Ethereum (ETH) has declined for consecutive months. However, it enters May with increasing optimism. Historical trends, on-chain data, whale accumulation behavior, and upcoming technological upgrades create a solid foundation for price recovery.

Here are four main reasons why analysts believe ETH could recover strongly in May.

Why Ethereum Could Recover in May 2025

The first reason stems from the historical price performance of ETH. Data from CoinGlass shows that May is typically the best month for ETH.

In recent years, ETH has achieved an average profit of 27.36% in May, the highest among all months.

Ethereum's monthly price performance. Source: Coinglass

Ethereum's monthly price performance. Source: CoinglassAlthough not every May ends with profit, historical trends suggest this month typically brings positive sentiment and upward momentum for ETH. Under current conditions, Cyclop expects ETH to maintain growth momentum this month and reach a target of $2,500.

"May is the best month for ETH in history. $2,500 by the end of the month," analyst Cyclop predicts.

Another important factor supporting price prospects is on-chain data, especially the MVRV (Market Value to Realized Value) ratio. According to analyst Michaël van de Poppe, ETH's MVRV ratio is currently at its lowest since March 2020, when the COVID-19 pandemic heavily impacted the cryptocurrency market.

Ethereum MVRV. Source: Glassnode

Ethereum MVRV. Source: GlassnodeA low MVRV ratio indicates ETH is undervalued compared to its on-chain value. This signal has appeared only six times in the past decade, typically preceding major recoveries. The chart also suggests ETH could experience significant growth in the next 3 to 12 months.

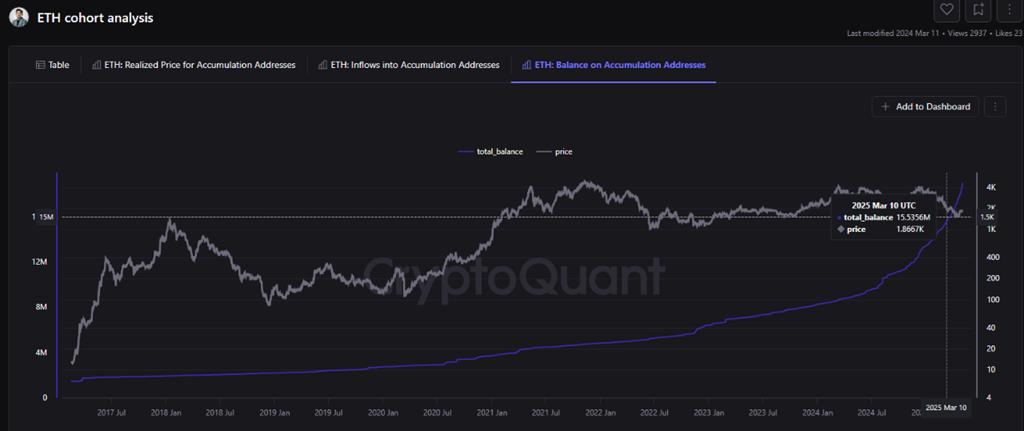

The third price increase sign is recent whale accumulation behavior. According to CryptoQuant, these investors have not abandoned their strategy despite ETH's price decline, with many accumulation addresses still holding unrealized losses.

Instead, they have increased their ETH holdings.

On March 10th, accumulation addresses held 15.5356 million ETH. By May 3rd, this number had increased to 19.0378 million ETH — a 22.54% increase.

ETH: Balance on accumulation addresses. Source: CryptoQuant.

ETH: Balance on accumulation addresses. Source: CryptoQuant."ETH investors are showing strong confidence in the asset, project, and ecosystem. Their on-chain behavior reflects structural confidence and clear expectations of short-term price increases — consistent with Ethereum's broader development," analyst Carmelo_Alemán says.

Finally, Ethereum's upcoming Pectra upgrade, expected on 05/07/2025, contributes to market optimism. This upgrade aims to improve wallet usability and user experience. It could boost dApp adoption and long-term ETH demand.

Meanwhile, 05/07 is also the FOMC meeting, where the Fed will announce interest rate decisions. If macroeconomic news is favorable, it could amplify ETH's short-term profits along with other factors.

However, if the news is negative, it could complicate ETH's price action in May.