Author: JE Labs

1. Overview

The Memecoin market has developed rapidly around the world in recent years, and regions such as the United States, China, South Korea, and Europe have formed their own distinctive ecosystems. In these markets, KOLs have a significant impact on community activity, market sentiment, and trading trends. This article will focus on the six major markets of the United States, China, South Korea, Europe, Japan, and Russia , identify the most representative Memecoin KOLs in each region, and analyze their trading activity, dissemination methods, and community influence. By studying the characteristics of KOLs in different markets, we can better understand the dissemination logic and trading patterns of Memecoin around the world.

1.1 Research Purpose

Compare the development of Memecoin in different regions - compare their trading volume, regulatory policies, KOL influence, etc.

Screening representative KOLs from various regions - Screening out the most influential KOLs in the Memecoin market in the United States, China, South Korea and Europe. And studying the KOLs in different regions in the market, the right to speak, the way of communication and the audience preferences, and finding out the market differences.

Summarize the characteristics of active KOLs in the community - analyze these KOLs' social media strategies, community interaction methods, and their impact on transaction trends, so as to provide reference for projects that want to enter the corresponding market.

1.2 Logic of research area selection

In the global crypto market, Memecoin, as a unique crypto ecosystem, shows great regional differences due to its community-driven, cultural influence and market speculation. This report selects China, the United States, Europe, South Korea, Japan and Russia as the main analysis objects for the following reasons:

The United States: As the core region of global cryptocurrency trading, it has long dominated the liquidity and trading volume of Memecoin. Many well-known Memecoins (such as $DOGE and $SHIB) originated in the United States and have formed a huge ecosystem around the world.

China: With a large investor base and a highly active community, despite regulatory restrictions, users are still enthusiastic about trading Memecoin through DeFi and CEX. The Chinese market is highly speculative, which often drives short-term trends and even gives birth to Meme tokens with local characteristics.

South Korea: It has always been one of the most active cryptocurrency markets in the world , especially in short-term trading and community operations. South Korean investors tend to be high-frequency traders and have a FOMO mentality, which makes local Memecoin often explode in extreme market conditions in a short period of time. In addition, South Korea's K-Pop culture also provides a rich source of creativity for Memecoin narratives.

Europe: Compared with the more speculative Asian market, European users are more inclined to cultural identity and long-term value investment. Many local Memecoins combine elements such as political satire and social movements to form a unique market style .

Japan: The Memecoin market is significantly influenced by ACG (animation, comics, and games) culture and the two-dimensional brand effect. The project content is mostly based on anime characters, Internet memes, and VTubers, forming a local Meme model that is different from other countries.

Russia: Affected by international sanctions and the local social environment, the Russian Memecoin market is distinctively closed and speculative. High inflation and ruble depreciation drive demand for safe havens, and cryptocurrencies have become an alternative investment tool for speculation and hedging against asset shrinkage.

