Written by: KarenZ, Foresight News

In the evolution of DeFi, most stablecoin designs have long been constrained by the shackles of endogenous yield models. The yields of mainstream stablecoins are highly dependent on the economic cycles within protocols - whether it's the "flywheel effect" formed by token incentive emissions or the value closed loop constructed by user transaction fees, essentially consuming themselves like an "Ouroboros", struggling to break through protocol boundaries for scalable growth, and unable to withstand systemic risks of market cycles.

In contrast to this closed loop is the exploration of exogenous yields. Exogenous yields originate from economic activities outside the protocol, such as arbitrage, MEV, RWA, etc. These yields were previously monopolized only by financial institutions and high-net-worth players, while CAP, positioned as a "stablecoin engine with trusted financial guarantees", aims to break this deadlock by introducing exogenous yield sources and risk transfer mechanisms. This article will introduce CAP from its positioning, core mechanisms, yield logic, and industry impact.

What is CAP?

CAP (Covered Agent Protocol) is an innovative protocol that shifts stablecoin yield sources from internal protocols to external markets. Its core goal is to transform institutional-level exogenous yields (such as MEV, arbitrage, RWA) into stable yields accessible to ordinary users through agency mechanisms and shared security networks.

Unlike traditional stablecoins that rely on token incentives or single collateral, CAP uses smart contracts to achieve automated capital allocation and risk management, constructing a complete closed loop of "yield generation - risk isolation - value distribution".

In terms of financing, in October 2024, CAP Labs completed a $1.9 million Pre-Seed round, with investors including Kraken Ventures, Robot Ventures, ANAGRAM, ABCDE Labs, SCB Limited, and angel investors like Synthetix founder Kain Warwick. In early April 2025, CAP raised another $11 million, with traditional asset management giants like Franklin Templeton and Triton Capital participating, marking the recognition of its model by traditional finance.

Regarding team background, CAP founder Benjamin was a core team member of the stablecoin protocol QiDao. CAP founding member and CTO Weso is also an advisor and contributor to the DeFi optimization protocol Beefy. Additionally, Cap has been selected for the MegaETH flagship accelerator program "Mega Mafia", and will launch its core protocol on Ethereum.

