If users want to maximize profits, they can maximize the value of stablecoins through yield-generating stablecoins.

Yield-generating stablecoins refer to assets that generate returns through DeFi activities, derivatives strategies, or RWA investments. Currently, these stablecoins account for 6% of the $240 billion stablecoin market cap. With growing demand, JPMorgan believes reaching 50% is not far-fetched.

Yield stablecoins are minted by depositing collateral into protocols. The deposited funds are invested in yield strategies, with returns shared by holders. This is similar to a traditional bank lending deposited funds and sharing interest with depositors, except yield stablecoins offer higher interest.

This article aims to review 20 yield-generating stablecoins.

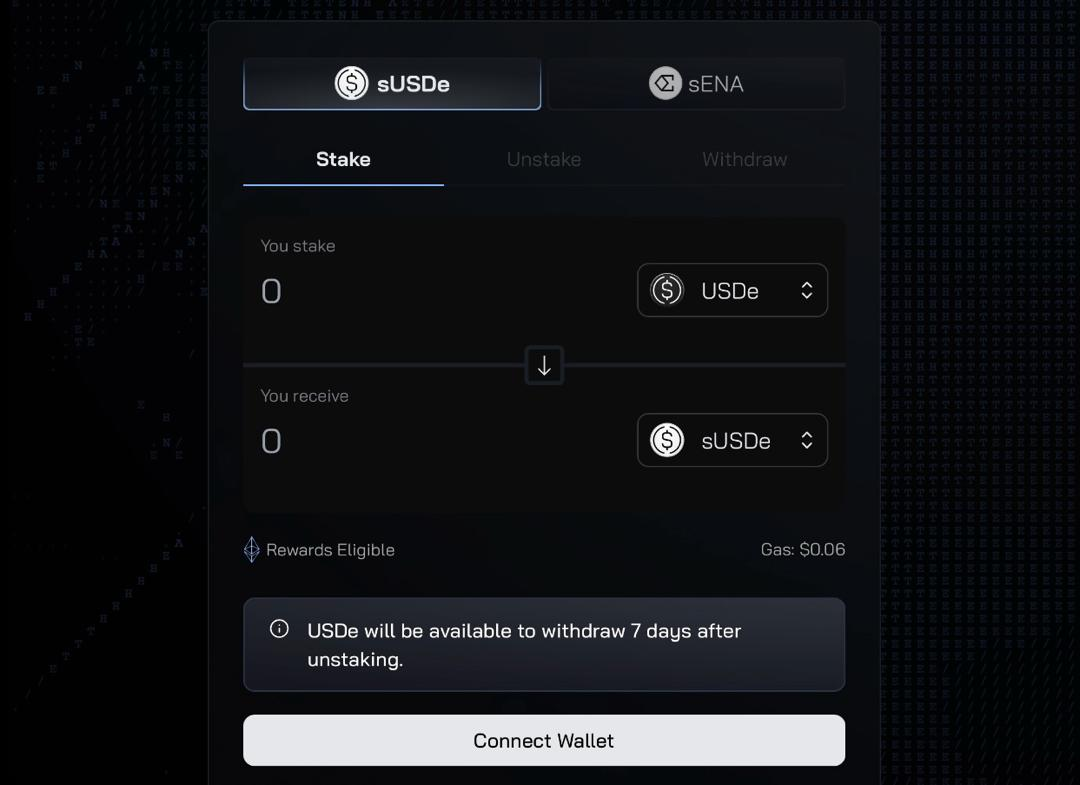

1.Ethena Labs(USDe / sUSDe)

Ethena maintains its stablecoin's value and generates yield through delta-neutral hedging.

USDe is minted by depositing staked ETH (stETH) into the Ethena protocol. The ETH position is then hedged through short selling.

In addition to stETH's yield (currently 2.76% annually), the positive funding rate from short selling also generates returns, which Ethena distributes to users who stake USDe for sUSDe (with a 5% annual yield).

