Written by: KarenZ, Foresight News

The crypto world is often compared to the "Wild West," filled with chaos and disorder. The trust issue has always been a key obstacle hindering the industry's further popularization and maturity. Targeting this pain point, Ethos Network is committed to measuring reputation and credibility on the blockchain, creating a more trustworthy environment for the crypto ecosystem.

As Ethos says, in real-world society, reputation is ubiquitous - resumes determine job opportunities, ratings screen doctors, and five-star drivers get priority orders. However, the reputation system in the Crypto world is almost blank, lacking an easy-to-reference and clear reputation system, leading to high trust costs, zero cost for malicious actions, and frequent fraud.

Ethos will fill this gap. Ethos's solution is an on-chain reputation protocol - generating a Credibility Score through decentralized mechanisms, like a "credit report" in the crypto world, but completely based on open protocols and on-chain records, driving the crypto ecosystem towards a more ordered and mature direction.

Ethos's Core Design

Ethos protocol ensures the reliability, decentralization, and anti-Sybil attack capability of its reputation system through a series of innovative mechanisms, combined with Social Proof of Stake (Social PoS). Here are its main functions and mechanisms:

I. Invitation System and Sybil Attack Protection

To ensure the network's resistance to Sybil attacks (avoiding manipulating the system by creating multiple fake identities), Ethos adopts a strict invitation system. Users must be invited by existing Ethos account holders to create their own Ethos Profile. This effectively limits the proliferation of malicious accounts.

The invitation mechanism also introduces a "reputation binding" design: the inviter and the invited form a binding relationship within 90 days of invitation, with the inviter receiving 20% of the invited user's credibility score, regardless of positive improvement or negative decline. This means that if the invited user gains a high score through honest behavior, the inviter can share 20% of their score; conversely, if the invited user loses points due to malicious behavior, the inviter will also suffer corresponding losses. This mechanism incentivizes inviters to carefully choose who they invite, enhancing the network's overall credibility.

II. On-chain Credibility Score

Ethos's core function is generating a Credibility Score, a numerical indicator quantifying users' on-chain trust. The score is based on the following on-chain activities and social interactions:

Review Mechanism: Only Ethos Profile holders can leave comments, providing positive, neutral, or negative reviews for others. While a single review has minimal impact, the cumulative effect of multiple reviews can significantly alter a user's reputation score. For example, consistent positive reviews from high-credibility users can substantially improve the target user's credibility.

Vouching Mechanism: Allows Ethos users to endorse other users by staking Ethereum (with plans to support other assets), indicating trust in their reputation. Vouching directly affects the target user's credibility score. Key features of the vouching mechanism include:

Vouchers must stake a certain amount of ETH. The higher the stake, the more positive impact on the target user's credibility score.

Staked ETH is locked, serving as a financial endorsement of the vouchee's reputation.

Vouchers can withdraw their vouching at any time. If they discover misconduct, withdrawal will cause the target user's credibility score to drop.

When users A and B vouch for each other, the system identifies this as a mutual vouching relationship, with a more significant effect on both parties' credibility scores.

Slashing: Aimed at deterring misconduct through a community-driven punishment mechanism. This mechanism is not yet online.

Any Ethos participant can act as a "reporter," providing a reward to validators to request manual verification.

Validators receive the same reward regardless of voting results, which somewhat prevents validator bias.

If validators support the reporter's allegations, a portion of the reported user's staked funds will be deducted and awarded to the reporter. A single Slash does not exceed 10% of the total Ethos stake. If the reporter's allegations are unfounded, they will be punished.

Slashed funds are directly deducted from the reported user's stake and transferred to the reporter. This punishment is the only mechanism that can forcibly deduct funds without the staker's consent, but is designed to occur rarely (usually addressed through negative reviews or vouching cancellation).

Punished users will not be penalized for the same type of report within 72 hours, providing a buffer and preventing malicious consecutive attacks.

Ethos users can also initiate "Social Slashings" without financial risk, instead affecting participants' credibility scores.

Attest Mechanism: Allows participants to link other digital identities, social network profiles, and on-chain wallets, reflecting authority, reputation, and influence from other channels. Attestation itself is free, with users only paying necessary Gas fees. Certified accounts and wallets are permanently recorded on-chain. Users making fraudulent attestations (such as linking unowned social accounts) will face severe penalties:

Financial penalty: Staked ETH (if any) may be confiscated.

Social penalty: Significant drop in credibility score, potentially triggering social slashing.

III. Ethos Profile Display

User profiles can provide transparent, verifiable trust references for the community and other dApps. Users can remain anonymous or use pseudonyms without exposing their real identity. Ethos Profile includes a credibility center and credibility score, integrating data from attestation, vouching, reviews, and slashing mechanisms. The Profile's credibility center displays a summary of credibility clues from Ethos protocol or associated wallet on-chain activities, highlighting the most influential Ethos elements like significant vouching, notable reviews, and major financial asset holdings.

IV. How is Credibility Score Calculated?

By analyzing social interaction data generated from these mechanisms, Ethos will generate a numerical Credibility Score, displayed in the Ethos Profile.

Regarding the credibility score calculation, the scoring algorithm comprehensively considers multiple weighted indicators covering various on-chain actions. For instance, vouching-related indicators include the number of vouches, mutual vouching situations, vouching amount, mutual vouching duration, and default scenarios. Other factors include the credibility scores of reviewers or vouchers, the user's average rating on Ethos, the duration of attested accounts, etc. Indicator weights are non-linear, and indicators and weights will be adjusted based on credibility consensus to ensure scientific accuracy and adaptability.

For score range and levels, the score ranges from 0 - 2800, divided into 5 levels. 0 - 799 points represent untrustworthy; 800 - 1199 points are questionable; 1200 - 1599 points are neutral; 1600 - 1999 points are of good reputation; 2000 - 2800 points are excellent. All wallets and attestations start with a default score of 1200 points (neutral).

