Since Bitcoin briefly broke through $10,200 on February 4th, Bitcoin has experienced a three-month-long oscillating stalemate, with its price unable to effectively stabilize above $100,000. Just recently, the market finally witnessed a key breakthrough, with Bitcoin breaking through $10,100, showing a 24-hour increase of 4%.

In the first half of 2025, the crypto market has been through numerous twists and turns, with Bitcoin's market share continuously rising to a historic high. The Trump administration has simultaneously released regulatory benefits while disrupting tariff order and facing market manipulation suspicions.

At the beginning of the year, strong U.S. employment data and persistent inflation pressure led the market to expect the Federal Reserve would delay interest rate cuts. Higher interest rates reduced investors' interest in high-risk assets, causing capital outflows. In February, Bybit suffered a hacker attack, losing assets worth $1.5 billion, becoming one of the largest cryptocurrency theft events in history, which further raised market concerns about cryptocurrency security and suppressed Bitcoin prices.

In early April, Trump announced a new round of tariffs on almost all imported goods, triggering global market panic. Stock markets plummeted, investor risk appetite declined, affecting the cryptocurrency market. As a risk asset, Bitcoin was not spared and experienced a significant price drop.

However, with recent tariff negotiations, ETF fund inflows, continuous holdings by listed companies, and state-promoted strategic reserve bills, Bitcoin is ushering in a new structural rise. The market is showing a trend of transformation from retail to institutional investors, and from speculative risk to asset allocation.

Bitcoin Reserve Plans of Listed Companies and U.S. States

Bitcoin is welcoming continuous "big buyers".

MicroStrategy has always been a firm Bitcoin purchaser. On May 2nd, they announced a bold "42/42 plan" to raise $84 billion for Bitcoin purchases within two years, following their previous "21/21 plan" of $42 billion last year.

Additionally, the Japanese listed company Metaplanet recently announced another investment of $53.4 million to acquire 555 BTC. They also issued ordinary bonds worth $25 million for additional Bitcoin purchases.

The CEO of the Indian listed company Jetking, Harsh Bharwani, stated that they are raising billions to purchase 18,000 BTC.

Jetking's CEO said: "In the next six months, we plan to raise funds and expand to about 180 Bitcoins. In the next year, we will reach around 1,800 Bitcoins. And ultimately, around 2030, using various tools and resources at our disposal, we will reach a scale of about 18,000 Bitcoins."

