Tether issues 1 billion USD USDT on Tron, raising the total supply to 71.4 billion USD, just 1.4 billion USD away from Ethereum (72.8 billion USD) to lead.

Tether has just issued an additional 1 billion USD USDT on the Tron network on 5/5, raising the total stablecoin supply on this platform to 71.4 billion USD, according to data from Arkham Intelligence and Tether's transparency report.

With this increase, Tron is now only about 1.4 billion USD away from Ethereum – the network currently holding 72.8 billion USD USDT – to reclaim the leading position in total USDT supply.

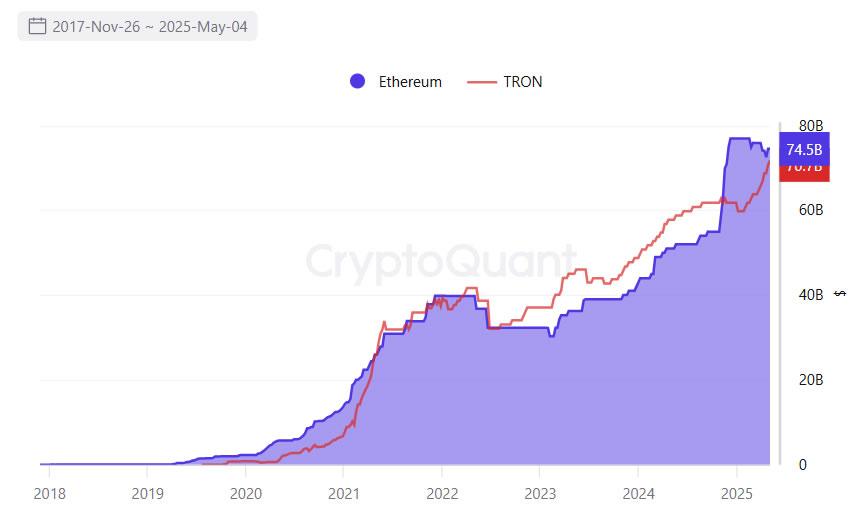

In the past, Tron held a dominant position from July 2022 to November 2024, before being overtaken by Ethereum due to a USDT issuance of 18 billion USD, according to statistics from CryptoQuant. Currently, the third-largest network in USDT volume is Solana, with around 1.9 billion USD in circulation.

Besides these three main networks, USDT is also issued on several other blockchains such as TON, Avalanche, Aptos, Near, Celo, and Cosmos. To date, the total USDT in circulation across all networks has reached a record high of 149.4 billion USD, showing an 8.6% growth since the beginning of 2025.

With this scale, Tether continues to maintain its dominant position in the stablecoin market with 61% global market share, according to data from CoinGecko. Its largest competitor is Circle with USDC, currently having around 62 billion USD in circulation, representing nearly 25% of the market share.

The stablecoin market has seen a clear growth trend in the past 6 months and currently accounts for about 8% of the total cryptocurrency market capitalization. According to a report from the US Department of the Treasury published at the end of April, the stablecoin market could reach a size of 2,000 billion USD by 2028, provided a clear and comprehensive legal framework is established.

There are two bills expected to shape the legal landscape for this sector in the US. The first is the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins), which provides a specific legal definition for payment stablecoins and reserve requirements for issuers.

The second is the STABLE Act (Stablecoin Transparency and Accountability for a Better Ledger Economy), aimed at the supervision and approval process for non-bank stablecoin issuers that meet federal conditions.

The US Senate is expected to vote on the GENIUS Act before 5/26, while the STABLE Act is still under discussion in Congress. In this context, Tether has also announced plans to issue a USD-denominated stablecoin based in the US, expected to launch by the end of this year – with progress largely dependent on the completion of the aforementioned legal framework.