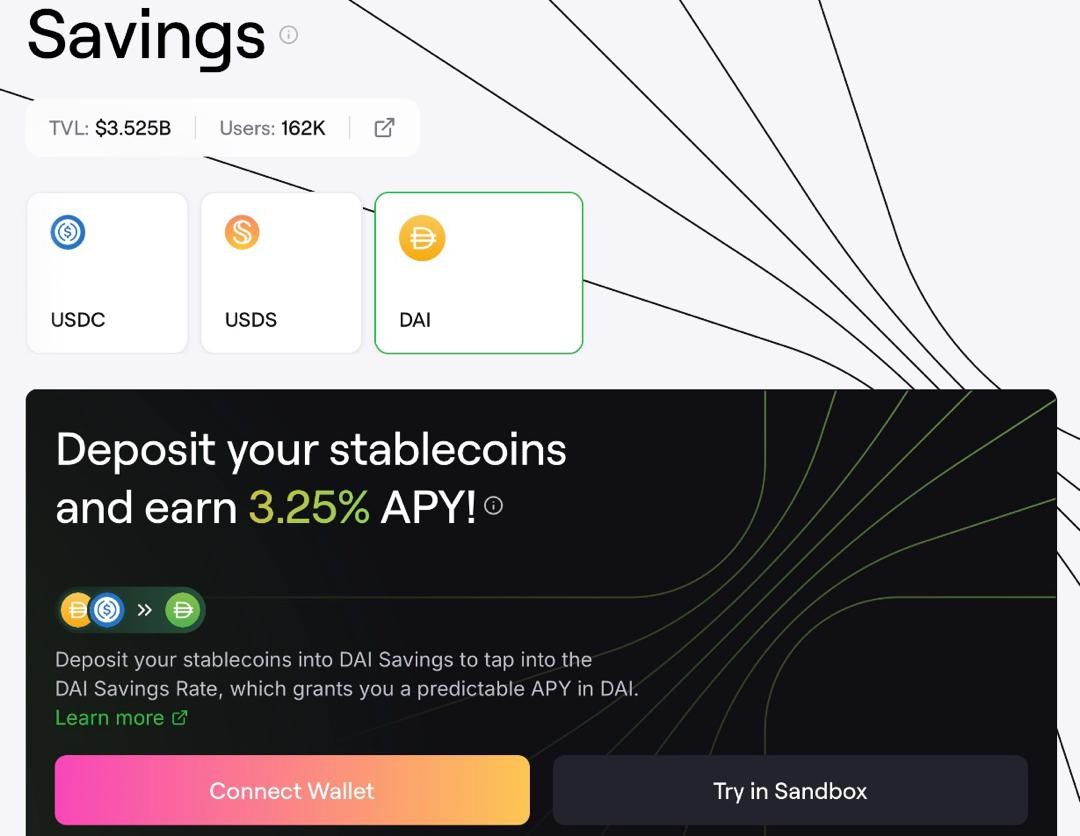

2.Spark(sDAI)

sDAI is generated by depositing DAI into Maker's DAI Savings Rate (DSR) contract. The current annual yield is 3.25%.

Yield is accumulated through DSR interest (rate determined by MakerDAO). sDAI can also be traded or used in DeFi like other stablecoins.

