Master Chen's Hot Topic Discussion:

The market trend is quite different from what everyone expected. Previously, many thought that if the beautiful stocks dropped, BTC would not only withstand it but also surge against the trend. However, last night, beautiful stocks rose by over 2%, and BTC not only failed to follow but instead experienced a slight oscillation.

Today is the last trading day of the week, and next week will be about GDP gambling. The latest GDPNow data has downgraded the first quarter GDP of the United States, which is a major indicator for May trading difficulty.

BTC's recent performance has been somewhat zen-like. Although the price has slightly pulled back, investor sentiment remains stable without significant ups and downs. The turnover rate has decreased, indicating low trading enthusiasm.

For medium to long-term perspectives, the 83k support level still seems precarious. The main reason is that this position has not experienced a major washout, and its foundation is unstable. The number of people in the 93-98k position interval is increasing, and these people are quite patient.

Especially investors who didn't run at 74k are now even more calm, which means they are not short-term players. Currently, Master Chen has two hypotheses. If 95k is the top of this rebound, the market will likely oscillate for at least two weeks. Prices will wash out in this area, shaking out those who are not confident.

If 95k is not the top or the top has not yet been reached, the oscillation period might be longer, with prices oscillating while slowly probing upward. But don't expect to surge too high, as it will be a gradual grind that will wear you out.

For the current situation, Master Chen has a few things to clarify. First, don't try to short at the top. If you want to catch the top and then go big on a short position? Wake up, brother, the timing is wrong, the structure is wrong, it's too early. Trend-type short positions are not viable now.

Secondly, return to short-term trading. The move starting from 75k was a great time for long positions, and everyone made good profits. But now? The pattern is gone, and it has become a market for short-term players. Quick in, quick out, don't linger.

Starting next week, GDP data will become quite important. GDPNow has already lowered expectations. If the official data is poor, beautiful stocks might shake, but how it will move depends on sentiment transmission.

However, currently, BTC investors seem calm and are unlikely to collapse easily. Focus on short-term trading, watch the 83k support and 93-98k pressure, and don't always bet on the trend!

