Key Points:

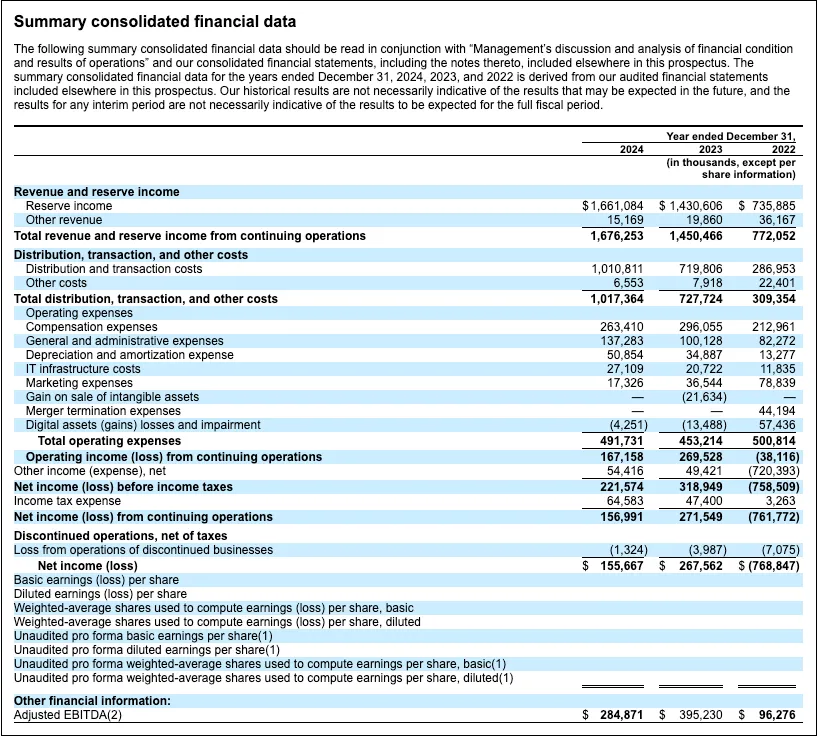

1. Circle achieved revenue of $1.7 billion in 2024, with 99% coming from USDC reserve interest income. Distribution costs with partners like Coinbase and BN totaled $1.01 billion, reflecting trading platforms' key role in expanding USDC coverage.

