Bitcoin recovers to $94,000 after Strategy, led by Michael Saylor, purchases an additional 15,355 BTC, valued at approximately $1.42 billion.

Bitcoin has recovered to $94,000 after a slight correction over the weekend to around $92,000, partly driven by the announcement of a significant Bitcoin purchase by Michael Saylor's Strategy. On Monday, Strategy announced the addition of 15,355 BTC with a total value of approximately $1.42 billion, at an average price of $92,737 per BTC.

Since then, Bitcoin has recovered to $95,000 and is currently trading around $93,966.19 at the time of update. This move continues to consolidate Strategy's position as the largest Bitcoin treasury among listed companies, with a total of 553,555 BTC – 11 times more than Marathon Digital Holdings, the second-largest holding company with 47,531 BTC.

London-based Standard Chartered Bank currently predicts that Bitcoin will set a new historical peak in Q2/2025, and will more than double from its current price by the end of the year.

"We expect Bitcoin to reach a new peak in Q2," the bank said. "The target of $200,000 by the end of 2025 will be within reach."

Bitcoin Market Overview

In the most recent trading session, Bitcoin moved within a range from $92,860.81 to $95,598.49, reflecting an optimistic sentiment despite some short-term corrections.

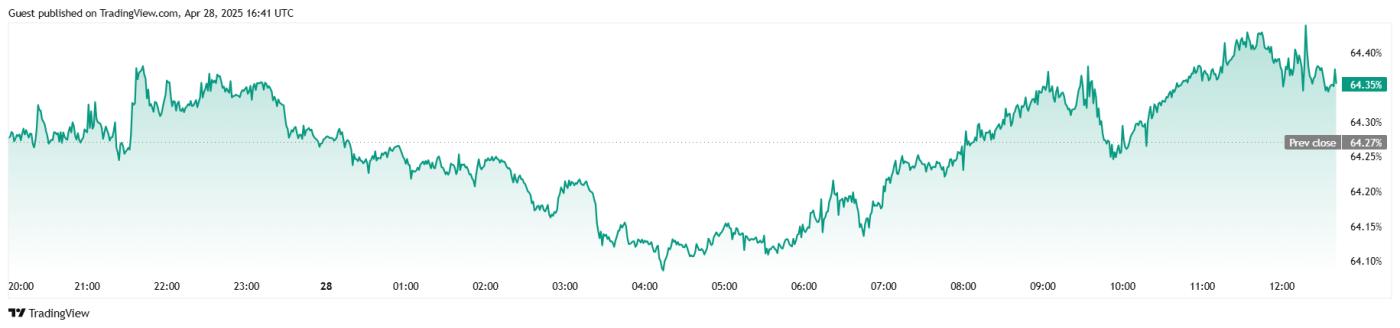

The 24-hour trading volume increased significantly by 71.64%, reaching $30.46 billion, typical of the upward trend after the weekend. Bitcoin's market capitalization also slightly increased by +0.09% to $1.86 trillion, while BTC's dominance ratio increased by +0.17%, reaching 64.35%. Despite the price and trading volume increase, futures contract activity remained relatively stable, with BTC's total open interest slightly decreasing by 0.12% to $63.525 billion.

According to data from Coinglass, the total 24-hour liquidation value was only $2.11 million – a low level, with Longing positions accounting for most of the damage at $1.7 million, while Short positions recorded only $403,250 in liquidations.

Overall, the data shows a cautiously optimistic picture for Bitcoin, with a strong support foundation even as trading activity begins to stabilize again after the weekend.