Written by: TechFlow

Last year, we paid early attention to VIRTUALS Protocol, when the AI Agent trend had not yet begun, and the VIRTUAL token had a market cap of around 800k.

(See details: virtuals.io | AI Agent Version of Pump.fun Arrives: What's It Like to Launch an AI Agent Token That Earns Money for You?)

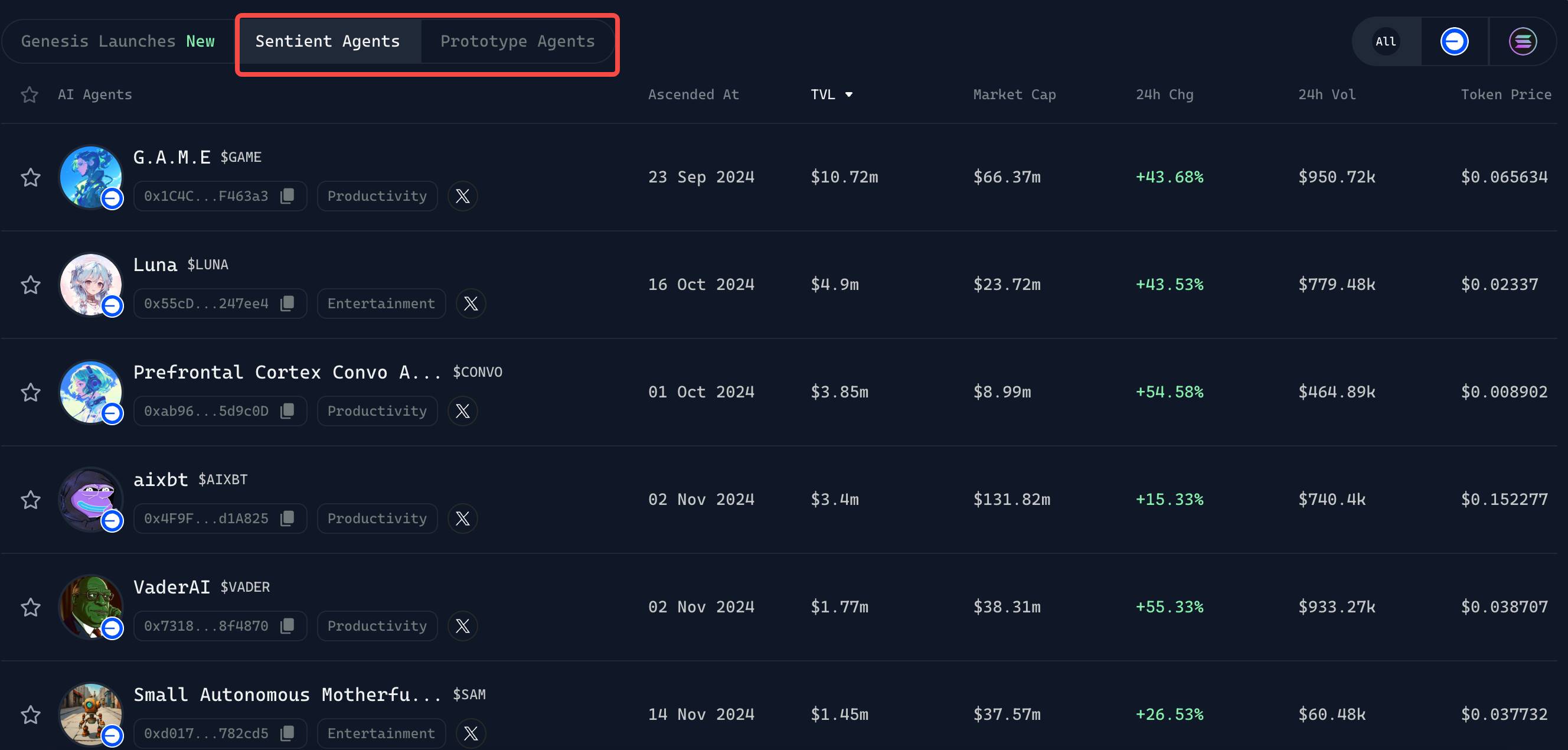

The subsequent story is well-known, Virtuals initiated an AI Agent wave on Base, and besides the Virtuals token itself being eye-catching, it also produced a phenomenal token like AIXBT.

