Bitcoin has surpassed the 95,000 USD mark, an important psychological level, bringing new optimism to the market, at least for Miners.

This important milestone has created a change in Miners' sentiment, with on-chain data showing a significant increase in Miners' BTC reserves in recent days.

Miners Bet on BTC Price Increase as Reserves Rise from Yearly Low

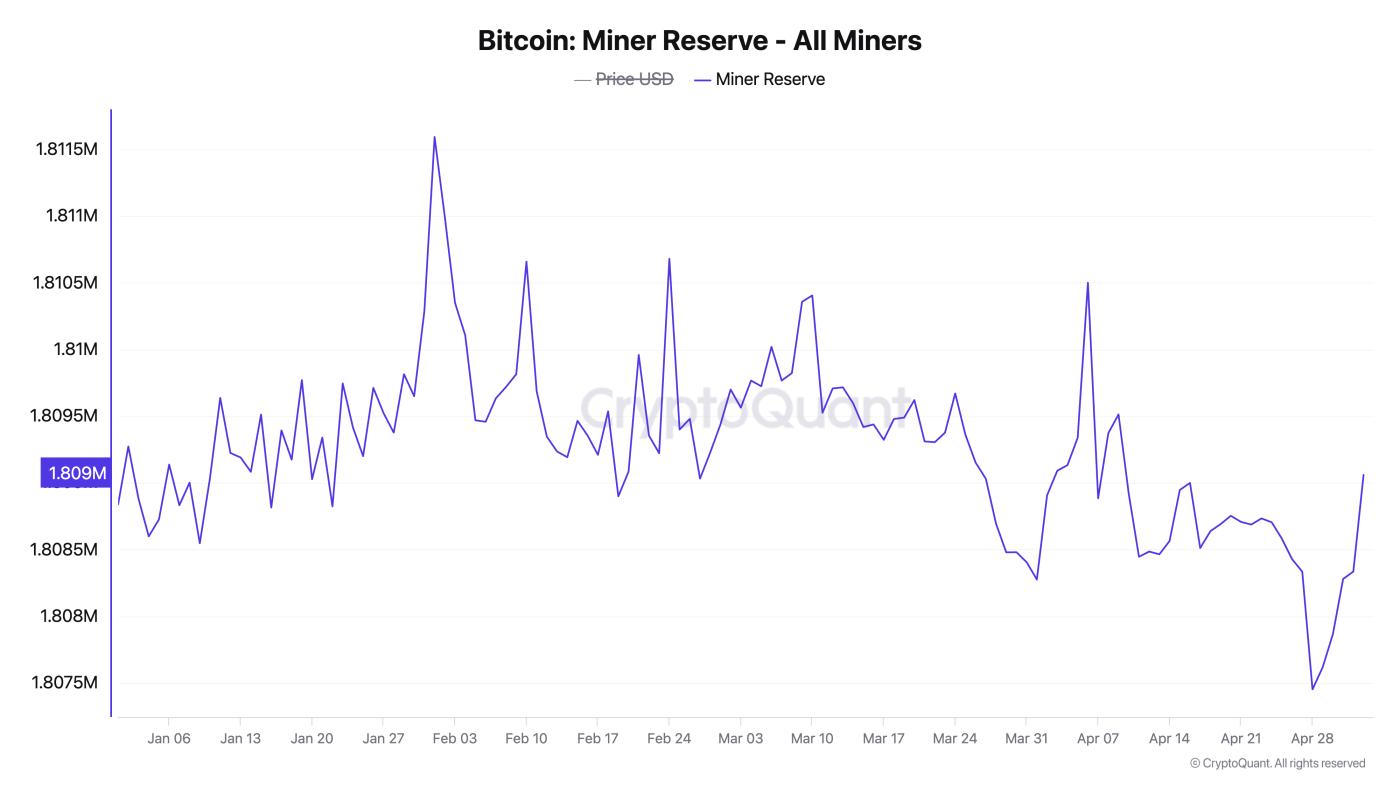

According to CryptoQuant, Bitcoin Miners' reserves, which had been continuously declining, began to increase on 04/29/2025, right after BTC closed above the 95,000 USD threshold.

