Written by: shushu

After months of ecological silence, a community proposal named AIP-119 has injected new controversy and vitality into this Layer 1 public chain.

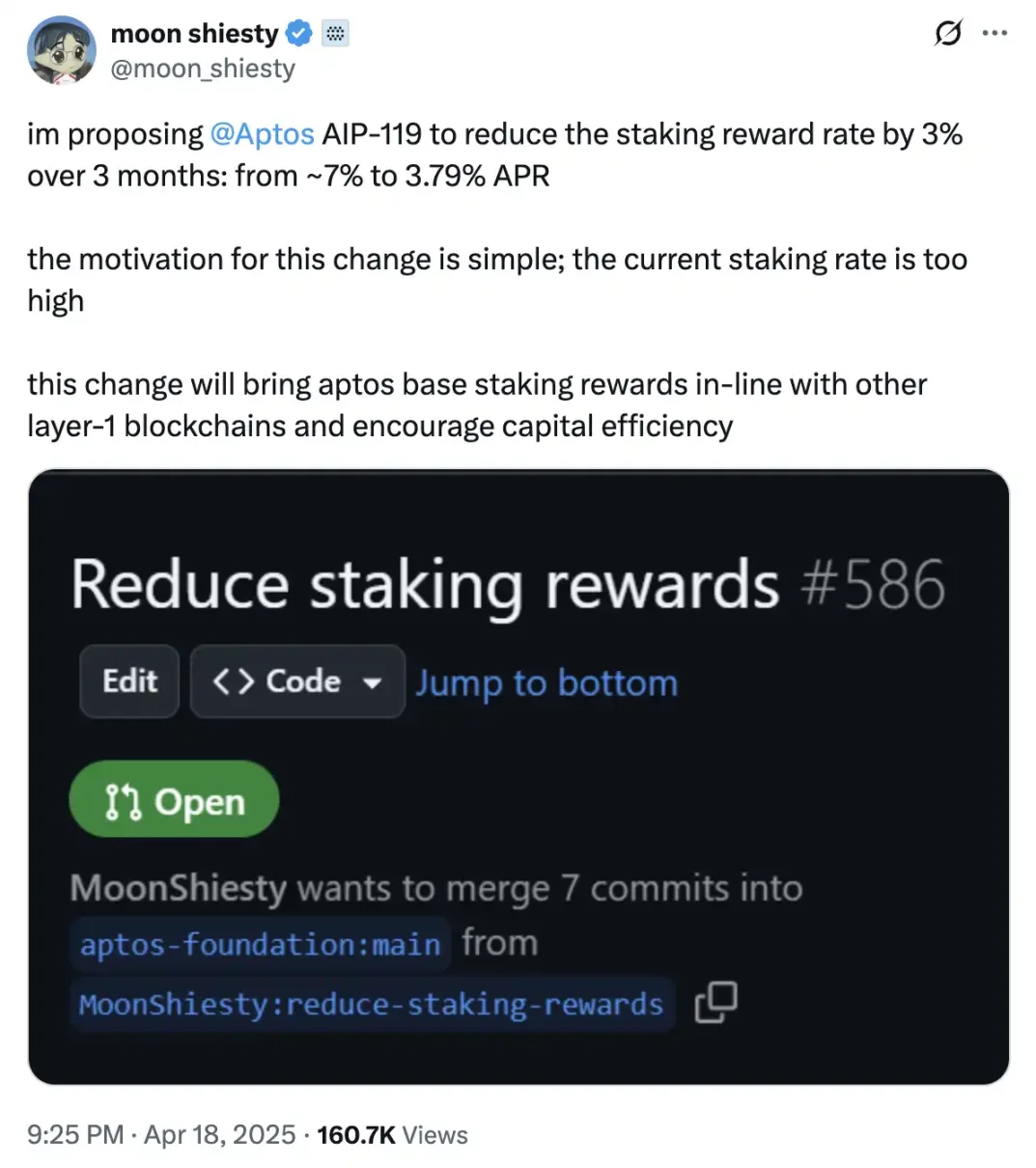

On April 18, Aptos community member moon shiesty initiated the "Phased Reduction of Staking Rewards Rate" proposal "AIP-119", suggesting reducing the staking rewards rate from the current approximately 7% to a monthly decrease of 1% over the next 3 months, ultimately lowering the annual yield to 3.79%.

