Author: Henry Shi

Translated by: Random Squad

Squad Introduction

Henry Shi is the Co-founder and COO of Super.com (formerly Snapcommerce), who successfully led the company to annual revenue of $150 million.

Recently, after in-depth communication with over 100 founders, Henry summarized four early enterprise financing models and analyzed them with detailed data, believing it will definitely open up new perspectives for you. Enjoy!

Henry Shi recently exited his startup with annual revenue of $150 million and raised $200 million. He discovered a shocking fact: 90% of founders are fundamentally wrong in establishing their companies.

For decades, entrepreneurs have been trapped in a false binary choice: either Bootstrap (meaning struggling for years) or fundraising (meaning potentially giving up control). But in 2025, AI changed everything. Henry Shi witnessed a revolution in company creation models, with the wisest founders applying an almost unmentioned emerging model.

Henry communicated with over 100 founders and learned from excellent founders on the Lean AI ranking. Based on this, he summarized four methods of creating companies and raising funds, and provided his recommendations.

I. Traditional Financing: The Way Making Most Founders Fail

Model 1: Bootstrapping

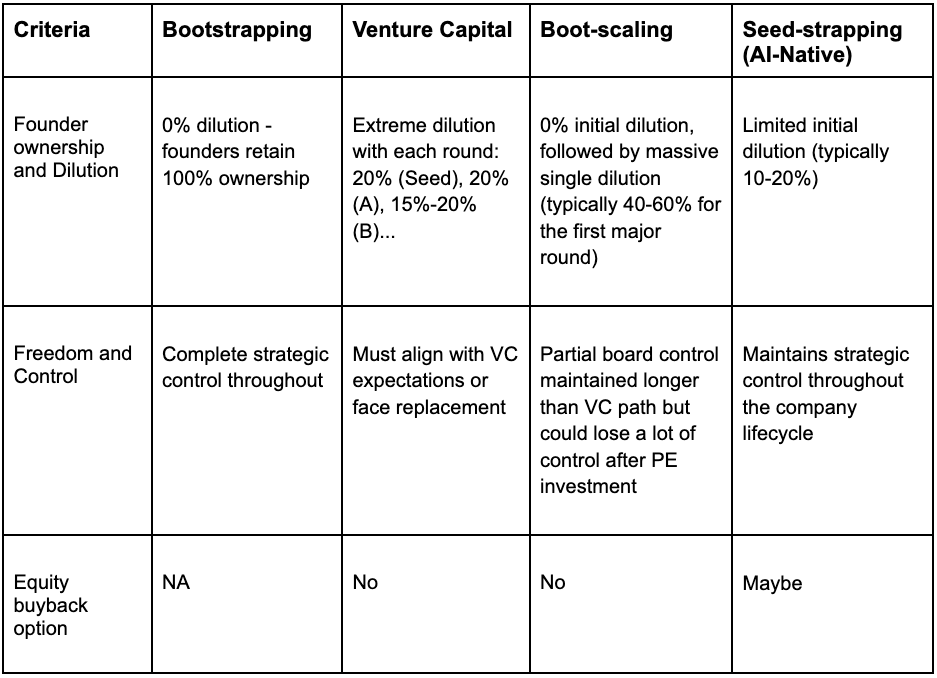

Founders bear all funds themselves, maxing out credit cards, emptying savings accounts, but retaining 100% ownership. In this model, 90% of startups fail within the first 3 years, with Bootstrapped companies having a higher failure rate compared to companies accepting other financing methods.

8 out of 10 Bootstrapped companies will fail within 18 months due to funding constraints. For years, entrepreneurs' personal financial situations remain in continuous deficit, with no guarantee of company survival. Even successful Bootstrapped companies typically require over 5 years to reach six-digit revenue (and only under conditions of working 80-hour weeks with wages below minimum wage standards).