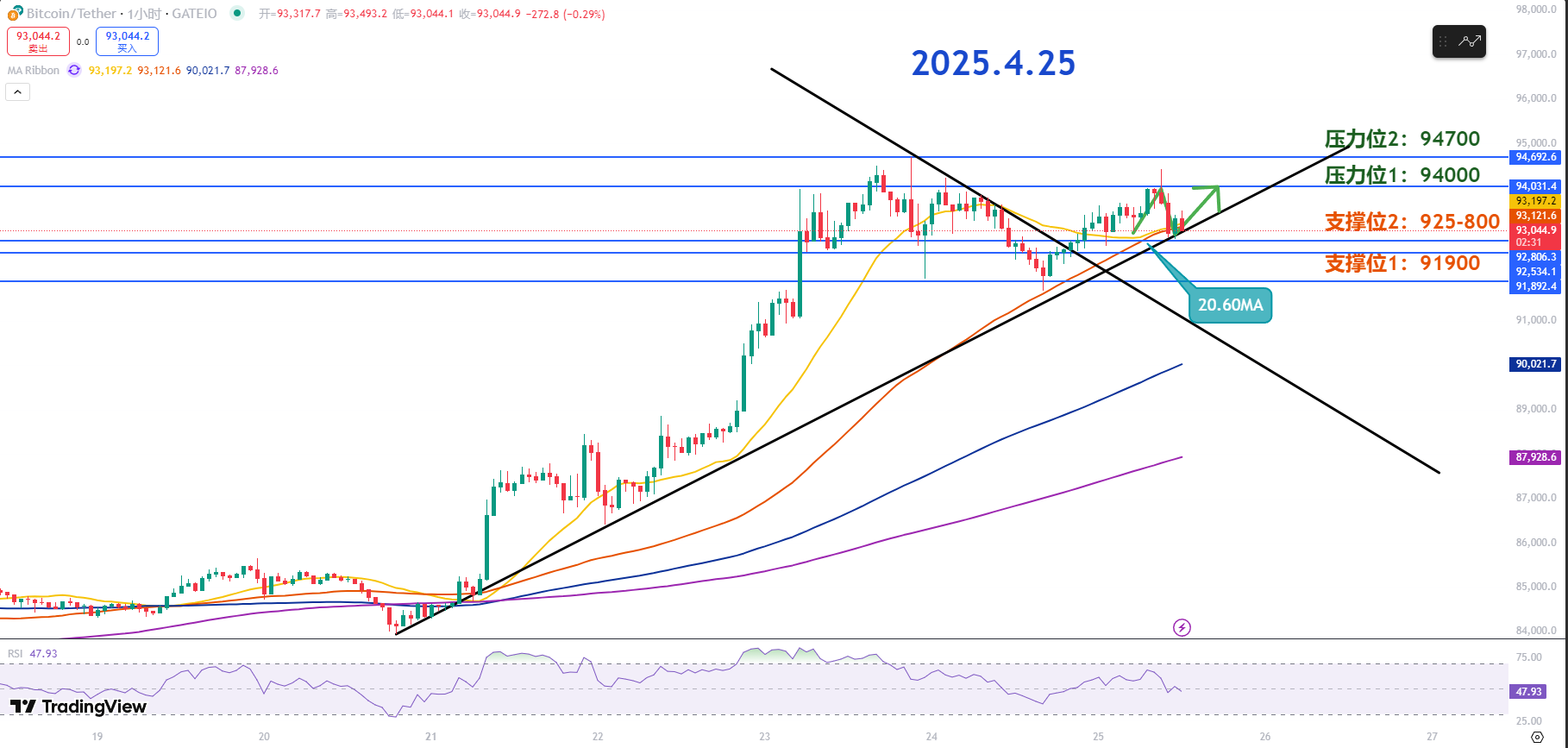

Master Chen's Trend Analysis:

Resistance Levels Reference:

First Resistance Level: 94700

Second Resistance Level: 94000

Support Levels Reference:

First Support Level: 92500-92800

Second Support Level: 91900

Today's Recommendation:

Bitcoin is currently attempting a complete trend reversal. Especially in the price rebound range, if the price can obtain buying support after horizontal consolidation and does not break below the previous low point, a step-by-step upward movement can be expected.

Additionally, the key is whether the current price can maintain stability and not break below the important previous low point. This is also an important basis for judging trend continuity.

Prices at round numbers like 93K and 94K may form psychological resistance. Within the price rebound range, the psychological support area may experience temporary pullbacks.

If the price successfully breaks through the first resistance at 94k, the target can be adjusted to 94.7K. Before reaching 95K, 94.7K is an important resistance level. If a slight adjustment occurs at this point, it may provide an opportunity for further upward movement.

Yesterday's 92.5K was an important support level. As the chart shows a rebound trend, support also needs to be correspondingly raised to the 92.5-92.8 range to better set the profit-loss ratio and manage risk.

To maintain the current rebound momentum, the price should ideally hold the 92.5-92.8 range. If it breaks below this range, it may drop to the previous low of 91.9K. In a low trading volume situation, this low point can be used as an ultra-short entry opportunity.

4.25 Master Chen's Wave Band Preparation:

Long Entry Reference: Light long position in 91900-92500 range, Target: 94000-94700

Short Entry Reference: Not recommended at the moment

This content is exclusively planned and published by Master Chen (Public Account: Coin God Master Chen). If you want to learn more about real-time investment strategies, hedging, spot, short, medium, and long-term contract trading methods, operational techniques, and K-line knowledge, you can join Master Chen's learning exchange group. Fan experience group and community live broadcast are now open!

Warm Reminder: Only the column public account (above) is written by Master Chen. Advertisements at the end of the article and in the comments are unrelated to the author! Please be cautious in distinguishing authenticity, thank you for reading.