The proposal argues that reducing the staking rewards rate will help Aptos ecosystem's long-term growth, particularly by promoting more active competition in the DeFi field, while also enhancing APT's token economics to support its long-term sustainability. As the first step in Aptos' economic model reform, the proposal will accept community feedback, and if passed, will set a 6-month observation period to assess the impact.

In the eyes of many observers, this is not just a technical governance adjustment, but also an attempt to reconstruct the underlying logic of Aptos' economic model.

Hidden Dangers of High Yields and Structural Inflation

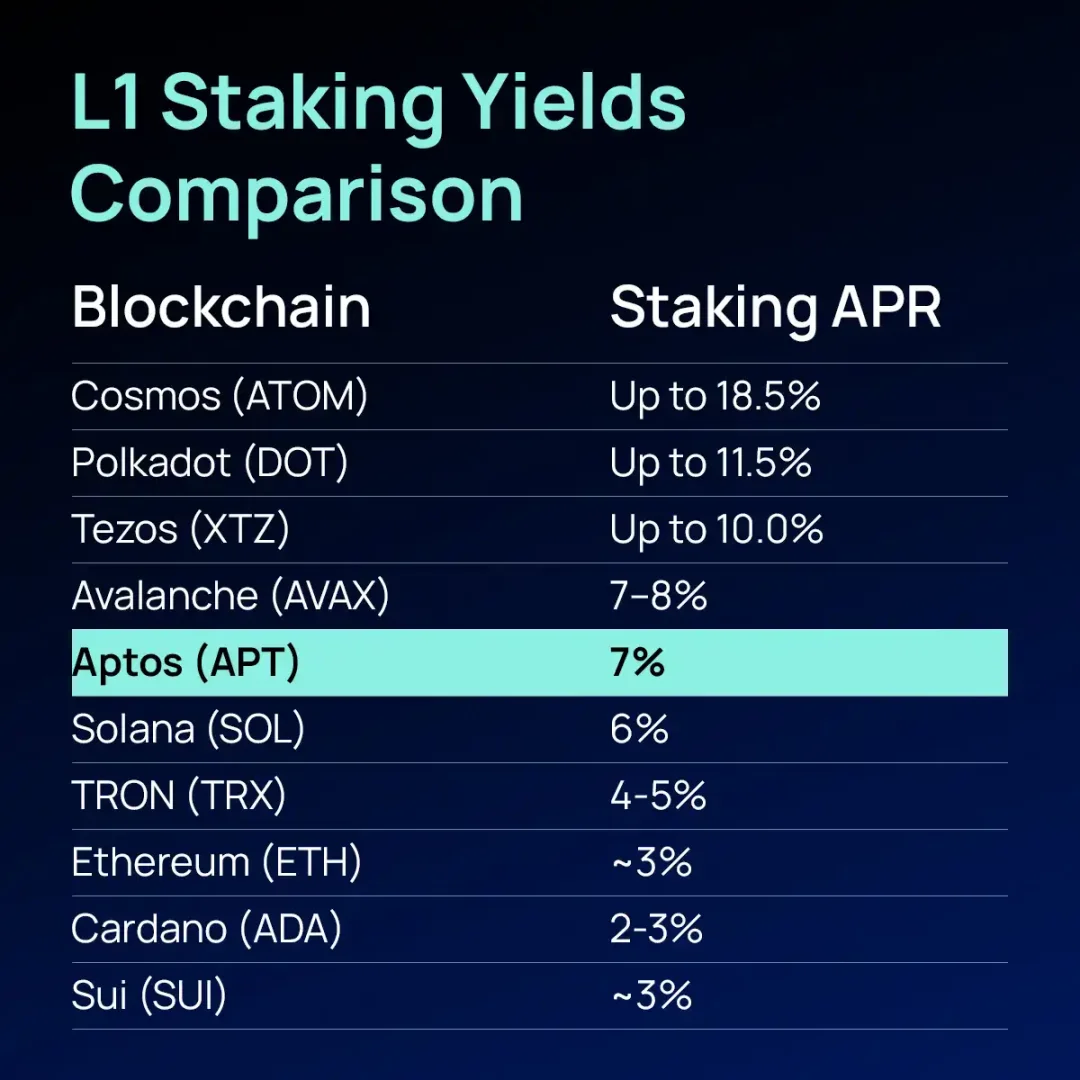

Aptos' current staking yield ranks among the top in L1 public chains, but the problems it brings are increasingly prominent. The 7% risk-free annual return has attracted a large number of users to lock APT for staking, but simultaneously caused severe inflation pressure and low fund utilization efficiency.

The community generally believes that this model is constantly diluting token value and hindering ecological funds from flowing to more risky and innovative applications. As the proposal initiator metaphorically said, staking rewards play the role of a "central bank interest rate", and the current "interest rate" may have deviated from market reality.

In the past two years, although Aptos attracted developers with its ultra-high performance and Move language safety, its ecosystem activity has never matched. Meanwhile, Sui, also a "Move twin star", continues to grow strongly, forming a sharp contrast.

Many community members attribute this to Aptos' structural token model issues - high proportion of tokens concentrated in the foundation and core nodes, coupled with early high staking yields, causing ecological funds to be excessively concentrated on "passive earning", thereby suppressing constructive innovation.

New Official's First Three Fires

The background of the proposal is a series of recent changes in Aptos' management and market positioning. According to community information, Aptos founder Mo Shaikh had legal disputes with early members, ultimately resulting in Chinese-American Avery Ching taking over as Aptos Labs CEO (originally CTO), with Mo Shaikh stepping down from daily management.

After his appointment, Aptos' strategic narrative shifted from "scalable L1" to "next-generation global transaction engine", more explicitly emphasizing performance and transaction experience as core competitiveness.