2. Global Memecoin Market Overview

2.1 Memecoin VS Traditional Crypto Projects

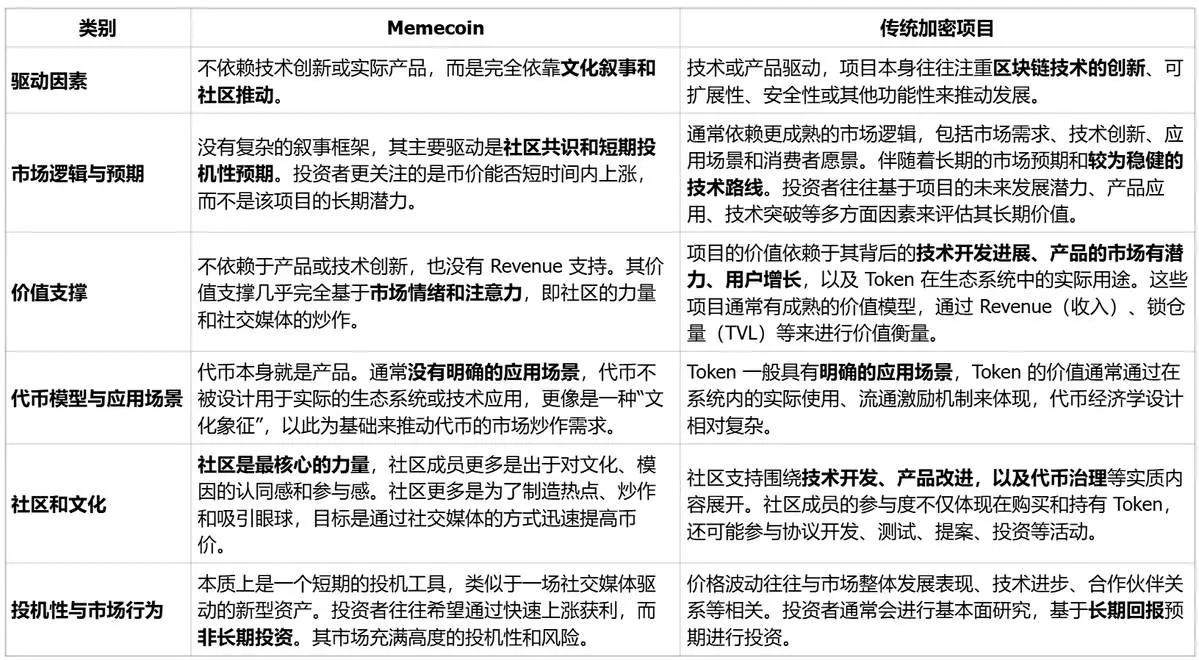

Although Memecoin and traditional crypto projects (such as public chains, DeFi protocols, Dapps, etc.) all belong to the field of cryptocurrency, they have significant differences in core values, driving forces, and market understanding and response.

Comparison between Memecoin and traditional crypto projects

2.2 Comparison of market characteristics in different regions

The development of Memecoin in different regions is influenced by culture, regulation, and market preferences , and the market characteristics vary greatly:

Comparison of market characteristics by region

United States: The United States has a large cryptocurrency investor base, but the investor structure is diverse, including institutional investors and individual investors. Institutional investors prefer to invest in mainstream cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH); however, individual investors , especially the younger generation, show great interest in Memecoin.

China: Due to the Chinese government's strict regulation of cryptocurrency trading, domestic exchanges have been closed and investors mainly participate through OTC or overseas platforms. Chinese investors are still interested in high-risk, high-return investment opportunities.

South Korea: According to a survey by the Korea Financial Intelligence Unit (KoFIU), the number of cryptocurrency investors in South Korea is estimated to be over 6 million, accounting for more than 10% of the total population. Among them, transactions are mainly conducted through centralized exchanges (CEX), and Upbit has a market share of about 80% in South Korea. South Korean investors have shown a strong interest in Altcoin with high return potential and tend to accept the associated high risks. This is also considered to be one of the reasons for the high proportion of Altcoin transactions in the South Korean market.

Europe: The acceptance of cryptocurrencies in Europe is gradually increasing, and the regulatory environment is relatively relaxed. However, investors prefer to make steady investments and focus on mainstream cryptocurrencies. Although Memecoin is traded in the European market, its overall share may be relatively low.

Japan: Influenced by ACG culture, anime-themed tokens are popular, but overall trading activity is low to moderate. Strict regulation requires exchanges to hold licenses, and discussions are mainly focused on 5ch and X platforms.

Russia : The market is driven by sanctions, with active DEX and P2P trading. Telegram communities are highly speculative about Memecoin, but long-term persistence is low, and politically related tokens occasionally appear.

3. Analysis of Memecoin Ecosystem in Various Regions

3.1 United States

Top narrative drive - Trump and Musk: The top narrative of American Memecoin revolves around the two core figures of Trump and Musk. Traders will dig deep into their social media dynamics, looking for potential narrative opportunities from avatars, signatures, reposts, and tweets, in order to create corresponding Memecoins and hype them. Musk's avatar change, Trump's campaign speech, or even a short tweet may become the fuse for the birth of a new Meme token. For example, Trump's X signature was "45th President of America" before. Later, when he ran for president again, many people predicted that he would change his signature to "45th & 47th President of America", so many coins like $47 and $4547 appeared on the Sol chain.

Political, economic, and social events drive secondary narratives: The second-level Memecoin topics also involve influential figures in politics, technology, and other fields, such as Gabe Newell, founder of Steam, and Vitalik Buterin, founder of Ethereum. At the same time, the American Memecoin ecosystem is also closely integrated with economic policies, political events, and social news. For example, Trump's promise to pardon Ross (Silk Road founder Ross Ulbricht) gave rise to the $FreeRoss market; Trump's announcement that he would make public the list of "Lolita Island" has also made tokens with related names a hot spot for market speculation; in terms of social news, Luigi's trial process has triggered $LUIGI The rise has made it the top celebrity coin.