But after a cycle, the AI Agent hype gradually faded, and the market seemed to fall into silence; with the emergence and iteration of large models like DeepSeek, everyone gradually felt that the AI Agent narrative in Web3 was being falsified and not very useful.

When you relax your vigilance and feel discouraged about the market, there are always new ways of creating assets that emerge and can cause dramatic token price fluctuations.

In the past week, the Virtuals token rose by 150%, and in the past day alone, it rose by 42%. Discussions about Virtuals have once again returned to the timeline of crypto news.

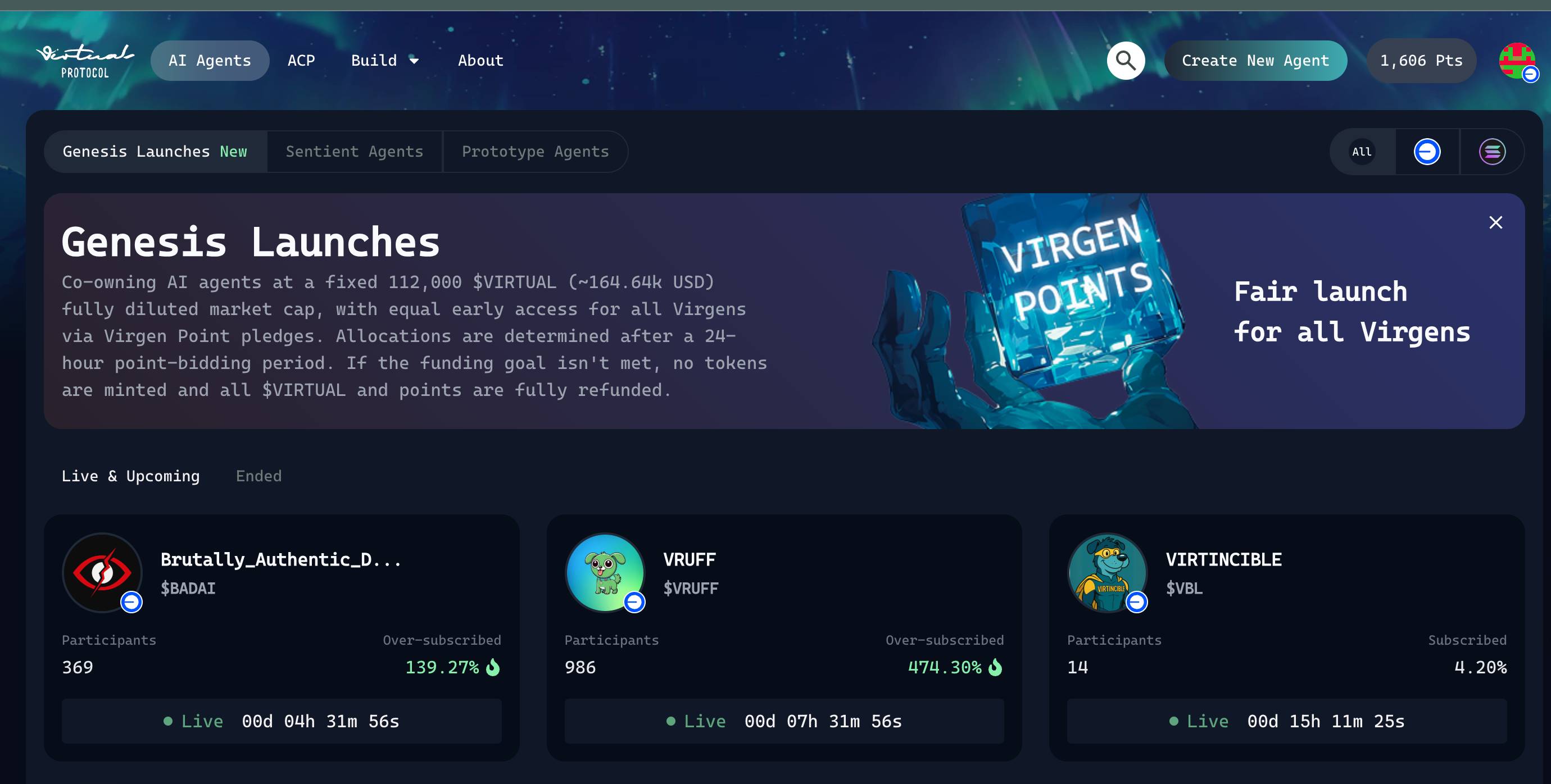

The catalyst for Virtuals' rise is undoubtedly the newly launched Genesis Launches activity on its own platform.

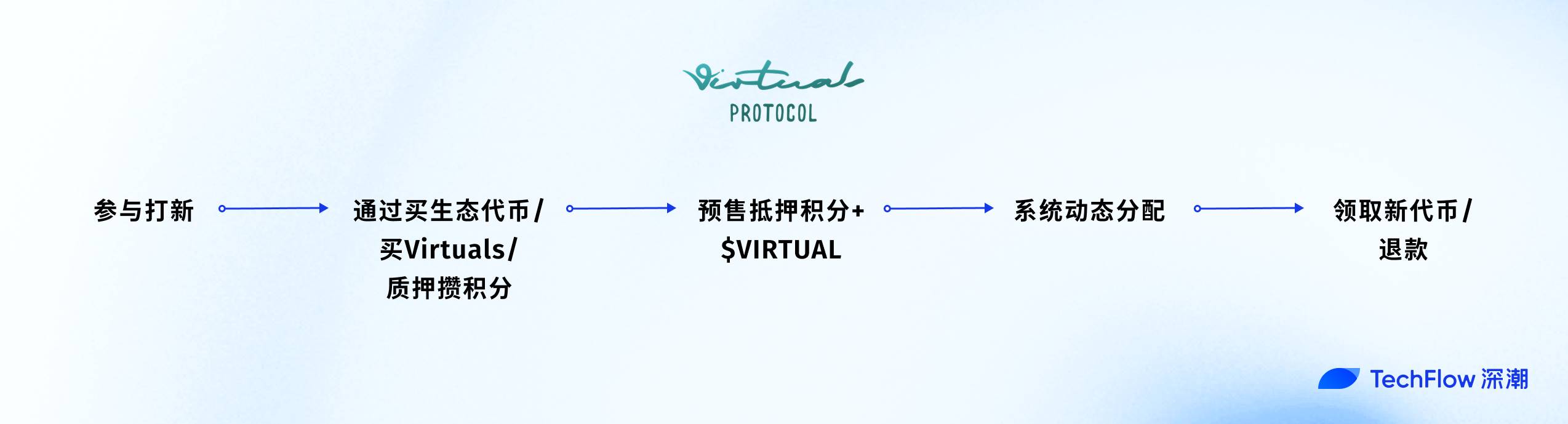

If you haven't heard about this activity so far, you can briefly understand it as:

A mechanism that allows you to obtain "priority ticket rights" for hot new AI agent tokens by holding $VIRTUAL tokens and earning points.

To put it simply, it's a variation of the "IPO" mode.

Each generation has its own legend, and each version creates assets. New tokens, new stories, and new mechanisms always ignite market enthusiasm.

And various activities and mechanism designs around asset creation can easily become the start of a new trend.

The previous AI Agent wave on Base was largely initiated by Virtuals; does this round of Genesis Launch contain new opportunities?

We also experienced the product and will quickly help you understand the gameplay and mechanism of Genesis Launch.

Contribution Prerequisite, Zen-like IPO

From the official description, Genesis Launch is a fair launch platform specifically designed for AI agent tokens by Virtuals Protocol.

Simply put, it's a mechanism that allows new AI agent projects to issue tokens through community-driven methods. Users can obtain priority allocation rights for these new tokens by holding $VIRTUAL tokens and earning points.

