Written by: TechFlow

Trading is the main theme of encryption, so exchanges are the core infrastructure of encryption.

This is the case with BitMEX, which introduced perpetual contracts to the crypto market in 2016;

Made in America: FTX Takes Capital Efficiency to the Next Level with Backpack

From FTX to Backpack: Twins Made in the USA

Whether it is FTX or Backpack, both of them have the indelible "Made in the USA" mark:

FTX was born in the United States, and Backpack was also founded in the United States;

In terms of financing background, Backpack also overlaps with FTX:

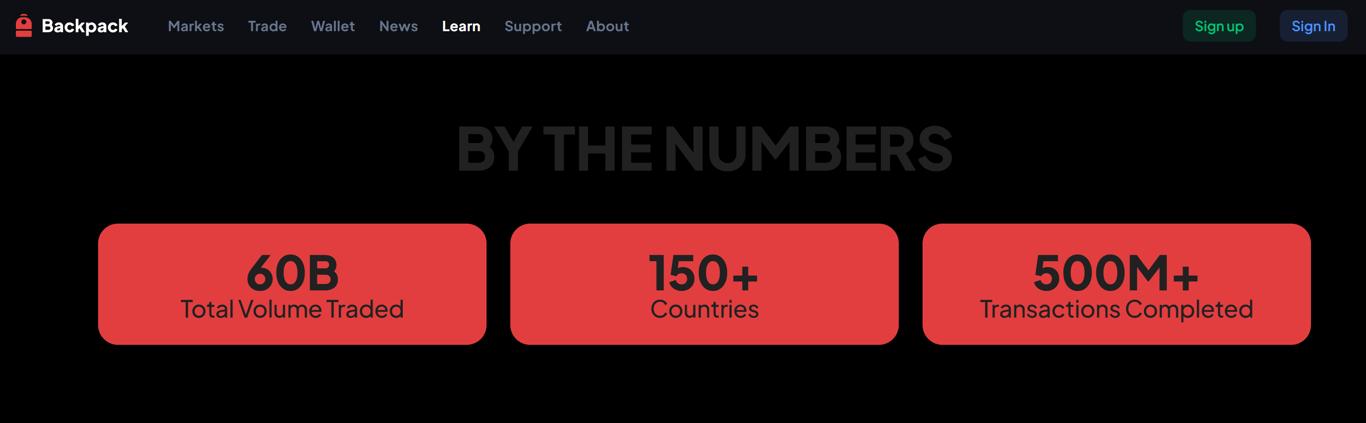

Born for Traders: New Issues in the New Cycle

No proprietary market maker + three-stage liquidation: Backpack's powerful risk engine

Global margin + automatic lending + automatic profit and loss settlement: Backpack builds a perpetual motion machine for income

For each sub-account, users can set up the "automatic lending" function:

Compliance pioneer: integrating on-chain and off-chain to create a core hub for asset management

Let every transaction happen in a "glass house": Backpack's pursuit of transparency