More significantly, Aptos' renewed embrace of the Chinese market: establishing the Chinese community MovemakerCN, hosting multiple hackathons, and providing ecosystem grants worth millions of dollars, demonstrating its determination to rebuild community trust and expand the global developer network.

Technically, Aptos continues to advance Zaptos upgrades and Block-STM v2 performance optimizations, hoping to attract developers in the new ecosystem of "low yield, high performance" by focusing on PMF driven by real needs.

What Does the Community Think?

Although AIP-119's proposal touches the interests of existing stakeholders, the community's overall feedback has not fallen into emotional confrontation. Instead, multiple parties, including the largest liquid staking protocol Amnis Finance, have shown relatively rational review and feedback. Amnis publicly responded that the current proposal direction is reasonable, but the execution pace is too aggressive and might harm Aptos' competitiveness.

If reduced to 3.79%, Aptos will be in the lowest yield tier among L1 camps, potentially causing funds to flow to Solana or US Treasury bonds with higher returns. Additionally, opponents worry that a sudden yield drop would weaken retail investors' lock-up motivation, increase APT's market circulation, and thus intensify selling pressure. The DeFi ecosystem might also face TVL decline due to leveraged staking strategy contraction.

For validation nodes, opponents point out that reduced yield rates will significantly impact small nodes' profitability. Taking 1 million APT staking volume as an example, 3.79% yield and 7% commission would only bring about $13,000 annual income, while operating costs might reach $72,000 to $96,000. This might force small nodes to exit, increasing network centralization risks.

Supporters emphasize that for Aptos to overcome current challenges, it must prioritize solving inflation expectations and token over-issuance. The "credit illusion" created by high-yield staking mechanisms is quietly eroding the ecosystem's foundation.

More notably, the proposal introduced a "Community Staking Support Plan", attempting to support validation nodes with smaller staking volumes while reducing interest rates, mitigating decentralization degree decline risks.

Ecosystem Evolution Turning Point

AIP-119's deeper significance is Aptos' active adjustment to its economic model and ecosystem mechanism after facing market cyclical recession, DeFi liquidity decline, and "high APY trap". In the current L1 public chain's vicious cycle of "issuance - staking - inflation", Aptos becomes a rare proactive attempt to compress basic returns and release long-term potential.