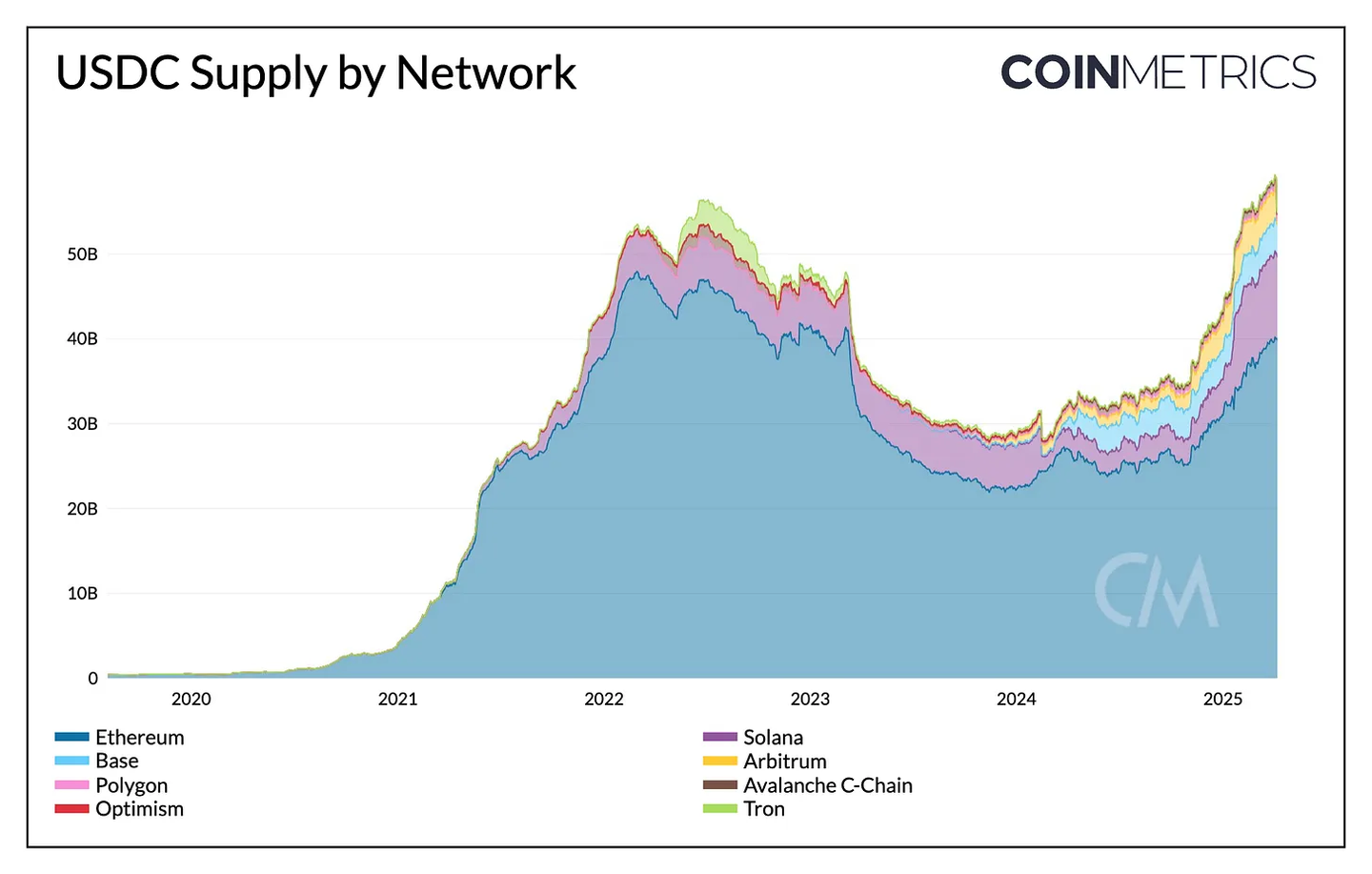

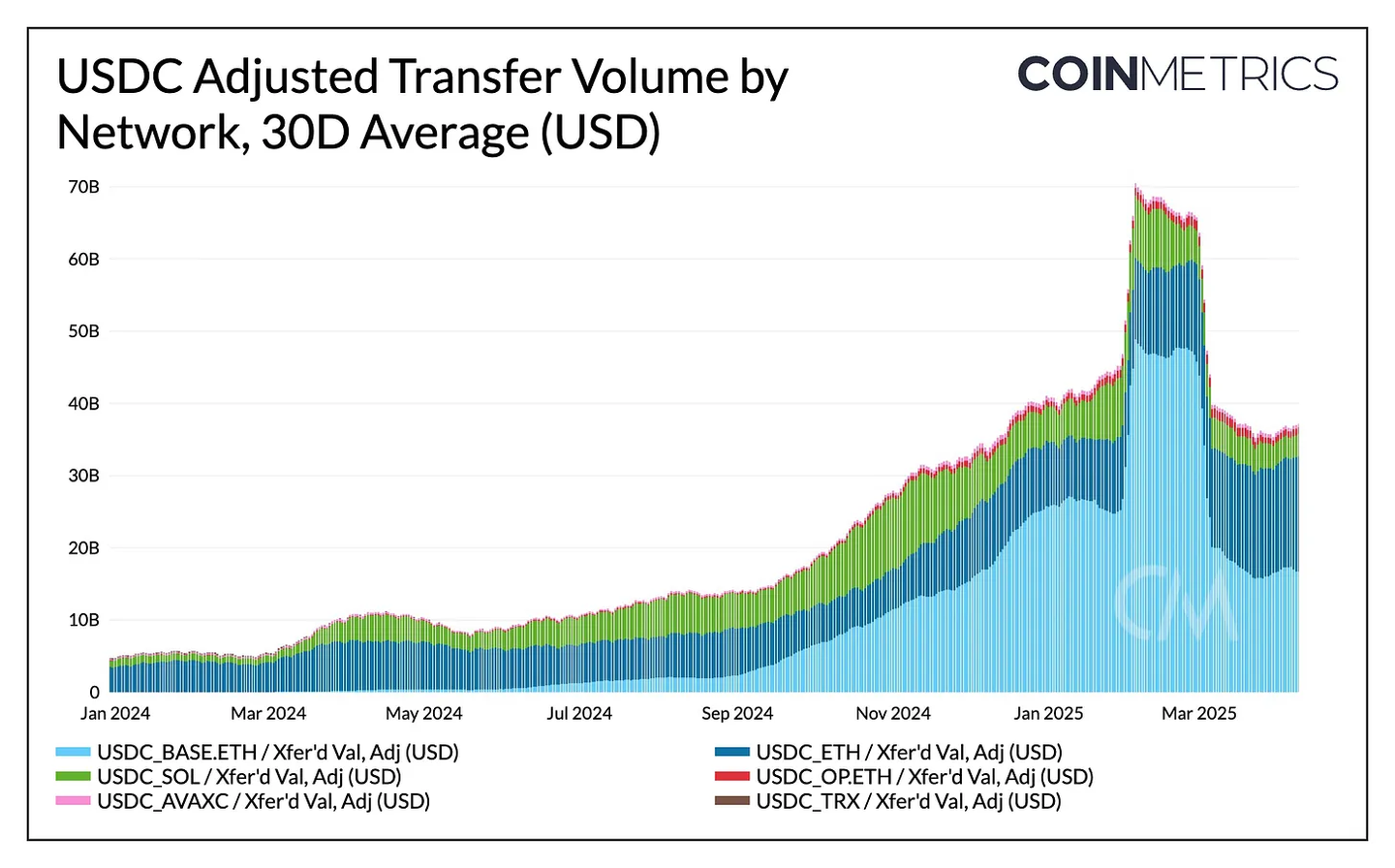

2. Total USDC supply has rebounded to $60 billion, with a 30-day average transfer volume of $40 billion, showing market confidence and cross-chain adoption recovery. However, USDC remains sensitive to interest rate changes, competitive pressures, and regulatory developments.

3. USDC usage continues to grow on major trading platforms, currently accounting for 29% of BN spot trading volume, thanks to Circle's strategic partnerships.

4. Looking forward, Circle's next phase may depend on diversifying from passive interest income to active income sources, including tokenized assets, payment infrastructure, and capital market integration.

Introduction

Circle is the largest stablecoin issuer in the United States and the company behind the $60 billion USDC, recently filing an IPO application that provides insight into the financial condition and strategic prospects of this crypto infrastructure company. As the only direct investment pathway in the fastest-growing crypto sector in the public market, Circle's IPO application comes at a critical moment of emerging stablecoin legislation and intensifying competition. Although market conditions might delay the IPO, by combining on-chain USDC data, we will extract key information from Circle's IPO filing to analyze its revenue sources, the impact of interest rates on its business, and the role of platforms like Coinbase and BN in shaping USDC distribution, while assessing Circle's positioning in an increasingly competitive market.

Circle Financial Overview

From an initial Bitcoin payment application to becoming a leading stablecoin issuer and crypto infrastructure provider, Circle has navigated numerous challenges in its 12-year journey. After explosive revenue growth in 2021 (450%) and 2022 (808%), growth slowed in 2023 with an 88% revenue increase, when USDC was impacted by Silicon Valley Bank's collapse. By the end of 2024, Circle reported $1.7 billion in revenue, a 15% year-on-year growth, demonstrating a more stable expansion trend.

