Solana (SOL) rose by 2% over the past 24 hours, buoyed by market optimism ahead of the upcoming FOMC meeting. The Layer-1 (L1) coin is currently trading at $147.83.

On-chain data indicates a surge in demand for Longing positions, suggesting an increase in traders expecting price appreciation.

Solana Futures Strengthen Ahead of FOMC

SOL's price increased by 2% over the past 24 hours, with a slight rise in overall cryptocurrency market trading activity. This modest increase reflects growing investor optimism ahead of today's FOMC meeting.

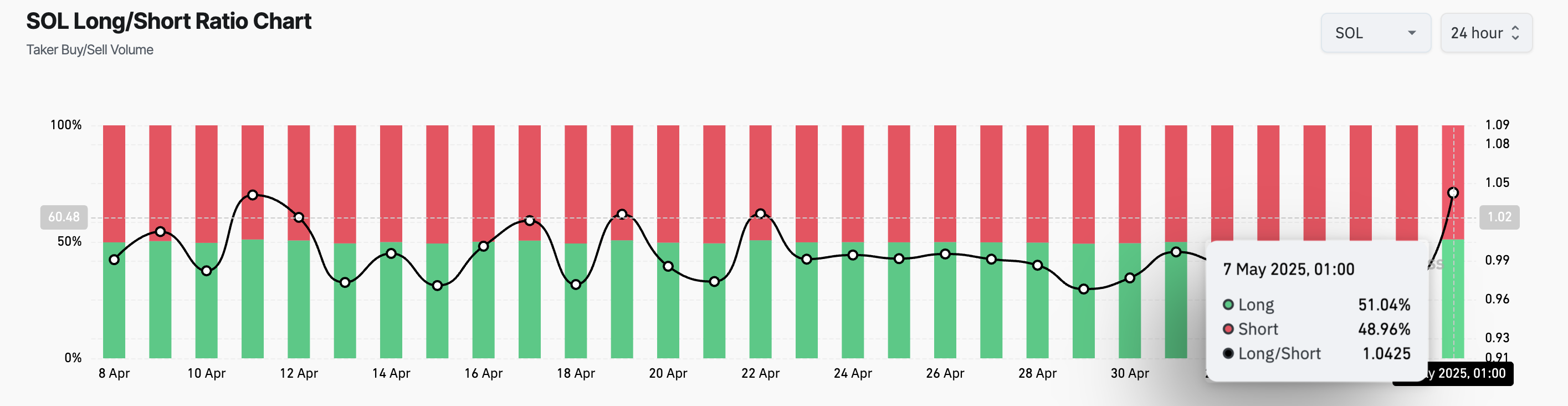

SOL futures traders expressed optimism by increasing demand for Longing positions. According to Coinglass, the coin's Long/Short ratio reached a monthly high of 1.04, indicating a preference for Longing positions among futures market participants.

The Long/Short ratio measures the proportion of rising (Long) and falling (Short) positions in the market. A value lower than 1 indicates more traders are betting on the asset's price decline.

Conversely, when the ratio exceeds 1, as with SOL, it means Long positions outnumber Short positions. This suggests a bullish sentiment, implying most SOL futures traders expect its value to rise.

