Digital asset investment products strongly attract capital, with $2 billion in the past week, raising the total investment amount in three weeks to $5.5 billion.

The digital asset market is experiencing an impressive investment wave with continuous capital inflow into investment products. According to the weekly report from CoinShares, cryptocurrency investment products have attracted $2 billion in just the past week, pushing the total capital flow in the past three weeks to a record $5.5 billion. This recovery marks an important turning point after the previous prolonged period of capital outflow.

Capital Allocation and Market Trends

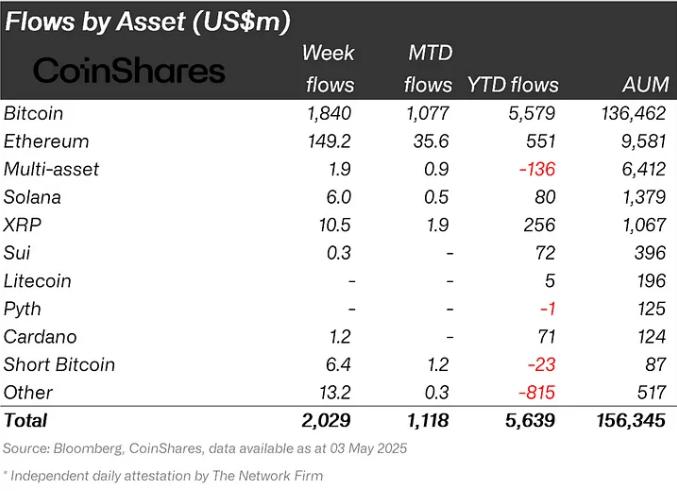

Bitcoin continues to lead with $1.8 billion in investment capital in the past week. Notably, despite Bitcoin's recent strong price increase, investment products in the short position still recorded active activity with $6.4 million – the highest since mid-December 2025, indicating that a portion of investors still maintain a cautious attitude.

Ethereum also showed a stable recovery with $149 million in inflow during the past week. Combined with $187 million from the previous week, the total Ethereum inflow in the past two weeks has reached $336 million, reflecting investors' increasing confidence in the potential of this second-largest blockchain.

While Solana only attracted a modest $6 million, XRP and Tezos surprised with investment capital exceeding expectations, reaching $10.5 million and $8.2 million respectively. The interest in these altcoins shows that investors are seeking opportunities to diversify their investment portfolios beyond top digital assets.

Blockchain-related stocks are also not exempt from this trend, with capital inflow reaching $15.9 million, reflecting the growing interest in companies operating in the blockchain technology sector.

Geographically, the United States continues to lead with $1.9 billion in investment capital, followed by Germany ($47 million), Switzerland ($34 million), and Canada ($20 million). This distribution reflects the increasingly important role of the US as a global cryptocurrency investment center.

These strong capital flows have pushed the total Assets Under Management (AUM) of cryptocurrency investment products to $156 billion – the highest since mid-February, marking a significant market recovery.

This three-week upward trend reflects a clear shift in sentiment towards a more optimistic direction in the digital asset space. Both institutional and individual investors are repositioning to anticipate growth opportunities, especially in the context of gradually improving legal environments and increasingly widespread recognition of cryptocurrency as a legitimate asset class.