However, profitability was compressed, with net profit and adjusted EBITDA declining 42% and 28% respectively, to $157 million and $285 million. Notably, Circle's financial data shows revenue is highly concentrated in reserve interest income, with distribution costs with partners like Coinbase and BN reaching approximately $1.01 billion. These factors drove USDC supply's recovery, growing 80% to $44 billion annually.

USDC's On-Chain Growth

USDC is the core of Circle's business, launched in 2018 in collaboration with Coinbase. USDC is a tokenized form of the US dollar, allowing users to store value digitally and trade on blockchain networks, enabling near-instant, low-cost settlement. USDC uses a full reserve model, backed 1:1 by high-liquidity assets including short-term US Treasuries, overnight repurchase agreements, and cash held by regulated financial institutions.

USDC's total supply has grown to approximately $60 billion, firmly establishing itself as the second-largest stablecoin after Tether's USDT. Despite market share pressure in 2023, it has rebounded to 26%, reflecting restored market confidence. Approximately $40 billion (65%) is issued on Ethereum, $9.5 billion on Solana (15%), $3.75 billion on Base Layer-2 (6%), with the remainder distributed across Arbitrum, Optimism, Polygon, Avalanche, and other chains.

USDC's speed and transfer volume have also grown significantly, with a 30-day average transfer volume of around $40 billion. In 2025, USDC transfers primarily occur on Base and Ethereum, sometimes accounting for 90% of adjusted total transfer volume.

These indicators suggest continuous growth in USDC usage as stablecoins become increasingly attractive as USD alternatives and as payment and fintech infrastructure in emerging markets. This also reflects Circle's cross-chain strategy, with USDC widely available across major blockchains and supported by interoperability tools like the Cross-Chain Transfer Protocol (CCTP).

