Welcome to the US Crypto Morning Newsletter—the essential summary of the most important developments in the crypto field for today.

Let's sip some coffee and see what experts say about Bitcoin (BTC) price in the context of recovery efforts. Bitcoin's position as a hedge against inflation and economic instability is gradually becoming suspicious, with influences from large institutions adding to concerns.

Can Strategy's $555 million BTC purchase push Bitcoin past $90,000?

Michael Saylor, chairman of Strategy (formerly MicroStrategy), has revealed the company's latest Bitcoin purchase, including 6,556 BTC tokens worth approximately $555.8 million. With this, the company has achieved a 12.1% Bitcoin yield year-to-date (YTD) in 2025.

"MSTR has purchased 6,556 BTC for ~$555.8 million at ~$84,785 per bitcoin and has achieved a 12.1% BTC YTD 2025. As of 04/20/2025, Strategy holds 538,200 BTC purchased for ~$36.47 billion at ~$67,766 per bitcoin," Saylor shared.

Strategy uses Bitcoin YTD yield to measure the increase in BTC holdings per share. This model has been an important part of the company's financial strategy since they first bought Bitcoin in August 2020.

This purchase aligns with the optimistic market sentiment towards Bitcoin, gradually approaching the $90,000 mark, as US Crypto News recently pointed out.

Bitcoin (BTC) price performance. Source: BeInCrypto

Bitcoin (BTC) price performance. Source: BeInCryptoAlthough Bitcoin has slightly recovered this week, increasing over 3% in the past 24 hours, it's important to note that Bitcoin is very sensitive to economic indicators.

Similarly, the global market is very sensitive to monetary policies set by major economies, especially the US. BeInCrypto contacted Paybis founder and CEO Innokenty Isers for insights into the current market outlook, particularly for Bitcoin.

"With strong investor focus on tech stocks, changes in trade policies and government interventions affecting key indices like Nasdaq Composite create spillover effects across financial markets," Isers told BeInCrypto.

According to the Pybis CEO, since the US Presidential inauguration, Bitcoin's prospects have shifted from a reliable inflation hedge to a higher-risk asset.

"With relatively high volatility, risk-averse investors may prefer alternative inflation hedges instead of Bitcoin," he added.

Iners is aware of the prolonged trade war and potential inflation. Based on this, he notes that allocating capital to Bitcoin as a hedge against economic instability may be reduced.

Strategy's stock price spread narrows as Bitcoin hype cools down

Meanwhile, Strategy has seen a significant change in its stock pricing dynamics over the past year. Saylor recently revealed that as of Q1 2025, over 13,000 institutions and 814,000 small retail investor accounts directly hold MSTR.

"Estimated 55 million beneficiaries have indirect exposure through ETFs, mutual funds, pensions, and insurance portfolios," Saylor added.

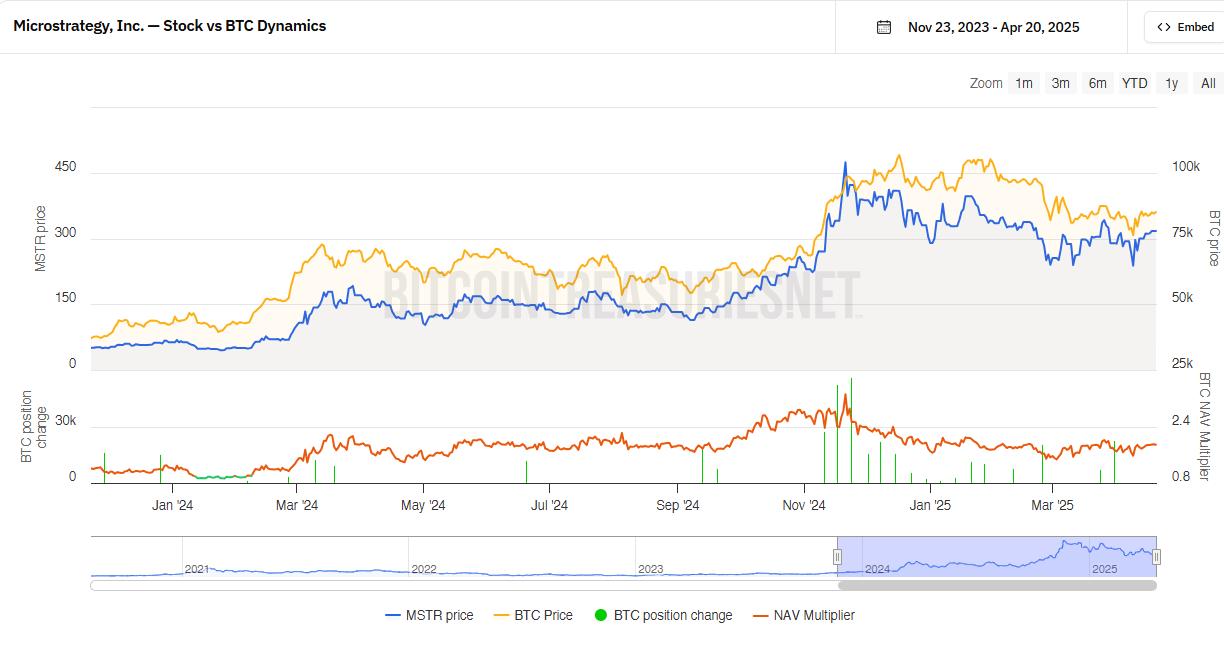

According to data on Bitcointreasuries.net, the insurance premium that investors previously paid to expose themselves to the company's Bitcoin holdings has significantly narrowed.

Specifically, the NAV ratio, which measures how much the stock trades above Strategy's Bitcoin asset value, has decreased compared to last year. This indicates that MSTR is now trading closer to the actual value of its Bitcoin reserves.

In 2024, investors were willing to pay a significant insurance premium for MSTR shares, driven by Bitcoin's hype and MicroStrategy's aggressive accumulation strategy.

"I don't know if buying strategic stocks is a good idea for the government. Stocks will only increase in price, and likely trade at a premium to NAV with a higher risk profile. Additionally, I believe the government will struggle to find institutions willing to sell their BTC in large quantities," an analyst said recently.

The narrowing NAV ratio suggests a more cautious market sentiment. Analysts believe this reflects a shift towards valuing MicroStrategy based on its fundamental factors rather than Bitcoin hype.

This indicates a more mature market approach to the company's unique investment strategy.

Chart of the Day

Strategy (MSTR) NAV multiplier. Source: Bitcoin treasuries

Strategy (MSTR) NAV multiplier. Source: Bitcoin treasuriesThis chart shows Strategy's stock price (green) moving with Bitcoin price (orange). When Bitcoin increases, MicroStrategy typically follows, but with more significant fluctuations.

However, the NAV multiplier has narrowed compared to last year, meaning MicroStrategy's stock is now trading closer to the actual value of the Bitcoin holdings.

Last year, investors paid a higher premium to access MSTR, but that gap has narrowed. This suggests a more cautious sentiment or a shift towards valuing the company based on fundamental factors rather than just Bitcoin hype.