Author: Nancy, PANews

Recently, the sentiment in the MEME market has gradually warmed up, especially with the drive of multiple large MC memecoin projects, significantly improving the overall market activity. However, the MEME ecosystem is still in the early stages of recovery, and investor confidence has not yet fully recovered. Meanwhile, under the backdrop of insufficient liquidity and highly sensitive sentiment, the head effect has gradually become the core driver of traffic and capital, particularly with the synergistic effect of platforms and tools further amplifying the market influence of the head, making it a key variable in capital flow and sentiment fluctuations.

Launchpad: Significant Head Effect Driving Emerging Platforms

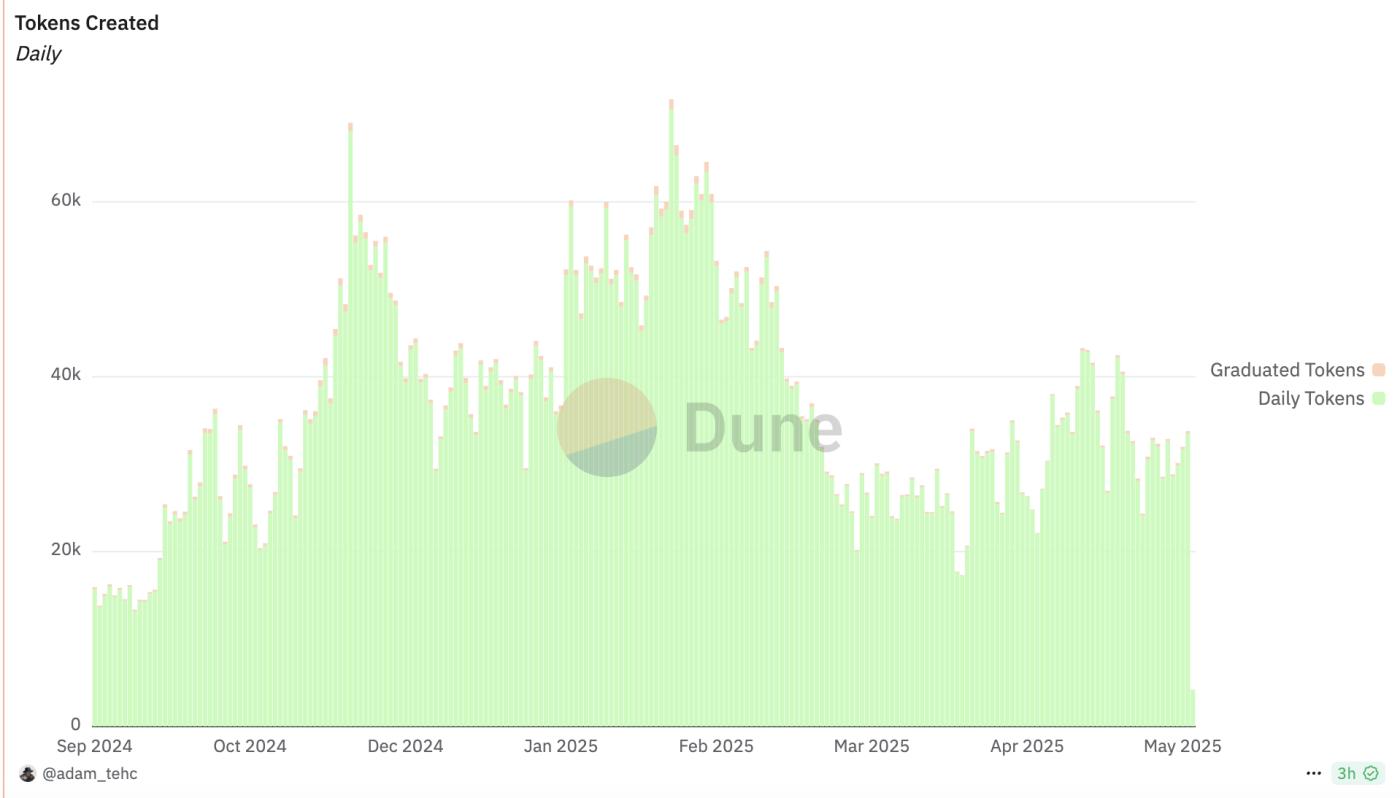

Although the MEME market has shown some recovery, in terms of token creation volume and user activity, it is still far from its historical peak.

