Since Delphi Digital’s last deep dive into Sui’s architecture, ecosystem, and token economics, the network has completed a number of key upgrades across its infrastructure and application stack. In this follow-up report, we will analyze key developments in its ecosystem, including the buildout of Bitcoin Finance (BTCfi) infrastructure, the growth trajectory of lending protocol Suilend, and the expansion of Aftermath Finance.

On the infrastructure side, the launch of Mysticeti v2 introduced a "Fast Path" for low-contention transactions, significantly reducing latency and rebalancing validator workloads. At the same time, Move VM 2.0 achieves significant execution improvements through high-level composability, region-based memory management, modular architecture, and enhancements designed to support more complex and dynamic on-chain logic.

Meanwhile, Sui’s scaling roadmap continues to evolve as Pilotfish moves forward with sharding to achieve true horizontal scalability and elastic validator configurations. These improvements by Sui were further enhanced by the implementation of a localized object-based fee market and MEV-aware optimizations including prioritized transaction submission and consensus block flow.

Ecosystem Updates

DEX trading volume on Sui has fallen from last quarter’s highs, but it can be seen that trading volume has increased after the WAL token of decentralized storage protocol Walrus went online on March 27.

BTCfi on Sui

BTCfi has recently emerged as an emerging niche on Sui, bringing lending, staking, and yield-earning fundamentals to Bitcoin, which has traditionally been viewed as a passive collateral. According to DeFiLlama, the total locked value (TVL) in the BTCfi space has grown from less than $100 million to more than $4.5 billion, covering a variety of assets such as re-pledged, anchored and decentralized BTC.

At the end of 2024, Sui announced a partnership with Babylon Labs and Lombard Protocol to introduce native BTC staking through LBTC. LBTC is a liquidity pledge token minted directly by Lombard on the Sui and Cubist platforms, designed to help users manage deposits, minting, cross-chain and pledge. A few weeks later, in December 2024, Sailayer partnered with LBTC and WBTC to launch BTC re-staking opportunities for LBTC and WBTC. Prior to this, Lorenzo Protocol launched stBTC on Sui, a liquid staking token powered by Babylon that aims to aggregate BTC returns and integrate with DeFi protocols such as Cetus and Navi. In early February 2025, Sui Bridge added support for wrapped BTC assets such as WBTC and LBTC, and since then, more than 587 BTC have flowed into the Sui DeFi platform.

To date, over $111 million in wrapped BTC has been deposited into Sui native protocols like Suilend, Navi, and Cetus.

DeFi Protocol on Sui

Suilend

Suilend is a lending protocol in the Sui ecosystem. In less than a year of operation, its annualized revenue reached US$15 million in February 2024, of which 70% flowed into SEND's treasury. The vault initially received 1.2 million SUI from “mdrop”.

Suilend also launched Steamm, an automated market maker (AMM) with an integrated money market component that aims to maximize capital efficiency by depositing idle liquidity into the lending market. The protocol has a composable architecture that supports various quotation systems, including constant product quotation, stablecoin professional quotation and dynamic fee quotation based on market volatility. By allowing idle funds to generate yield in the lending market while still being available for trading, Steamm improves capital efficiency and provides additional returns to liquidity providers through its bToken mechanism.

Aftermath

MetaStables was incubated by Aftermath on Sui as a vault system that allows users to deposit cross-chain assets or native assets to mint stablecoins such as mUSD (pegged to the US dollar) and mETH (pegged to ETH), with plans to launch meta tokens such as mBTC in the future. It uses oracle-based exchange rates (such as Pyth) to perform slippage-free trades between vault assets, avoiding the inefficiencies caused by AMM slippage, and supports lending deposited assets to increase returns. The idea of MetaStables is to address the problem of liquidity fragmentation by promoting meta tokens and allowing users to earn mPOINTS.

In addition to MetaStables, Aftermath has also launched Perp DEX on testnet, an on-chain perpetual contract order book built entirely on Sui.

Walrus is now live

The decentralized storage protocol Walrus launched mainnet on March 27, 2025, and completed a $140 million financing led by Standardcrypto.

Walrus is a decentralized storage network built on Sui, designed to store a variety of data, from NFT assets, AI model weights to blockchain archives and website content. It can also act as a data availability layer for rollups, similar to Celestia or EigenDA. While Walrus leverages Sui for metadata and governance, it offloads storage tasks to a separate set of nodes, thus avoiding the overhead of Sui validators.

