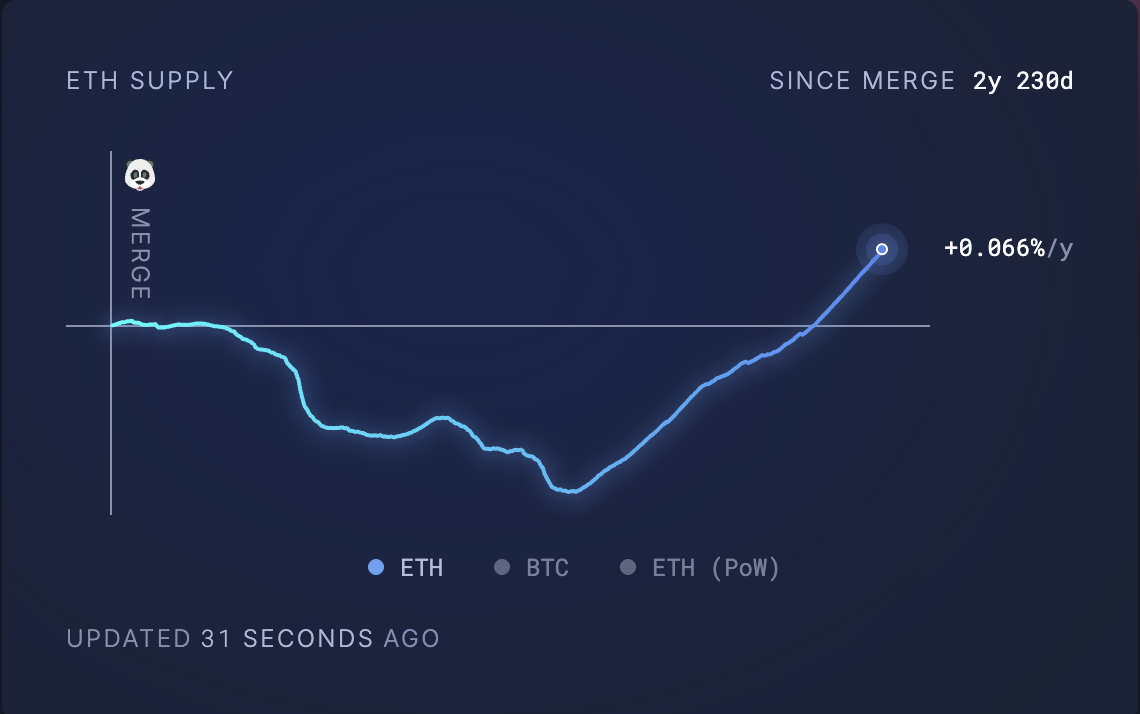

Over the past few months, Ethereum has experienced a significant decrease in user activity on its blockchain. This has led to a reduction in the network's burning rate, weakening the mechanism that reduces ETH supply over time.

With fewer tokens being burned, the circulating supply of ETH has increased, putting inflationary pressure on the asset. As a result, the coin has struggled to maintain a stable level around $2,000 in recent months.

Low Burning Rate, Increase in Circulating Coins

According to Ultrasound Money, 72,927 ETH was added in the past month, adding ETH worth $134 million to the circulating supply at current market prices.

At the time of reporting, this brings the total to 120,731,199 ETH, significantly higher than pre-merge levels.