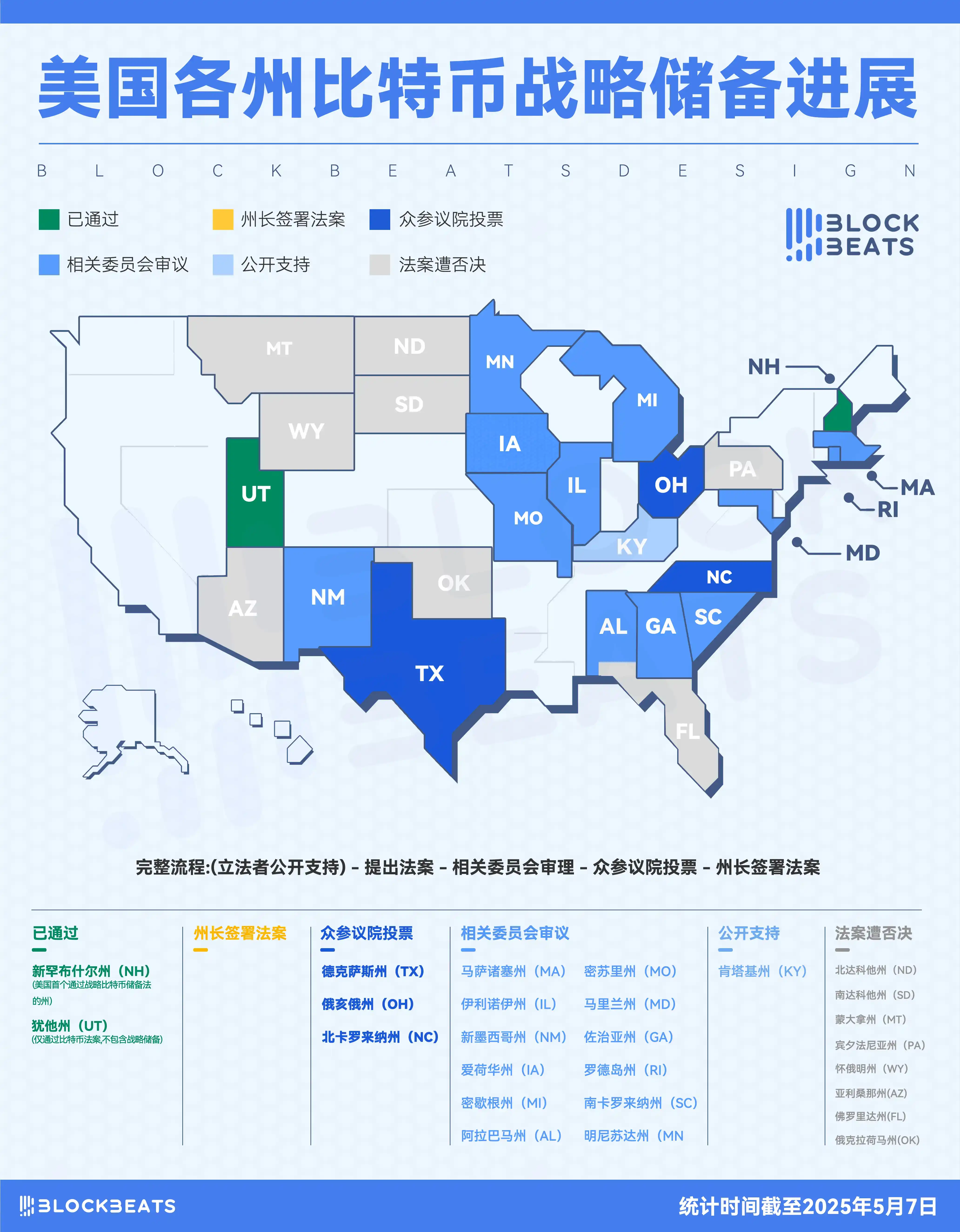

Besides MicroStrategy and other listed companies constantly buying, U.S. states are also progressively pushing Bitcoin strategic reserve bills. At the federal level, Trump has signed an executive order in March requiring the establishment of a strategic Bitcoin reserve and digital asset inventory.

On May 7th, crypto journalist Eleanor Terrett revealed that New Hampshire became the first U.S. state to pass a strategic Bitcoin reserve bill, authorizing state financial officials to directly purchase or through exchange-traded products (ETP) the world's largest digital asset.

In the early morning of yesterday, the Texas Strategic Bitcoin Reserve Bill (SB 21) passed the DOGE committee review without amendments and will enter the final full vote stage. As the Texas legislature will adjourn on June 2nd, the final result of the bill is expected to be revealed in the next three weeks. The bill is an important legislative initiative for Texas to establish a strategic Bitcoin reserve and has completed all committee review procedures, just one step away from final passage.

Related reading: 《After the King's Signature, Which U.S. States Are Steadily Promoting Bitcoin Strategic Reserve Bills?》

Interest Rate Cut Expectations and Improved Trade Environment

On the morning of May 8th, the Federal Reserve, withstanding Trump's pressure, announced maintaining the benchmark interest rate between 4.25% and 4.5%. This is the third consecutive meeting without a rate cut. Despite the U.S. economic contraction in the first quarter and inflation pressure caused by Trump's import tariffs, the Federal Reserve still stated that the economy is "steadily growing", the job market is "strong", and emphasized that the current inflation level is "slightly high but controllable", without releasing an immediate rate cut signal.

However, Powell stated that "despite increasing uncertainty, the economy remains fundamentally robust". He noted that the unemployment rate remains low, and the labor market has "reached or is close to full employment". The market expects the Federal Reserve to reduce the federal funds rate to 3.6% by the end of 2025.

BitMEX co-founder Arthur Hayes said at the recent Token2049 conference that investors should thank U.S. monetary authorities. He believes inflation might continue, which the market generally sees as positive for assets like Bitcoin. In an interview, he also pointed out: "I think the current market environment is very suitable for the rise of risk assets, just like we saw from the third quarter of 2022 to early 2025."

Analysis shows the current market presents a complex game: on one hand, the high-interest-rate environment continues to suppress investors' interest in high-risk assets like cryptocurrencies; on the other hand, geopolitical risks combined with inflation expectations are driving some funds to use Bitcoin as a "digital gold" for hedging and allocation.

Notably, the Federal Reserve's policy statement first mentioned "considering broad economic data rather than a single indicator", which the market interpreted as a potential future shift towards easing when economic slowdown signs become clear. Currently, CME rate futures show a 68% probability of a September rate cut, an increase of 12 percentage points from before the resolution. The correlation between the crypto market and traditional financial markets continues to strengthen, with macro policy changes becoming key variables affecting digital asset prices.