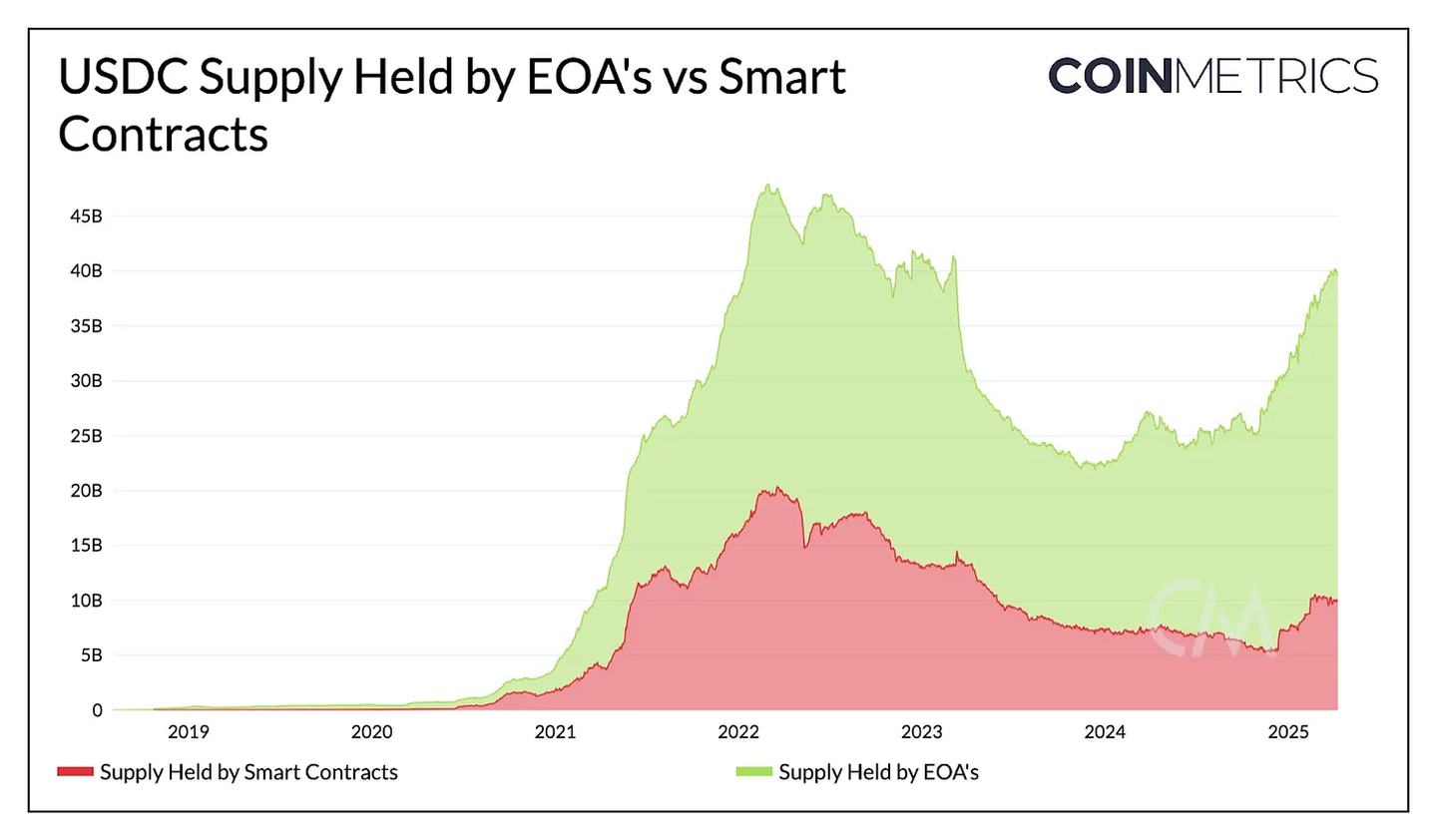

(Translation continues in the same manner for the rest of the text)By distinguishing between USDC supply held in smart contracts and external owned accounts (EOA) on Ethereum, one can understand the distribution of USDC in user wallets and applications. Currently, approximately $30 billion is held by EOA, representing a 66% year-on-year increase, while around $10 billion is in smart contracts, with a year-on-year growth of about 42%. The growth in EOA balance may reflect increased custody by trading platforms and personal user holdings, while the growth in smart contracts indicates the importance of USDC as collateral in DeFi lending markets and liquidity in decentralized exchanges (DEX).