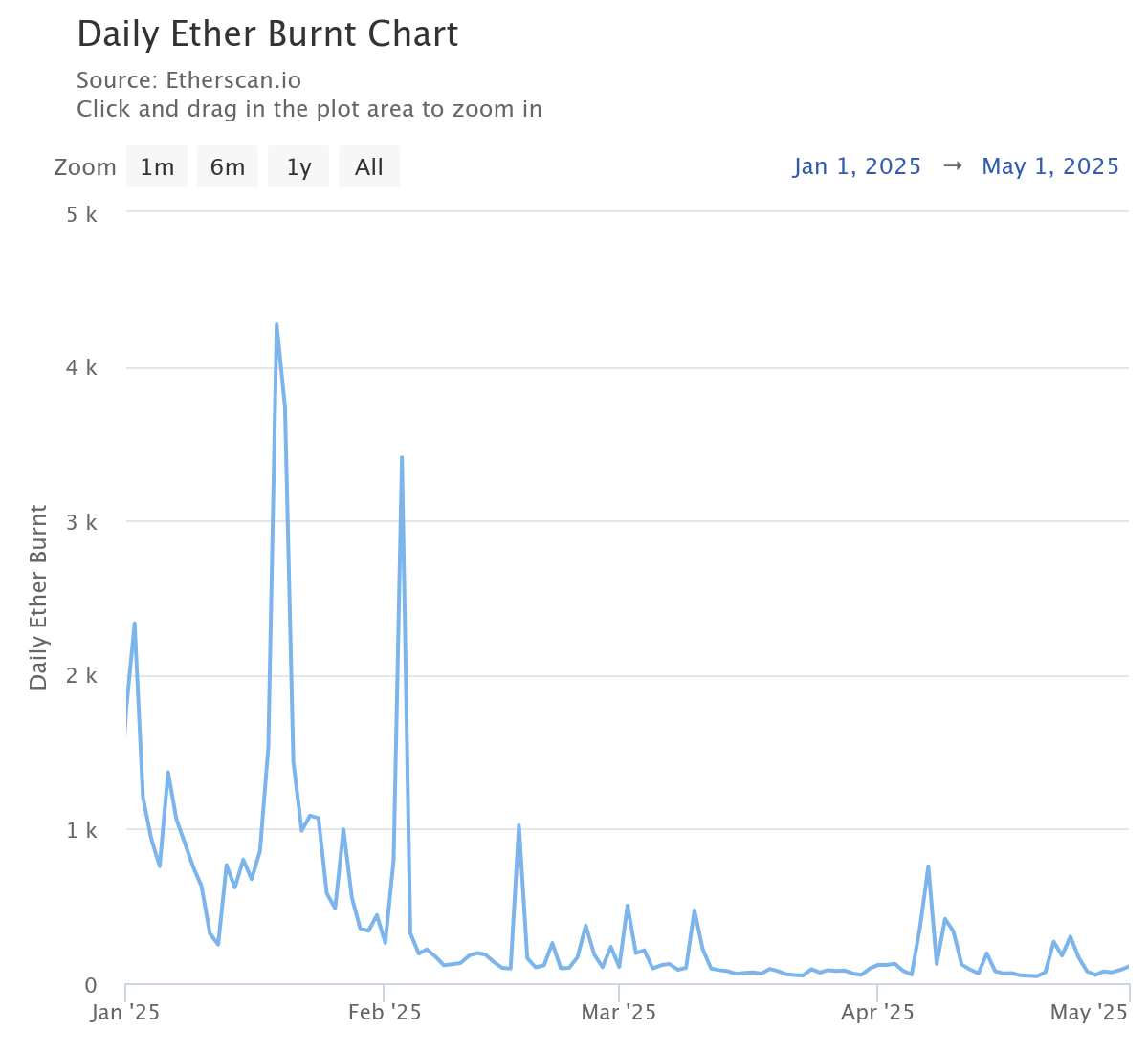

The decrease in user activity on the Ethereum network has led to an increase in ETH supply and a reduction in burning rates. Ethereum's burning mechanism, introduced through EIP-1559, burns a portion of transaction fees to reduce the circulating supply of ETH.

However, this mechanism is directly linked to network usage. Therefore, when fewer transactions occur, less ETH is burned, causing a surge in ETH supply.

According to Etherscan, the daily burning amount has decreased by 95% compared to the beginning of the year. In fact, the network recorded its lowest daily coin burning on April 20th.

Why Are Ethereum Users Leaving the Blockchain?

