Ethereum (ETH) continues to struggle below the $2,000 mark, a level it has not recovered since March 28, 2024, as downward momentum persists in both technical and chain indicators. Despite attempts to stabilize, recent data shows increasing ETH concentration in whale wallets, along with continuous weakness in trend indicators like EMA lines.

Meanwhile, small and medium investors are gradually losing market share, making ownership increasingly tilted towards large investors. The combination of reduced small investor participation and whale dominance could make ETH vulnerable to significant adjustments if sentiment changes.

ETH Holdings by Whales Reach 9-Year High, Raising Concentration Concerns

ETH held by whale addresses – wallets controlling over 1% of circulating supply – has reached its highest level since 2015, accounting for 46%.

This marks a significant shift in Ethereum ownership data, as whales surpassed small investor holdings on March 10, 2024, and have continued to increase their market share since. In comparison, investor-tier addresses holding 0.1% to 1%, and small wallets holding under 0.1%, have both reduced ETH market share.

The increase from 43% to 46% in just a few months reflects strong accumulation among the largest holders, indicating growing ETH concentration in fewer hands.

ETH Historical Concentration By Different Types of Wallets. Source: IntoTheBlock.

ETH Historical Concentration By Different Types of Wallets. Source: IntoTheBlock.Whales typically represent institutional investors, funds, or pioneers, and their behavior can significantly impact price due to the volume they control. Investor-tier addresses usually reflect high-net-worth individuals or smaller organizations, while small addresses include daily traders and holders.

While some may view increased whale holdings as a vote of confidence, it also raises the risk of sudden volatility if large holders begin selling.

With small and investor participation declining, the market could become more fragile and susceptible to significant, unexpected price fluctuations driven by a few dominant players.

Whales Holding 1,000 to 100,000 ETH Currently Control $59 Billion

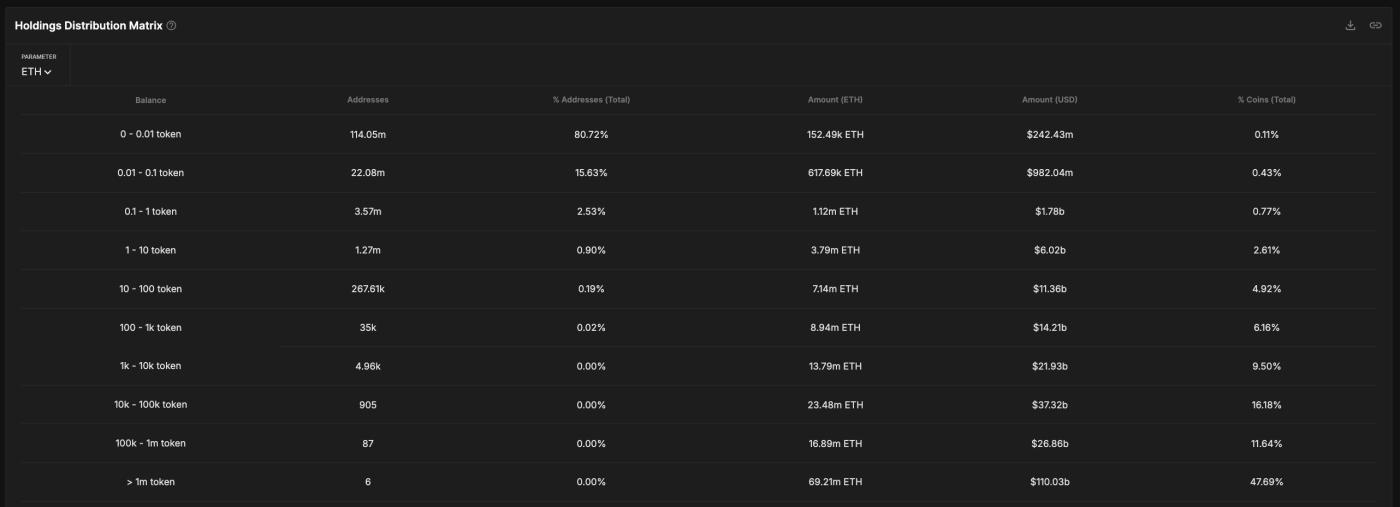

Analysis of the ETH Holdings Distribution Matrix reveals concerning signs of deepening concentration.

Excluding addresses with over 100,000 ETH – typically associated with centralized exchanges – whale addresses holding 1,000 to 100,000 ETH currently control around $59 billion in ETH, representing approximately 25.5% of circulating supply.

This group has consistently accumulated network supply, reinforcing the power shift towards large entities operating outside exchanges but still significantly influencing the market. Recently, Galaxy Digital transferred 100 million USD in Ethereum, raising questions about whether this represents a strategic change or a selling signal.

ETH Holdings Distribution Matrix. Source: IntoTheBlock.

ETH Holdings Distribution Matrix. Source: IntoTheBlock.While some may view this trend as strategic positioning by confident holders, it also exposes Ethereum to significant price decline risks.

With over a quarter of the supply concentrated among these whales, any coordinated or panic-driven selloff could cause substantial price drops, especially in an environment of weakening small investor participation.

Rather than a sign of long-term stability, this concentration level may make the ETH market increasingly fragile and susceptible to volatility if these holders begin shifting capital to other assets.

Declining EMA Structure Puts Pressure on ETH

Ethereum's EMA lines continue to emit bearish signals, with short-term averages remaining below long-term lines – indicating ongoing downward momentum.

If a new correction occurs, Ethereum might test initial support at $1,535. Breaking below that could open deeper decline potential to $1,412 or even $1,385.

If these support levels also fail, Ethereum will dangerously approach the $1,000 mark, a level some analysts have identified as a potential decline target in prolonged market correction scenarios.

ETH Price Analysis. Source: TradingView.

ETH Price Analysis. Source: TradingView.However, a price reversal is not entirely excluded. If buying pressure returns and Ethereum regains short-term momentum, it could test resistance at $1,669.

A breakthrough above that would be a significant technical signal, potentially pushing Ethereum's price to $1,749 and even $1,954.

However, with EMA lines still tilting downward, the burden remains on buyers to prove that momentum has decisively shifted in their favor.