CAP's Core Mechanism: Three-Part Roles

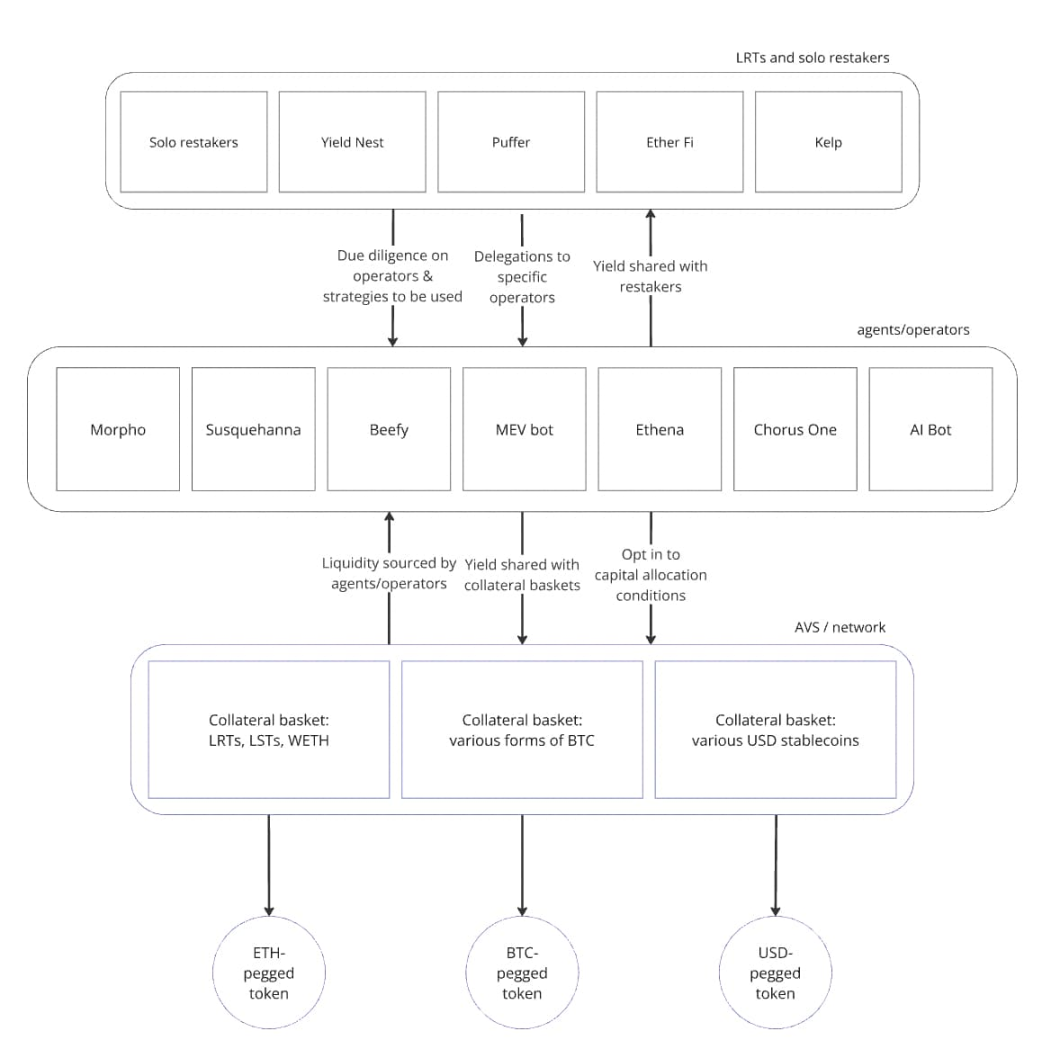

CAP implements self-executing capital allocation and security guarantees through smart contracts, relying on an agency layer and shared security model to transfer yield generation risks to re-stakers, protecting stablecoin users from strategy failure impacts.

In CAP, there are three main system participant roles: Operators, re-stakers, and stablecoin depositors.

Source: CAP

Stablecoin Depositors: Low-Risk Yield Receivers

Users deposit mainstream stablecoins like USDT/USDC to mint cUSD, earning a base loan interest rate. CAP officially states, "cUSD can always be redeemed 1:1." cUSD can also be directly used in DeFi ecosystem scenarios or further staked on the CAP platform to earn yields.

Stablecoin depositors can obtain exogenous yields created by professional agents without bearing token price volatility or strategy risks, escaping the traditional DeFi "high-risk mining" dilemma.

Operators: Exogenous Yield Capturers

Operators are the agency layer responsible for generating yields, including market makers, banks, high-frequency trading companies, private equity firms, MEV participants, RWA protocols, and other DeFi protocols, used to capture exogenous yields from crypto-native and real-world assets. CAP's yield generation does not depend on a single strategy but dynamically adapts to market changes through diversified agent strategies.

Initially, CAP adopts a whitelist mechanism for Operators, gradually transitioning to a permissionless mode. Each Operator must first obtain "economic security endorsement" from re-stakers (re-stakers delegate assets as their guarantee), borrowing corresponding stablecoins from the CAP pool to execute yield strategies. Collateral requirements are similar to crypto lending markets (such as over-collateralization). After paying base yields to stablecoin users and sharing with stakers, Operators retain remaining yields as incentives.

Re-stakers: Economic Risk Guarantors

Re-stakers delegate assets to specific Operators, guaranteeing Operators while providing economic security for stablecoin depositors. Re-stakers can earn yield sharing from Operators while also bearing the risk of strategy failures.

How are Interest Rates and Yields Determined?

Cap Labs founder Benjamin states that the base interest rate paid by agents to stablecoin users is programmatically determined, consisting of deposit rates from major lending markets plus CAP's additional utilization premium. This utilization premium is calculated as a percentage of borrowed capital, indicating the competitiveness of capital allocation under specific market conditions. Agents can choose to enter or exit based on the base rate.

After paying interest to stablecoin users and re-stakers, agents retain the remaining yields. This will largely incentivize agents to develop better yield strategies.

However, if an agent's yield strategy incurs losses or performs malicious operations causing borrowed funds to be lost, a portion of the re-stakers' ETH will be confiscated to fill losses in the CAP pool, ensuring cUSD holders do not suffer losses.

In terms of rules, considering re-stakers bear all economic risks, CAP grants them significant rights and choices. For example, re-stakers have the final say on which third parties can join the protocol and generate yields; re-stakers' yield rates (also called Premium) are negotiated between re-stakers and Operators. Additionally, premiums will be paid in blue-chip assets like ETH and USD, rather than inflationary governance tokens or off-chain point systems.

Interaction Strategy

Currently, CAP supports minting cUSD on the MegaETH testnet. Users can mint 1000 testnet-cUSD at a time. CAP has released a page for minting cUSD using USDC on the Ethereum mainnet, but interaction is not yet possible.

Summary

CAP's emergence marks a leap from "endogenous cycles" to "exogenous value capture" for stablecoins. Through exogenous yields and shared security models, CAP not only enhances DeFi's yield sustainability but also increases user protection through risk isolation. As RWA and institutional participants are integrated, CAP may become a key infrastructure connecting traditional finance and DeFi.

It's worth noting that CAP's operation heavily depends on smart contract reliability, so smart contract risk is its core potential challenge. According to official disclosures, the protocol is currently being audited by security firms like Zellic and Trail of Bits, with the Pre-Mainnet version having passed Electisec's audit. Additionally, since CAP is built on shared security networks like EigenLayer, ongoing attention to potential risk transmission in related ecosystems is necessary.