In other words, unlike Pump.fun where everyone can compete by speed, participating in new token launches on Virtuals now has conditions; and this condition essentially judges pre-contributions and somewhat curbs token sniping at the opening.

Specifically, in previous platforms' IPOs, snipers used high-speed scripts to grab low-priced tokens, and scientists could monopolize most shares through batch wallets and gas fee bidding. Sometimes before retail investors could even load the trading interface, the token price had already doubled.

To participate in "IPO", you needed to understand gas fee settings, monitor contract deployment, and even wake up in the middle of the night to watch on-chain dynamics. How could ordinary players have such technical skills and energy? They could only watch technical experts grab the meat while struggling to even drink the soup.

This Genesis Launch seems relatively zen and mild. You don't need to frantically compete for speed during the IPO opening, but instead, it changes the logic:

Want to participate in AI token IPO? First contribute to the Virtuals ecosystem and accumulate points.

How to get points? For example, hold $VIRTUAL tokens, stake other tokens, or help Virtuals promote through content contributions, which will be specifically introduced later.

But looking at the overall effect, Genesis Launch has simplified "IPO" to the extreme.

You only need to hold $VIRTUAL tokens, accumulate points, and then stake these two things in the 24-hour new token pre-sale window, and the system will automatically calculate your new token allocation.

Point Mechanism Detailed Explanation

Let's now look specifically at the point-based IPO mechanism of Genesis Launch.

First, how do you get points?

