📝 Editor’s Note:

Welcome to OurNetwork's latest. Crypto markets have climbed steadily, gaining 8.8% in the past week as of Apr. 29. This represents a $250B increase in total market capitalization, pushing the sector above $3T for only the third time in its history.

Our focus today — derivatives platforms, whose financial instruments derive value from underlying crypto assets. These protocols have become increasingly central to the ecosystem — perpetual futures offered by the six platforms included in this issue generate over $300M in daily volume according to Artemis.

As the market heats up, sophisticated investors are turning to these platforms not just to hold assets, but to amplify returns and manage risk exposure beyond traditional spot positions.

In this issue we have the following six players — Drift, GMX, Hyperliquid, Vertex, gTrade, and Contango.

Let's get into it.

– ON Editorial Team

Derivatives 📊

Drift | GMX | Hyperliquid | Vertex | Gains Network | Contango

Drift 🏎️

👥 James Hanley | Website | Dashboard

📈 Drift Vaults Lead the Way for Total Value Locked and Open Interest Resilience During Market Downturn

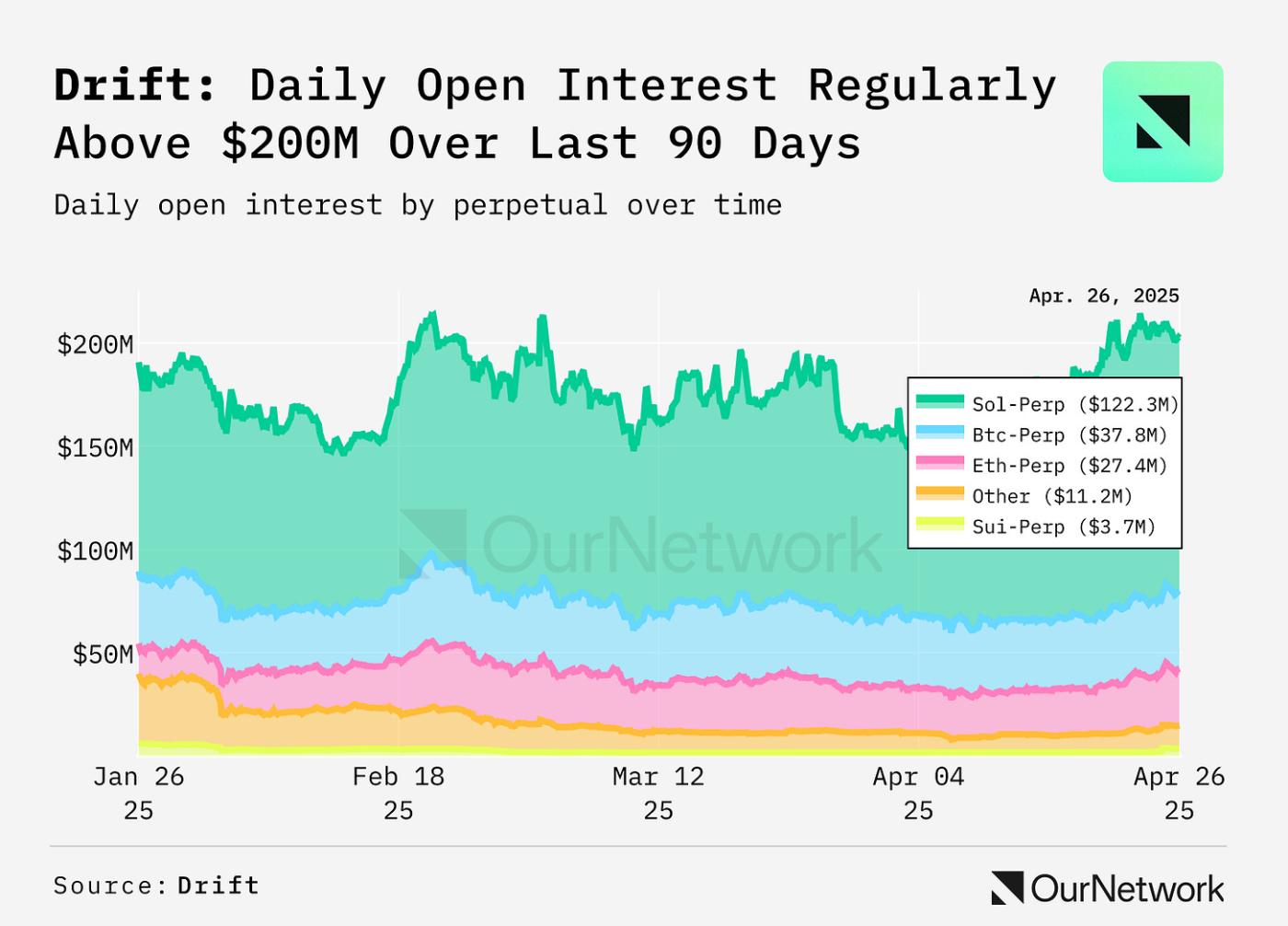

Drift is an all-in-one DeFi platform built on Solana. Open interest (OI) on Drift's perpetuals market remained strong over the past 90 days despite a broader market downturn. Drift's OI ranged between $145M and $205M. For much of the 90 days, Drift's OI remained higher than daily trading volume on the platform demonstrating considerable OI-to-volume strength compared with other venues. Drift's SOL-PERP, the Solana token's perpetual futures contract, remained the leader, making up around 60% of OI on Drift's perp market.

✏️ Editor's Note:

Perpetuals, also called perps, are derivatives which don't expire, essentially allowing traders to hold leveraged positions indefinitely.

Open interest in the context of perpetuals indicates how many positions haven't been closed yet.

Quick Links: Disclosures

ork! Subscribe for free to receive new posts and support our work.