Besides the Federal Reserve's rate cut expectations, the market also received a definitive positive signal with progress in tariff negotiations. On May 8th, the UK and the U.S. reached an agreement on tariff trade terms, with the UK government agreeing to make concessions on importing U.S. food and agricultural products in exchange for reduced tariffs on UK car exports.

According to CNBC, U.S. Treasury Secretary Becent said in an interview on Monday that he expects progress in U.S.-China trade negotiations in the coming weeks and noted that Trump's 145% tariffs on China cannot be maintained long-term. This suggests that the Trump administration has some room for softening its tariff policy, which is beneficial for the stable development of the crypto market.

Continuous Net Inflow of Bitcoin ETF

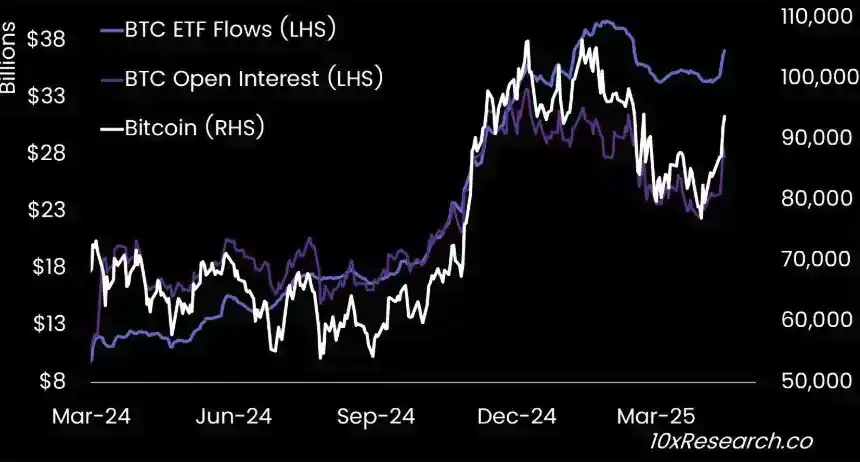

In late April, the analysis firm Matrixport stated that from the daily chart since March 19th, Bitcoin ETF funds have been continuously outflowing, with futures market positions also declining simultaneously. From January to April, ETF cumulative net outflow was close to $5 billion.

However, recently, nearly $3 billion of large-scale funds have been observed flowing in, with futures open interest also increasing, while funding rates remain at a low level. This indicates that the current new fund inflow primarily comes from genuine long-term holding demand, with the overall bullish signal more positive compared to the ETF buying driven by arbitrage funds earlier this year.

On May 4th, according to Farside data, Bitcoin ETF's total net inflow again exceeded $40 billion, reaching $40.207 billion, approaching the historical high point. The highest total net inflow for Bitcoin ETF occurred on February 7th, reaching $40.78 billion.

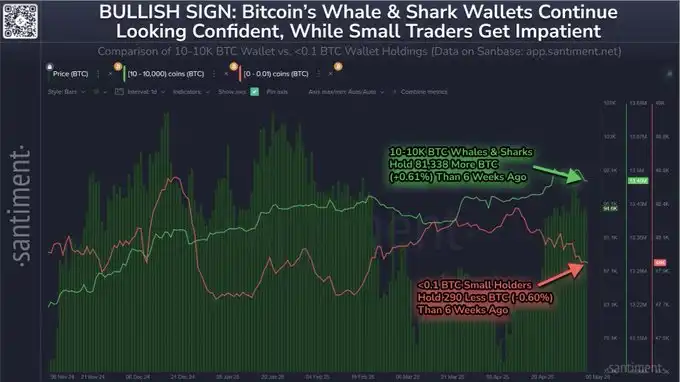

Meanwhile, data shows that while Bitcoin continues to consolidate below $100,000, small-investors have started started selling BTC. Crypto analyst Santiment recently pointed out that the behavioral differences between Bitcoin whales and retail investors often indicate that Bitcoin may be moving towards the next upward trend.

Data shows that wallet addresses highly correlated with the overall crypto market health (holding 10 to 10,000 BTC) have collectively accumulated 81,338 Bitcoins during the past 6 weeks of volatility, representing 0.61% of their total holdings.

At the same time, small wallets (holding less than 0.1 BTC), which typically exhibit a a lagging inverse inverse relationship with price trends, have sold 290 Bitcoins over the past 6 weeks, representing a reduction of approximately 0.60% of their total holdings.