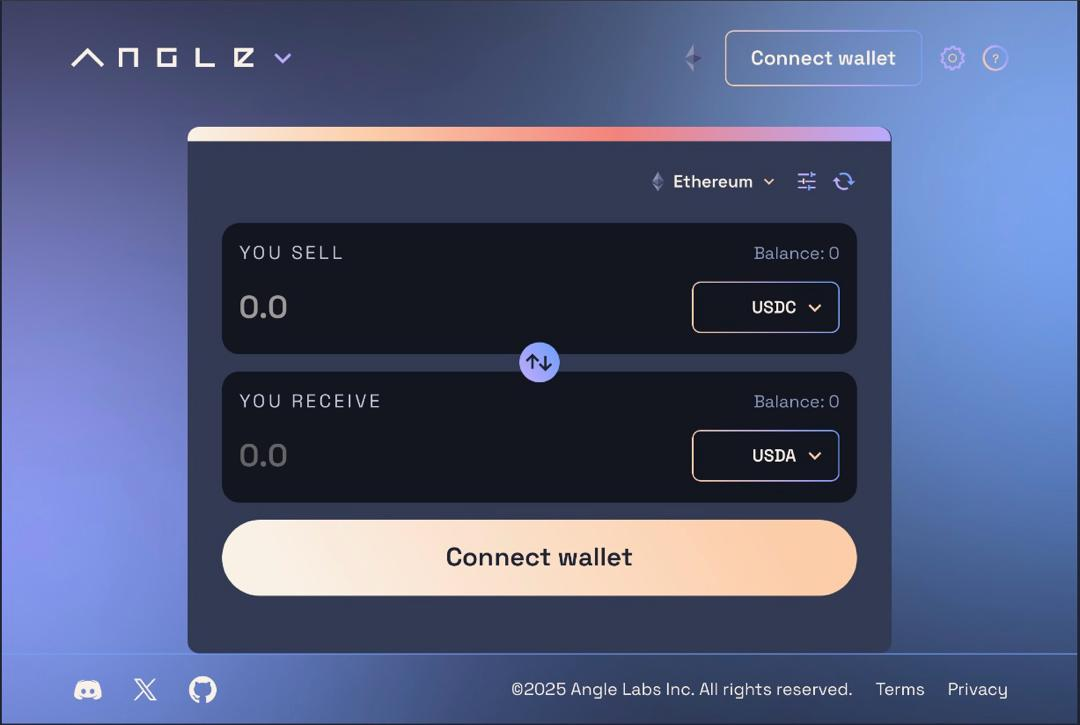

16.Angle(USDA / stUSD)

USDA is minted by depositing USDC. USDA's yield is generated through DeFi lending, treasury bills, and tokenized securities trading.

USDA can be deposited into Angle's savings solution to obtain stUSD. stUSD holders can receive yields from USDA (annual interest rate of 6.38%).

17.Paxos(USDL)

USDL is the first stablecoin that provides daily yields under a regulatory framework. Its yield comes from short-term US securities held in the Paxos reserve, with a yield rate of around 5%, which USDL holders can automatically receive.

