Solana (SOL) is showing strength in various aspects, maintaining a bullish structure on the Ichimoku chart and gaining momentum in key market indicators. The BBTrend indicator has turned bullish again, indicating that buying pressure has resumed after a short correction.

On-chain activity remains strong, with Solana leading all blockchains in DEX Volume and gaining an advantage in fee generation thanks to the explosive growth of meme coins and launchpad activities. SOL is now trading above major resistance levels, opening the path for further increases, but momentum loss could still trigger a retest of the lower support line.

Solana Maintains Bullish Structure... Momentum Test

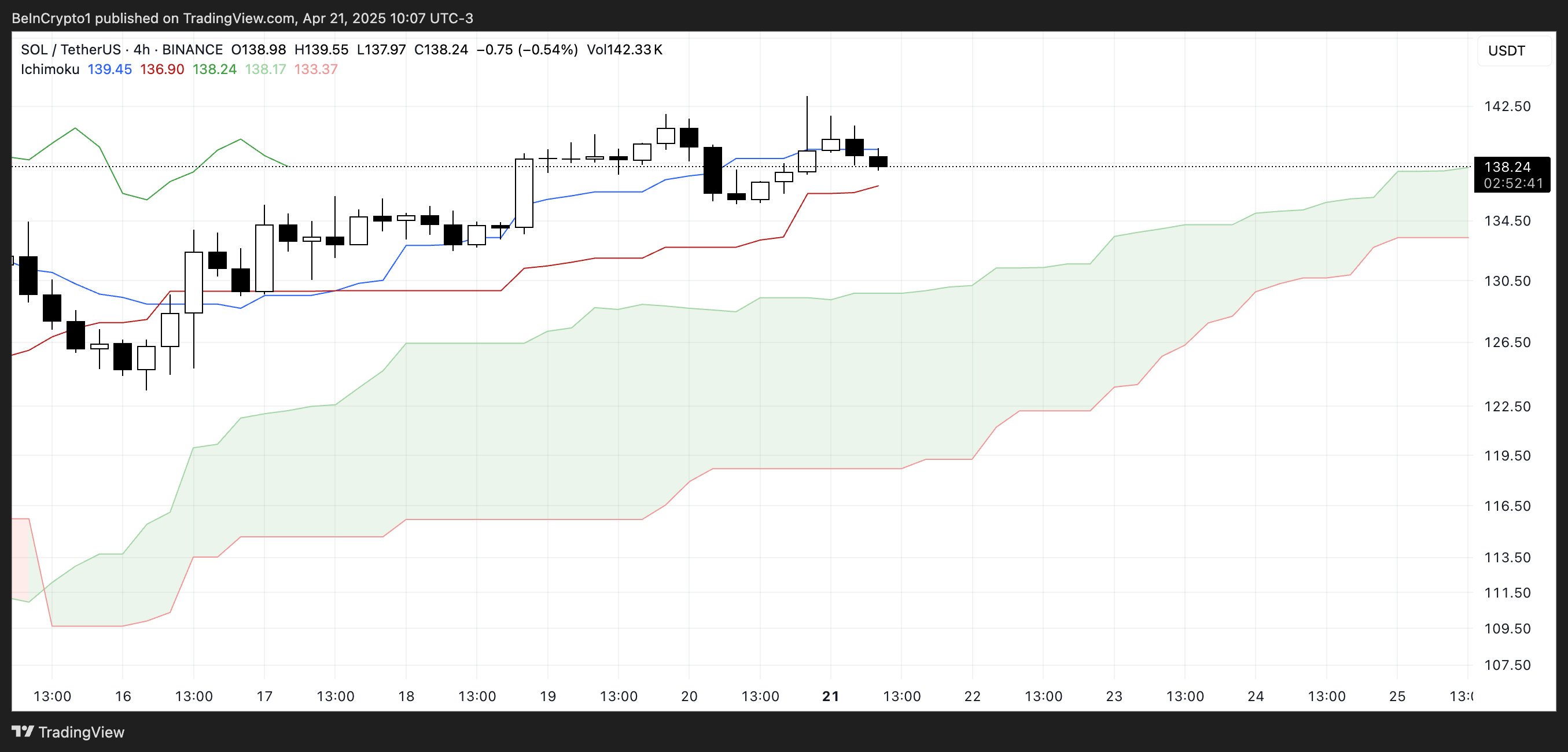

On Solana's Ichimoku chart, the price is currently above the baseline (red baseline) but has fallen below the conversion line (blue conversion line), indicating weakening short-term momentum.

The flattened conversion line and price action suggest either consolidation or an initial correction stage. However, with the price maintaining itself above the baseline, medium-term support remains solid.

The overall Ichimoku structure remains bullish, with a thick rising cloud and Leading Span A far above Span B, indicating strong fundamental support.

If Solana finds support at the baseline and rises back above the conversion line, the uptrend could regain strength. Otherwise, it may test the upper boundary of the cloud.

