Happy Wednesday good degens! Last day of April!

Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.03T

Gold: $3,322.50

Oil (WTI): $58.13

US 10Y Treasury: 4.172%

Biggest Price Movers

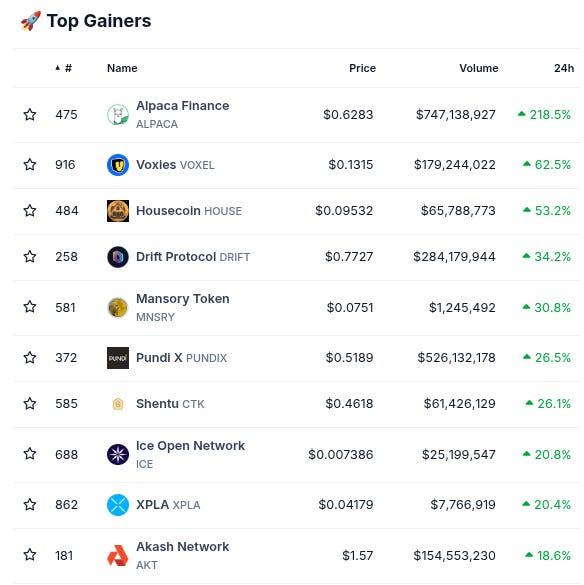

(From @coingecko top 1000, by 24 hour change)

Spotlight

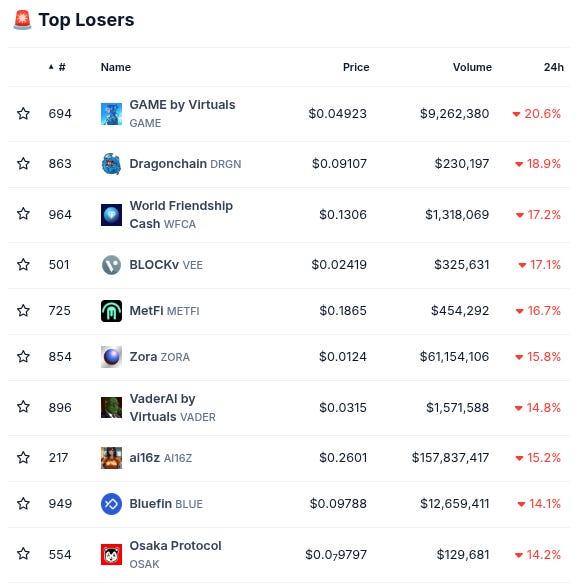

Want exposure to the HyperEVM trenches good anon?!? Well, our Official Sponsor @upshift_fi has one of the best opportunities out there, with their Hyperbeat Ultra HYPE Vault!

“Partnering with @0xHyperBeat and @ultrayieldapp, the hbHYPE vault will dynamically allocate $HYPE deposits across HyperEVM DeFi protocols. Delta-neutral strategies, funding arbitrage and more will be deployed to maximize returns. hbHYPE democratizes institutional yield for $HYPE holders…

The hbHYPE vault offers incentives from @Hyperlendx, @HypurrFi, @HyperSwapX, @0xHyperbeat, @TimeswapLabs, @silhouette_ex and more. Early depositors can also earn 5x Upshift points… Deposit to earn yield on your HYPE...”

The vault in question just hit $10M TVL, and is currently surging upwards at a rapid clip!

Learn more via the tweet below, and via Upshift co-founder @AElkrief’s recent interview with The Index Podcast embedded below that!

Biggest TVL Movers + Other Interesting Data

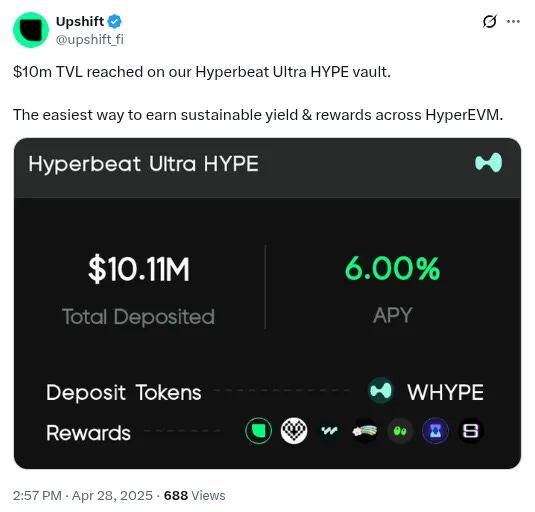

Chains are mixed today. Top 20 chains up at least 20% on the monthly include Solana (#2), Sui (#9), Hyperliquid L1 (#14), Sei (#16), Unichain (#17), and Bitlayer (#20).

Protocols are also mixed today. Top 20 protocols up at least 20% on the monthly include Spark (#8), Jito (#15), BlackRock BUIDL (#16), and Kamino (#20).