To clarify, reserves had dropped to the year's lowest point of 1.80 million BTC just a day earlier before reversing and showing signs of accumulation.

Bitcoin Miners' reserves. Source: CryptoQuant

Bitcoin Miners' reserves. Source: CryptoQuantBitcoin Miners' reserves track the number of coins held in Miners' wallets. It represents the coins that Miners have not sold. When it decreases, Miners are moving coins out of their wallets, usually to sell, confirming an increasingly bearish sentiment towards BTC.

Conversely, when this indicator increases, as currently, it shows that Miners are holding more mined coins, typically reflecting growing confidence in BTC's future price appreciation.

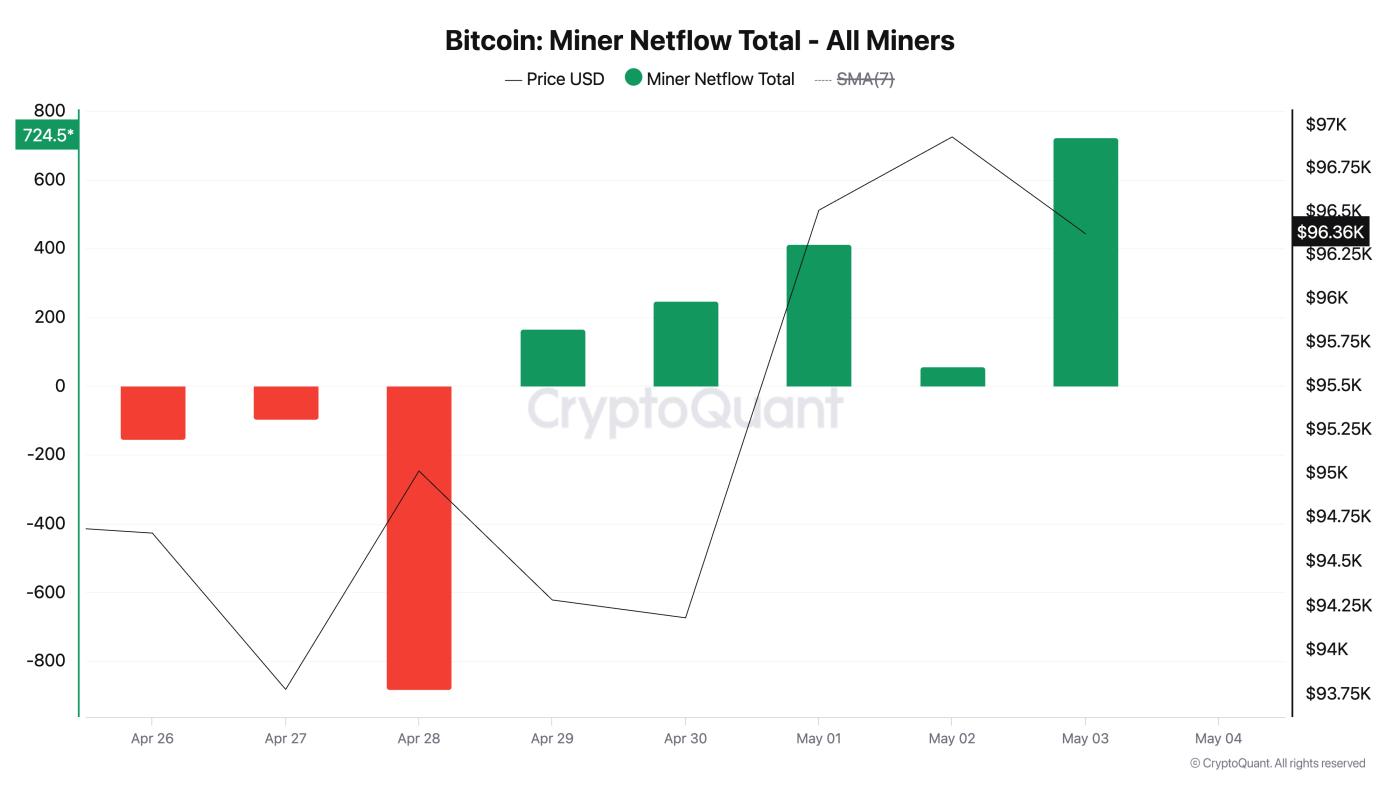

Moreover, the positive change in Miners' sentiment is further supported by the active Miners' net inflow recorded since 04/29/2025. This indicates more coins are being moved into Miners' wallets rather than being sold on exchanges.

Bitcoin Miners' net flow. Source: CryptoQuant

Bitcoin Miners' net flow. Source: CryptoQuantThis behavior reflects confidence in further price increases, as Miners, typically considered long-term holders, are choosing to accumulate instead of selling.

One Thing to Note

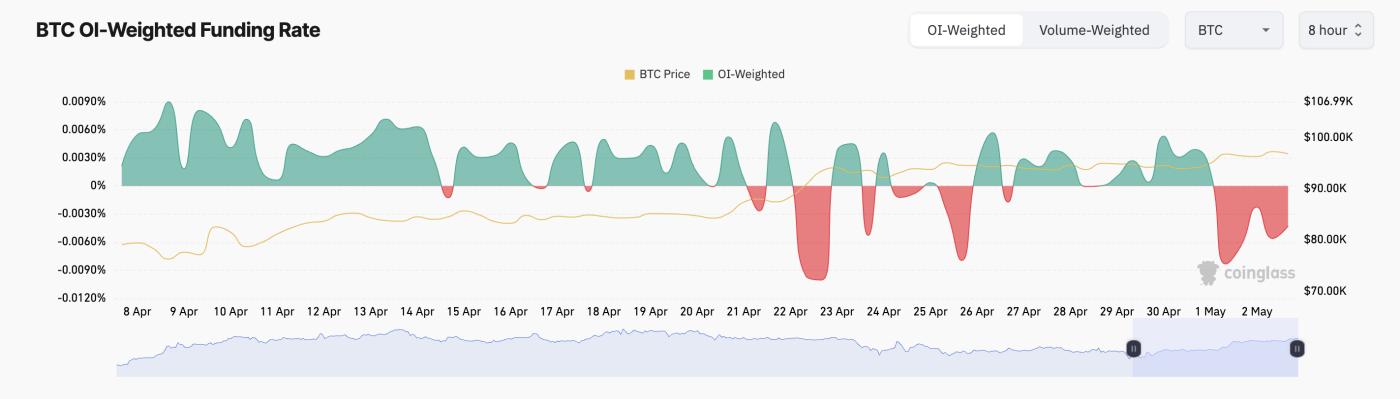

However, the sentiment is not entirely optimistic. While BTC Miners are temporarily pausing sales, Derivative data tells a different story.

In the Futures Contract market, BTC's funding rate has remained negative since early May, indicating that a significant portion of traders are betting on a short-term price correction. At the time of writing, the coin's funding rate is -0.0056%.

BTC Funding Rate. Source: Coinglass

BTC Funding Rate. Source: CoinglassThe funding rate is a periodic payment exchanged between long-term and short-term traders in perpetual Futures Contracts to keep the contract price aligned with the spot price.

When it is positive, it means long-term position holders are paying short-term position holders, indicating a prevailing optimistic market sentiment.

Conversely, a negative funding rate like this signals more short-term bets than long-term ones, suggesting downward pressure on BTC price.

Breakthrough or Decline as Traders and Miners Diverge

Although Miners' behavior may indicate new confidence, the stable bearish sentiment in Derivatives suggests that traders remain cautious about potential correction.

If coin accumulation becomes stronger, BTC could extend its profits, breaking through the resistance level at 98,515 USD and attempting to reclaim the 102,080 USD price mark.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingViewHowever, if bearish bets against the top coin prevail and witness a lack of demand, its price could drop below 95,000 USD to reach 92,910 USD.