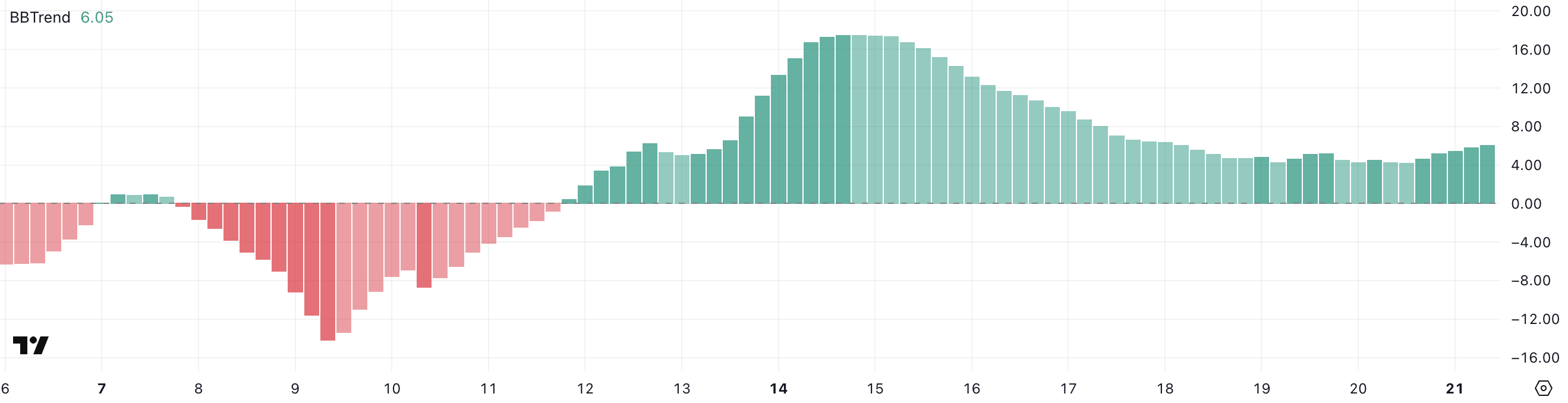

Meanwhile, Solana's BBTrend is currently at 6, having remained in the positive area for almost 10 days after peaking at 17.5 on April 14th. The recent increase from 4.26 to 6 suggests a resumption of bullish momentum after a short correction.

BBTrend, or Bollinger Bands Trend, tracks the strength of price movements based on Bollinger Bands expansion.

A positive value like the current one indicates an active uptrend, and if the BBTrend continues to rise, it could suggest stronger momentum and further upside potential.

Solana Dominates DEX Volume and Fees... Meme Coin Ecosystem Growth

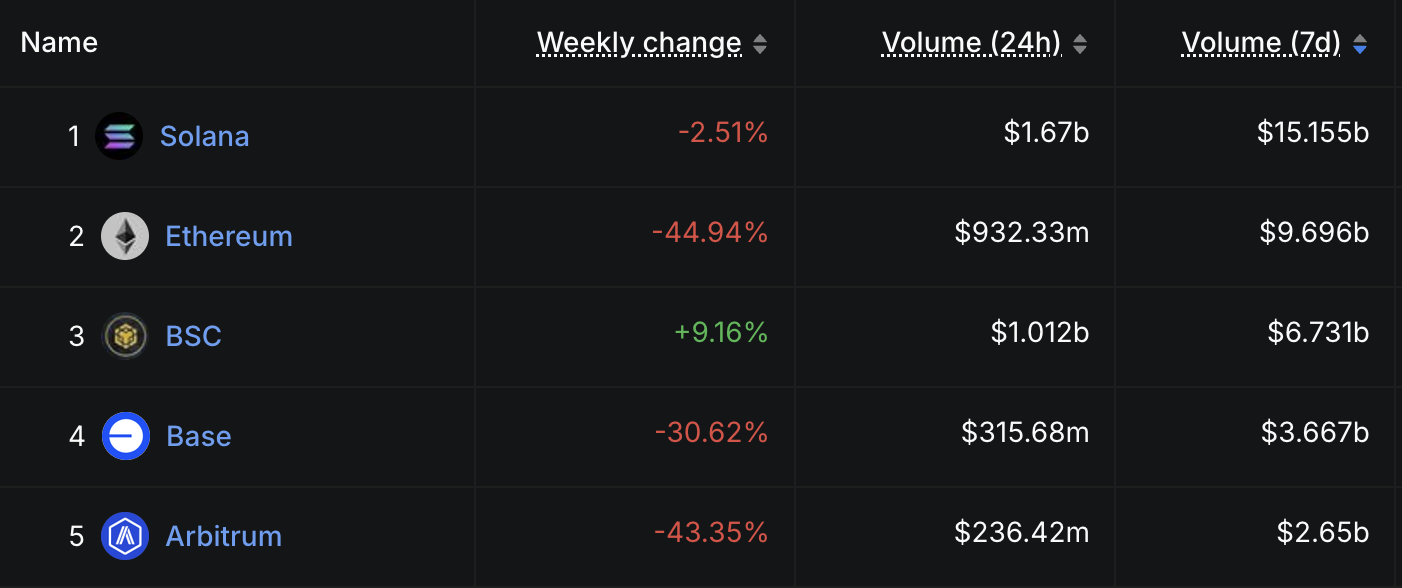

Solana has again topped all chains in DEX Volume, recording $15.15 billion over the past 7 days. The combined total of Ethereum, BNB, Base, and Arbitrum reached $22.7 billion.

Over the past 24 hours, Solana recorded $1.67 billion in volume, primarily driven by the rapidly growing meme coin ecosystem and the launchpad war between PumpFun and Raydium. Adding to this positive momentum, Solana recently overtook Ethereum in staking market capitalization.

Regarding application fees, Solana's momentum remains clear. Four of the top 10 fee-generating apps last week—PumpFun, Jupiter, Jito, Meteora—are Solana-centric.

Pump is leading, recording nearly $18 million in fees alone.

Solana Breaks Major Resistance... Uptrend Target Rises, Risks Remain

Solana has finally broken through the $136 major resistance, converting it to a new support level, which was successfully tested yesterday.

The EMA lines remain aligned in a bullish setup, suggesting the uptrend is still maintained.

If this momentum continues, SOL price could target the next resistance zones at $147 and $152. Breaking these levels could open a potential move to $179.

The current structure is favorable for buyers. Higher lows and strong support reinforce the trend.

However, if momentum weakens, a retest of the $136 support line is expected.

Falling below that level could expose Solana to deeper corrections to $124 and even $112.