This article is machine translated

Show original

Bitcoin Approaches 100,000, @HyperliquidX Ecosystem Unstoppable - 0502 Coin Research Weekly Report

🔥 @movementlabsxyz Internal Turmoil: Co-founder @rushimanche Suspended Due to Governance and Market Maker Disputes, Third-Party Review Ongoing, Market Watching Subsequent Impact.

🔥 @yalaorg and @plumenetwork Open New Chapter: Yala RealYield Joins Forces

View the full content, welcome to subscribe to the Coin Research Weekly

Let's grasp the weekly macro trend and ambush alpha 💥

bit.ly/defi-0502-weekly

📍 @yalaorg and @plumenetwork have reached a strategic partnership to allow Bitcoin holders to access Plume's tokenized assets through Yala RealYield to achieve stable income and asset appreciation.

📍Japanese listed company @Metaplanet_JP will issue 3.6 billion yen (about 24.69 million US dollars) of zero-coupon plain vanilla bonds to purchase Bitcoin.

📍 @movementlabsxyz confirms co-founder @rushimanche twitter.com/171181931531248025...

📍 Morgan Stanley plans to add new cryptocurrency trading functions such as Bitcoin and Ethereum to the E*Trade platform, which is scheduled to go online next year. It is currently negotiating cooperation with well-known crypto companies.

📍 @SkyEcosystem proposed to upgrade MKR to SKY, enable staking and USDS rewards, MKR will be converted at 1:24000, there will be a 1% penalty for conversion starting September 18, and the transition will be completed in mid-May.

📍 @coinbase will be at 2am on May 16th twitter.com/143507893548675891...

📍 @ShadowOnSonic is the first token of @SonicLabs chain to be listed on Binance Alpha, with a 24-hour increase of over 80%

📍Japan @Metaplanet_JP will establish a subsidiary, Metaplanet Treasury Corp., in Florida with $250 million in capital to advance Bitcoin financial strategy and expansion into the U.S. market. twitter.com/762205930171670528...

💡 Market trend: The market rebounded to 94K

Bitcoin fluctuated above $96,500 on May 2, rising in sync with the S&P 500, ending a short-term decoupling. The market predicts that if the U.S. stock market rebound continues, Bitcoin may break through its current position, but its price will be affected by macro policies and news. @Cointelegraph shows that Bitcoin and the S&P 500 have been highly correlated recently, with the past 10

💡 Release time of important macro events in May (UTC +8)