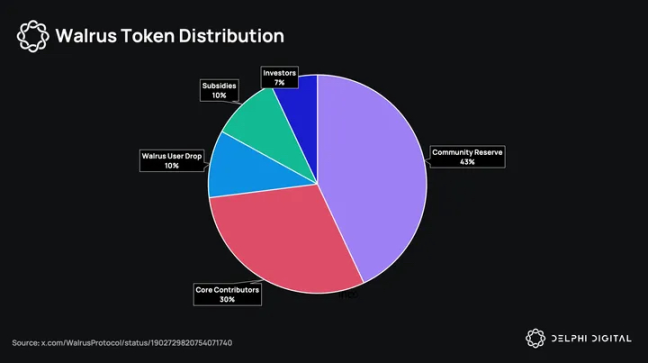

At the heart of Walrus is Red Stuff, a two-dimensional encoding protocol that enables efficient single-shot file encoding with powerful data recovery capabilities. The system is secured through a staking-based WAL token incentive model, where nodes are rewarded for uptime and correct processing of data, and penalized for failures or malicious behavior. The breakdown of WAL token economics is as follows:

- Community reserve: 43%

- Core Contributors: 30%

- Walrus user airdrop: 10%

- Subsidy: 10%

- Investors: 7%

Technology Updates

Sui Core Development Project

Mysticeti V2 Update

Delphi Digital covered Mysticeti v1 in detail in its previous report, Sui Network: Demystifying the Monolithic Contender. It eliminates the need for block certification by embedding submission rules directly into the DAG structure. This allows each block to be committed with a theoretical minimum delay of just three rounds of messages, reducing Sui’s consensus latency from about 1900 milliseconds (Bullshark testnet) to about 390 milliseconds. Additionally, since only one signature is required per block, it reduces the CPU load on validators, thereby increasing execution throughput and responsiveness.

Mysticeti-FPC (v2) is an extension suite based on Mysticeti-C (v1), introducing a "fast path" for transactions that do not require full consensus, especially for common scenarios such as token transfers or NFT minting, which involve assets owned by only a single address. Instead of executing a separate protocol (such as FastPay or Sui Lutris), Mysticeti-FPC embeds the fast-path logic into the same DAG, avoiding additional messaging, redundant cryptographic operations, and post-consensus checkpoints.

Move VM 2.0 enhancements

Sui's Move VM v2 is a foundational optimization focused on execution efficiency and system composability. Core improvements include Arena Allocation, Package Caching, and Low Lock Contention, designed to reduce latency under load. Internal calls are now significantly faster with cross-package pointer references (including system-level access).

In addition, the virtual machine introduces a multi-stage abstract syntax tree (AST) for validation, optimization, and execution, as well as join logic for cross-package virtual table parsing and updating, simplifying modular development. Early benchmarks show speedups of 30% to 65% on various execution paths. This will enable Sui to scale the suite to more complex, high-throughput use cases with Move VM v2.

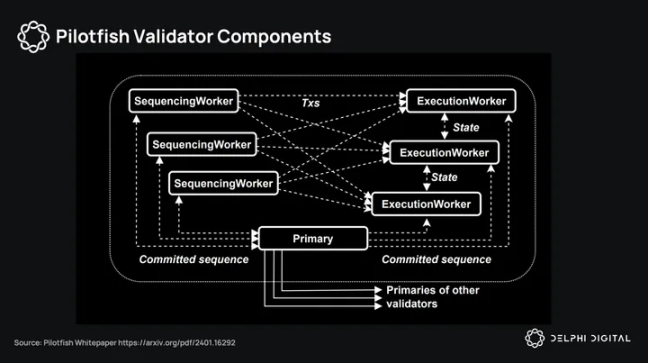

Execution Sharding with PilotFish

Pilotfish is a horizontally scalable suite of execution engines that breaks the bottleneck of Sui's original single-machine execution model. Traditionally, Sui validators have been monolithic, handling consensus, data retrieval, and state execution on a single machine, limited by vertical scalability in terms of compute, memory, and storage.

Pilotfish breaks this whole thing down into three distinct layers:

- Primary: The central coordinator that handles transaction ordering and consensus;

- SequencingWorkers (SWs): scalable suite nodes responsible for extracting and routing transactions;

- ExecutionWorkers (EWs): Horizontally distributed machines that store shards of the on-chain state and perform the actual execution.