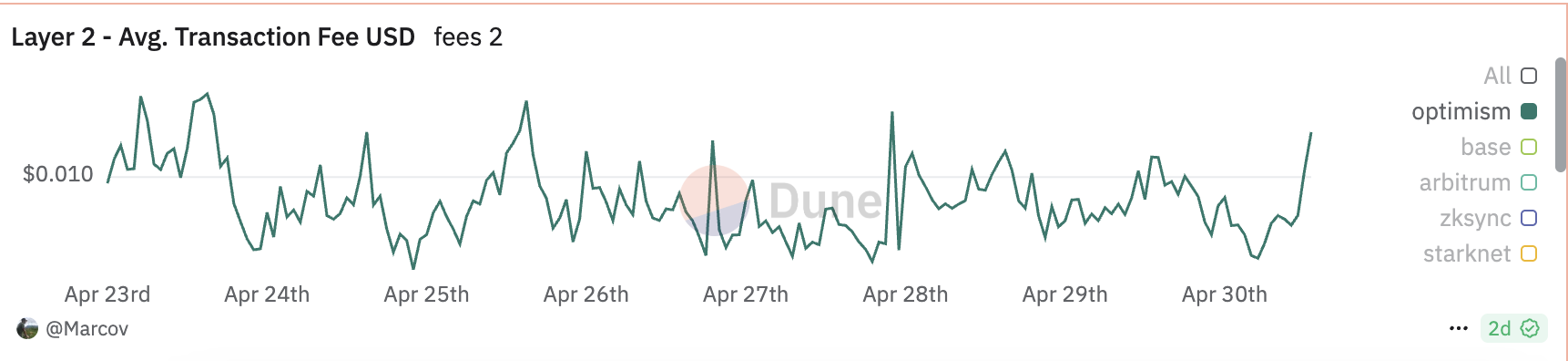

Many users and developers are moving to Layer 2 (L2) solutions like Optimism and Arbitrum. These networks have much lower transaction fees and faster execution speeds, reducing user activity on the Ethereum mainnet.

For example, as of April 30th, the average transaction fee on the Optimism mainnet was just $0.024. In contrast, completing a transaction directly on Ethereum cost an average of $0.18 on the same day, which is more than 7 times more expensive.

Moreover, due to the recent meme coin craze, "Ethereum killers" like Solana have gained significant popularity, attracting users away from L1.

This trend has led to a decrease in Ethereum transactions, consequently lowering the network's burning rate.

What About Ethereum's Fundamentals?

The decrease in user demand and increase in ETH supply have raised important questions about its fundamental strengths.

When asked how Ethereum compares to other Layer 1 (L1) networks amid overall market weakness, Vincent Liu, Chief Investment Officer at Chronos Research, shared his perspective.

"Ethereum's fundamental strengths remain robust compared to other Layer 1s, particularly with its Total Value Locked (TVL) at $36.892 billion, placing it at the top of the leaderboard," Liu said.

Liu acknowledged that Ethereum ranks 5th in 24-hour fees, following TRON, Solana, Hyperliquid, Bitcoin, and BNB Chain. He emphasized that the network still shows "significant demand and usage".

Temujin Louie, CEO of WanChain, shares a similar view. In an interview with BeInCrypto, Louie mentioned:

"Compared to other Layer 1s, the fundamental strengths remain Ethereum's strength. While many Layer 1s have aggressive inflation by design, Ethereum's post-merge architecture potentially causes deflation. However, the benefits of EIP-1559 depend on on-chain activity. Nevertheless, this is a structural advantage compared to most competing Layer 1s."

While the increased activity of "Ethereum killers" like Solana and Layer 2 (L2) solutions may have contributed to the decrease in Ethereum's user demand, Louie believes that the L1 network remains "the leader in decentralization and continues to secure its position in the market".

What About ETH Price?

Despite strong fundamental strengths, the decrease in Ethereum's activity poses challenges in the short to medium term. Liu explained that the network activity reduction generally indicates weakened demand for ETH.

Simultaneously, the increase in coin issuance on the network weakens Ethereum's deflation model, which was designed to support price appreciation.

"This combination could lead to price decline," Liu warned. "Especially when investors are seeking alternative Layer 1s that offer better scalability and lower fees."

Kadan Stadelmann, CTO of Komodo Platform, also emphasized the role of macroeconomic factors:

"If Ethereum's usage continues to decline over an extended period, the price could significantly drop in line with usage reduction, especially if the Fed continues its quantitative tightening policy. In the short term, the price could fall to the $2,000 range. However, if this trend continues, Ethereum could enter a long-term correction or downward trend."

ETH Eyeing $2,000 Breakthrough Amid RSI Strength

ETH is currently trading at $1,834, recording a 1% price drop over the past day. Despite the short-term correction, the coin's bullish pressure in the spot market continues to strengthen, reflected in the rise of its Relative Strength Index (RSI).

At the time of reporting, this momentum indicator is 57.68. The RSI value of ETH indicates that bullish conditions are increasing. This means that altcoins have room to rise as buying pressure increases.

In this case, the price could break through $2,027.

However, if buying pressure weakens, the value of ETH could drop to $1,733.