📍US April NFP non-farm data: May 2 at 20:30

📍FOMC announces interest rate decision: May 8, 02:00

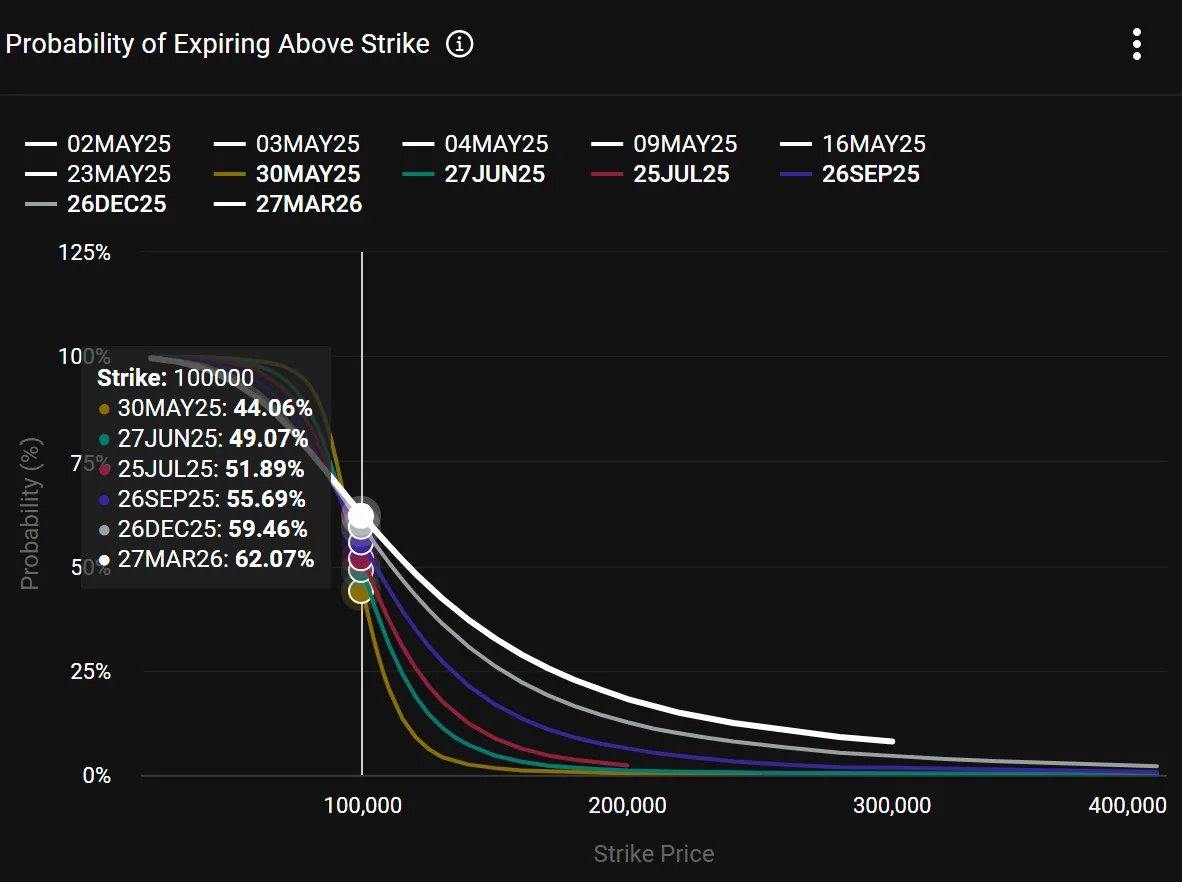

💡 Deribit BTC Breakout Data

The implied probability of BTC breaking through the price of 100,000 has increased slightly since the second half of the year! 📈

📍May 30, 2025: 44.06% (previous 34.92%)

📍June 27, 2025: 49.07% (previous 42.16%)

📍July 25, 2025: 51.89% (previous 46.20%)

📍September 26, 2025: 55.69% (previous 51.42%)