Hashkey Capital member Rui pointed out, "Validation node base yield rate shouldn't be high, increase yield through LST MEV earnings, provide more network ownership to major players through DeFi and ecosystem, and secondly, allow flexible entry and exit."

AIP-119 is still in draft stage, but it might have become an important node for Aptos to break free from its ailments and redefine its economic model.

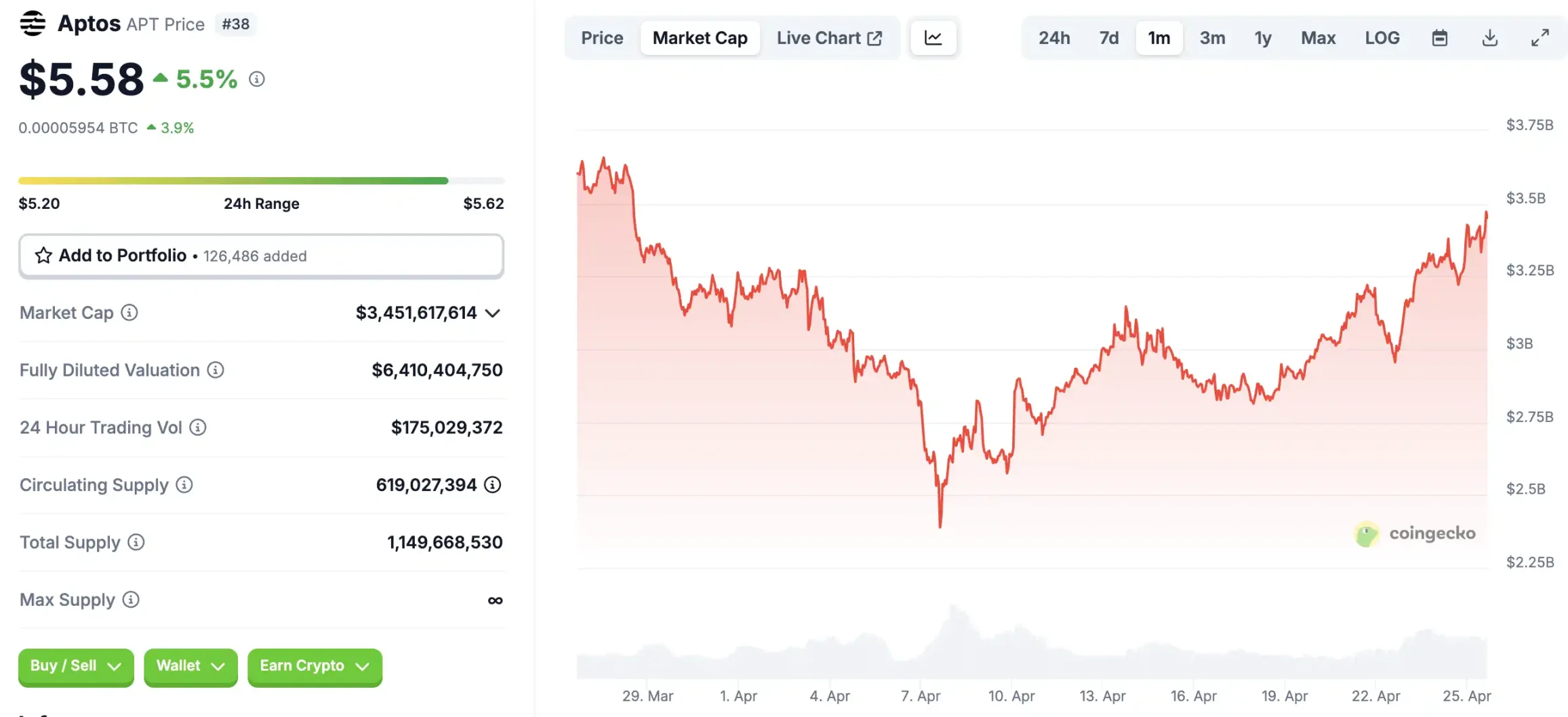

At the time of writing, APT token price was $5.58, up 5.5% in 24 hours; it has notably rebounded from the market's significant decline in April.