Model 2: Venture Capital

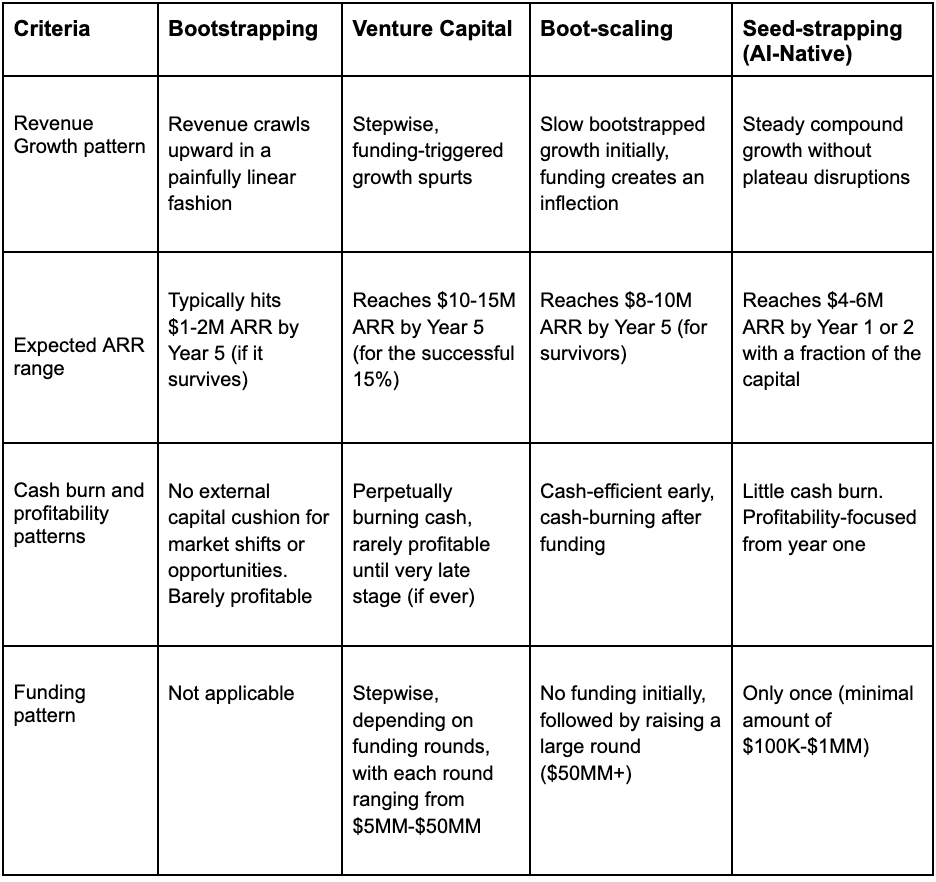

Among numerous VC-supported startups, 75% of companies never bring returns to investors, with only 0.1% growing into unicorn companies that provide investors with substantial returns, as reported by TechCrunch.

However, in this model, all founders must operate as if they will be part of that 0.1%. Founders must give up significant equity in each funding round: 20% in seed round, 20% in Series A, 15-20% in Series B, and so on.

By Series C, founders typically own only 15% of company shares, while 99% of companies never even reach this stage. A founder who builds a $50 million company through VC often has less personal wealth compared to a founder who builds a $10 million company through Bootstrapping.

Model 3: Boot-Scaling

Entrepreneurs first Bootstrap until the company shows good development momentum, then conduct a large-scale financing round, usually from private equity.

The advantage of this method is retaining company ownership in the early stages, but it also has several risks: entrepreneurs must endure years of financial constraints from Bootstrapping. Subsequently, they will be significantly diluted in this large-scale financing (potentially 40-50%), losing company control to private equity buyers who might destroy company culture.

This approach is high-risk: entrepreneurs exhaust personal funds, then bet everything on this "expansion", which has a 72% failure probability.

II. New Model: Made Possible by AI

Model 4: Seed-Strapping (Applicable to AI Native Enterprises)

For AI native enterprises, this model is precisely why Henry is excited about the future of company creation. Entrepreneurs need to find investors who understand the founders' desire to maintain company control and ownership, and are willing to invest $100,000 - $1 million in seed funding.

From the first day of company establishment, focus should be on revenue and profitability, disregarding vanity metrics that impress VCs. Entrepreneurs can grow revenue without further equity dilution, allowing 100% focus on business without worrying about fund depletion or constantly chasing VC funding.

As AI disrupts the economic model of company creation, more founders are expanding AI-based services and pricing by results - something impossible in the past. Now, entrepreneurs can quickly become profitable and raise ARR to seven or even eight digits.

In this model, entrepreneurs can obtain stable returns from profits without waiting for uncertain exit opportunities. Over time, they might even repurchase equity, increasing their personal stake. The model's greatest advantage is achieving compound revenue growth in the early stages of entrepreneurship.

