Michael Saylor, CEO of Strategy (formerly MicroStrategy), suggested that the company may be preparing for another large Bitcoin purchase.

This suggestion appeared as Bitcoin gained new momentum, crossing the $100,000 threshold for the first time in several months.

Increasing Bitcoin Betting Strategy

On 05/11/2025, Saylor posted a screenshot of the company's Bitcoin portfolio tracker on the social media platform X, along with the phrase "connecting the dots."

Although brief, this post follows a familiar pattern of Saylor using mysterious messages before official announcements. These messages often indicate that the company is preparing to add more BTC to its balance sheet.

According to the Saylor Tracker platform, Strategy currently holds 555,450 BTC, currently valued at over $58 billion. This makes the company the largest cryptocurrency holder in the world.

Strategy's Bitcoin purchases. Source: Saylortracker

Strategy's Bitcoin purchases. Source: SaylortrackerMeanwhile, Strategy's bold approach to Bitcoin has influenced many other companies to follow suit.

To clarify, Japan's Metaplanet, which currently holds over 5,000 BTC, has been compared to MicroStrategy in Asia. The company recently launched a unit in the US to expand its Bitcoin strategy beyond regional borders.

At the same time, competition is increasing in the US corporate Bitcoin space. Banking giant Cantor Fitzgerald, in partnership with stablecoin issuer Tether, has launched a joint $3 billion initiative to build a dedicated Bitcoin treasury company.

Elsewhere, Vivek Ramaswamy's Strive has merged with Asset to create another player in this field.

Bitcoin Surpasses $104,000 as Market Optimism Increases

Strategy's purchase hint appeared as Bitcoin increased 10% in the past week, pushing it above $100,000 for the first time since February.

At the time of writing, BTC was trading at around $104,621, only 4% below the All-Time-High of $109,021 in January.

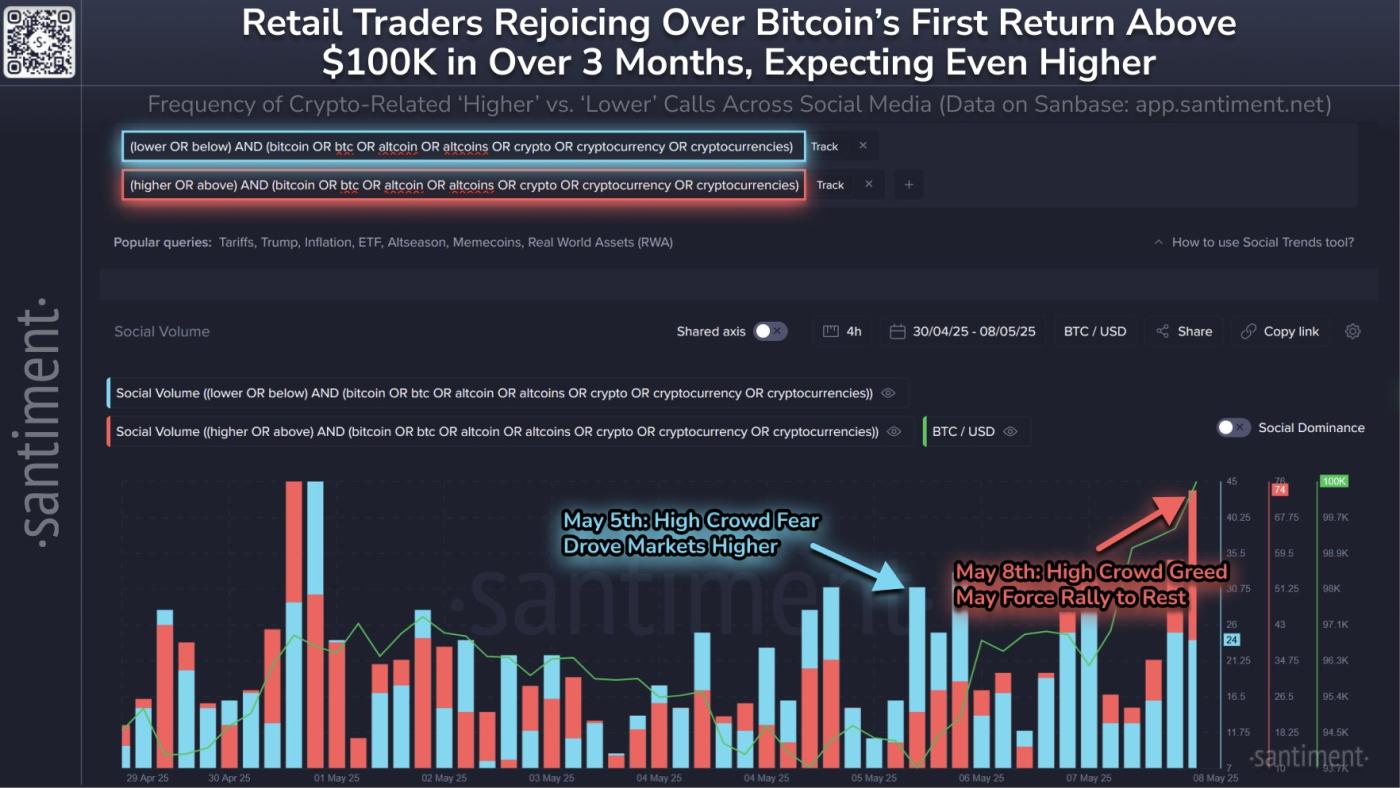

Market analysts at Santiment point out that the current market sentiment is very optimistic, which could lead to a short-term correction. They note that retail investor enthusiasm and media hype often coincide with local market peaks.

"With Bitcoin crossing the important psychological resistance level of $100K for the first time since 02/03. The current sentiment is quite optimistic, which could be a double-edged sword for upcoming price volatility," Santiment noted.

Bitcoin market sentiment. Source: Santiment

Bitcoin market sentiment. Source: SantimentHowever, Saylor remains confident in the long-term value of this top asset. According to him, Bitcoin would have been trading at $150,000 if not for recent selling pressure, reflecting short-term investors taking profits.

Nevertheless, he expects long-term investors to continue driving the price increase in the coming weeks.