Core Highlights

- SIGN combines decentralized identity, on-chain proof, and cross-chain distribution protocol, providing over 6 million proofs and $4 billion in token distribution in 2024, unlocking global-scale verifiability and trust in digital credentials.

- Its token economics allocates 40% of signatures to community initiatives and rewards (including 10% TGE airdrop), with the remaining 60% distributed to supporters (20%), early team members (10%), foundation (10%), and ecosystem development (10%).

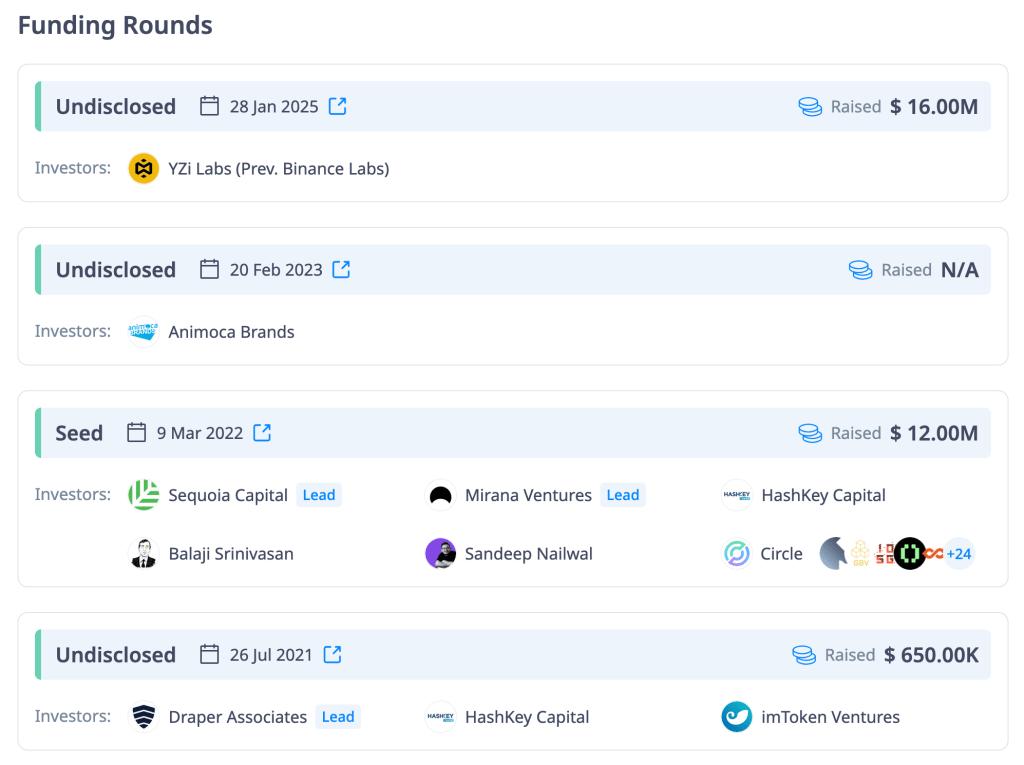

- The project raised $14 million in a seed round led by Sequoia Capital in 2022, $16 million in a Series A round led by YZiLabs in 2025, and then conducted a token generation event (TGE) through Binance HODLer airdrop on April 28, 2025, followed by spot trading on Binance the same day at 11:00 UTC.

- SIGN's roadmap covers launching a flagship super app in Q2 2025, government-level product adoption in Q3 2025, and launching a flagship media network in Q4 2025, while preparing for sovereign Layer 2 stacks and memorandums of understanding with Barbados and Thailand.

The SIGN Token is pioneering a new infrastructure for global credential verification and token distribution by merging cross-chain certification protocols with a smart contract-based distribution suite.

Its vision is to bring trust to trustless networks, enabling governments, enterprises, and developers to verify identities, ownership proofs, and contracts on-chain, while providing a transparent, scalable verification framework and large-scale token distribution solutions.