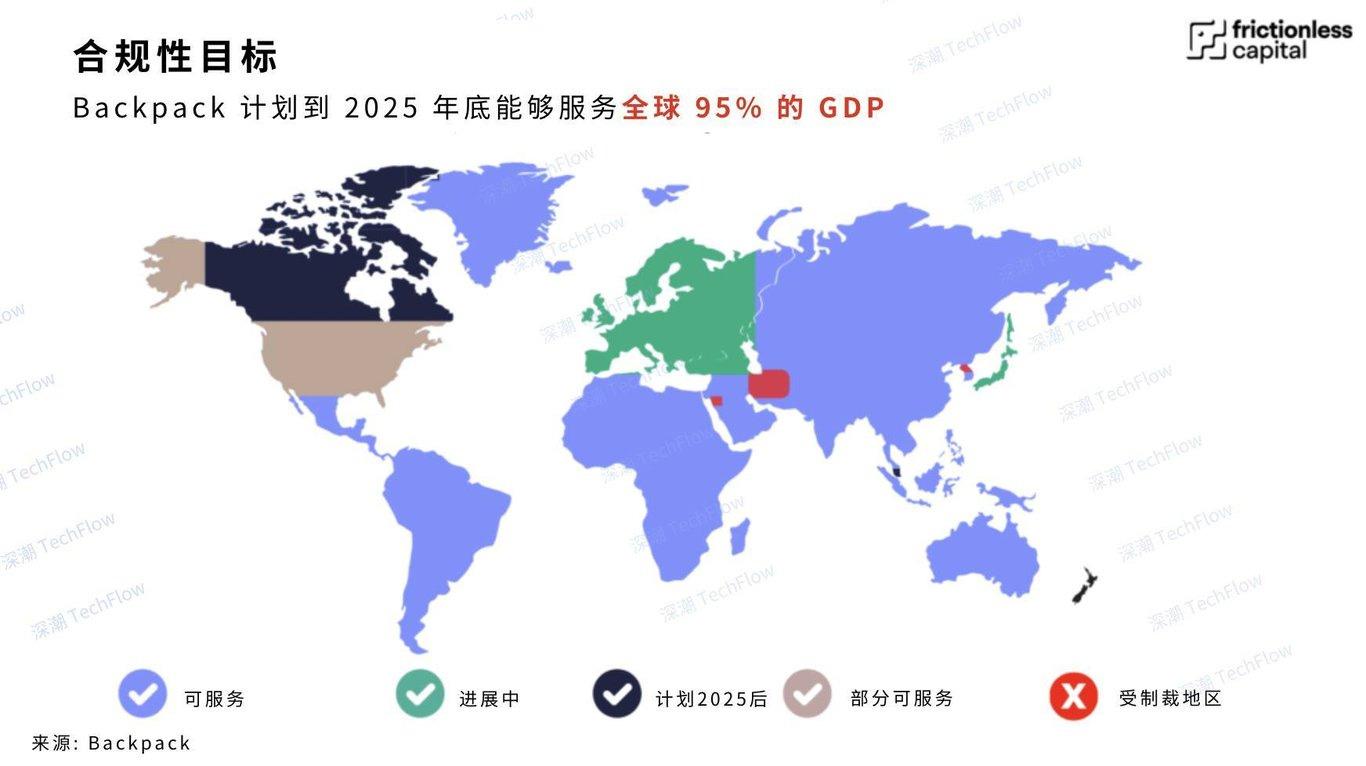

From the US, EU to Asia: Backpack's global compliance strategy

In addition to transparency, the more important issue is compliance.

This is exactly the value of Backpack's "Global Compliance Cryptocurrency Trading Platform":