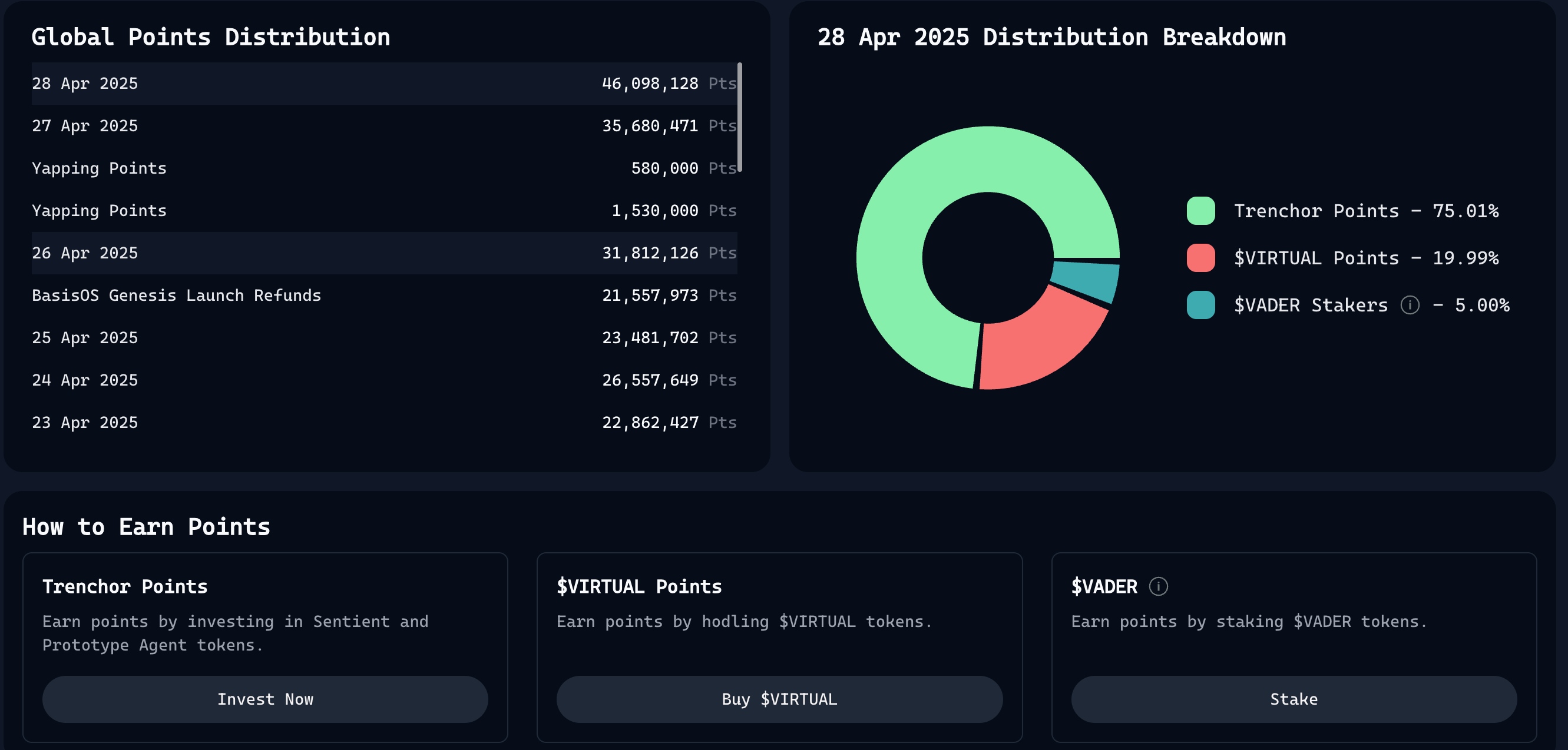

The official provides 3 ways to obtain points:

Invest in other Agents in the Virtuals ecosystem, currently two categories: Sentient (emotion-based AI Agents) and Prototype (prototype AI Agents). This is actually buying existing AI Agent tokens in the ecosystem with Virtuals, and after buying, the points are like a cashback that you can use to participate in the platform's Genesis Launch.

Directly buy and hold Virtuals tokens. This doesn't need much explanation, equivalent to holding coins and earning points, similar to a loyalty reward.

Stake $VADER tokens. VADER is also an AI Agent project token in the Virtuals ecosystem from Vader AI. Holding and staking this token can earn points to participate in the IPO, essentially supporting the Vader AI project. The author believes this sets an example of ecosystem support, as the staking rules are not necessarily fixed, and other projects might become "stake for points" targets in the future.

It's worth noting that this point system is dynamically updated daily.

Virtuals will distribute a certain total number of points daily, according to different allocation proportions, to players who meet the above 3 categories of behavior, to incentivize their contributions to the ecosystem.

From the allocation ratio, purchasing other AI Agents in the ecosystem accounts for 75% of point allocation; direct token holding accounts for about 20%, and the remaining 5% is given to VADER token staking.

This might also partly explain why tokens in the Virtuals ecosystem, including the VIRTUALS token itself, have seen significant increases in the past one to two weeks.

After understanding this point rule, let's look at how new AI tokens are launched.

Genesis Launch uses a 24-hour pre-sale window with a transparent allocation rule that prevents monopolization, specifically as follows:

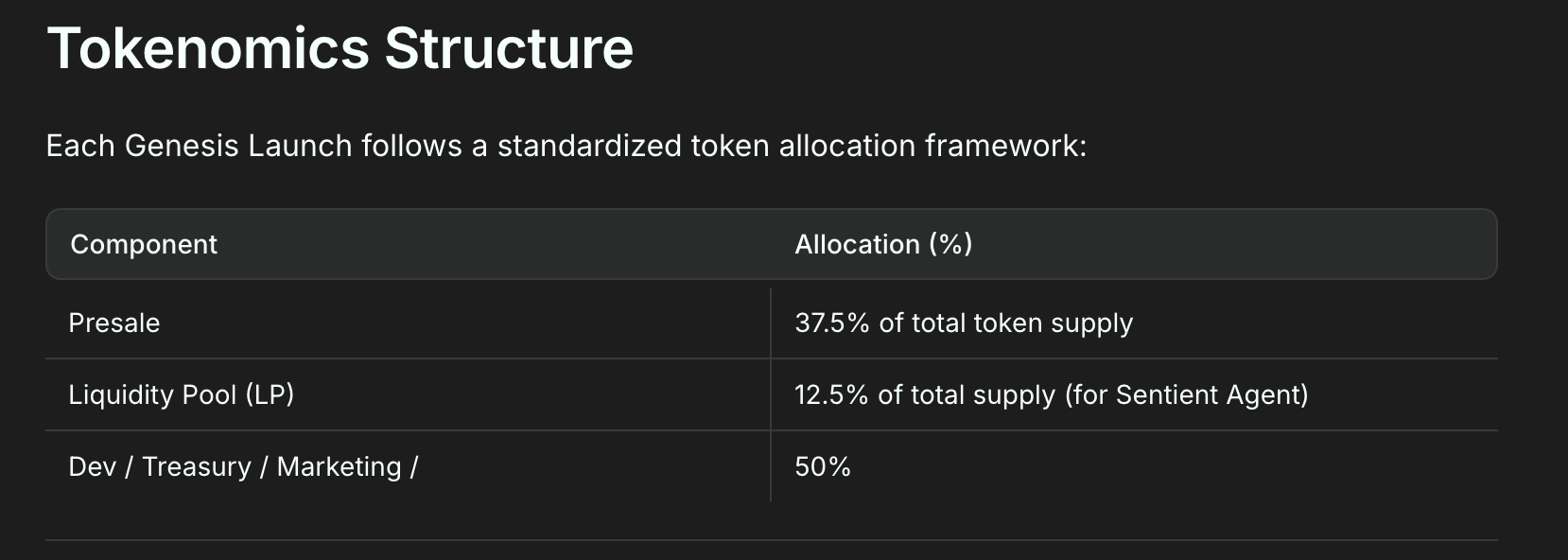

Allocation Ratio: 37.5% of the new token's total supply is used for pre-sale, 12.5% injected into liquidity pools (such as Sentient Agent pool), with the remaining 50% for project development, finance, and marketing. The 37.5% pre-sale is the "big cake" retail investors can grab.

Dynamic Allocation: During the 24-hour pre-sale window, your staked points determine your allocation. More points mean more tokens, but each person can get at most 0.5% of total supply to prevent large holders from draining the pool. The system calculates everyone's proportion based on the total points pool. For example, 1000 points in a 100,000 total points pool might get 1% of the pre-sale allocation.

Refund Mechanism: Staked $VIRTUAL and unused points? Don't worry, the system will return them to you.

In the Genesis Launch "IPO" process, you need to simultaneously stake points and $VIRTUAL tokens to compete for new AI token allocation rights.

A simple process is as follows:

Hold $VIRTUAL: Buy $VIRTUAL tokens, prepare your "ticket".

Accumulate Points: Obtain a certain number of points through the 3 point acquisition modes mentioned above.

Stake to Participate: After the new token pre-sale begins, stake your points and $VIRTUAL within the 24-hour window on the Virtuals official website. The system will estimate the required $VIRTUAL staking amount.

Wait for Allocation: After the pre-sale ends, the system calculates your share based on the total points pool, and the new tokens are directly credited. Unused $VIRTUAL and points are returned.

Claim or Trade: After obtaining new tokens, you can hold them or trade on DEX.

Points are your "priority certificate" for participating in "token launch", determining the share of new tokens you can receive. The more points you have, the higher the allocation ratio (but capped at 0.5% of the total new token supply per person).

It's important to note that points will be consumed when participating in the pre-sale. The points allocated to you by Virtuals will expire after a certain time if unused, thus encouraging you to invest points in token launches.