Here’s The Top 12 Best-Performing Chains By TVL On The Weekly With At Least $100M TVL (from @DefiLlama):

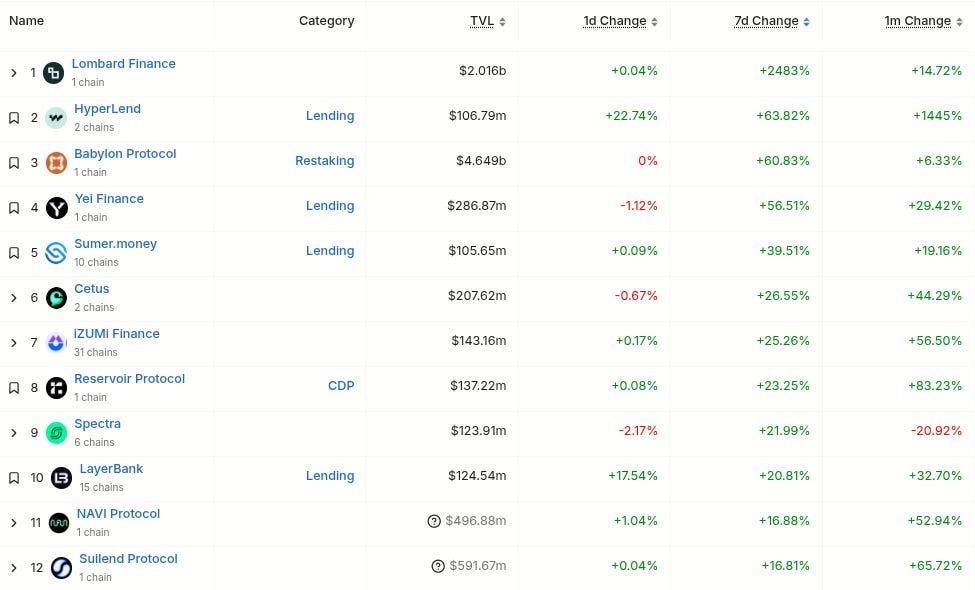

Here’s The Top 12 Best-Performing Protocols By TVL On The Weekly With At Least $100M TVL (from @DefiLlama):

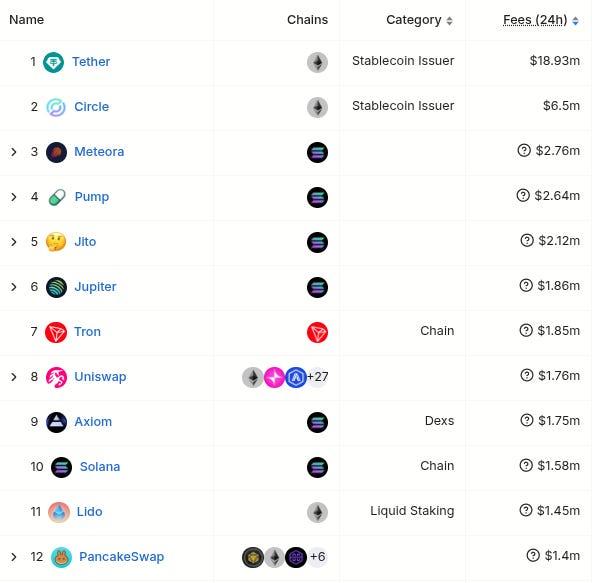

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

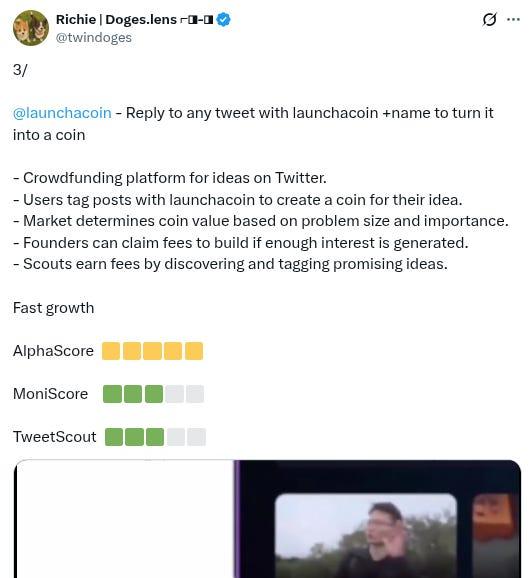

-Something new called @launchacoin. Twitter bio states “Reply to any tweet with @launchacoin +name to turn it into a coin. Powered by @believeapp.” Followed by 28 of our mutuals. h/t @twindoges:

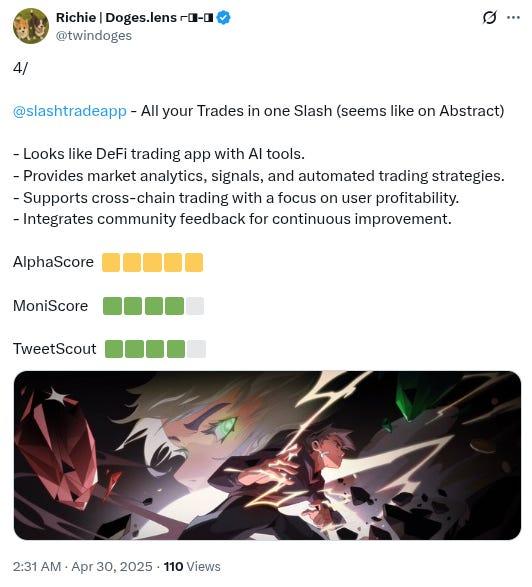

-Something new called @slashtradeapp. Twitter bio states “All your Trades in one Slash ⚡️” Followed by 5 of our mutuals. h/t @twindoges:

-A new project called @Veildotcash has been added to @DefiLlama, categorized as a privacy protocol on Base. Twitter bio states “Veil is a privacy protocol on @base using zk-SNARKS”. Followed by 43 of our mutuals.

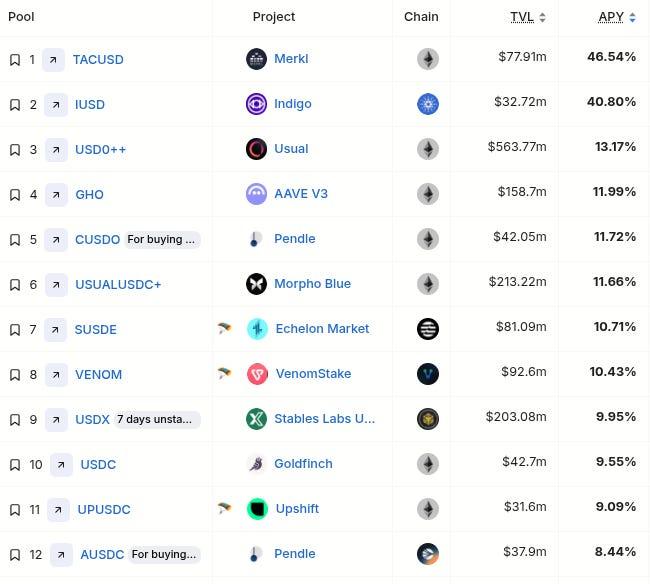

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (single-exposure, no-IL, $25M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

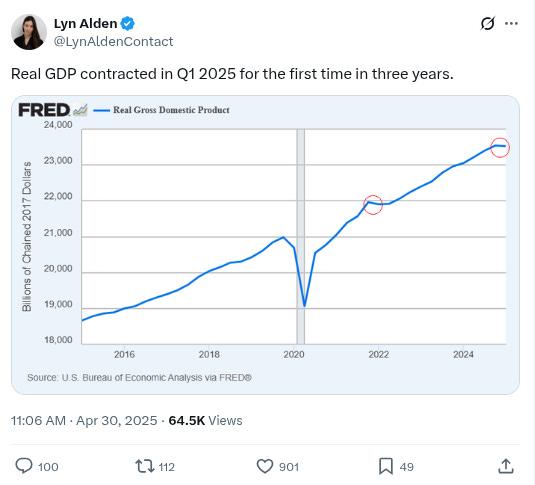

-Much attention on new GDP data, which shows that US GDP declined in Q1 for the first time since 2022, h/t @LynAldenContact:

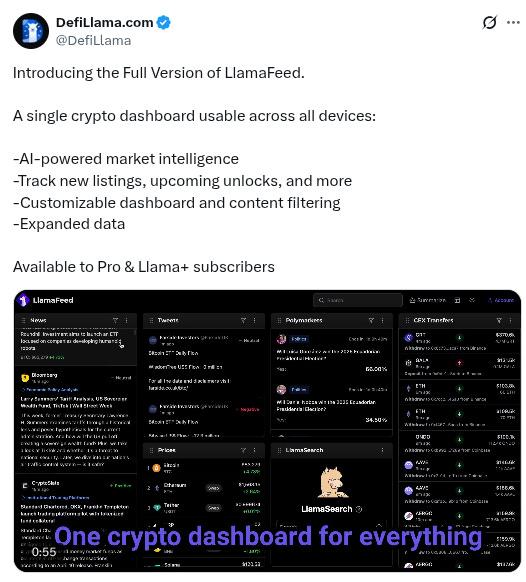

-@DefiLlama announces new paid tiers as it continues expanding its offerings:

-The above DefiLlama announcement generating much discussion as it incorporates a novel logistical setup involving deposits and yield from Aave, h/t @patfscott and @Cryptoyieldinfo:

-Treasury buybacks are apparently going to be ramped up, h/t @fejau_inc:

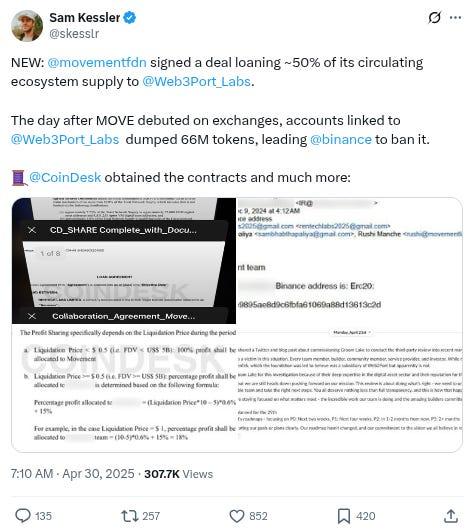

-New details and documents from the recent Movement token-dumping controversy have come out, from reporting by @skesslr and @coindesk, generating much discussion:

-The SEC delayed decisions today on a bunch of altcoin ETF’s, but many think they will still be approved later on this year, h/t @NateGeraci:

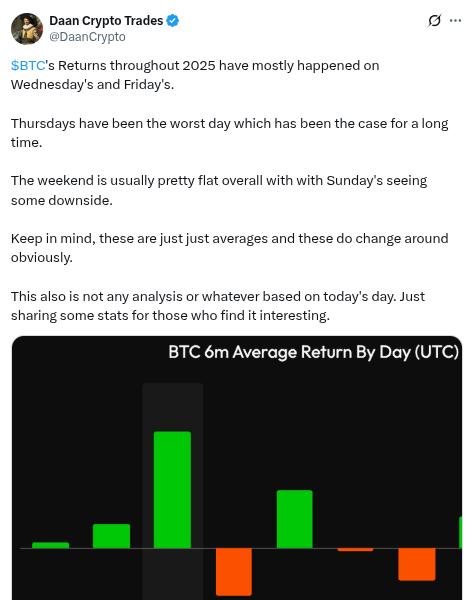

-Interesting stat that so far in 2025 Wednesdays and Fridays have had the best returns by far, and Thursday the worst, h/t @DaanCrypto:

-Interesting prediction from @TheOneandOmsy that the Circle IPO will fail and it will instead get acquired by a SPAC made up of members that previously tried to acquire it several years ago:

-Are things happening in Cosmos-land? h/t @MikeIppolito_:

-@Lombard_Finance generating excitement amongst Kaito Yappers, h/t @DidiTrading:

-$ALPACA situation with Binance de-listing + short-squeeze continues to catalyze discussion, h/t @thedefivillain:

-Great new interview with Doomberg on the macro situation right now:

-New roundtable from @Unchained_pod discussing all sorts of crypto + macro stuff:

-New episode of the 1000x Podcast on all sorts of crypto topics:

-New roundtable from @BanklessHQ on all things Ethereum:

-Interesting new discussion between Bitcoin-evangelist @PrestonPysh with @natbrunell discussing all sorts of crypto + macro stuff:

-Parting wisdom from @santiagoroel:

Conclusion

Have a great Wednesday and stay alert out there good frogs!

And please RT/subscribe/etc if you found this valuable!

-

-

Note

Take note friends!

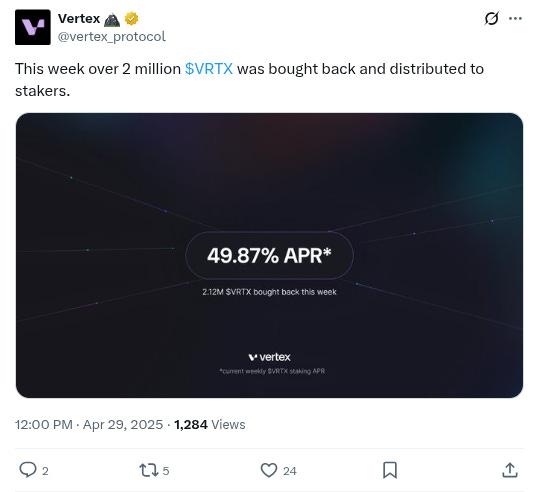

The team at @vertex_protocol are putting up absolutely incredible numbers as of late!

-Consistently a top 5 perps dex on DefiLlama by total volume

-Aiming to be on 25+ EVM chains by the end of this year

-Tons of bullish news and announcements (learn more in this thread!)

They are also currently paying out 49.87% to $VRTX-stakers, as seen in the tweet below!

Make sure to visit the Vertex site now to get started trading 60+ perps and spot markets, make sure to follow Vertex on Twitter for more updates, and stay tuned as we continue shining a light on everything they are doing!

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.