President Donald Trump. Whether you love or hate him, we may be witnessing oneessing of the largest cover-up and misdirection campaigns in modern politics.

The Art of Deception

Deception is the foundation of war and strategy. – Robert Greene

War is deception, and deception is war – Abu Bakr

War is the art of deception – Niccolo Machiavelli

In war, deception and misinformation are as important as weapons and ammunition – John Keegan

Trump's campaign may not be related to prominent issues like tariffs, immigration, or legal battles. These are just pawns, knights, and bishops on the chessboard – intentional distractions. Some observers believe that Trump's real intention might be deliberately hidden behind public distractions and controversies.

Although these prominent battles are important, serving as top priorities and attracting public and media attention, they work exactly as intended – distractions hiding a deeper strategic goal.

Real Target: Big Banks

Some critics argue that Trump's actions suggest the banking system could be the primary target. Not just the US banking infrastructure, but the entire global network of central banks and and large financial corporations, including powerful institutions like JP Morgan Chase and Citi.

But why banks? The answer is very simple, but something people have forgotten amidst all the noise. Financial institutions attacked first.

After ending his presidential term, many banks terminated their relationship with Trump. described this as de 'debanking'. They targeted his capital access and attempted to cut essential financial services and economically isolbusinesses.Banking Services for Donald Trump

The financial isolation Trump faced was not subtle. After After leaving January 021, many banks had had systems closing his accounts andinating-relationships:

< ul><>Freedom is different. Freedom is a condition, often granted or restricted by external forces, easily reduced or revoked by governments, crowds, or circumstances. Liberty exists as a sacred principle; freedom fluctuates according to power and desire.

Sounds good, but how do cryptocurrency investors feel?

Ultimately, as traders and/or investors, price is usually more important than principles and politics. But how are crypto traders currently feeling about the DeFi space? What is the current sentiment?

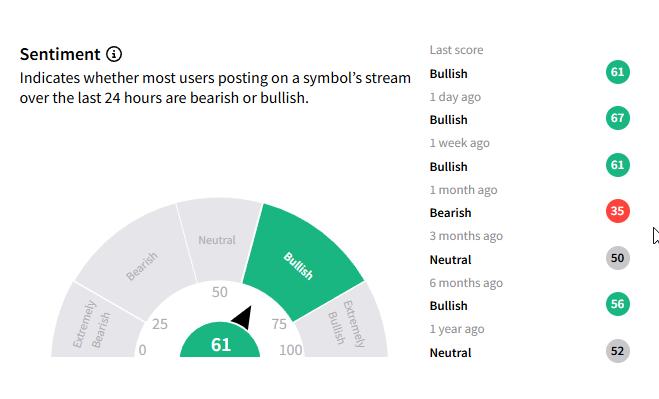

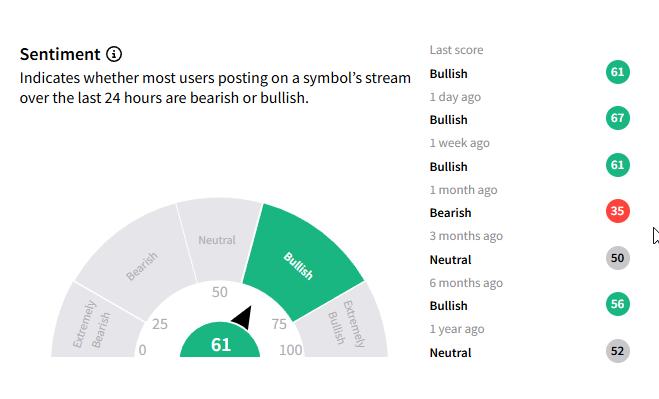

Stocktwits data extracts information from the world's largest social network for traders and investors. For example, let's look at Ondo Finance, a recent acquisition by World Liberty Financial of Trump.

Despite uncertain crypto market conditions, Stocktwits users show a strong optimistic sentiment towards Ondo Finance. Traders consistently predict positive long-term prospects, proven by Ondo's sentiment recovering impressively from a 35-point depreciation.

ONDO Sentiment. Source: Stocktwits

ONDO Sentiment. Source: StocktwitsReinforcing this optimism, message volume—another important sentiment indicator tracked by Stocktwits—remains significantly high.

ONDO Message Volume. Source: Stocktwits

ONDO Message Volume. Source: StocktwitsPro tip: When the price is in a downtrend, but Stocktwits sentiment score and message volume increase, this is often a strong indicator that a dip is forming or about to develop very soon.

The Inevitable Rise of DeFi

Even without Trump's financial war against traditional banks, DeFi's advancement has long been inevitable. Decentralized platforms provide transparency and efficiency that cannot be matched by traditional financial institutions. With negligible operating costs and the rapid maturation of the entire space, superior lending rates and significantly higher yields are the future.

It can be argued that Trump's moves will significantly accelerate DeFi's rise. Instead of traditional finance (TradFi) gradually losing market share, some may view Trump's silent war against global banking infrastructure as a swift attack on centralized financial institutions.

This article reflects the author's perspective and is based on public information and speculative analysis.

The views and opinions expressed in this article are solely those of the author and do not reflect the official stance of Stocktwits or BeInCrypto.

BeInCrypto contacted World Liberty Financial and the banks mentioned in this article to request comments, but no one responded at the time of writing. The author does not hold positions in Ondo Finance or World Liberty Financial.