Introduction

Cryptocurrency venture capital investment remains below previous bull market levels. Although the investment amount this quarter reached a new high since the third quarter of 2022, over 40% of the funds came from a single investment by MGX, a UAE sovereign-linked fund, in Binance ($2 billion). Macroeconomic concerns continue to suppress investors' interest in venture investments, and the cryptocurrency market remains fragmented - with Bitcoin performing particularly strongly, while Altcoins and previously popular crypto venture platforms remain relatively weak.

Even excluding the Binance case, the overall investment scale for startups remains higher than the 2023 low. Trading, infrastructure, tokenization, payment, and artificial intelligence sectors continue to maintain investment enthusiasm. Given the new US government's push for Bitcoin, cryptocurrency, and blockchain technology applications, the country's long-standing dominance in this field may be further strengthened.

Core Data

• In the first quarter of 2025, cryptocurrency startups raised $4.9 billion in venture capital (a quarter-on-quarter increase of 40%), involving 446 transactions (a quarter-on-quarter increase of 7.5%)

• Late-stage projects absorbed the majority of funds (65%), with early-stage projects accounting for 35%. This is the first time since the third quarter of 2020 that late-stage investment has exceeded early-stage investment

• Trading companies led financing (with Binance receiving a $2 billion investment from MGX), followed by DeFi protocols ($763 million) and infrastructure companies ($506 million)

• Influenced by Binance financing, Malta-based enterprises received the highest investment proportion (36.8%), with the United States and Hong Kong following closely. By transaction volume, the United States leads with a 38.6% share, followed by the United Kingdom and Singapore

• In terms of fundraising, investors allocated $1.9 billion to 18 new crypto venture funds

Venture Capital

Transaction Volume and Investment Amount

In the first quarter of 2025, venture capitalists invested $4.8 billion (a quarter-on-quarter increase of 54%) in startups focusing on cryptocurrency and blockchain, completing 446 transactions (a quarter-on-quarter increase of 7.5%).

... [rest of the text continues in the same manner]Companies established in 2017 (primarily Binance) raised the most funds, while companies founded in 2024 led in transaction volume.

Venture Capital Financing Dynamics

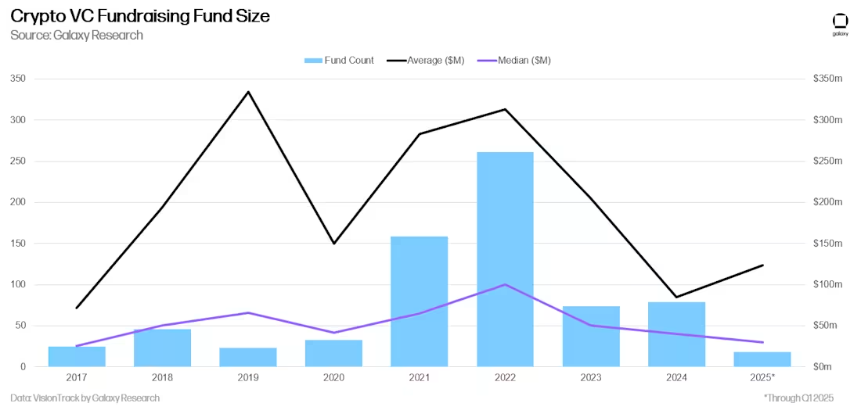

Although the number of new funds and capital allocation scale increased year-on-year in the first quarter of 2025, the fundraising environment for crypto venture funds remains challenging. The macroeconomic environment and cryptocurrency market volatility from 2022 to toinder some capital allocators from restoration restoring their commitment levels to crypto venture investors investors seen between early 2021 and 2022. The recent rise in AI sector attention has also diverted some funds originally intended for crypto investments. In the first quarter of 2025, total fundraising for crypto-focused venture funds rebounded to $$1.9 billion, on par with the second quarter of 2024, marking the highest quarterly fundraising since the third quarter of 2023.

Calculated on an annualized basis, the first quarter of 2025 has started the year strong, with current growth expected to exceed the total fundraising of 2024.

Compared to the first quarter of 2024, both the number of new funds and fundraising scale achieved year-on-year growth, with the average fundraising per fund rising to $130 million, though the median continues to decline. This average increase is primarily due to large-scale fundraising by institutions likebit Capital Somnia Ecosystem Fund.

Summary

Market sentiment is improving, and investment activities are increasing, but both remain far below historical peaks. While Bitcoin continues to perform strongly, Altcoins' liquidity prices remain subdued. Although crypto startup financing in the first quarter of 2025 reached a new high since the third quarter of 2022, nearly half the funds came from late-stage transactions by Binance andanceX a UAE government-affiliated fund). Excluding this transaction, Q1 2025 financing would drop to around $2$2. .6 billion, the lowest since3of p and to four-point During the bull market cycles in 2017 and venture investment activities were highly corwith crypto asset liquidity prices, but over the past two years, despite rising crypto prices,ility, has remained persistently low. This venture investment stagnation stems from multiple factors: declining attractiveness in previously hot crypto investment areas like gaming, Non-Fungible Tokens, and Web3, competition from AI startups for investment funds, and high-interest rates suppressing risk capital allocation willingness.

Late-stage transactions have dominated for the first time since the third quarter of 2020. Although the surge in late-stage investment entirely stems from MGX's investmentance-transaction numbers have the seed round transactions. theatures, seed round transaction proportions continue to decline. With traditional institutions gradually adopting crypto technology and many venture-backed companies achieving market fit, the golden age of crypto seed and pre-seed investments may have ended.

Spot ETP products may pressure funds and startups. Major investments in US Bitcoin spot ETP products by allocators suggest that some large investors (pension funds, endfunds funds be themselves high liquproducts than early-stage risk investments.. Market interest in Ethereumance spot ETP is warming up this trend continues or new ETP products covering other Layer 1 blockchains emerge, market demand forDeForWeb3 areas may shift to products than venture investment system.

The US continues to dominate the crypto startup ecosystem.. Despite an exceptionally complex complex and hostile regulatory regulatory environment, US-and based and projects occupy the majority of transactions and investment amounts. The new government and Congress have begun implementing the most-history, multiple dimensions. We anticipate the US's dominance will further especially regulatory matters like ststablecoin frameworks and market structure legislation are as scheduled, which will encourage encourage traditional US financial to institutions enter.