Although the market capitalization of altcoins has not returned to previous highs, the market capitalization of stablecoins continues to reach new records in 2025, surpassing 240 billion USD. Investors are seeking ways to optimize profits in a highly volatile environment without immediately allocating capital.

Stablecoin yield protocols are emerging as an important option for 2025. Analysts have made strong arguments for this trend, and the topic of stablecoin yields is attracting increasing attention in the cryptocurrency community.

Signs of the Stablecoin Yield Wave

One of the clearest signs of growing interest in stablecoin yields is the recent moves by major industry companies.

Ledger, the famous hardware wallet provider, announced on 29/04/2025 that they have integrated stablecoin yield features into their Ledger Live app.

With this update, users can earn up to 9.9% APY on stablecoins like USDT, USDC, USDS, and DAI. Users still retain full control of their assets. To date, Ledger has sold over 7 million hardware wallets.

PayPal has also joined the race. The company now offers an annual yield of 3.7% on its PYUSD stablecoin. After the SEC concluded its investigation into PYUSD, PayPal currently faces no major regulatory obstacles in expanding its stablecoin initiative.

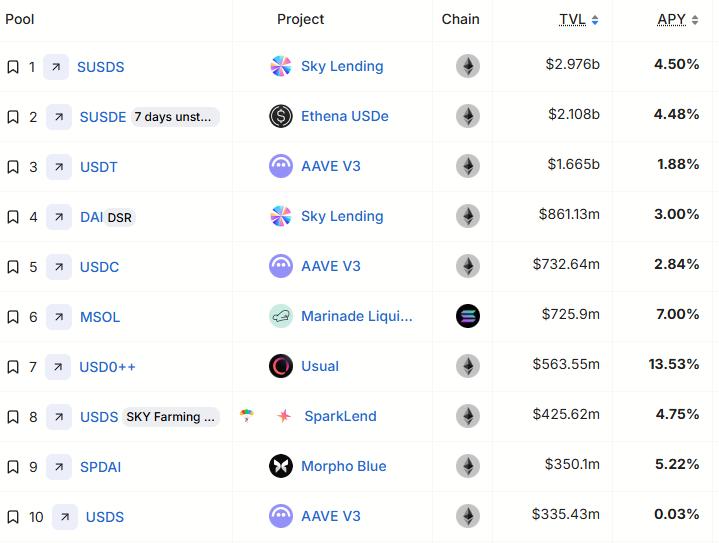

Moreover, data from defillama shows over 2,300 stablecoin pools across 469 protocols and 106 blockchains. This indicates a strong growth in demand for yield opportunities through stablecoins.

Stablecoin Yield Ranking. Source: defillama

Stablecoin Yield Ranking. Source: defillamaThe data also shows that the top 10 stablecoin pools have a TVL ranging from 335 million USD to over 2.9 billion USD. APY in these pools can reach up to 13.5%.

While many investors are waiting for an altcoin season to recover from portfolio losses, the current momentum is pointing towards a "stablecoin season" driven by attractive yields.

Why Are Stablecoin Yields Becoming a New Investor Trend?

GC Cooke, CEO and founder of Brava, has identified the main reasons why investors are turning to stablecoins to seek profits.

He argues that unpredictable policy changes are creating spillover effects in markets. Even stocks considered "safe" experience significant volatility due to a headline. He believes moving from stocks to yield-generating assets like stablecoin yields is a way to avoid directional risk — the risk of significant stock price declines.

Chuk, a developer at Paxos, also notes that as the legal framework around stablecoins becomes clearer in the US, EU, Singapore, and UAE, yield integration will become easier.

As a result, stablecoin wallets could develop into personal financial centers, eliminating the need for traditional banks.

"[Stablecoin] wallets could: Receive salary. Issue a card linked to stablecoin balance to allow direct spending without converting to fiat. Enable global P2P payments. Provide yields through tokenized money markets. This continues an existing trend: wallets becoming financial centers — no bank branches needed," Chuk said.

But What Are the Risks?

Despite the optimism, the stablecoin yield market comes with significant risks.

Analyst Wajahat Mughal points out that fewer than 10 stablecoins have a market capitalization over 1 billion USD. Most stablecoins still have a market capitalization below 100 million USD.

Some protocols offer high APY. Teller provides 28%–49% yield for USDC pools. Yearn Finance, founded by Andre Cronje, offers over 70% APY for CRV pools. Fx-protocol and Napier offer 22%–30% APY for RUSD and EUSDE, respectively. But these high returns often come with significant risks.

Choze, a research analyst at Amagi, has highlighted some concerns. Many pools still have low TVL, ranging from 10,000 USD to 120,000 USD, meaning these strategies are still early and potentially volatile.

Some rewards depend on ecosystem tokens. Strategies often involve multiple protocols, increasing complexity. He warns that investors should pay attention to the long-term development of each project's ecosystem.

"The opportunity is real, especially for those who know how to navigate small, emerging farms. But it's crucial to understand what you're actually farming: Not just stable yields, but the ecosystem's development and early-stage incentives," Choze said.

Investors may also face risks such as lending or staking platforms for stablecoins being hacked, exploited, or experiencing technical issues, all of which can lead to loss of funds. Some algorithmic stablecoins or less reputable ones may also lose value compared to the dollar.

However, the increasingly significant role of stablecoins cannot be denied. With attractive yields and robust real-world payment use cases, they are reshaping how investors participate in the crypto market.

This opens up new ways to generate profits beyond waiting for the next altcoin season.