Positive and inspiring narrative core: A large number of Memecoins in the United States carry some kind of positive and inspiring narrative core, which inspires a universal resonance. For example, the "FIGHT" shouted by Trump when he was shot evolved into the Memecoin $FIGHT of the same name, symbolizing the spirit of resistance that never yields; $FAFO (Fuck Around and Find Out) originated from the satire of the corruption and inefficiency of the US government system; Squirrel Coin $PNUT Its mascot, the squirrel, symbolizes justice and overcoming all obstacles in religion and is highly recognized in European and American culture.

Community-driven, long-term holding: Compared to other regions, Memecoin traders in the United States are more inclined to long-term community building rather than short-term speculation. $FAFO has fostered a strong community, with many holders being long-term “diamond holders”. This model of narrative-driven consensus and community-supported value has given the U.S. Memecoin ecosystem greater durability and influence.

3.2 China

Dominated by European and American hot spots, lack of localized narratives: China's Memecoin market mainly follows European and American hot spots , and traders tend to invest around the trends of overseas markets, and localized narratives are relatively lacking. However, many popular European and American Meme images lack recognition in the Chinese market, making it difficult for local users to resonate. For example, $PEPE , which is popular in the European and American markets, due to cultural differences and language barriers, Chinese traders failed to understand the meaning of this emoticon package, so the participation in the early construction of $PEPE was relatively low. At the same time, since the information circulation in the crypto market is mainly in English, many Chinese retail investors find it difficult to obtain first-hand information in a timely manner, which easily leads to delayed entry. In addition, the vast majority of tokens are named in English , making it difficult for many local narratives to form a global consensus, further limiting the development of Chinese local Memecoins.

The local Memecoin ecosystem is weak and the hot spot effect is short-lived: Although there are localized Memecoins in the Chinese market, the overall popularity is limited, often lacking long-term narrative support , relying more on short-term hot spot effects, and having a short life cycle. For example, Shen Teng mentioned $DogeKing in the Spring Festival Gala sketch, and CEX happened to have a token with the same name, which ushered in a wave of market value increases in the short term. After that, the Spring Festival Gala section Memecoin will be opened every year, and retail traders will find angles to trade in the Spring Festival Gala program. In addition, when the domestic IPs of film and television culture such as Nezha were released in North America, tokens such as $NEZHA and $AOBING were derived and attracted attention in a short period of time. Some of China's early recursive token projects originally had Meme attributes, but due to regulatory restrictions and market environment, they failed to survive. For example, Pangu Coin was defined as a pyramid scheme fraud by the state and eventually disappeared due to regulatory issues.

Focus on AI and technology sectors : Chinese traders are interested in the latest trends in AI and technology when choosing Memecoins, and tend to invest in the direction of technological development. AI-related Memecoins have a high degree of attention in the Chinese market, such as the local AI token DeepSeek and AI Goku developed by the University of Hong Kong. There were once multiple Memecoins with the same name on the market. Many overseas on-chain platforms or AI tools will be issued tokens by the official team TGE and listed on exchanges, making the projects more valuable and credible in the long term. This difference makes AI-themed Memecoins in the Chinese market more speculative , and investors need to be more cautious in identifying them to avoid falling into the trap of short-term speculation.

3.3 South Korea

High-risk investment: South Korea's social class is seriously solidified, and investors prefer to accumulate wealth quickly through high-risk and high-return investment methods. This mentality has prompted Korean investors, especially young people aged 20-30, to be interested in VC-style, and Memecoin trading has become one of their first choices. Korean Memecoin transactions are fast-paced, volatile, and the community is highly enthusiastic, but the profit window is extremely short , and the market operation model is more inclined to short-term speculation rather than long-term value investment.

Strong association with popular entertainment culture: Korean Memecoin traders often combine K-pop idol culture, film and television works and Internet memes to promote market speculation. For example, the $LUNA cryptocurrency-themed movie "Crypto Man" released at the beginning of this year caused a craze because of the fictitious token $MOMMY mentioned in it. The concept was even hyped by speculators, and the market value of the token of the same name in the primary market reached 5 million. In addition, there were rumors that the second season of "Squid Game" would involve the name of a certain cryptocurrency, which also triggered a speculation frenzy of Altcoin on the chain. However, this kind of phenomenon is often accompanied by extreme short-term speculation. Market participants rely on information asymmetry to quickly pull the market and create a "wealth-making effect", but the subsequent market crash is also extremely fierce, making non-core circle traders become receivers.