Taking the current MEME token launch platform Pump.fun as an example, according to Dune data, as of May 7, the platform's daily token creation volume has exceeded 33,000, a 48.6% increase from the previous low point (around 17,000), but still only 47.5% of its historical peak. In terms of token graduation rate, it has now rebounded to 0.81%, a significant improvement from the lowest point, but still far from the historical high of 1.67%. In user activity, Pump.fun's daily active wallets currently reach 199,000, a 55.1% rebound from last month's low point, but only 46.9% of its historical peak (around 424,000). Notably, from the perspective of new users, the current daily new wallets are about 94,000, which is still limited compared to the historical peak of over 216,000. This means that although MEME heat has obviously recovered in the short term, overall user participation and liquidity breadth have not yet been fully restored.

However, some emerging token launch platforms have also rapidly expanded by leveraging the head effect. For example, the recently popular Boop successfully achieved user growth and market value leap in the short term through KOL-driven FOMO effects, platform incentive mechanisms, and precise market rhythm control. But this approach also faces challenges such as short-term retention issues from KOL airdrops and competitive pressure from potential strategy replication by competitors.

It's worth mentioning that several recently hyped large MC memecoin projects have demonstrated significant head effects, where high-influence figures like KOLs and large investors drive traffic and capital inflow, forming a snowball-like spread that further amplifies the token narrative value. For instance, large investors collectively pushed Fartcoin's market value to over $1 billion, and House gained momentum with support from famous KOLs like ansem and him. In contrast, recent MEME coins relying on event-driven or grassroots narratives, despite attracting short-term attention, struggle to convert traffic into effective capital inflow, leading to rapid heat decline.

Trading Robots: Trading Volume Rebounds, Still Down Nearly 90% from Peak

Trading robots are gradually becoming an important tool for on-chain users to improve trading efficiency, and have recently rebounded with market sentiment. Dune data shows that as of May 6, trading robots' daily trading volume reached $85.37 million, with daily users exceeding 57,000, respectively rising nearly 64.1% and 43.8% from recent low points. However, compared to the peak in January this year, daily trading volume and daily users have still dropped by 89.1% and 62.5% respectively.

In fact, for ordinary retail investors, trading robots' functions like smart money tracking, automated follow-trading, and on-chain data analysis enable them to real-time monitor and quickly capture KOL/large investor dynamics in an information-asymmetric market environment, effectively improving participation efficiency and reducing PVP risks.

Meanwhile, retail investors often hold high trust in trading robots recommended or used by heads, and this endorsement effect significantly enhances the market acceptance and activity of related robots. Of course, heads, due to their capital volume and market appeal, are more inclined to use robots with characteristics like operational convenience, fast execution speed, and high success rates to ensure trading efficiency and maximize returns. Therefore, whether trading robots can meet demands in functional diversity, safety, and response speed is a core factor influencing heads' usage willingness. Of course, the potential risk of market manipulation by some heads through robots cannot be ruled out.

For example, Axiom, which recently emerged, quickly gained favor among MEME players with advantages like complex strategy support, efficient trade execution, and user-friendly design, especially by satisfying the core needs of heads (KOLs/large investors), thus rapidly rising to become the leading trading robot in the track.