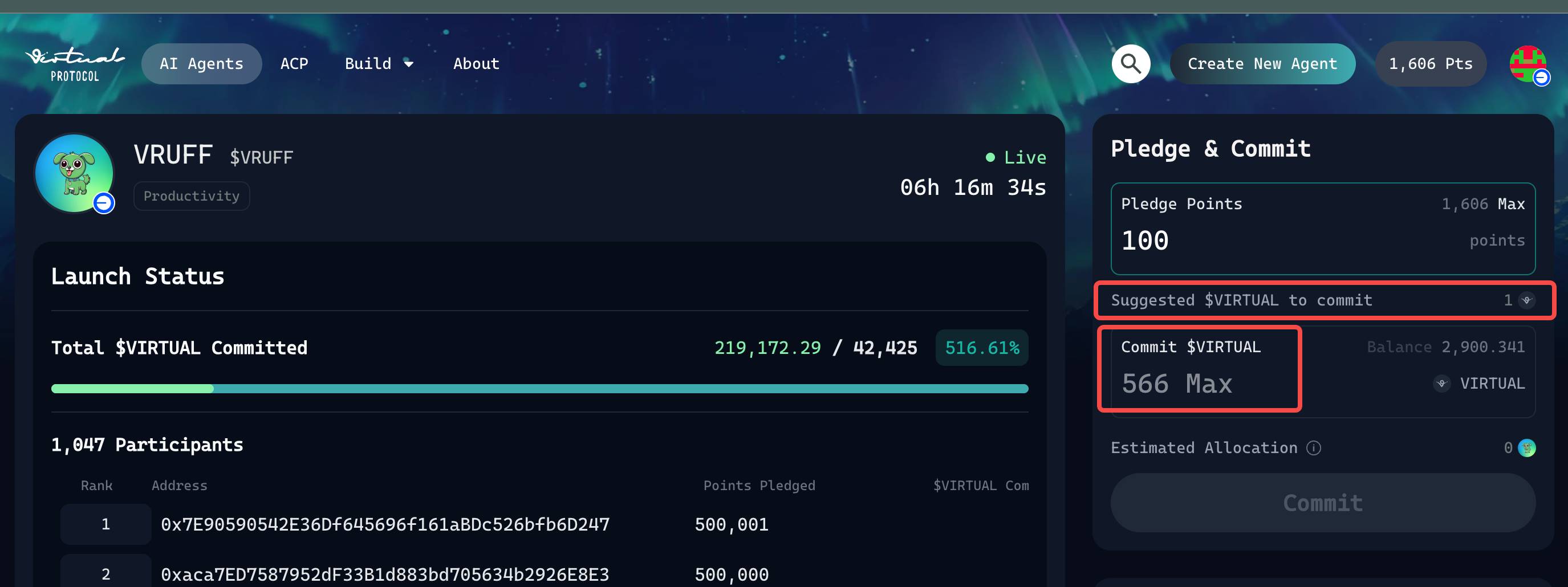

The Virtuals tokens themselves are the cost of your token launch participation. The system will also suggest the number of Virtuals tokens you need to invest based on your points, with the following logic:

More points mean a higher token allocation limit;

Fewer points make investing more Virtuals in token launch less meaningful.

To prevent monopoly, a wallet can invest a maximum of 566 Virtuals in token launch, with a 1% transaction tax.

What if you don't have enough points and don't want to buy old assets?

Virtuals has also launched its Yaps mechanism, allowing you to earn points through content contribution and promotion, giving players more low-cost token launch options.

Launching New Assets and Reviving Old Assets

Experience tells us that the mechanism design around crypto assets should not be short-sighted, but rather aim to maximize benefits.

The Genesis Launch approach clearly aims to launch new assets while reviving old assets.

In the Virtuals ecosystem, established AI tokens (such as Luna, AIXBT) already have their market narratives.

As the AI Agent trend cooled down, these old coins experienced a significant decline in trading volume and community enthusiasm.

This wave requires points for token launch, and points must be obtained by purchasing old assets. This design increases the demand for old assets through new asset launch rules, thereby driving up the prices of old assets.