The market is highly volatile and the turnover rate is extremely high: Since Korean investors prefer short-term speculation , the turnover rate of Memecoin in the Korean market is usually much higher than that in the European and American markets. The rapid flow of funds leads to sharp short-term price fluctuations, which is also one of the main characteristics of Memecoin trading in the Korean market. The trading volume of Korean Memecoin is often highly correlated with the popularity on social media. In Telegram, Twitter, Naver Café and KakaoTalk groups, investors frequently share trading strategies, market sentiment and hot discussions, forming a strong network effect. When a Meme topic becomes popular in the community, the corresponding Memecoin trading volume usually rises rapidly within a few hours. On the contrary, if the market's attention to a project decreases, its trading volume will quickly dry up and enter a long-term downturn.

3.4 Europe

Multicultural narratives, strong regional meme influence: The Memecoin ecosystem in Europe is more obviously influenced by regional culture . For example, the French and Belgian markets have a certain degree of acceptance of Memecoins with cartoon characters such as Asterix and Obelix, while the German market prefers Memes with political satire, such as tokens related to EU policies, energy crises, and inflation. In addition, football culture is prevalent in European countries. During the World Cup, the Champions League and other events, a large number of football-related Memecoins, such as $RONALDO, $MBAPPE, $MESSI, etc., often appear, which often have short-lived but extremely explosive market conditions.

Driven by political and social issues: Compared with the US market's focus on personality cults (such as Musk and Trump), the European Memecoin ecosystem is more inclined to political issues, social issues and collectivist sentiments . For example, in the controversy over France's retirement reform in 2023, a token called $MACRON was briefly popular to satirize the reform policies of then-President Macron. In addition, Europe has a strong anti-establishment sentiment. For example, the $EUBUREAU token satirizing the EU bureaucracy and the $GRETA (in the image of environmental activist Greta Thunberg) satirizing the carbon tax policy have all triggered an investment boom in a specific period of time.

NFT combined with Memecoin, artistic attributes enhanced: Since Europe has a strong artistic and cultural tradition , the Memecoin ecosystem in Europe is more likely to be combined with NFT to form NFT assets with collection value. For example, the Web3 communities in France and Italy tend to launch Meme tokens that combine classic art elements, such as $MONA based on the image of Leonardo da Vinci's "Mona Lisa", or $VANGOGH based on Van Gogh's works. These tokens are usually issued in combination with NFT to increase market recognition and collection value. In addition, the digital art market in Europe is relatively developed, making the combination of Memecoin and NFT more market-acceptable, biased towards culture and art, rather than pure speculation.

Low-risk investment preference and stricter regulatory environment: European investors have a lower overall risk appetite and are more cautious in Memecoin transactions. Large-scale FOMO-style speculation usually does not occur. The Memecoin ecosystem in Europe is more robust and prefers low-volatility Memecoins, which are held for the long term based on community consensus.

Low social media influence and slow market spread: The spread of Memecoin in the European market mainly relies on Telegram, Reddit, and Discord, while X and TikTok have relatively low influence. This leads to a slow spread of Memecoin, and its explosive power is not as good as that of the US and Korean markets. For example, some Memecoins that are popular in the United States, such as $PEPE, were accepted later in Europe, and gradually entered the field of vision of European investors until the market heat had passed. This slower spread mode makes the European Memecoin market less likely to experience a sharp rise and fall in a short period of time, but is more inclined to a community consensus and slow accumulation development model.

3.5 Japan

Combining animation, games and ACG elements: The development of Memecoin in Japan is influenced by local culture, especially ACG elements such as animation, games, and light novels. Japan has the most mature ACG (Anime, Comic, Game) industry in the world, and many Memecoin projects will borrow from well-known IPs or derive popular Internet memes. For example, there have been Memecoins with characters from "Attack on Titan" or "Neon Genesis Evangelion" as the theme. However, due to the strong copyright awareness in Japan, many such tokens will face greater legal risks due to copyright issues and will be difficult to survive in the long run .

Social media and VTuber influence: In Japan, VTuber (virtual anchor) culture is prevalent. Many traders pay attention to VTuber's remarks and live broadcast content. Even some well-known VTubers may accidentally mention a certain Internet meme, triggering a Memecoin craze. For example, a VTuber under Hololive once mentioned "kusa" (くさ/kusa ) in a live broadcast. This Japanese Internet term originated from "warai" (わらい/warai), which triggered a Memecoin craze. $KUSA In addition, platforms such as X, Niconico and 5ch forums are also the main channels for Japanese Memecoin traders to obtain information.