📍December 26, 2025

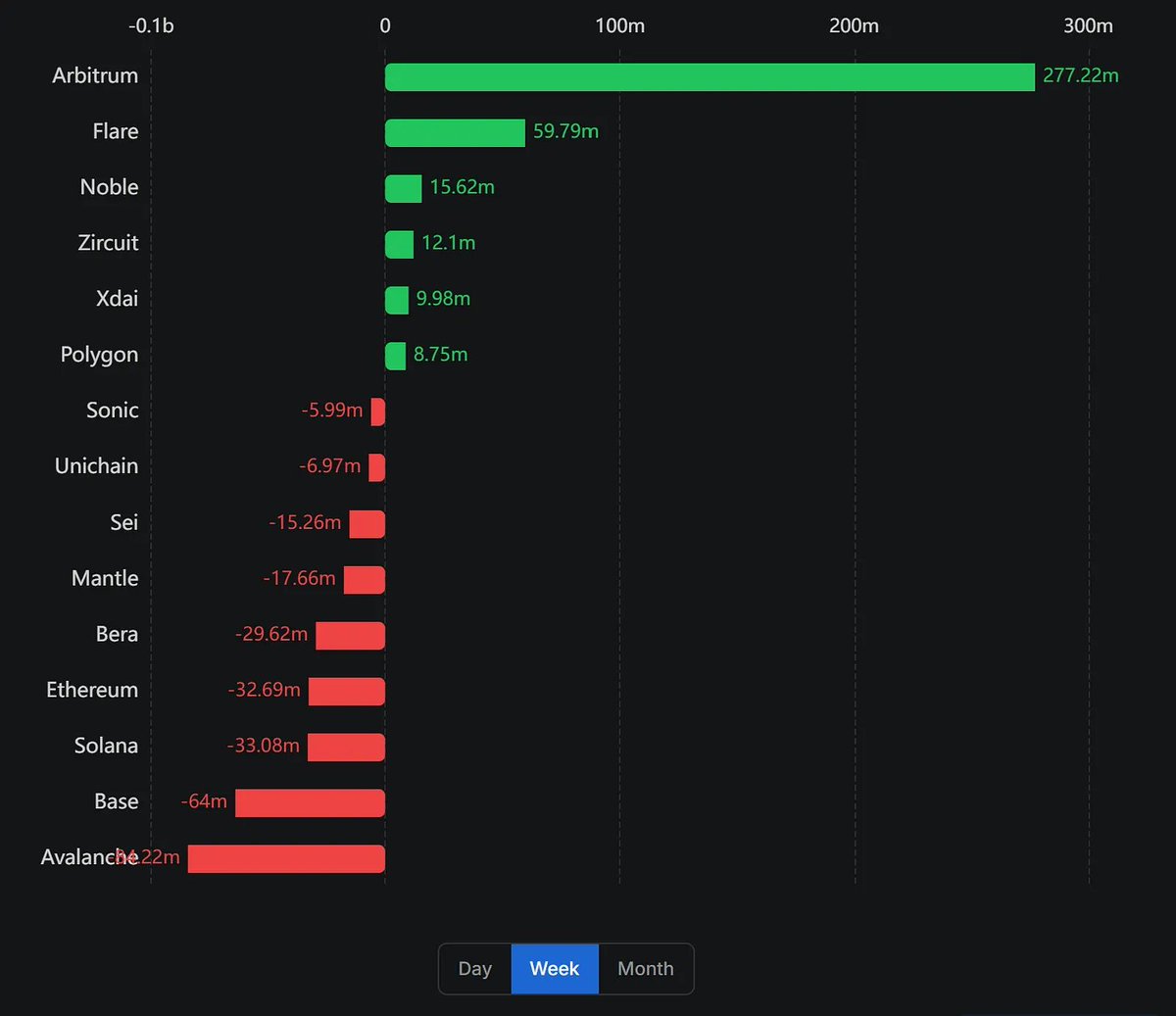

💡Cross-chain net inflow data

📍 @arbitrum / @HyperliquidX +270M (previously +330M) for multiple weeks🔥

This week, the USDT0 stablecoin trading pair supported by @Tether_to was quickly claimed just one week after its launch. At the same time, nearly 40% of the $HYPE tokens were allocated to the community, driving about 3.4 million $HYPE cross-chain transfers in a single week, and the price once exceeded US$21.

Worth watching @HyperSwapx, @HyperLendX, twitter.com/109895558490743193...

💡BTC ETF net inflow - 1.13 billion net inflow

The above chart shows the net inflow of funds on a weekly basis. In the past week, BTC ETF recorded a net inflow of US$1.13 billion. Although it was less than half of the annual high in the previous week, it was still a positive signal, indicating that market confidence was gradually recovering and institutions continued to increase their holdings of BTC ETF.

After breaking through the 95,000 resistance level, the market is currently trading at 97,000.

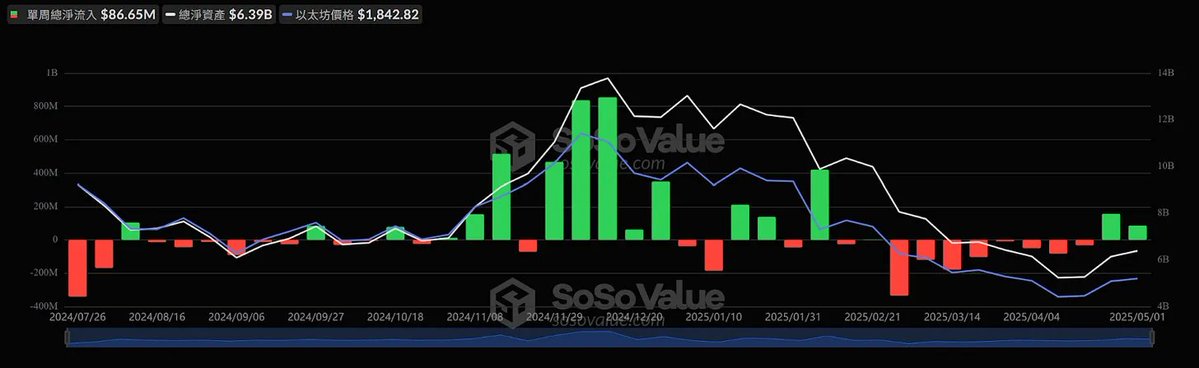

💡ETH ETF Net Inflows - Continuous Net Inflows

In the past week, ETH ETF recorded $86 million in net inflows, achieving net inflows for two consecutive weeks. BlackRock ETF had the largest inflow this week, and other institutions also began to increase their holdings, indicating that the outflow sentiment of ETH has reversed and the pressure of capital outflow has eased. The market has sent out a buying signal for ETH, which, combined with the positive news released by the Ethereum Foundation, is expected to reverse Ethereum's downward trend and restore market confidence.

