XRP is emerging as a strong contender to surpass Ethereum (ETH) in market Capital . The 2025 market outlook reveals several factors that support the scenario of XRP becoming the second-largest altcoin by market Capital .

Recent data highlights three key reasons why XRP has the potential to reach this milestone in the short term: XRP ’s Fully Diluted Valuation (FDV) has surpassed ETH, Capital is shifting from ETH to XRP, and investor sentiment is increasingly positive towards XRP.

XRP 's Fully Diluted Value Has Surpassed ETH

According to the latest data from CoinMarketCap, XRP has officially surpassed Ethereum in terms of Fully Diluted Valuation (FDV). Specifically, XRP 's FDV is $210 billion , while ETH 's is $196 billion .

FDV is an important metric. It reflects the potential value of all Token in the total supply, including those that are not yet in circulation. This shows that XRP is more valued than ETH when XEM their Max Supply supply.

Investors like John Squire and Edoardo Farina see XRP 's lead in FDV as an early sign that its market Capital could soon surpass ETH.

“This marks over 6 consecutive months of XRP outperforming Ethereum. The flip has begun!” Edoardo Farina predicted .

Investor DONNIE also believes that XRP ’s higher FDV signals a shift in market perception. According to him, this reflects growing investor acceptance of XRP. This sentiment seems to favor the narrative and forecasts around XRP over ETH.

Capital is moving from ETH to XRP

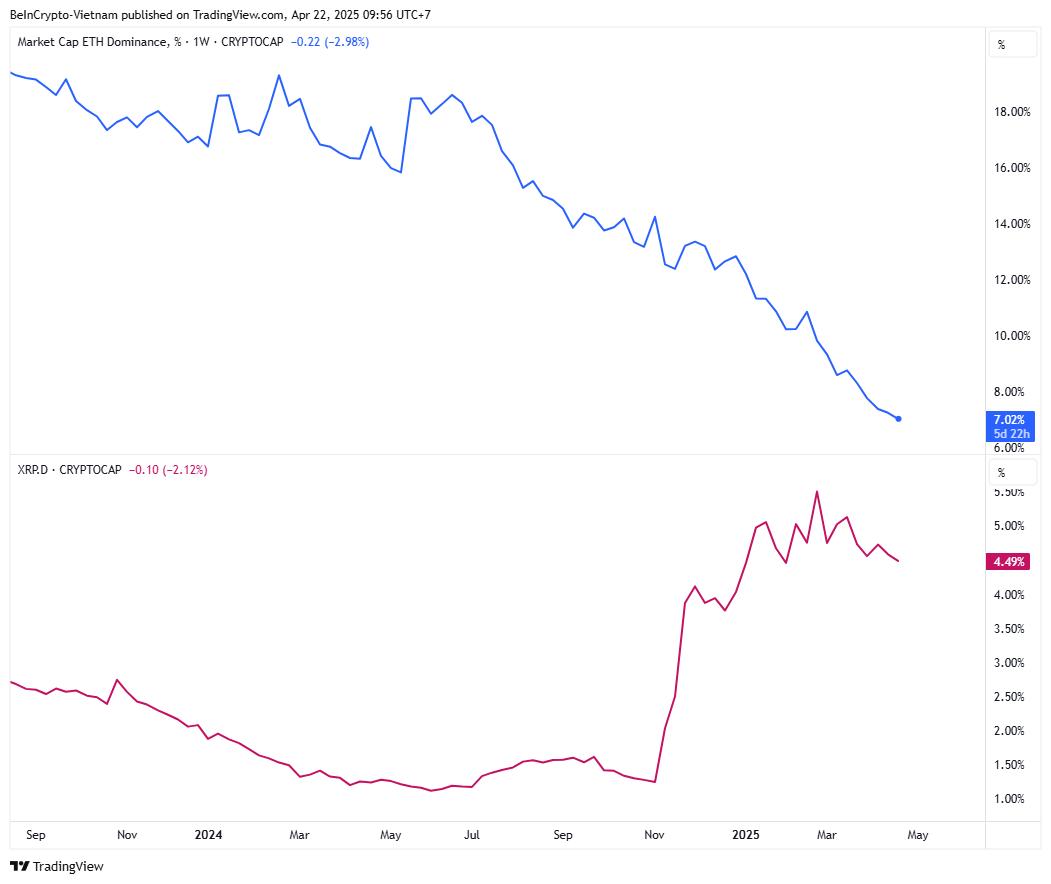

Another important factor is the shift of investment Capital between the two cryptocurrencies. Data from TradingView shows that ETH (ETH.D) dominance has dropped to a new low, while XRP (XRP.D) dominance has increased sharply in 2025.

Ethereum dominance vs. XRP dominance. Source: TradingView .

Ethereum dominance vs. XRP dominance. Source: TradingView .Dominance indices reflect how Capital is distributed in the market. Since November last year, ETH.D has fallen from 14% to 7%. Meanwhile, XRP.D has increased from 1.2% to 4.5%. This contrast shows that investors are favoring XRP over ETH.

This Capital movement also triggered a significant technical outcome. The XRP/ ETH chart broke a downtrend line that has been in place since 2016, signaling a long-term uptrend for the pair.

XRP/ ETH performance chart. Source: Cryptollica

XRP/ ETH performance chart. Source: CryptollicaThis breakout is more than just a technical signal. It reflects a broader shift in market sentiment. Investors are increasingly focusing their attention on XRP.

A recent report from CoinShares supports this. The report said that digital asset investment products saw opposite flows between ETH and XRP over the past week. While Ethereum saw outflows of $26.7 million, XRP attracted strong inflows of $37.7 million.

This Capital shift shows XRP 's growing potential to close the market Capital gap with ETH.

Investor sentiment is more positive towards XRP

Ultimately, investor sentiment is tilting towards XRP. Recent reports highlight growing optimism around XRP, while ETH faces more skepticism.

According to a recent report by BeInCrypto, the price of XRP appears to be “ predestined ” for growth. This is driven by support from financial institutions and the growth potential of the XRP Ledger.

Recent news has created a positive atmosphere for XRP holders. Ripple acquired Hidden Road in a deal worth $1.25 billion. HashKey launched the first institutional XRP investment fund in Asia. Coinbase also introduced CFTC-regulated XRP Futures Contract .

On the contrary, ETH continues to face negative headlines and doubts. Reports such as “ Ethereum dominance hits 5-year low ” and criticism of ETH as a “ centralized pre-mined coin ” have worsened public perception.

Market sentiment is a major factor driving price volatility. Growing support for XRP could push it past ETH in terms of market Capital .