Pilotfish's shard workload distribution:

- Each transaction is routed to a specific sequencer worker.

- Each chain object (i.e. state) is reflected to a specific executor.

Transactions that require access to objects across multiple shards are handled through coordinated data exchange, a pull-based model where workers request remote state on demand. This maintains consistency without sacrificing parallel execution, and ties in nicely with Sui's lazy consensus design, which achieves consensus based on batches of metadata rather than full transaction metadata.

This enables parallelism without shared memory, allowing compute-intensive workloads to scale linearly with available hardware. Benchmark tests show that Pilotfish can achieve up to 10x throughput improvement using only 8 EWs compared to the baseline execution engine.

Horizontal scaling suites can pave the way for true resiliency in validator infrastructure. Unlike vertical scaling, which is strictly limited by hardware costs and provisioning latency, horizontal scaling allows validators to elastically launch general-purpose servers (e.g., 32-core servers on AWS or GCP) to handle spikes in demand. If the traffic persists, validators can migrate to more cost-effective bare metal servers.

The impact is threefold:

- Validator operation becomes hardware-agnostic: no special high-level configuration is required;

- Infrastructure provisioning becomes elastic and programmatic: automatically scaling suites based on demand;

- The design space opens up room for Sui-native innovations, such as package-specific fee markets or prioritized queues, which are enabled by Sui’s object-centric state model.

This will make Sui one of the few execution environments capable of absorbing consumer-grade transaction throughput without increasing centralization or compromising latency.

Implementing an Object-Based Local Fee Market

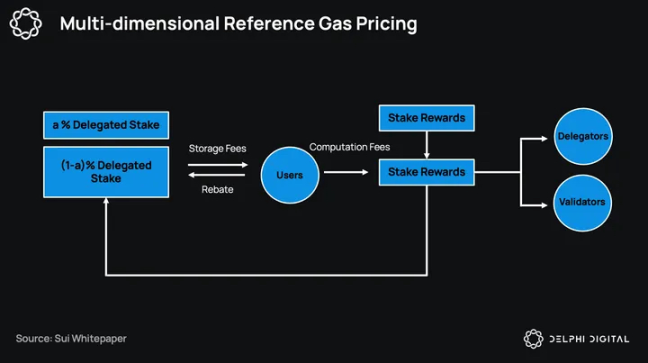

Sui uses a multi-dimensional reference gas pricing mechanism that divides fees into two main parts: computational fees and storage fees. So, how does Sui's local fee market work in the context of Sui objects?

Sui implements an object-based local fee market mechanism that is different from Ethereum and more similar to Solana's fee structure. Sui sets fees based on specific needs associated with individual items or assets. Each asset or application on Sui has an independent fee market, allowing local adjustments to be made without impacting the entire network.

In contrast, Ethereum operates a unified global fee market where every transaction contributes to overall network congestion, leading to higher fees across the chain during periods of increased demand. Likewise, Solana uses a localized fee market system that adjusts fees around specific disputed state objects or accounts.

Sui further extends the concept of localization by associating costs directly with "things" rather than "states". By associating fees with specific objects, Sui can process transactions involving different assets in parallel, avoiding fee interactions or congestion overflows. This isolation means that new app activity can reach high levels even when other apps on Sui are already very active. For example, popular trading pairs on DEX can independently adjust fees based on their own needs. This makes Sui's native fee market with object-level granularity fairer to its user base and more efficient for its developer base.

Standard Balanced Totalizer

Sui's "Canonical Balance Accumulators" use an object-based design, and the balance is an on-chain Move object. These objects are not abstract concepts within the contract, but independent, verifiable state objects. This setup enables transaction-level parallelism because execution relies only on access to specific objects rather than shared global storage.

Ethereum uses centralized reflection to track balances in ERC-20 contracts. Every transfer triggers shared state, which hinders parallelism and ties composability to contract-specific logic. Each coin has its own implementation and there are often integration edge cases.

Solana handles balances via token accounts, which facilitates parallel execution. But developers need to specify all accounts in advance for each transaction. This creates resistance to building modular systems and limits flexibility under dynamic conditions.