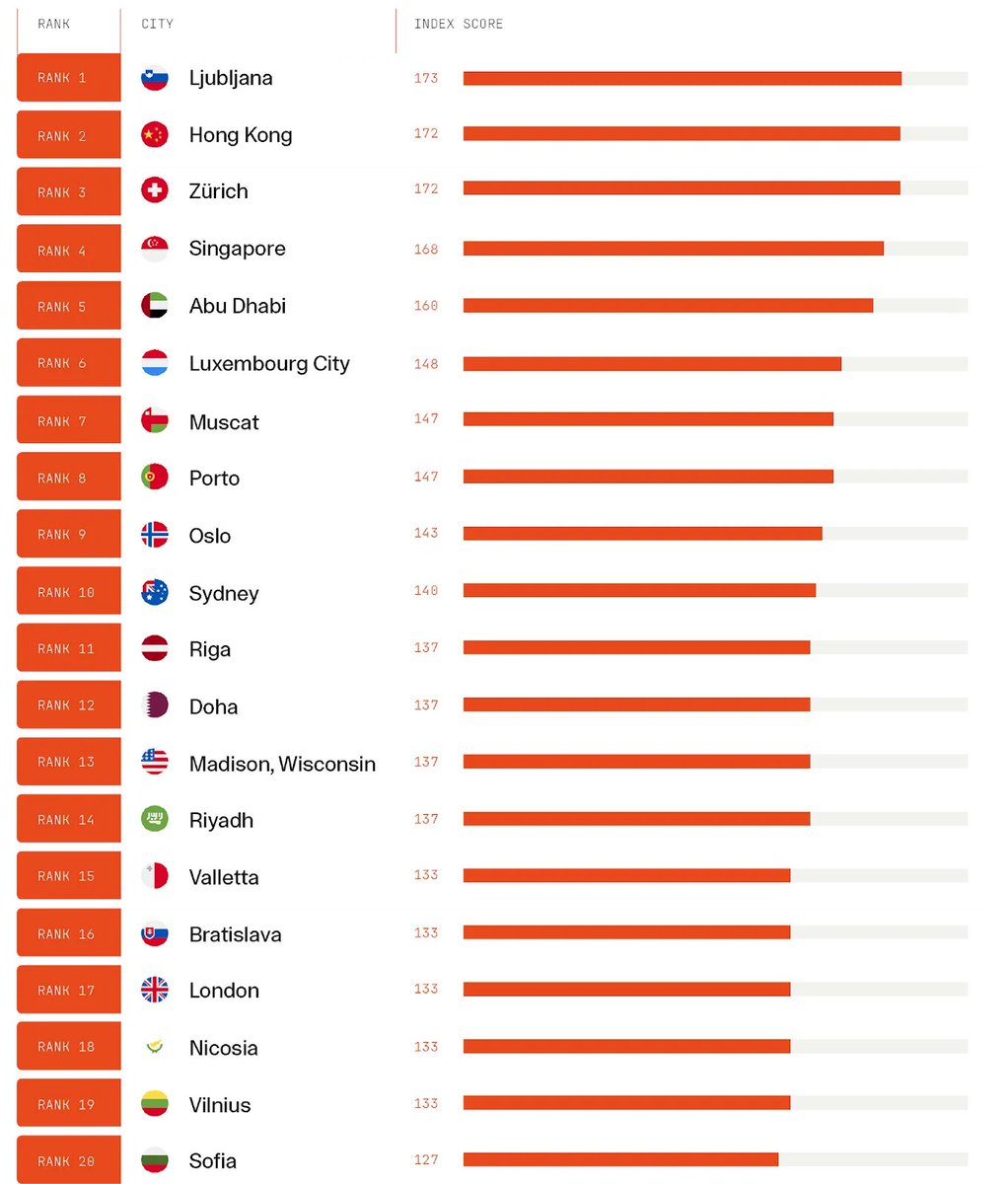

💡 Crypto-Friendly Cities Index 2025 By @MultipolitanSG

Overview 🗒️

The global financial landscape is being reshaped, and blockchain and digital assets are leading the trend. The 2025 Crypto-Friendly Cities Index, published by @MultipolitanSG, reveals new hotspots of cryptocurrency wealth, talent, and innovation. This is not just a ranking, but also a roadmap to the future financial capital

Why Crypto-Friendly Cities Are the Future 🚀

The next wave of global financial centers will not only embrace cryptocurrency, but thrive with it at their core. Here’s what makes these cities stand out:

📍Clear regulation and significant competitive advantages: A clear and friendly regulatory environment attracts businesses and investors. Cities such as Dubai and Singapore stand out for their stable policies, while regulatory hostility in parts of the United States has led to a brain drain.

Top Crypto-Friendly Cities 2025 🏙️

These cities are redefining the future of finance with clear regulation, active ecosystems and physical integration:

📍Ljubljana, Slovenia: Home to 155 crypto ATMs and high transaction activity.

📍Hong Kong: Reemerging, with 201 ATMs and an average transaction value of $77,000 per user.

📍Zurich, Switzerland: clear regulation and top quality of life.

