Standard Chartered predicts Bitcoin will surge to 120,000 USD in the summer and reach 200,000 USD by the end of 2025, due to capital flowing out of US assets.

Standard Chartered, an international bank headquartered in London, continues to maintain a strong growth forecast for Bitcoin in 2025. According to a research report released on Monday, Mr. Geoffrey Kendrick, the bank's Head of Digital Assets Research, affirms that Bitcoin will reach 200,000 USD by the end of this year.

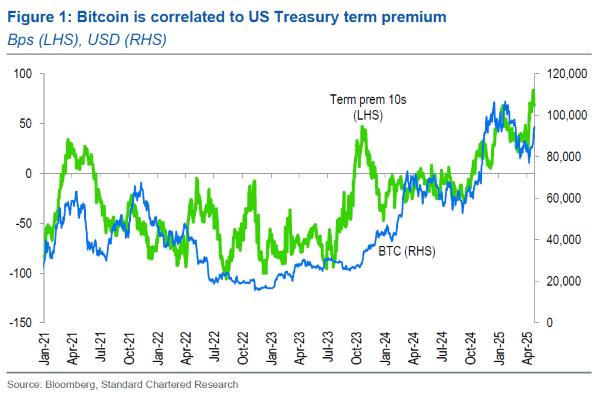

The report indicates that investors are shifting capital to assets outside the United States, including Bitcoin, due to the impact of President Donald Trump's new trade policies. A notable sign is that the US Treasury bond premium is currently at its highest level in 12 years – reflecting the fact that investors are viewing Treasury bonds as higher-risk investments.

Factors Supporting Price Increase

Besides the pressure of withdrawing capital from US assets, the report also analyzes other factors driving Bitcoin's price. Notably, continuous accumulation activities from "whales" – investors holding 1,000 BTC or more.

Meanwhile, gold Exchange Traded Funds are losing market share to Bitcoin ETFs, indicating a shift in institutional investor sentiment towards traditional safe-haven assets.

The report emphasizes: "We expect these supporting factors to push BTC to a new historical peak of around 120,000 USD in the second quarter. We forecast that the upward momentum will continue through the summer, bringing BTC-USD towards the target of 200,000 USD by the end of the year."