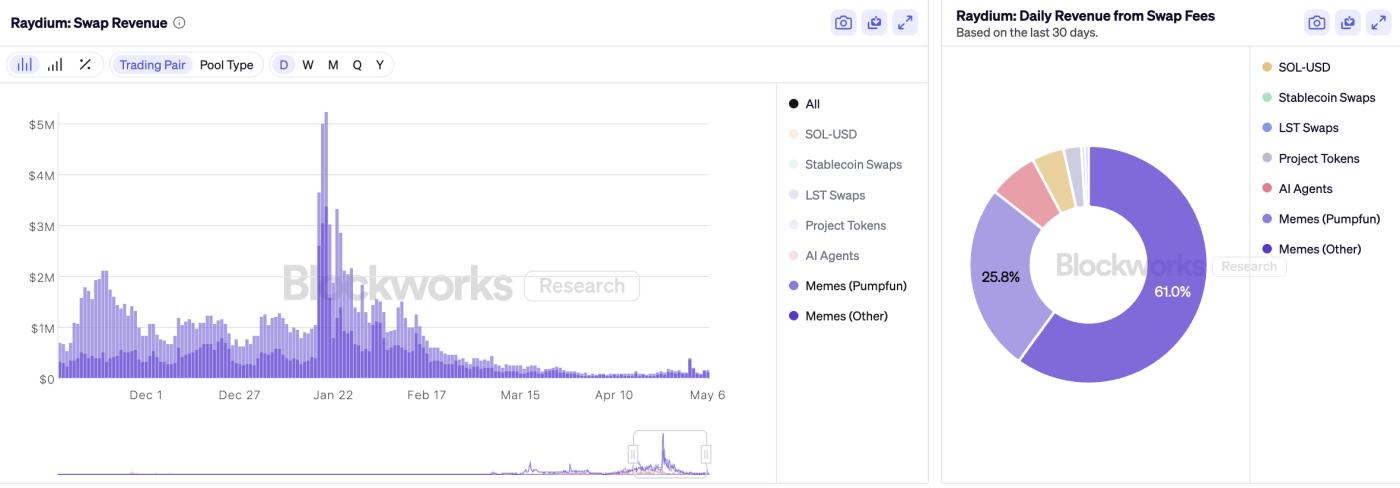

DEX: MEME Revenue Plummets, PumpSwap Shows Initial Advantages

MEME remains one of the core revenue sources for DEXs. Taking Raydium as an example, Blockworks data shows that in the past 30 days of trading revenue, MEME-related trading daily revenue accounted for as high as 86.8%, while daily revenue from MEME token issuance reached 93.5%, demonstrating its dominant position in the platform's overall revenue structure.

However, MEME-brought revenue is experiencing significant decline. Blockworks data shows that as of May 6, Raydium's daily trading revenue from MEME was only $156,000, a drop of over 97% from the January peak of $5.244 million. Simultaneously, daily revenue from MEME token issuance has slid from the high point of $149,000 to just $19,000, also demonstrating the rapid cooling of market heat and obvious retreat of user speculative sentiment.