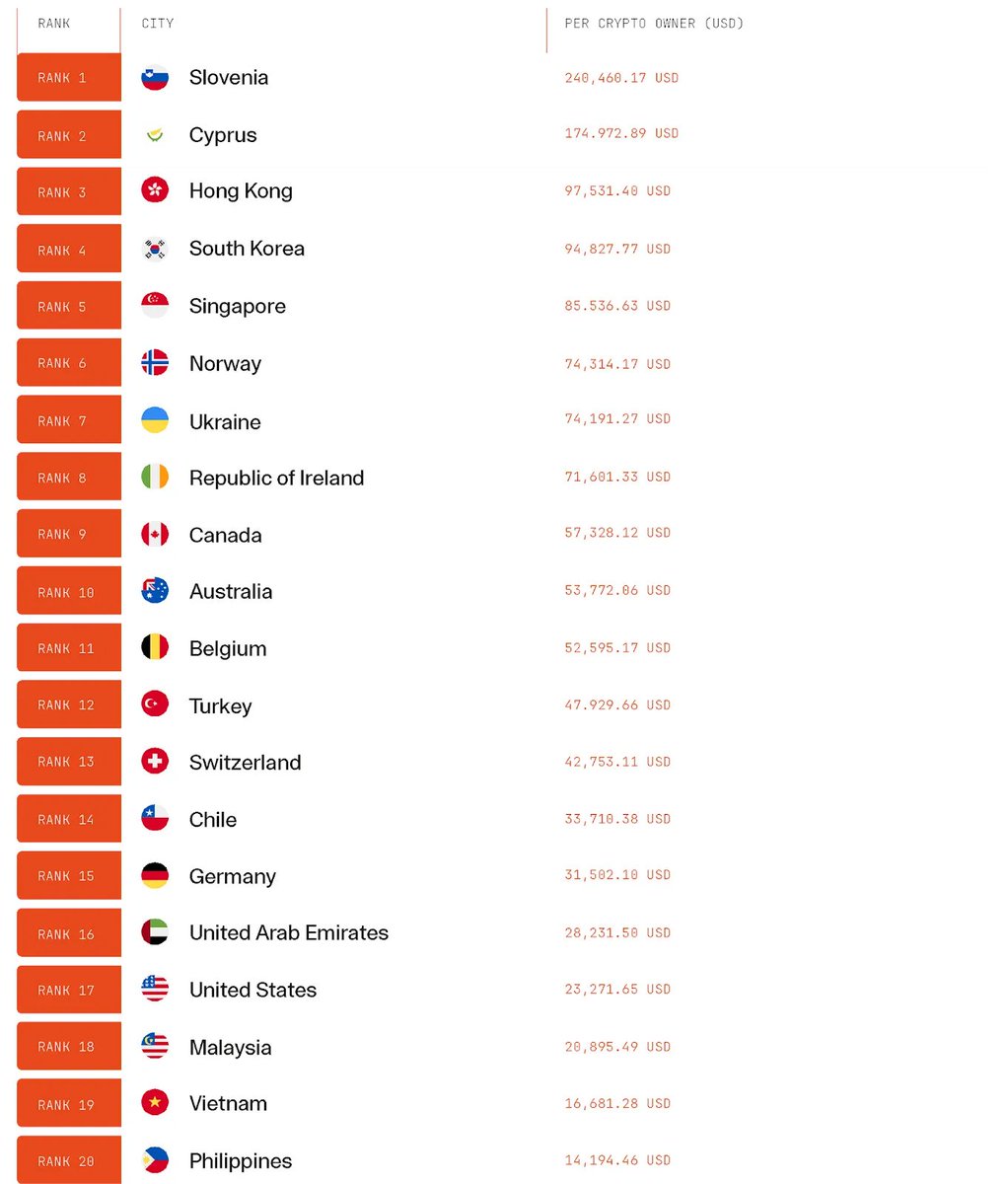

Crypto Wealth Concentration: Who Holds the Power? 💸

The 2025 Crypto Wealth Concentration Index goes beyond adoption rates to reveal what wealth concentration really looks like:

📍United Arab Emirates: 25.3% of the population own cryptocurrencies, and Dubai’s centrality is unrivaled.

📍India: With 118.9 million crypto holders, the world’s largest community, although regulatory challenges remain.

📍United States: Trading volume up to 2.07

The full content is on Biyan Substack, welcome to subscribe🔥

bit.ly/defi-0502-weekly

🔥 Join the Biyan community to discuss more market opportunities:

📍 Chinese Telegram community: bit.ly/3YmFBrN

📍 Hong Kong Telegram community: bit.ly/HK-TG-Group

📍 Subscribe to the Daily Coin Research Telegram channel:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content