During the past week, XRP's price remained within a range amid market recovery attempts.

However, as the bullish bias towards altcoins grows, XRP may break out of this range and transition to an upward trend. This analysis explains the reasons.

XRP Futures Traders Betting on Longing Positions

The momentum shift towards bullishness is particularly prominent in the futures market, with XRP's Longing positions exceeding Short positions. This is reflected in the token's XRP Longing/Short ratio, which is currently 1.07.

The Longing/Short ratio measures the proportion of Longing positions (betting on price increase) and Short positions (betting on price decrease) in the market.

When the value is lower than 1, it indicates that Short positions are more numerous than Longing positions in the market, suggesting bearish sentiment or lack of confidence in the token's future price performance.

When an asset's Longing/Short ratio exceeds 1, like XRP, it means Longing positions are more numerous than Short positions. This suggests traders are primarily bullish on XRP and likely to break through the narrow range.

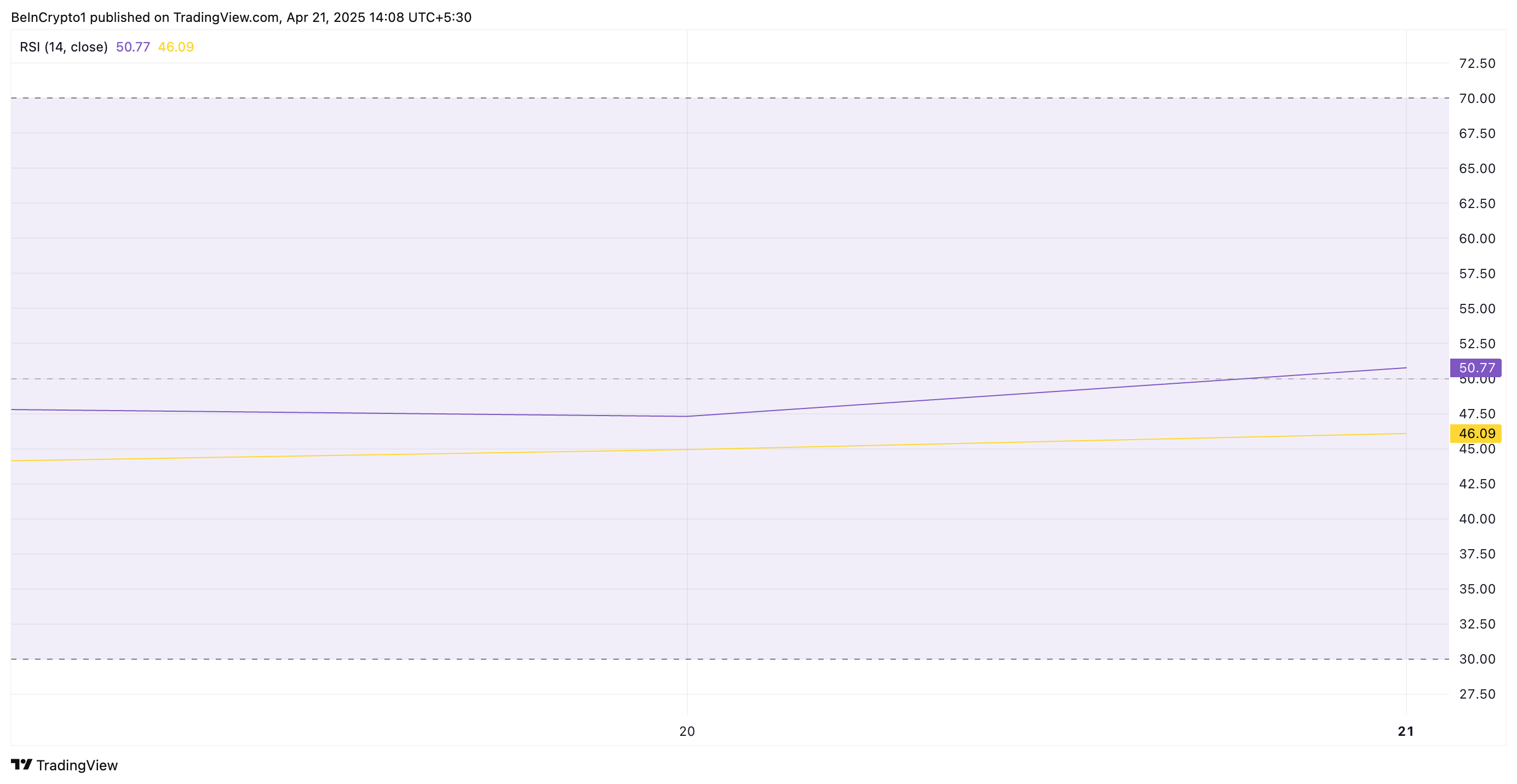

Additionally, XRP's Relative Strength Index (RSI) has been steadily rising, indicating gradually increasing demand for the token. The key momentum indicator is 50.77, currently above the neutral line and in an upward trend.

The RSI indicator measures overbought and oversold market conditions for an asset. It has values between 0 and 100. Values exceeding 70 indicate an overbought asset with expected price decline, while values below 30 suggest an oversold asset that may rebound.

At 50.77, XRP's RSI signals a transition to bullish momentum. This indicates buying pressure is beginning to exceed selling pressure and suggests the asset may be preparing for additional price increases.

XRP Eyeing $2.18 Resistance... Target $2.29

XRP is currently trading at $2.13, 3% away from the next major resistance level at $2.18. Strengthening buying pressure and altcoins converting this price level to support could trigger further price increases. In this case, XRP could potentially rise to $2.29.

However, if demand weakens and selling pressure resurfaces, XRP could remain within the range. It might even fall below the $2.03 support line to $1.99.