In governance, considering the importance of credibility scores, Ethos Labs plans to transfer the scoring algorithm's control to participants to avoid the drawbacks of centralized influence.

Ethos Reputation Market

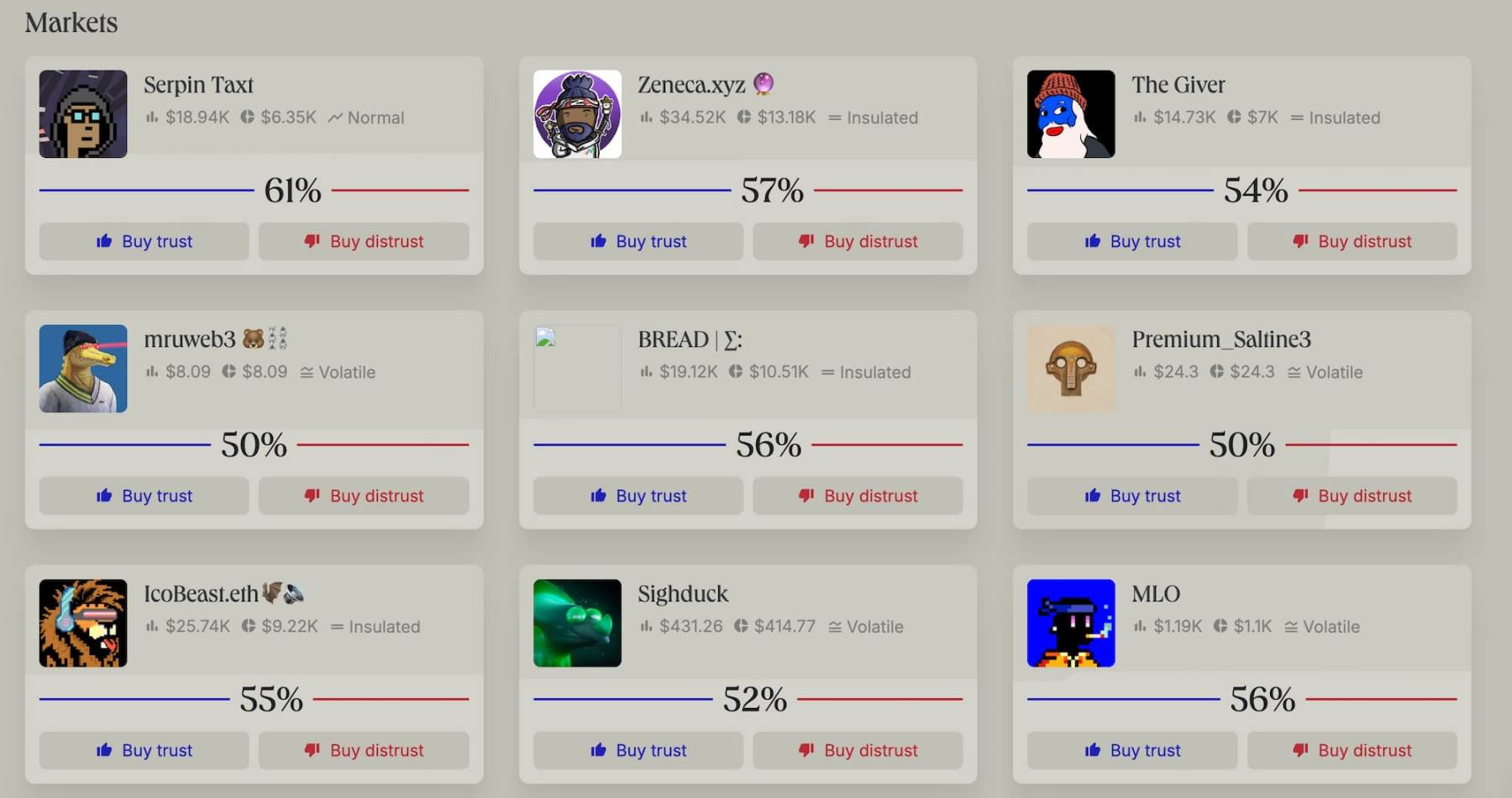

Ethos has also launched a reputation market called "Ethos Market". Ethos Market allows users to speculate on the reputation of individuals, companies, DAOs, or even AI entities by buying and selling "trust tickets" and "distrust tickets". Each market is linked to an Ethos Profile (associated Ethereum wallet), reflecting the real-time reputation score of the target.

The initial state is 50% trust vs. 50% distrust, with prices dynamically adjusting based on buying and selling. Buying "trust tickets" can raise the target user's trust score while lowering distrust ticket prices, and vice versa. Since reputation cannot be definitively determined at a single moment, the market continues to fluctuate, so Ethos Market adopts a perpetual market design.

In terms of predictive market pricing and liquidity, Ethos Market is based on an AMM smart contract, using the standard logarithmic market scoring rule (LMSR) algorithm to price two opposite positions. This is the same pricing algorithm used by Polymarket.

Summary

Ethos's goal is to make reputation the default element of the crypto economy, binding human values with on-chain behavior through a "social proof-of-stake" mechanism, incentivizing users to demonstrate honest behavior while punishing malicious actors, thereby promoting the development of the Crypto world in a healthier and more orderly direction. Additionally, the Ethos protocol can be integrated into wallet plugins, dApps, and other platforms, serving as a universal reputation layer for the crypto world, rather than a single application.

Ethos's innovative mechanisms and concepts bring new hope to solving current industry trust issues. However, Ethos also faces multiple challenges: invitation-based restrictions on user growth, the need to ensure fairness in scoring algorithms, and immature community governance.