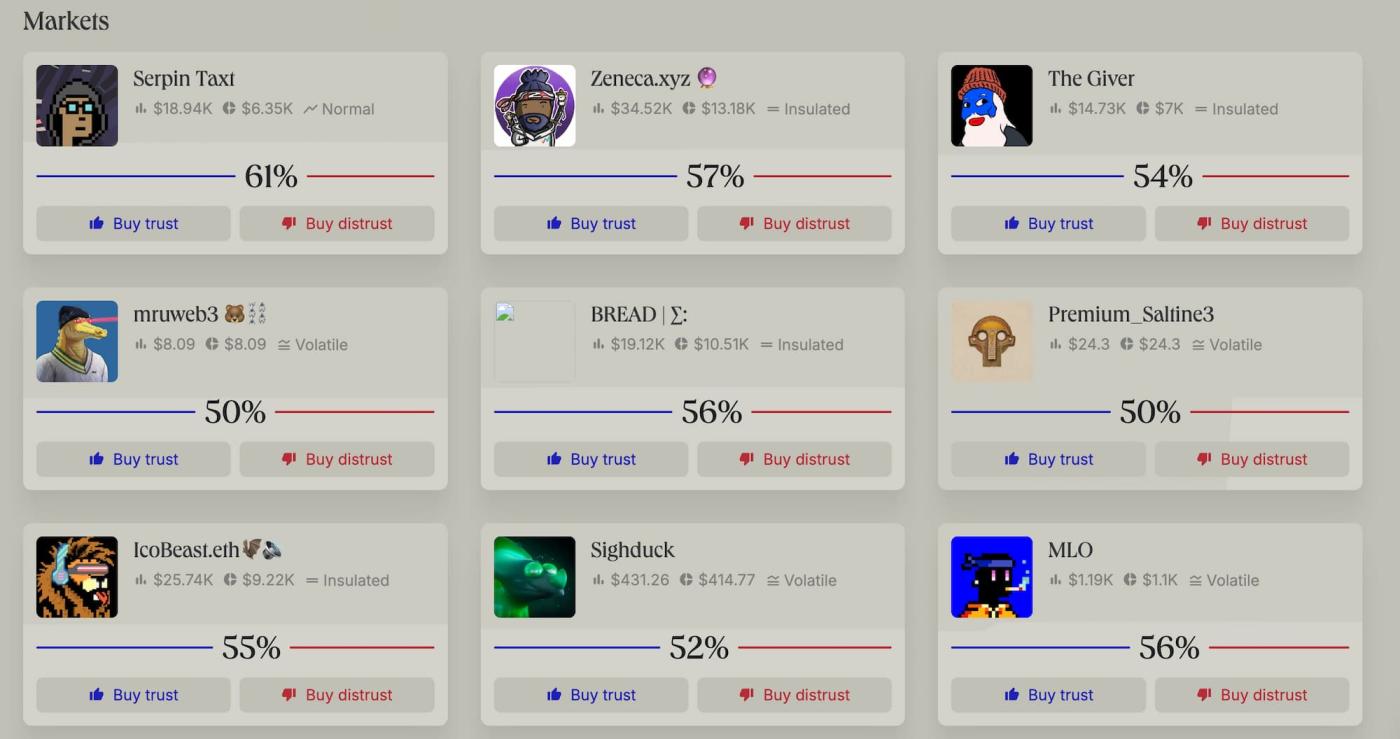

Ethos Reputation Marketplace

Ethos also released the reputation market "Ethos Market". Ethos Market allows users to speculate on the reputation of individuals, companies, DAOs and even AI entities by buying and selling "trust tickets" and "no-trust tickets". Each market is bound to an Ethos Profile (associated with an Ethereum wallet), which reflects the real-time reputation score of the target object.

The initial state is 50% trust vs 50% distrust, and the price is adjusted dynamically with buying and selling. Buying "trust tickets" can push up the target user's trust score while reducing the price of distrust tickets, and vice versa. Because credibility cannot be finalized at a certain moment and the market continues to fluctuate, the Ethos Market adopts a perpetual market design.

In terms of market pricing and liquidity, Ethos Market uses the standard logarithmic market scoring rule (LMSR) algorithm based on AMM smart contracts to price two opposite positions. This is the same pricing algorithm used by Polymarket.

summary

Ethos aims to make reputation the default element of the crypto economy. Through the "social proof of equity" mechanism, human values are bound to on-chain behavior, encouraging users to demonstrate honest behavior while punishing malicious actors, thereby promoting the development of the Crypto world in a healthier and more orderly direction. In addition, the Ethos protocol can also be integrated into wallet plug-ins, dApps, etc., becoming a universal reputation layer in the crypto world, rather than a single application.

Ethos' innovative mechanism and concept bring new hope to solve the current trust problem in the industry. But at the same time, Ethos also faces multiple challenges: the invitation system limits user growth, the scoring algorithm needs to ensure fairness, and community governance is not yet mature.