Sui simplifies the process. Standardized balance objects and managers like BalanceManager provide a clean way for protocols to track and modify balances without having to own state. The implementation is horizontally scalable by default, and balancing logic is portable across modules without having to be wrapped in a custom interface. It is much cleaner to build and unlock using object-level fee markets, isolation, and composability without coordination overhead.

Multi-signature account implementation

Sui's multi-signature implementation is based on a weighted k-of-n signature model. Each signer is assigned a weight, and when the sum of all weights reaches or exceeds a preset threshold, the transaction is executed. This allows for flexible signing policies, such as requiring 2 out of 3 signers, or enforcing that one key always signs with the others to implement something like two-factor authentication (2 FA).

Sui's approach is unique in that it supports the use of heterogeneous key schemes in the same multi-signature. Users can mix Ed25519, secp256 k1, and secp256 r1 keys in a single authentication object, opening up more composable wallet and custody designs without the need for specialized tooling.

Unlike threshold signatures, which compress approvals into a single opaque signature, Sui’s multi-signature makes public which keys signed which approvals. This improves auditability and cross-party coordination without the need for complex multi-party computation (MPC) setups. As such, it is easier to reason about, easier to rotate participants, and is natively compatible with the Sui transaction model.

Sui on MEV development

Priority transaction submission

At the execution level, Sui resolves conflicts on shared objects through a Gas-based priority mechanism. Prioritized Gas Auctions (PGAs) act as the main coordination layer. Since Sui’s implementation is object-centric and transactions that modify the same object must be serialized, PGAs act as a congestion pricing mechanism, which is particularly useful in the case of object hotspots or DEX volatility.

SIP-19 introduces a soft bundling mechanism to submit groups of transactions assembled off-chain as a unit. This enables reverse auctions (e.g. via Shio) where seekers can bid to attach their trade to a bundle with a high probability of execution.

SIP-45 adds consensus amplification capabilities. Transactions with a gas price exceeding kx RGP will be submitted multiple times by different validators, effectively amplifying their presence in the consensus. This reduces volatility caused by desynchronized validators or leader rotations, and ensures that gas prices accurately reflect inclusion priorities, thereby disincentivizing spam and improving fairness.

Mysticeti Block Streaming

One of the most interesting upgrades Sui is working on is Block Streaming. Full nodes will be able to subscribe directly to consensus blocks, providing access to pending transactions with less than 200 milliseconds latency before they are finalized. This reduces the advantage of co-located searchers and democratizes access to MEV opportunities.

Unlike off-chain relays, it is permissionless and open. It also provides third-party nodes with a deterministic view of transaction ordering, allowing speculative execution, arbitrage, and buyback logic to execute near-instantaneously.

Time-lock encryption is being planned to help Sui deal with harmful MEVs, and MEV revenue distribution models are also being explored. Incentives will benefit validators, applications, and users, not just searchers.

DevX Updates

Sui has some DevX improvements. Move Registry formalizes dependency management by supporting named and versioned import of packages on-chain, eliminating fragile address-based links. Key frameworks and libraries are being open sourced and provide registry support, enabling developers to write and upgrade applications securely. In addition, Sui provides Programmable Transaction Block (PTB) replay and Move tracing capabilities for deep debugging support, enabling developers to step through transaction execution and pinpoint fault states in multi-call flows.

in conclusion

Sui had quite a few highlights last quarter. Mysticeti v2 and Pilotfish are not just regular upgrades, they will change how Sui processes transactions under load and how validators execute their infrastructure. Move VM 2.0 also brings many improvements for developers building modular applications. Together, these improvements push Sui toward being able to truly support high-frequency use cases without adding coordination overhead.

In terms of the ecosystem, BTCfi is clearly becoming a wedge and may be favored by institutions. Protocols like Suilend and Aftermath are experimenting with new primitives that are natively compatible with the Sui architecture, such as object-based stablecoins, AMM lending hybrids, meta tokens, and more. The interesting part now will be watching how the fee market behaves as demand surges, whether MEV tools like soft bundling or Blockstream are adopted by seekers, and how infrastructure like Pilotfish changes validator economics in practice.

In addition to this, Delphi Digital has noticed an increase in institutional interest, with Canary Capital having filed for the Canary SUI ETF in the first quarter. Earlier, there were reports that financial institutions such as Grayscale, Franklin Templeton, VanEck, Libre and Ant Financial were also involved. They all launched related investment products on the Sui network, ranging from tokenized funds to exchange-traded notes (ETNs).