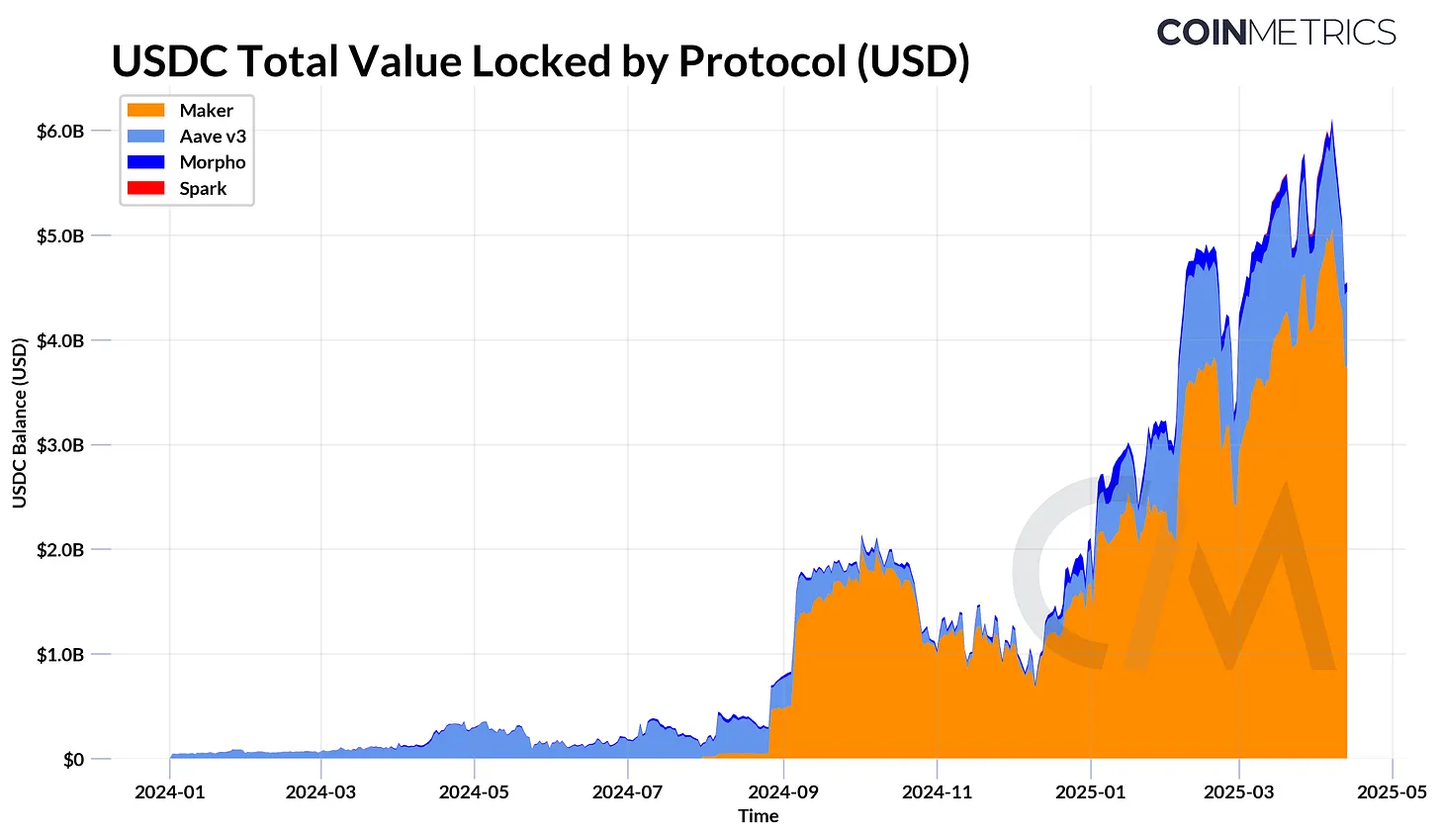

USDC continues to play a fundamental role in DeFi lending markets, with protocols like Aave, Spark, and Morpho locking over $5 billion (representing the portion of USDC supply not being borrowed). For collateralized debt protocols like Maker (now Sky), approximately $4 billion of USDC supports the issuance of Dai/USDS through its peg stabilization module.