Seasonal memes and festival-limited memes : The Japanese Memecoin market has a strong seasonal cultural feature. Memecoins with corresponding themes often emerge during specific festivals or events (such as the cherry blossom season, Tanabata, Halloween, the Red and White Songs Contest, and the Comiket anime exhibition). For example, during the cherry blossom season, tokens such as $SAKURA and $OHANAMI (お花见) were hotly traded in a short period of time, combining real festival culture with virtual assets, forming a "short-term speculation" phenomenon.

3.6 Russia

Local social platforms dominate, TG community is active: Due to Russia's restrictions on Western social platforms such as X and Instagram, the spread of local Memecoin mainly relies on Telegram and VK (Russian social platforms) for information sharing and market manipulation. This community culture has prompted Russia's Memecoin to prefer a closed circle dissemination model. Compared with the European and American markets, the spread speed is slower, but the community consensus is stronger and the holders are more loyal.

Due to sanctions, liquidity is limited: As Russia faces international sanctions, many mainstream exchanges have imposed restrictions on Russian users, making local Memecoin liquidity low and difficult to enter the international market. Therefore, Russian Memecoin transactions rely more on local CEXs such as EXMO and YoBit. In addition, due to the blockade of the payment system, Russian users have high transaction costs in overseas markets, resulting in limited activity in some Memecoin transactions and difficulty in forming a global consensus.

Risk aversion and speculation coexist : Russia is affected by long-term high inflation, ruble depreciation and international sanctions. The cryptocurrency market has become an alternative safe-haven asset for many investors to hedge against ruble depreciation and avoid asset shrinkage. Especially in times of economic turmoil and restricted fiat currency exchange, the trading volume of the crypto market tends to surge, and users tend to chase high-risk and high-return Meme projects, and make up for the losses caused by the depreciation of fiat currency assets through short-term speculation.