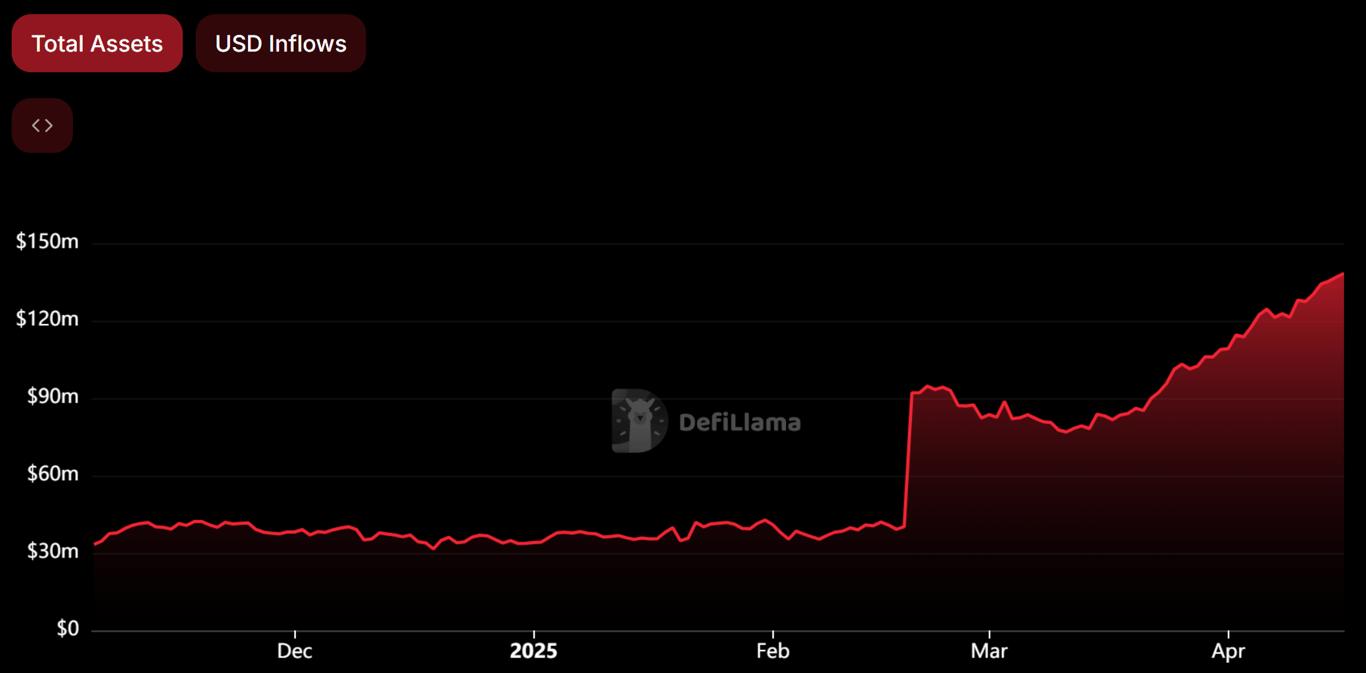

2025: The year of the rise of on-chain finance and the explosion of Backpack

How to participate in Backpack efficiently?

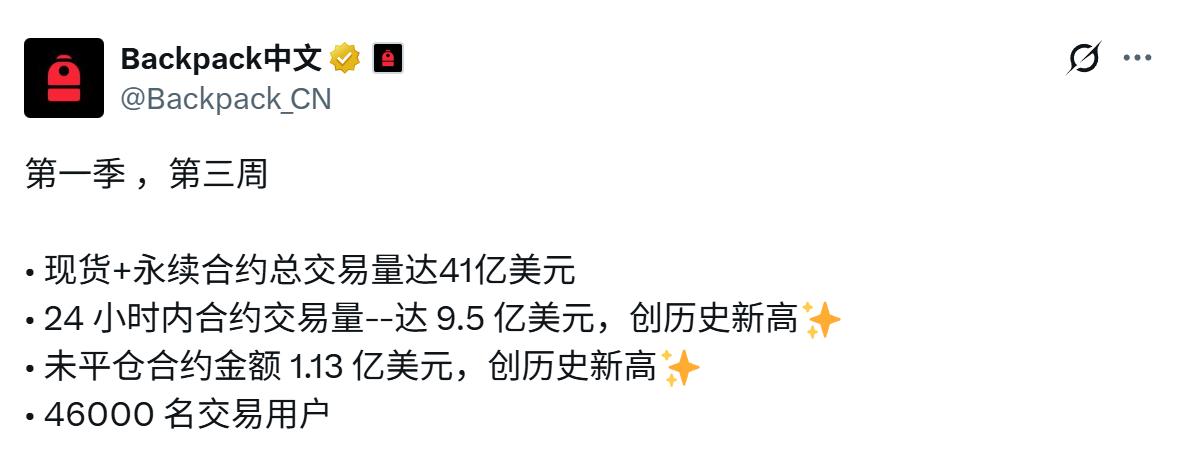

Season 1 is in full swing: Rewarding real trading participation and bringing a new paradigm of community incentives

So why did Backpack Season 1 generate such a large engagement?

On the other hand, it is inseparable from Backpack’s unique design of the activity rules.

Backpack aims to reward real trading users through Season 1:

At the same time, Backpack is committed to creating truly fair participation:

So, as a user, how can you participate in Season 1 more efficiently?

Perhaps following the rules and returning to basics is the most efficient way.

Conclusion

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Join the WeChat group and add assistant WeChat: blocktheworld

Donate to TechFlow to receive blessings and permanent records

ETH: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A