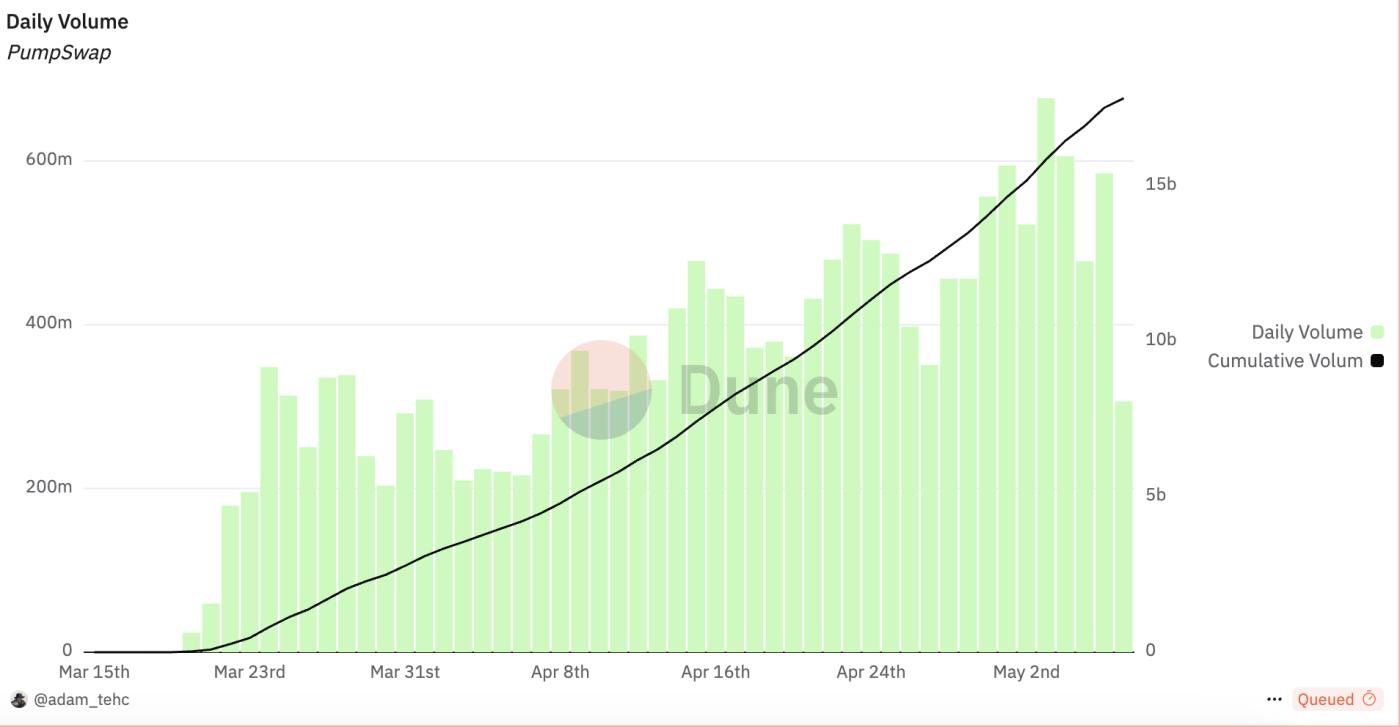

In contrast, PumpSwap has shown strong development momentum. Dune data indicates that since its launch on March 20, the platform has accumulated a trading volume of $17.67 billion, with a significant upward trend from early April, with single-day maximum trading volume exceeding $670 million. Meanwhile, platform user activity has continuously risen, quickly attracting many new users during the cold start phase, with return user ratio gradually increasing, showing strong user retention capability. Notably, in early May, its daily active wallets once exceeded 450,000. Worth noting is that as of May 7, PumpSwap has occupied 12.7% of Solana DEX's total trading volume, gaining an initial competitive advantage in the ecosystem.

In this process, the role of large investors/KOLs cannot be ignored, not only driving significant growth in MEME trading volume but also rapidly expanding liquidity pools and concentrated new user inflow, becoming the core driving factor for platform short-term explosion.

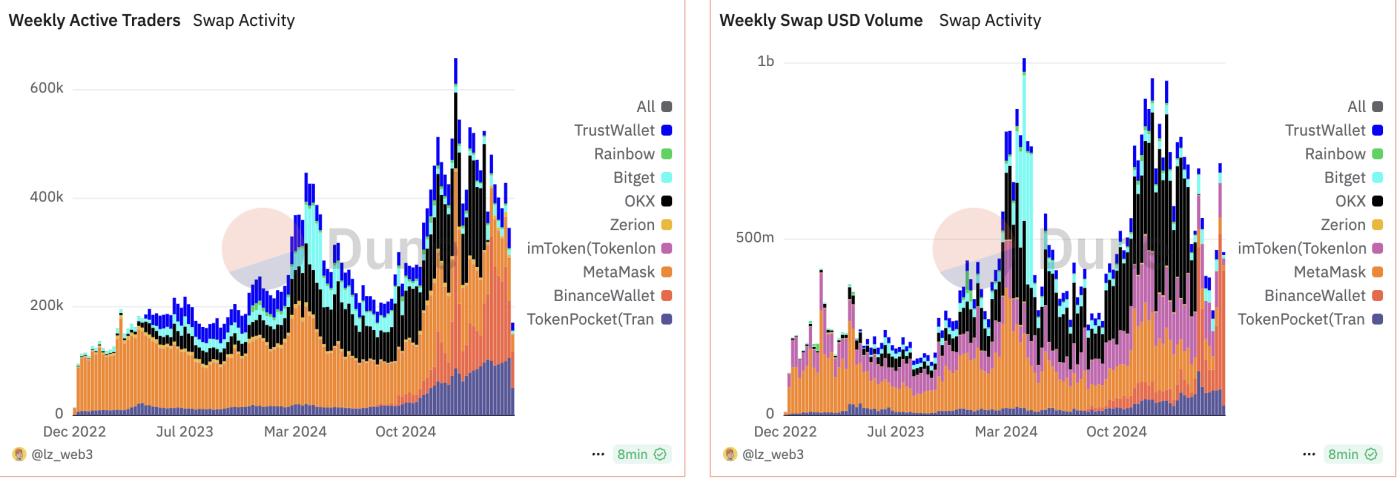

Wallets: Activity Rebounds, Down Over 80% from January Peak

Wallet usage is also an important indicator reflecting on-chain sentiment. Dune data shows that as of May 5, mainstream wallet weekly trading volume reached over $460 million, rebounding 35.2% from recent lows, but only 51.6% of this year's peak (around $950 million). Simultaneously, weekly active wallet addresses reached 17,000, a significant drop of over 80.4% from the January peak of 87,000. This indicates that although trading scale has somewhat recovered, user participation remains low, with overall on-chain activity still in the early recovery stage and market sentiment not yet fully warmed up.

Similarly, the attractiveness and user stickiness of a wallet depend on core factors such as the completeness of its functions, the breadth of use scenarios, and the ability to integrate with the ecosystem. For example, OKX Web3 Wallet and Binance Wallet, which have high market shares, have successfully attracted a large number of MEME players and become the mainstream choice in this niche field. In this process, the usage rate and word-of-mouth effect of large investors and key opinion leaders have also played a crucial driving role, not only significantly improving the wallet's visibility but also enhancing the trust and willingness to use among ordinary users.