Signature Fundraising and Launch Event

SIGN's fundraising began in June 2022 with a $12 million seed round led by Sequoia Capital, supported by top venture capital firms from the US, China, India, and Southeast Asia. Building on this, the team completed a $16 million Series A funding in March 2025, led by YZiLabs, with strategic ecosystem partners joining.

The Token Generation Event (TGE) occurred on April 28, 2025, at 10:00 UTC, when 350 million SIGN Tokens were distributed to eligible BNB holders through Binance HODLer airdrop.

Image Source: CryptoRanks

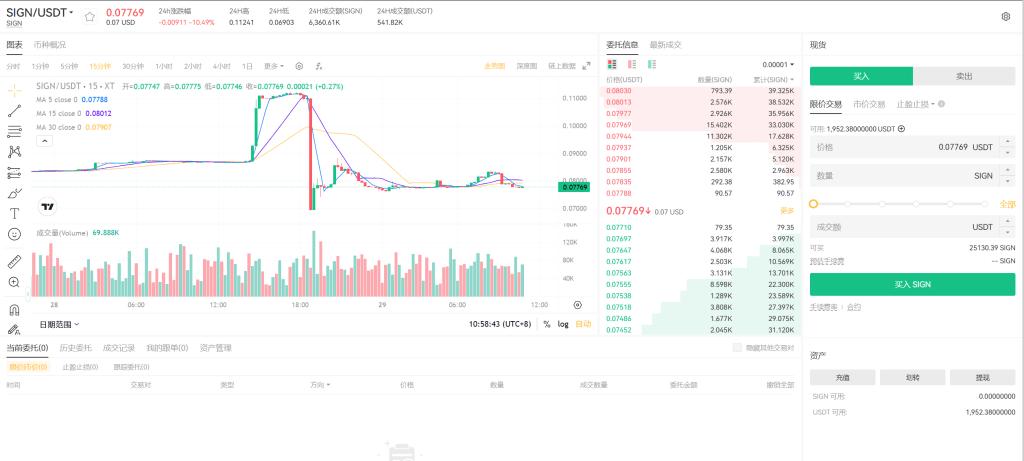

Market Status and Performance

At launch, 1.2 billion SIGN Tokens (12% of total supply) entered Binance circulation, establishing deep liquidity from day one. Market makers and early supporters seeded the order book, ensuring tight spreads and high on-chain depth.

First-day trading volume exceeded $200 million, indicating strong market demand. Price discovery stabilized around $0.05 per SIGN, with intraday volatility of ±15%, then stabilizing as buy-and-hold demand emerged.

To expand access, Sign secured additional listings in Q2 2025:

-Centralized Exchanges: XT.com, OKX, Kucoin, Bybit

-Decentralized Exchanges: Uniswap (v3), SushiSwap, PancakeSwap

-Cross-chain Bridges: Integration with Hop Protocol and AnySwap

These launches will deepen liquidity, reduce trading friction, and drive Sign's adoption across different markets.

How to Participate and Acquire SIGN Tokens

Spot Trading on XT.COM

-Listing: April 28, 2025 at 11:00 UTC

-Trading Pair: SIGN/USDT

XT.com SIGN/USDT Spot Trading Interface

DEX Listings and Bridges

-Direct swaps on Uniswap v3, SushiSwap, PancakeSwap

-Seamless transfer via cross-chain bridges through Hop Protocol or AnySwap

Community Plans and Rewards

-Referral Bonuses: Earn signatures by inviting friends to trade

-Staking Pools: Lock SIGN to earn protocol fees and alignment rewards

-Developer Grants and Hackathons: Submit application bounties using Sign Protocol

Join the conversation on X (Twitter) @ethsign and Telegram @orangedynasty for the latest competitions, AMAs, and distribution events.

Image Source: Official Sign X/Twitter

(Note: The translation continues in the same manner for the rest of the document, maintaining the specified translations for specific terms.)