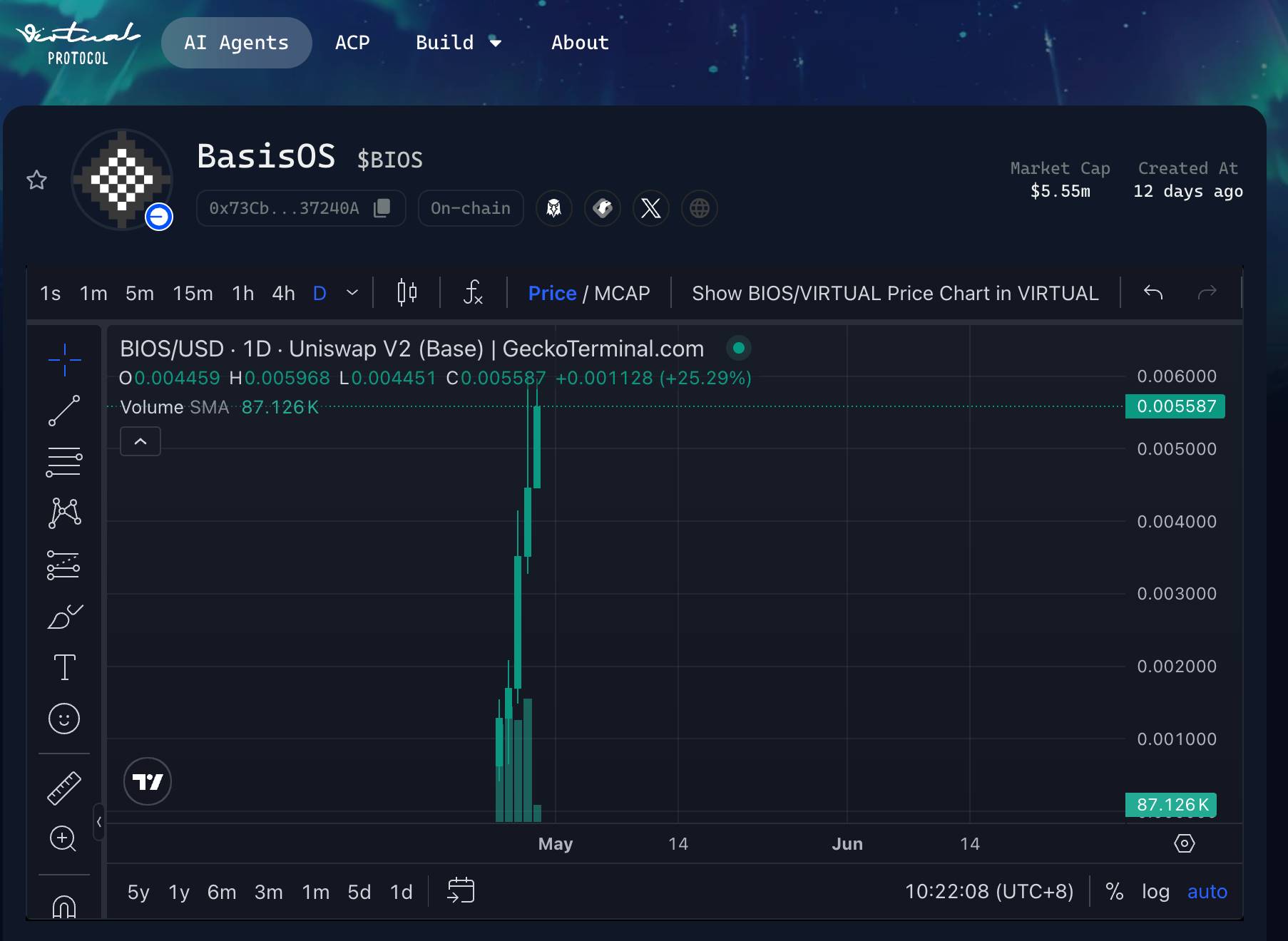

Meanwhile, new assets on Virtuals are quietly surging in price with limited participation.

For example, the BasisOS token born through this Genesis Launch has reached a market cap of $5.5M within 12 days, growing 40 times from its initial launch.

Without significant changes in Virtuals' technology and narrative, this "old-to-new" asset issuance approach can indeed create some waves in the recent dull market.

Looking at the broader environment, you'll find that previously popular AI Agent tokens have experienced a certain degree of rebound.

So, the AI Agent narrative may not have truly died, but rather urgently needs new asset issuance methods. Top projects from the previous cycle are actively seeking self-rescue by expanding their gameplay to reignite market enthusiasm.

Their approaches are remarkably similar. On the Solana ecosystem, ai16z seems to be doing something similar, creating a new asset launchpad Auto.fun, and designing rules to create economic incentives for the ai16z token, thereby driving the price of old coins.

As "token launch driving old assets" becomes the new gameplay for AI Agent platforms, a better approach for us is to treat old coins as Beta and actively seek new Alpha in this currently less competitive market environment.