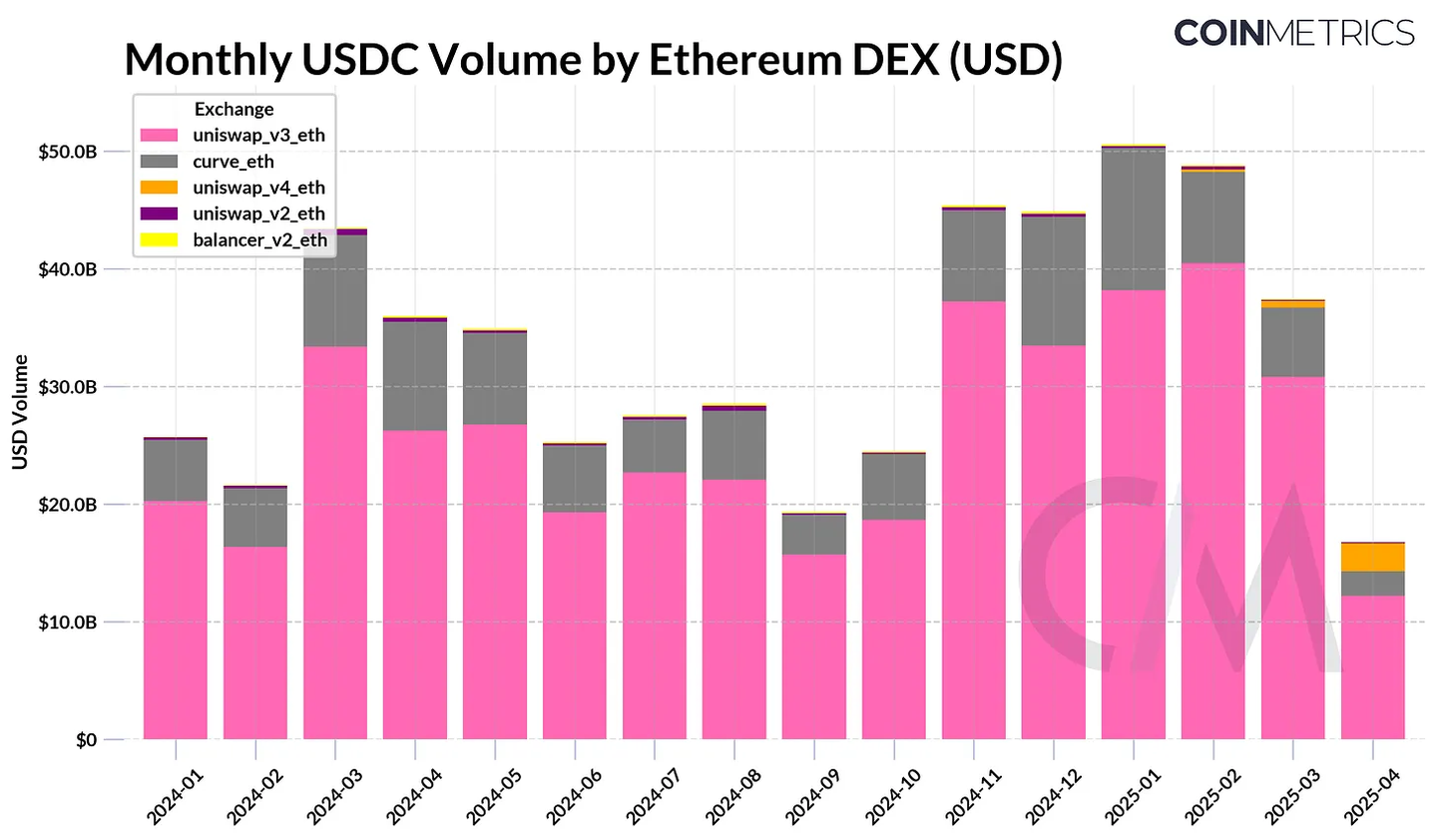

Similarly, USDC is a key liquidity source for various DEX pools, facilitating trades of stable value. It is increasingly supporting on-chain forex markets, especially with the rise of other fiat-pegged stablecoins like Circle's MiCA-compliant EURC.

Conclusion

USDC's on-chain growth reflects market confidence recovery, but Circle's documents also highlight key challenges, particularly high distribution costs and severe dependence on interest income. To maintain momentum in a low-interest-rate environment, Circle aims to diversify revenue through proactive product lines like Circle Mint and by acquiring Hashnote, the largest issuer of tokenized money market funds, to expand tokenized asset infrastructure.

With increasing regulatory clarity, especially the SEC's stance that stablecoins are not securities, Circle is well-positioned. However, it now faces increasingly fierce competition from overseas issuers like Tether and new U.S. competitors leveraging policy change momentum. Although Circle's valuation remains undefined, its IPO will mark the first public market opportunity for direct investment in stablecoin infrastructure growth.