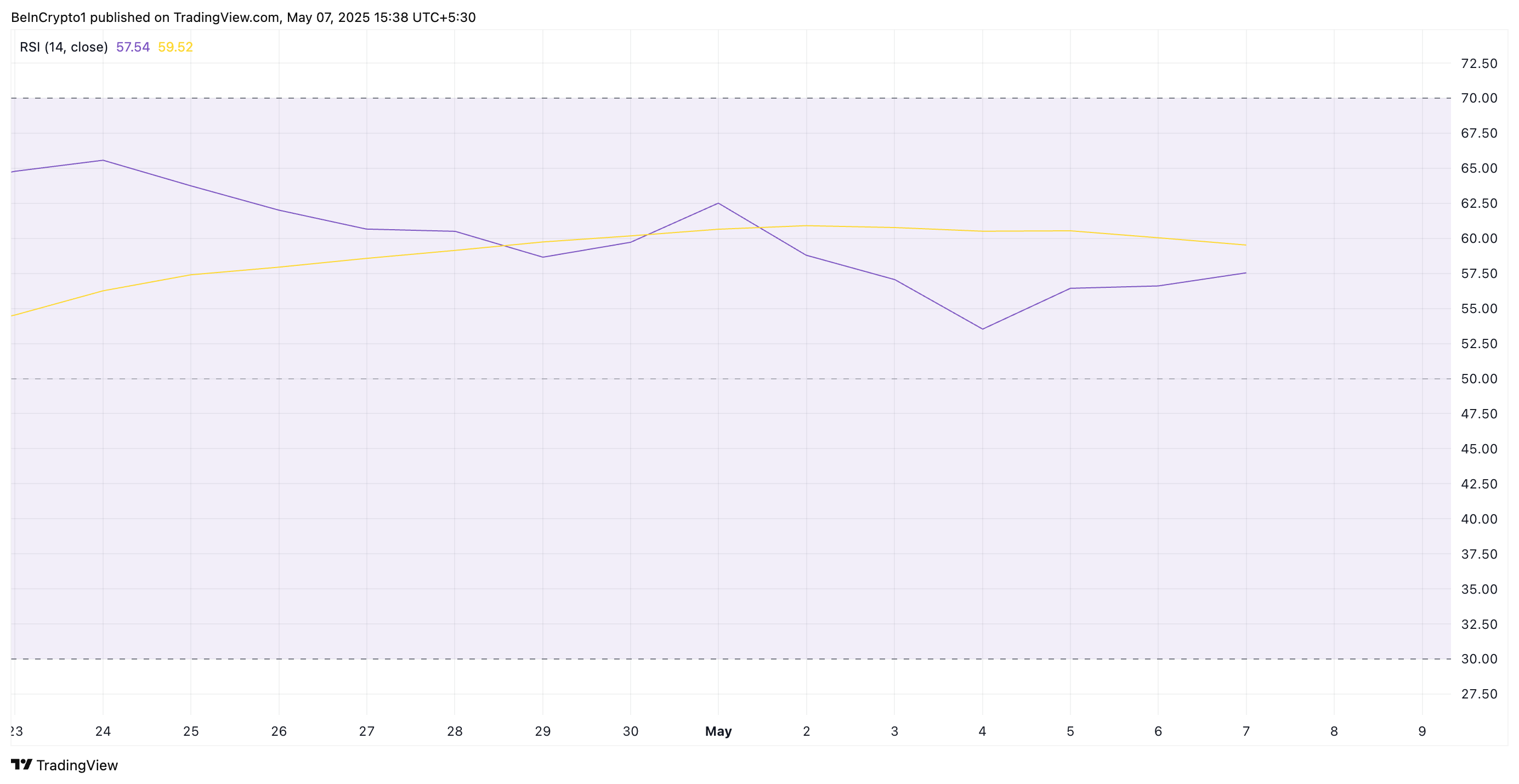

Additionally, the rising Relative Strength Index (RSI) on the daily chart confirms a surge in altcoin demand. At the time of reporting, this momentum indicator was at 57.54.

The RSI indicator measures an asset's overbought and oversold market conditions, ranging from 0 to 100. Values exceeding 70 typically indicate an overbought state, while RSI below 30 suggests an oversold condition.

SOL's current RSI value indicates increasing upward momentum, leaving room for further appreciation before entering the overbought territory.

SOL Price Balances at Support Level

At the time of writing, SOL is trading at $147.69, rebounding from the support level of $142.59. If demand continues to surge and market conditions remain favorable after the FOMC meeting, SOL could extend its rally to $171.88, last reached on March 3rd.

However, if the upcoming FOMC meeting reintroduces downward pressure, SOL could face selling momentum. In such a scenario, the coin might drop below the $142.59 support level, potentially falling to $120.81.