4. Summary of the characteristics of Memecoin KOLs from different regions

4.1 European and American countries

Representative KOL in European and American countries——Murad @MustStopMurad

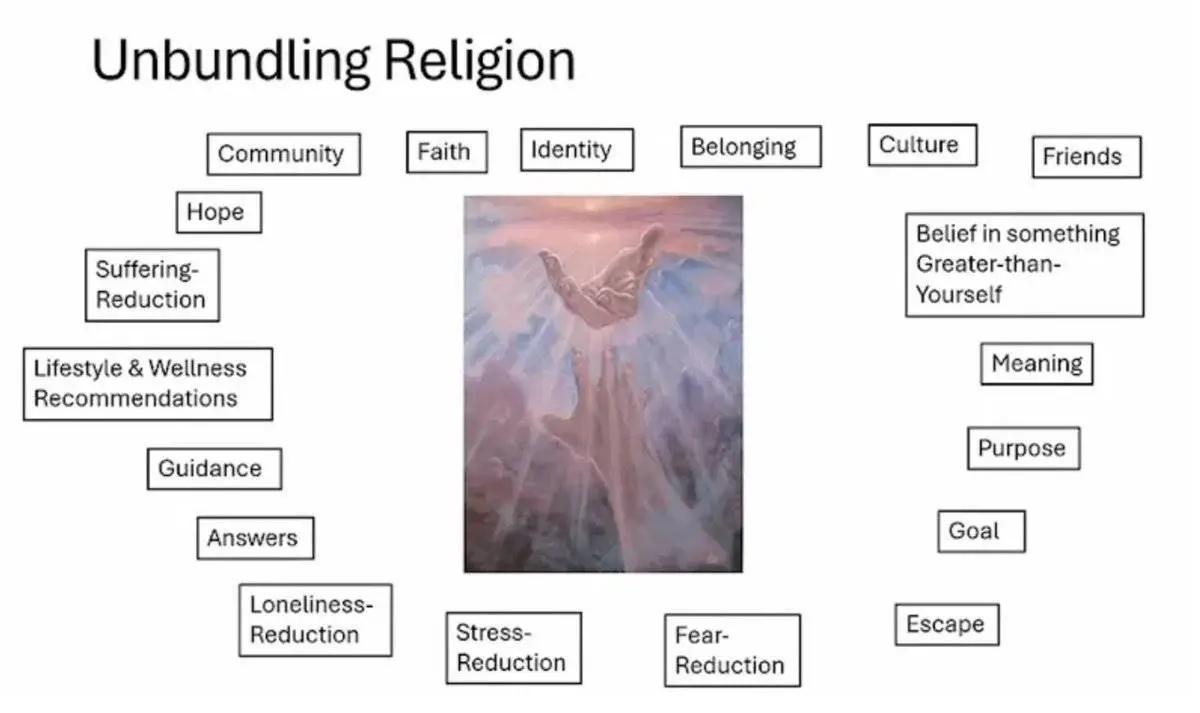

Murad's view on Memecoin: Memecoin has long been regarded as on-chain meme because it lacks technical support and practical applicability , and relies more on market sentiment and community consensus. However, Murad gives Memecoin's narrative a deeper value. He believes that the function of a good Memecoin is to provide fun, reduce loneliness, identity recognition, and bring resonance, emotional connection, a sense of mission and meaning, entertainment, and happiness.

Murad's Insights on Memecoin

Murad's criteria for screening Memecoins

Market Cap Range: Focus on mid-cap coins with a market cap between $5 million and $200 million.

Chain selection: prefer projects on Solana and Ethereum chains, and exclude projects on Base, Ton, Sui and other chains.

Project History: Choose tokens that have been around for at least six months and have experienced at least two 70% crashes.

Murad's recent investment performance : He purchased 10.25 million $SPX tokens at a cost of about $98,000 four months ago. The current value has risen to about $7.89 million, with a return on investment of about 7900%. However, his crypto asset portfolio has shrunk by about 45% in half a month, with a net loss of $11.1 million. The price of the main $SPX coin has fallen from $0.72 to $0.40.

Characteristics of Memecoin KOLs in Europe and America

Avatar and identity positioning: KOL avatars usually have unique visual symbols to establish their own identity. Avatars are often Pepe, BAYC, Milady, etc. NFT , or pixel-style cartoon characters, such as CryptoPunks, mean that they have been deeply involved in the Meme track, participated in the crypto market in the early stage, and have certain financial strength and industry influence. In the personal profile of X , the following keywords are usually included: Meme, Memecoin, gem, gem hunter/finder, 100X, degen, altcoin, alpha, to convey their focus and speculative style to the market.

Content operation and promotion strategy: European and American Memecoitn KOLs usually have the following operation mode. Continuous publicity, KOLs usually continue to post around a Memecoin, repeatedly mentioning the token within one to two weeks, rather than just releasing CAs of multiple new projects every day. Multi-angle marketing, they will not only release simple "buy" signals, but also combine market sentiment, KOL dynamics, related news and other content to create a more attractive narrative. If a Memecoin is related to Elon Musk and Trump, they will amplify the correlation and enhance the FOMO effect. Guide market sentiment, when Memecoin enters the key pull-up stage, KOLs will hint that the price may soar, affecting the FOMO group. When the market value is adjusted, they will turn to "long-term holding" and "community consensus" and other rhetoric to maintain investor confidence.

Tweet interaction: In terms of tweet operation, in addition to directly recommending projects, it is also common to interact with fans. For example, posting an open-ended question "What is the next 100x Memecoin?" and adding relevant hashtags #Memecoin #100x #crypto . This type of tweet guides fans to recommend tokens in the comment area, creating a highly interactive discussion atmosphere. Its advantage is that it can attract traffic, enhance community stickiness, and help KOLs identify market hotspots.

Community management model: European and American KOLs build their own private domains on TG and Discord. The community management method is relatively centralized , forming a KOL-led communication model, which is specifically manifested as follows:

1. Fixed news push: community operators (KOL or assistants) will release Memecoin-related news, market trends, KOL opinions, etc. every day.

2. Mute mode. Many European and American TG communities adopt semi-closed management. Ordinary members cannot chat and interact in the group at will. Instead, they mainly express their support through likes, hearts, and forwarding tweets, rather than free communication.

3. Create FOMO within the group. KOLs will send market sentiment information within the community, including large-scale buy orders, celebrity attention, and a certain coin will be listed on CEX, etc., to increase conversion rates. Overall, the operating model of European and American Memecoin KOLs is more stable, emphasizing brand building and long-term holding, rather than relying solely on short-term speculation to attract market attention.

