Bitcoin Supply continues to increase steadily despite recent obstacles and market challenges.

On-chain data shows that over 85% of BTC's circulating supply is currently profitable. This is a historical price increase signal that typically marks the beginning of euphoric phases in market cycles.

BTC enters price increase zone, but analysts warn of potential correction

BTC supply profitability measures the percentage of coin holders who purchased their assets at lower prices than the current market value. As this number increases, it indicates widespread investor confidence and strong capital flow into the asset.

In a recent report, CryptoQuant's anonymous analyst Darkfost discovered that over 85% of BTC's circulating supply is currently profitable. Although this trend represents a price increase signal, it comes with a condition.

Bitcoin Supply in Profit. Source: CryptoQuant

Bitcoin Supply in Profit. Source: CryptoQuant"A large portion of profitable supply is not a bad thing, quite the opposite. Certainly, some levels are more 'comfortable' than others, but overall, the increase in profitable supply tends to drive price increase phases," Darkfost wrote.

According to the analyst's notes, the market is entering a euphoric zone, a phase that occurs when profitable supply approaches or exceeds 90%. These levels, despite price increases, often coincide with local market peaks when traders begin taking profits, causing short to medium-term corrections.

"History shows that when profitable supply crosses the 90% threshold, it consistently triggers euphoric phases, and we are currently approaching that level. However, these euphoric phases can be brief and are usually followed by short to medium-term corrections."

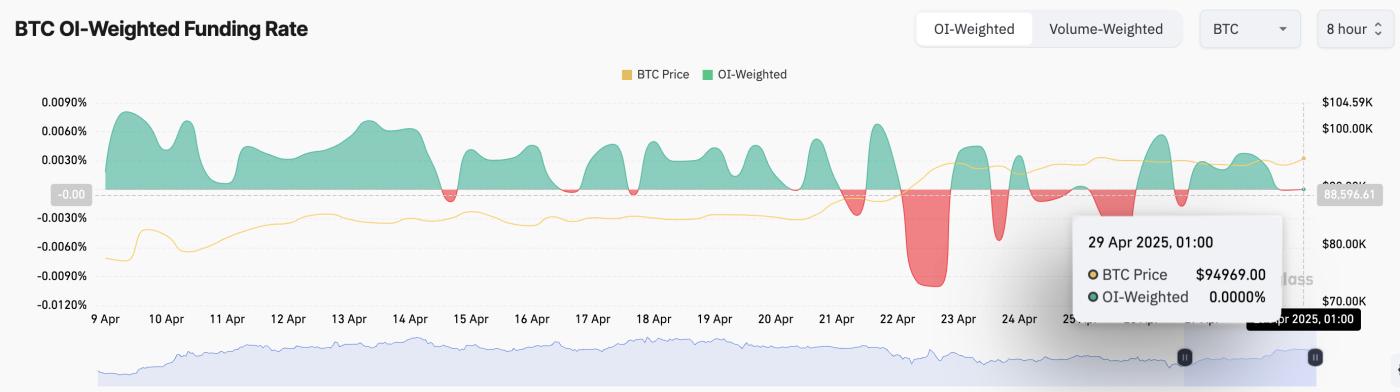

Funding rate signals market in wait-and-see mode

Interestingly, BTC's funding rate remains relatively balanced, indicating the market is in a waiting state. At the time of writing, the coin's funding rate is 0%.

BTC Funding Rate. Source: Coinglass

BTC Funding Rate. Source: CoinglassThe funding rate is a periodic payment between traders in the perpetual futures market, used to keep contract prices aligned with the spot market. For BTC, a 0% funding rate indicates a neutral market sentiment, where neither buy nor sell positions are dominant.

This suggests that BTC investors are waiting for a catalyst to provide a clearer direction. This neutral market sentiment and increasing profitable supply create the premise for potential short-term price volatility.

Bitcoin remains steady below resistance level

At the time of writing, the king coin is trading at $95,125, below the important resistance level of $95,971. Despite recent market fluctuations, BTC demand among spot market investors remains significant, reflected in its Relative Strength Index (RSI) of 68.21.

The RSI measures an asset's overbought and oversold market conditions. It oscillates from 0 to 100, with values above 70 indicating the asset is overbought and likely to decrease in price. Conversely, values below 30 suggest the asset is oversold and may recover.

BTC's RSI indicates room for further price increases before the coin becomes overbought. If demand increases strongly, the coin could break through the $95,971 resistance and rise to $98,983.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingViewHowever, if bearish sentiment increases, BTC could continue its downward trend and fall to $91,851.