Introduction: A $330 Million Money Laundering Case and XMR's Covert Revelry

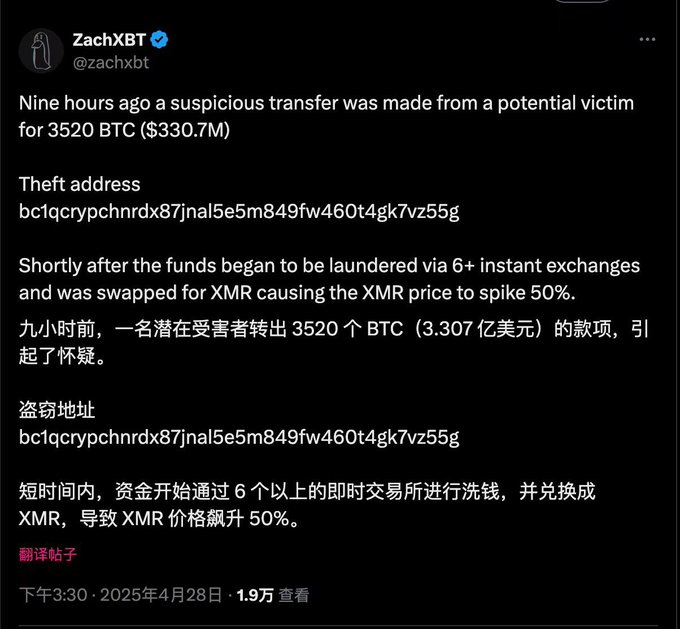

On April 28, 2025, a tweet by on-chain detective ZachXBT ignited the crypto community: An anonymous address exchanged 3,520 BTC (worth $330 $) through 6 instant exchanges to Monero (XMR), causing XMR's price to surge 50% within 9 hours before falling back to>

<>regulatory swords hang high and exchanges delist en masse, how does XMR still build a covert consensus? This article will deeply dissect XMR's underlying logic and explore its irreplaceability in the privacy track.

I. The "Three-Body Civilization" of Privacy Technology: How XMR Crushes Zcash and Dash

Monero's moat stems from its three-in-one privacy technology architecture, with its design philosophy directly pointing to the blockchain's most primitive anonymity need: "Privacy is not an option, right, but default."

Ring Signatures: The Core Weapon to Confuse Sender Identity

Each XMR transaction randomly selects 5 historical transaction outputs to form a "signature ring", making it impossible for outsiders to identify the real sender. Compared to Zcash's zero-knowledge proof (which requires users to actively choose privacy mode), XMR's privacy is mandatory and tractraceless, eliminating the possibility of users exposing their identity due to operational errors.

Stealth Addresses: The "Quantum State" Protection for Receivers

Each transaction generates a one-time address, with the main address never exposed. This mechanism far surpasses Dash's coin mixing service (which requires manual operation and relies on third-party nodes), achieving absolute anonymity for the receiver's identity.

RingCT: The Ultimate Solution for Amount Concealment

Since the 2017 upgrade, XMR's transaction amounts are encrypted into mathematical commitments, with only participants able to verify the amount's legality. In contrast, Zcash's transparent chain still exposes amounts, significantly compromising privacy.

Technical Comparison Table:Mcapability Matrix of Privacy Coin Track