4.2 China

China's representative KOL——0xWizard @0xcryptowizard

Narrative view on Meme coin: 0xWizard believes AI track + Meme narrative is a new trend in the future crypto market. He emphasized that the value of Memecoin is not only a reflection of market sentiment, but also includes community resonance, emotional connection and sense of mission. $ACT , $GOAT , $BMT AI Meme projects such as the 2016 AI Meme Project are seen as a renaissance of AI, and believe that future AI will no longer be a simple assistant, but a free soul with autonomous consciousness.

0xWizard's criteria for screening Memecoin:

1. Diversification of chips: Give priority to decentralized fund distribution, avoid highly controlled community coins, and avoid projects that are highly controlled by a single large investor or team.

2. New narrative, new track: He emphasized that Memecoin cannot be just a simple emotional hype, but must have innovative narratives and emerging market opportunities. For example, $ACT combines Meme coin with the AI track.

3. Active community: 0xWizard attaches great importance to community building. He believes that a successful Memecoin must rely on strong community consensus and give priority to projects with high user stickiness, active interactions, and a strong sense of belonging.

4. Small market capitalization, high growth potential: Screen projects with small initial market capitalization. Driven by market sentiment, such coins can create greater wealth effects for investors in the primary and secondary markets.

Timeliness: Prioritize projects that are at the forefront of the market, controversial, or booming. For example, $ACT combines the AI track with Meme culture, which fits the popularity of the AI field.

0xWizard's influence: Wizard pinned the introductory tutorial of Memecoin on Twitter, which expanded the audience and was friendly to novices, making more newcomers willing to follow his investment ideas. Unlike the general high- shill KOLs, Wizard shares his deep insights into the industry in his daily tweets, making his influence not only limited to Memecoin investors, but also attracting the attention of a wider range of Web3 practitioners. After successfully promoting the two Memecoin projects $ACT and $GOAT , Wizard's market influence and shill effect reached new heights. He intervened in the early small-cap stage of the project, and finally pushed the two coins to the exchange through community marketing and precise shill. These two successful cases not only verified his investment vision, but also made the market more trustful of his recommendations. Wizard has become a top KOL in the Chinese area with successful shill, deep insights and strong community influence , combining trading and branding.

0xWizard's X page

Characteristics of Chinese Memecoin KOLs

Business model : Compared with the content-driven, community-building KOL model in the European and American markets, many KOLs in the Chinese region will cooperate with Trading Bot (GMGN, PEPE, UniversalX, PinkPig). KOLs will also establish partnerships with CEX (Binance, bybit, okx) to get rebates by inviting new users to register for transactions. This cooperation model can provide KOLs with a stable source of income and chips to fully participate in the market. KOLs in the Chinese region pay more attention to short-term income and user growth, and attract users through high-frequency promotion, airdrop activities, trading incentives, etc.

Content operation and promotion strategy: The content operation strategy of Chinese Memecoin KOL is traffic-oriented , tending to quickly capture market hot spots rather than long-term deep cultivation of a single project, emphasizing " traffic capture" and "hot spot following" . One of the main operation methods is to release multiple CAs at a high frequency, using Twitter's traffic mechanism to maximize the use of short-term traffic dividends . When a popular Memecoin appears in the market, KOLs will quickly follow up and add tags ( #Token or $Token) to the tweets, so that the tweets can enter the traffic pool of the topic. This method can bring higher views and exposure, allowing the tweets to be seen by more potential investors, thereby quickly increasing fans in a short period of time.

Community management model: Telegram or WeChat communities operated by Chinese KOLs are usually very active. Unlike the "banning + information transmission" model adopted by European and American KOLs, Chinese communities allow members to communicate freely . The chat content includes not only transaction sharing, but also gossip in the circle, capital movements, and even daily life. This highly interactive community atmosphere makes the KOL's influence not only reflected in information release, but also in the real-time discussion and emotional interaction of community members.

The community structure is usually pyramid-shaped:

1. Core managers include group owners or assistant administrators. A small number of core personnel are responsible for managing the community, maintaining high-frequency interactions, and publishing newly discovered Memecoins or important market information as soon as possible.

2. Active contributors include senior traders and Alpha intelligence sharers, "dog-beating" users who frequently monitor the dynamics of the chain, and traders who enthusiastically promote a certain token after buying it. These people are highly sensitive to market trends and are willing to continuously output.

3. Ordinary members , who are the largest in number and include followers, observers, etc. They may not speak often, but will follow market sentiment to trade at critical moments.