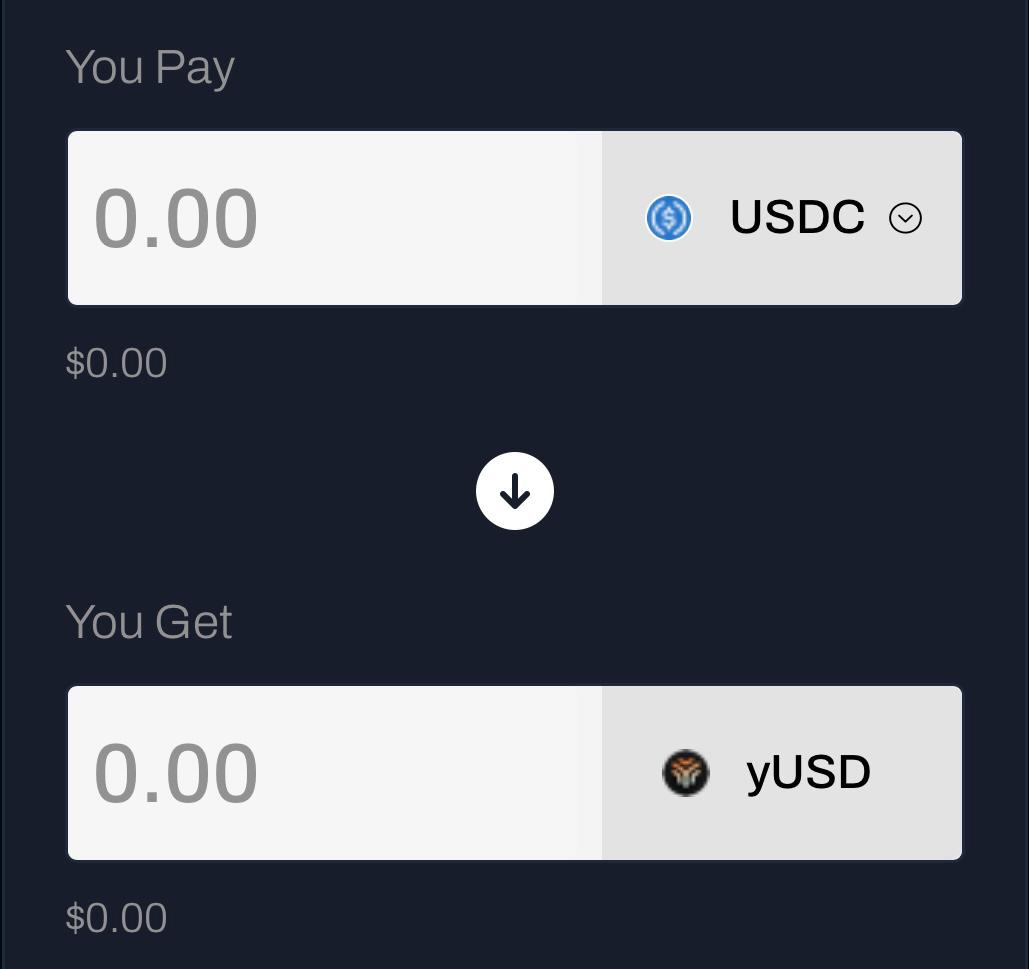

18.YieldFi(yUSD)

yUSD is backed by stablecoins and can be minted by depositing USDC or USDT on YieldFi (annual interest rate of 11.34%).

YieldFi generates yield by deploying collateral through a delta-neutral strategy, and yUSD can be used ineFsuch as lendingending and providing liquidity on protocols like Protocol like Origin Protocol.

19.OpenEden(USDO)

USDO is backed by tokenized US Treasury bonds and money market funds (such as OpenEden's TBILL).

Its underlying assets are invested through on-chain and off-chain strategies to generate yield. Yield is distributed to USDO holders through a daily rebase mechanism.

The underlying assets are invested through on-chain and off-chain strategies to generate yield. This yield is distributed daily to USDO holders.

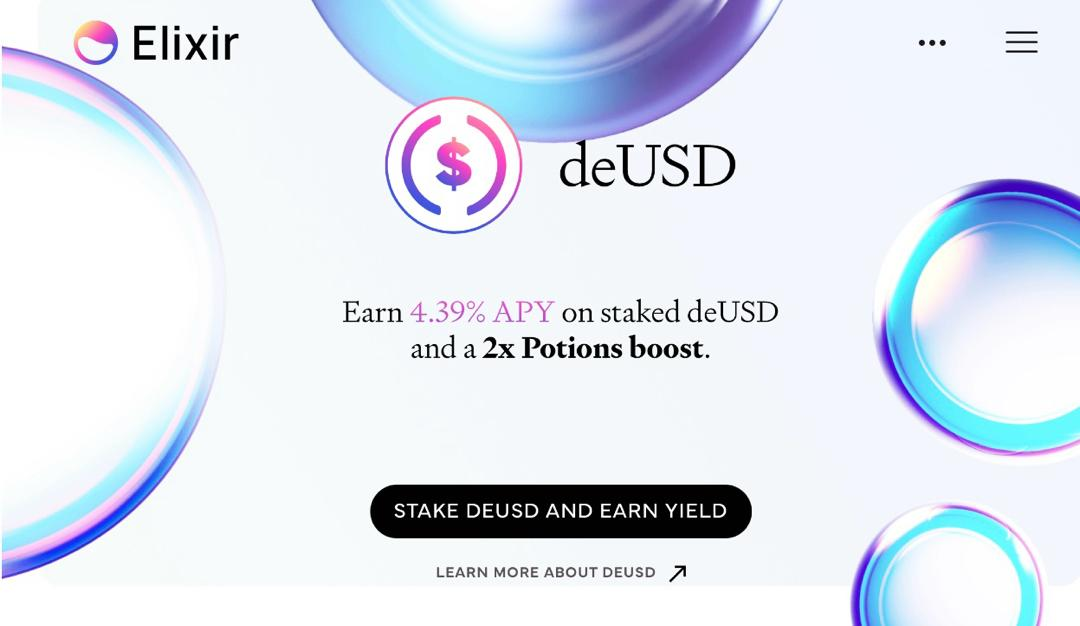

20.Elixir(deUSD / sdeUSD)

SimilarUto Ethena's USDe, deUSD's yield comes from its investment in traditional assets such as US Treasury bonds, as well as funding rates generated from lending within the Elixir protocol.

Users who stake deUSD as sdeUSD can receive an annual yield of 4.39% and 2x potion rewards.