Author: WOO

Raydium is the top Dex on Solana, and Pump Fun is the largest Launchpad. Interestingly, despite different tracks and businesses, they are still attacking each other, trying to capture more revenue.

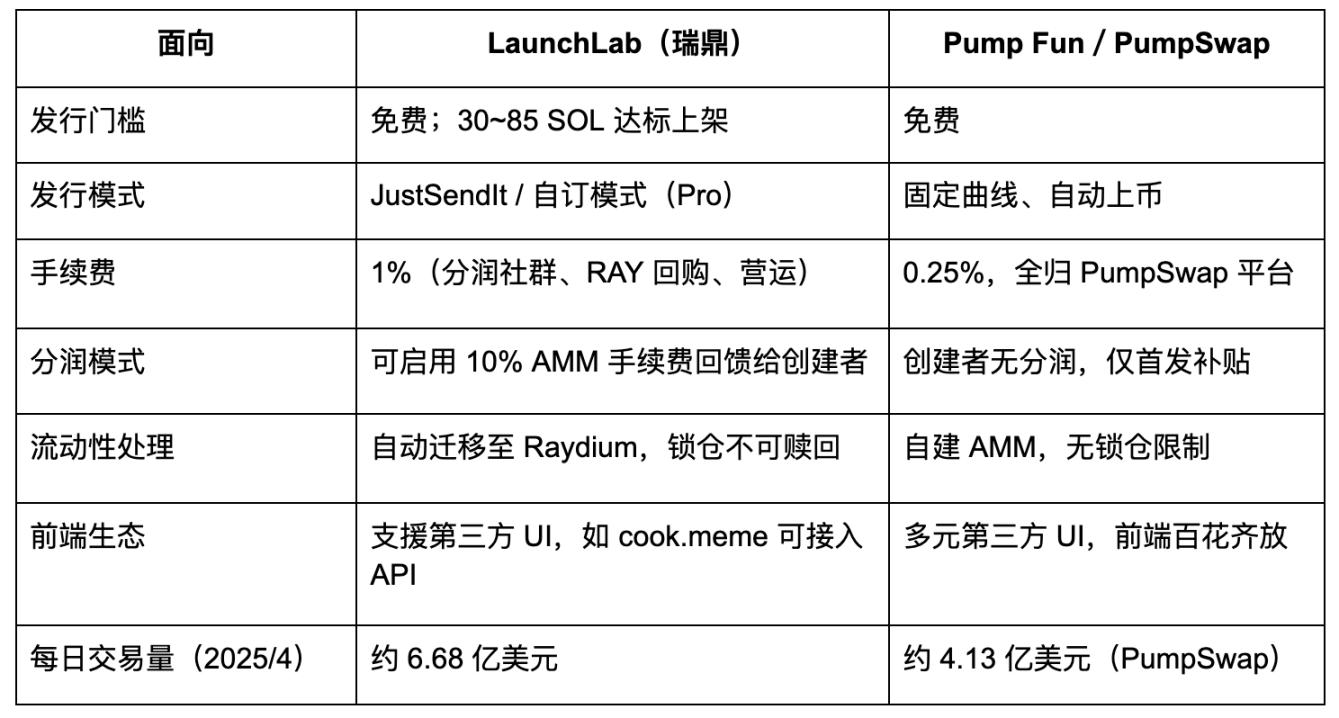

First, Pump Fun launched PumpSwap, which has recently stabilized at a daily trading volume of $400 million, approaching Raydium's $600 million daily trading volume. Raydium even pointed out that Pump Fun contributed up to 41% of its AMM revenue in the past month. However, after Pump Fun built PumpSwap, Raydium's traffic significantly decreased, forcing it to launch LaunchLab to "reclaim liquidity dominance".

What are the differences between LaunchLab and Pump Fun, and what notable projects are there? Let WOO X Research show you.

LaunchLab Basic Introduction

Raydium's LaunchLab is essentially a "zero-code token creation tool + automatic liquidity migration service" with two main usage modes:

- JustSendIt mode: Allows users to create tokens with one click, preset to raise 85 SOL, and automatically migrate to Raydium's AMM after successful fundraising, burning LP tokens to achieve liquidity locking.