4.3 South Korea

Summary of Korean KOL characteristics

Small population base, KOL content is widely distributed: Due to the relatively small population base in South Korea, KOLs in the crypto field have not formed a clear vertical division of labor like in Europe, the United States or China. Most KOLs have a wide coverage of content, usually publishing airdrops, industry news, BTC trends, secondary market investment research, on-chain hot spot tracking, and macroeconomic situation assessments in one account. This "wide-net" content strategy can attract audiences at different levels, and also reflects the characteristics of the Korean market being relatively concentrated but with diverse user needs.

Lack of vertical KOLs focusing on Memecoin: Unlike Europe, America or the Chinese region, Korea has not yet formed a top KOL focusing on the Memecoin field. Although some KOLs also mention Meme-related projects, they have not dug deep, followed up for a long time or established a dedicated Meme community.

Multi-platform operation - TG, YouTube, Instagram: Korean KOLs are not limited to a single platform, but will enhance exposure and influence through multi-platform content operation. For example, on YouTube, market analysis videos are the main type, and the common cover is a candlestick chart with strong visual elements, which is highly click-inducing; Instagram is used as an auxiliary communication channel, often publishing light content such as transaction screenshots, opinion summaries, and event previews. Many Korean KOLs will use a unified cover design style and brand visual identity system (Visual Identity) to improve content recognition and professionalism, and gradually establish their own brand image.

Korean Crypto YouTuber's page

4.4 Japan

Japan’s representative KOL——LUCIAN|るしあん@lucianlampdefi

Two-dimensional elements dominate: Japanese KOLs like to use anime-style avatars. Their background images, AMA posters, and brand promotion posters usually adopt two-dimensional or cyberpunk styles to attract young Japanese audiences. Influenced by Vtuber culture, some KOLs use virtual avatars instead of real photos for social interaction. This trend is particularly evident in the NFT field . Many Japanese KOLs will use anime PFPs or even AI-generated characters to enhance their personal brands.

Content style: Japanese KOLs’ content style is usually more delicate and aesthetically pleasing. They avoid overly ostentatious marketing and tend to attract audiences through narrative and visuals. When promoting Memecoin or blockchain games, they often use anime-like immersive narratives. The fan base highly identifies with the ACG culture, so KOLs will also cater to this when publishing content, using anime emoticons, ACG memes, etc.

LUCIAN's X page

4.5 Russia

Characteristics of the Russian crypto community:

Users are highly dependent on TG : Russia's Memecoin market is affected by the country's restrictions on social media platforms. Twitter is banned and local users cannot directly access the platform. This has forced KOLs in Russia and CIS countries to turn to other social platforms (TG/Discord), forming an ecosystem that is different from the global mainstream market. Russian KOLs mainly spread and promote tokens through TG groups or channels . The community adopts a semi-closed management form, and the dissemination method is more covert than Twitter. Some communities adopt a subscription system , and users need to pay to enter the VIP group to see internal information. In general, compared with the European and American markets, the promotion model of Russian KOLs is more low-key and decentralized.

Content transfer and interaction : KOLs usually transfer hot content on Twitter, such as crypto news, new coin listings, airdrop information, etc., to the TG channel and publish them with pictures and text . Community members can like, comment and interact with the messages, forming an interactive ecosystem. Unlike KOLs on Twitter who focus on posting tweets, Russian KOLs rarely directly post CA to promote Memecoin in the TG channel, but prefer to share market trends and investment information .

YouTuber influence : Russian KOLs may cooperate with the CTO community to produce YouTube videos for a certain token. The price of these YouTube videos is usually low, 300-500 US dollars per video, which is more cost-effective than the European and American markets. Since Russian Crypto users are more dependent on TG, the influence of YouTube videos is limited, but it is still one of the KOLs' publicity and profit channels.

Summarize

From the United States, South Korea, Japan, China to Russia, Memecoin markets in different countries and regions show completely different cultural genes. Local narratives and trading logic are always the key factors for whether Memecoin can quickly break through the circle and continue to pull up the market. For project parties who want to enter different regional markets, they must understand the community culture, communication channels and hot narratives of various places, and formulate targeted marketing and community strategies.

In the future, Memecoin will no longer be a pure speculative product, but a digital asset that combines entertainment, cultural identity and community consensus. JE Labs will continue to pay attention to changes in the global Memecoin ecosystem and help more projects achieve breakthrough growth in the Asian and even global markets.