Maximizing value on @SonicLabs means understanding the point system.

For those without the risk appetite for looping, DEX LPing is a very good bet.

Top 3⃣ strategies for yield and multiple layers of points.

🧵

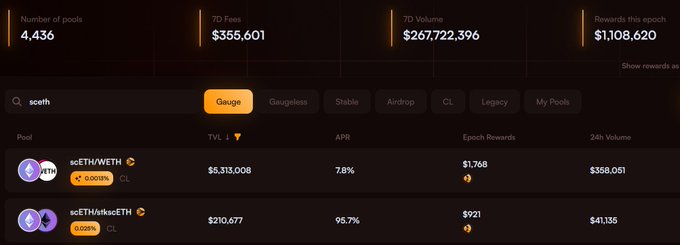

2⃣ scETH-ETH/stkscETH on @ShadowOnSonic

These are just pegged pools between $scETH and either ETH or stkscETH.

Since they're pegged tokens, warrants a very tight range - tighter range = more fees.

Up to 95% APY (tight range), Sonic Points and Rings Points.

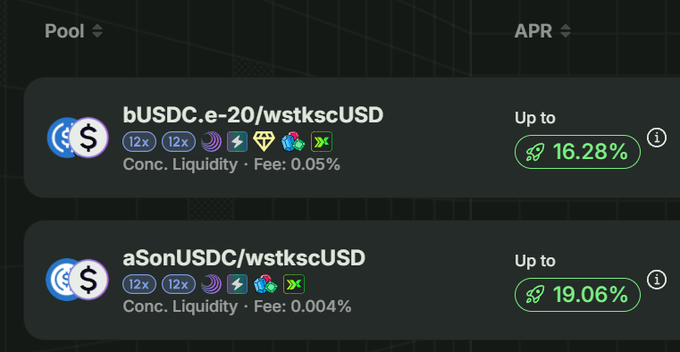

3⃣ wstkscUSD-bUSDC.e-20/aSonUSDC on @SwapXfi

Two pools pairing wstkscUSD with either bUSDC.e-20 or aUSDC.

This activates the special 24x Sonic Points multiplier on top of 16-20% APY as well as Rings Points.

You also get exposure to SwapX's GemsX program.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content