On April 22, the US asset market was once again caught in the eye of the storm. The Dow Jones Industrial Average fell 971 points, the Nasdaq fell more than 2.5%, and the S&P 500 fell below the 5,200-point mark. The seven technology giants fell across the board, with Tesla and Nvidia falling more than 5.7% and 4.5% respectively. The VIX panic index soared 14%, breaking through 33 points, indicating that the market's systemic risk aversion is rapidly heating up.

VX:TZ7971

The US dollar index also lost money, falling below the 98 mark, hitting a new low in nearly a year and a half. The ICE Dollar Index and the Bloomberg Dollar Index both recorded one of the worst monthly performances since 2009. At the same time, gold broke through $3,400, setting a new record high. Bitcoin briefly broke through $88,000 in the early morning, and then fell back to around $86,300 with the decline of US stocks. After the US stock market closed, it once again showed a different tough attitude, rising above $88,800, while Altcoin generally did not return to their highs in the early morning.

Price changes are only the result. What is more profound is the collective reassessment of the global asset anchoring structure and the historic return of non-sovereign assets emerging from institutional cracks.

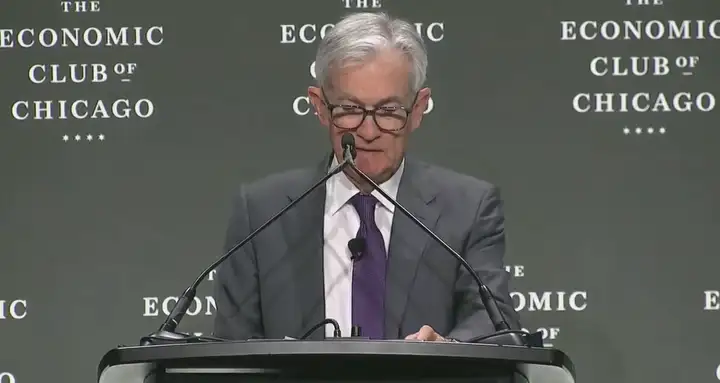

The Federal Reserve's independence is facing a political reshaping

Trump once again publicly blasted Fed Chairman Powell, demanding "an immediate rate cut or the economy will slow down." The market's confidence in the Fed's political neutrality is being tested as never before. This is the second time in just a few days that he has put pressure on the monetary policy path. Not only did he post on Truth Social directly pointing out that "policy is too tight," he also leaked on multiple occasions that he was "considering replacing Powell."

This move touched the most sensitive red line for global investors: whether the Federal Reserve is still a central bank independent of electoral politics. For 40 years, the Federal Reserve has played a core role in the global asset allocation system.

However, at present, the question of whether Powell can keep his job, which was originally considered to be a non-issue, has become one of the core variables of common concern for global financial capital. As a result, safe-haven funds are accelerating their inflow into non-sovereign assets.

It is worth noting that this sell-off is not a reaction to the short-term interest rate path, but a feedback to the "decision rule uncertainty" itself. When investors cannot judge whether interest rates are still based on economic fundamentals rather than political cycles, the credit anchor of the US dollar begins to loosen.

In the past decade, global capital has widely allocated US Treasury bonds and US dollar assets, precisely out of trust in the professional judgment and independence of the Federal Reserve. However, once this trust is eroded, US Treasury bonds will no longer be an unconditional safe-haven asset, and the US dollar will no longer have a natural premium attribute. This will trigger a reassessment of the entire global asset anchoring system.

Gold and Bitcoin rise in resonance

Gold has been a medium of value storage for thousands of years, and its price has never been just a response to inflation, but also a vote for institutional stability. Looking back at history, every rapid rise in gold prices has been accompanied by a decline in trust in the traditional political and monetary system:

In 1971, the Bretton Woods system collapsed, and gold prices skyrocketed after it was decoupled from the U.S. dollar;

After the 2008 global financial crisis, gold prices rose rapidly to record highs;

As the Federal Reserve is facing questions about political interference, gold has once again hit a new high.

This rule has not changed, because the essential advantage of gold is that it does not rely on national credit, is not subject to policy intervention, and has no default risk. In the process of institutional politicization and short-term policies, gold provides a kind of temporal independence and historical stable expectations.

The reason why Bitcoin began to rise synchronously with gold is not because it has the attributes of a central bank, but precisely because it is not an appendage of any central bank.

When the independence of the Federal Reserve was questioned and the US dollar was forced to accept administrative intervention, some funds in the market began to view Bitcoin as a "depoliticized store of value candidate."

Especially when the credit of U.S. Treasury bonds is limited (due to fiscal unsustainability), the gold price is overheated (high premiums may weaken risk-adjusted returns), and the compliance channels of crypto asset ETFs are gradually opened (improving accessibility), Bitcoin will play a hybrid role of "digital gold" and "decentralized dollar alternative."

Signals of a regulatory shift

While Trump continues to put pressure on the Federal Reserve, Paul S. Atkins was sworn in as the 34th Chairman of the U.S. Securities and Exchange Commission (SEC). Although this personnel appointment seems to be in accordance with the rules in terms of procedures, it actually sends a strong policy signal. As an important advocate of the "financial market liberalization" trend in the Bush era, Atkins has always advocated that regulation should serve the market rather than dominate the market. His appointment means that the governance philosophy of the U.S. capital market may enter a new turning cycle.

In the current context of crypto assets, this shift is particularly critical. If Atkins sticks to his consistent position, crypto assets may usher in an unprecedented period of policy easing in the future in terms of ETF compliance approval, RWA token issuance, and even the value distribution mechanism in the Token economic model.

Today's fear index is 47, and the market has returned to a neutral state.

It was thought that Bitcoin could not break through 8.8 yesterday. It went up and then down at 10 o'clock in the evening. Now it has been pulled up to 88628. The position of 8.8 is still relatively critical. If it stands firm, the next step will be 9.3. If it cannot stand firm, it will still have to touch 8.5 and 8.3. Pay attention to these positions in the short term.

The Ethereum exchange rate has hit a new low again. However, historically, when BTC's market share is high, there will be a general rise in the market. I hope this time will be no exception. Coupled with the new SEC official taking office, there will be a wave of market trends in the second quarter. If there is a pullback, be bold and buy.