- LaunchLab Pro mode: Customizable total supply, minimum fundraising of 30 SOL, bonding curve slope, vesting conditions, and option to enable AMM profit sharing (up to 10% transaction fee rebate to project side).

In the fee structure, Raydium charges a uniform 1% base fee, with 50% going to the "Community Pool", 25% used for $RAY buyback, and 25% as infrastructure and operational fund

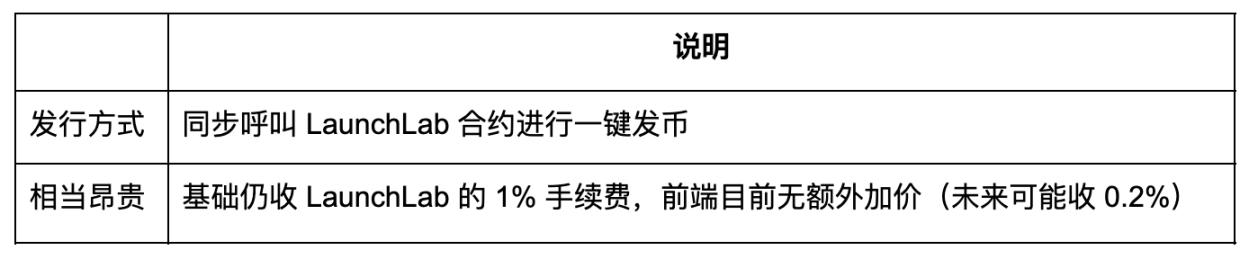

LaunchLab also allows third-party interfaces to access its backend services and build their own token creation frontend. The most famous among these is cook.meme

cook.meme is the first meme token platform using LaunchLab contract with a self-built UX frontend, focusing on zero fees, instant trading, and a clean UI. It immediately attracted many developers, positioning itself somewhat like a Pump Fun UI clone, but with underlying liquidity bound to Raydium.

Raydium's open approach is not just about traffic diversion, but about replicating the content and ecological flywheel that Pump Fun built through community frontend.

LaunchLab V.S Rump.fun

Key Projects

With LaunchLab's launch, $RAY (25% of fees used for buyback) is directly benefited, and its price rose about 8% after LaunchLab's announcement. If LaunchLab can sustain its momentum, $RAY's buyback intensity will increase, and when demand exceeds supply, there's a chance for price appreciation.

A LaunchPad's lifecycle depends on how many "large MC memecoins" it can produce. When the platform continuously creates wealth effects, user assets will naturally concentrate on that platform. With asset concentration, the probability of producing large MC memecoins increases, ultimately forming a positive flywheel loop.

The first step of the flywheel is to have large MC memecoins, but unfortunately, within 24 hours of LaunchLab's launch, only $TIME had a market cap exceeding $1 million. Other tokens like $ARUA and $Gaydium saw market cap spikes initially, but ultimately, market collective force determines the rise of a single market cap token.

So what are the narratives of $TIME, $ARUA, and $Gaydium?

As mentioned earlier, Raydium allows third parties to build platforms using their routing and token creation. Currently, Raydium, Cook.meme, and Pump Fun Robinhood are collaborating, and $TIME is the first meme coin created by Cook.meme; $ARUA is Raydium's own token, which was deployed earlier than $TIME but launched later.

Besides the pun, $Gaydium saw its contract address placed in Raydium's GitHub by a developer, only to be deleted within an hour, causing the token to crash.

$TIME

- Current Market Cap: $6 million

- Highest Market Cap: $8.5 million

- 24 HR Trading Volume: $30.2 million

- Token Holders: 7,600

Conclusion

Raydium's LaunchLab seems like a "delayed counterattack", but its overall design has systematically responded to Pump Fun's advantages, providing a customizable token creation mode and expanding an open frontend strategy represented by cook.meme, aiming to bring traffic, fees, and narrative back to the Raydium ecosystem.

However, whether LaunchLab can truly create wealth and reignite a meme craze depends on three core elements:

- Ability to produce strong, viral projects;

- Fee and liquidity design friendliness to retail investors;

- Ecosystem's speed in gathering frontend tools and creating network effects.

Currently, all three elements seem to need improvement, but LaunchLab has been open for less than a month, so it would be premature to declare the platform a failure. The crypto world is ever-changing, and perhaps the next 100x meme will be born on LaunchLab. Let's wait and see.