For example:

The same $100,000, starting today and compounding at 30% annual growth for 5 years, will yield much higher returns compared to starting two years later with the same growth rate.

$100,000 × 1.3^5 = $371,000,

$100,000 × 1.3^3 = $219,000,

That's 70% higher income.

III. Why AI Makes Seed-Strapping the Ultimate Model

AI fundamentally disrupts the economic model of company creation:

According to YC, 25% of the YC W25 code library is almost entirely AI-generated.

Over 15 AI native companies raised ARR to eight digits within 1-2 years with teams of less than 50 people.

As AI can generate complete functional systems, some software development costs are approaching zero.

These changes bring numerous opportunities: today, independent individual entrepreneurs can also build $100 million companies. Henry knows some vertical industry expert founders who, with AI assistance, achieve $3-5 million ARR with zero employees.

With AI's help, capital efficiency significantly improves. Companies that required $3 million to start in 2020 can now launch with $100,000. Moreover, AI native companies' market entry time has dramatically shortened from months or years to weeks.

Compared to traditional SaaS companies, AI-related services have much higher average contract value (ACV) - because AI-based services can be priced by results, not per seat. These services can also occupy the wage portion of company budgets, which is several times higher than software budgets.

Profitability has become unprecedented. Historically, wages were the largest startup expense, consuming 70-80% of funds. But AI native companies can now operate with extremely few or no employees, achieving over 80% profit margins from day one, without spending years building large teams.

Finally, adopting the Seed-Strapping model maintains flexibility with multiple options like generating cash flow, selling the company, or raising VC funding, with almost no significant drawbacks.

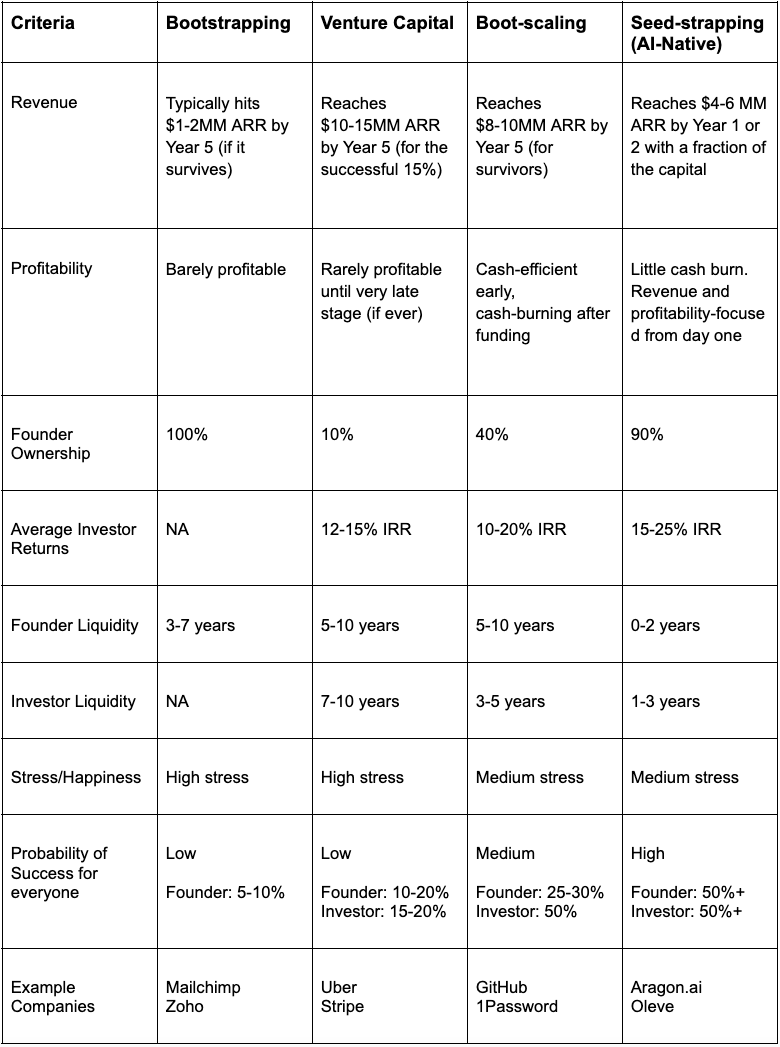

IV. Intuitive Comparison of Four Models

Henry will comprehensively analyze the performance of these models based on indicators truly important to founders and investors.

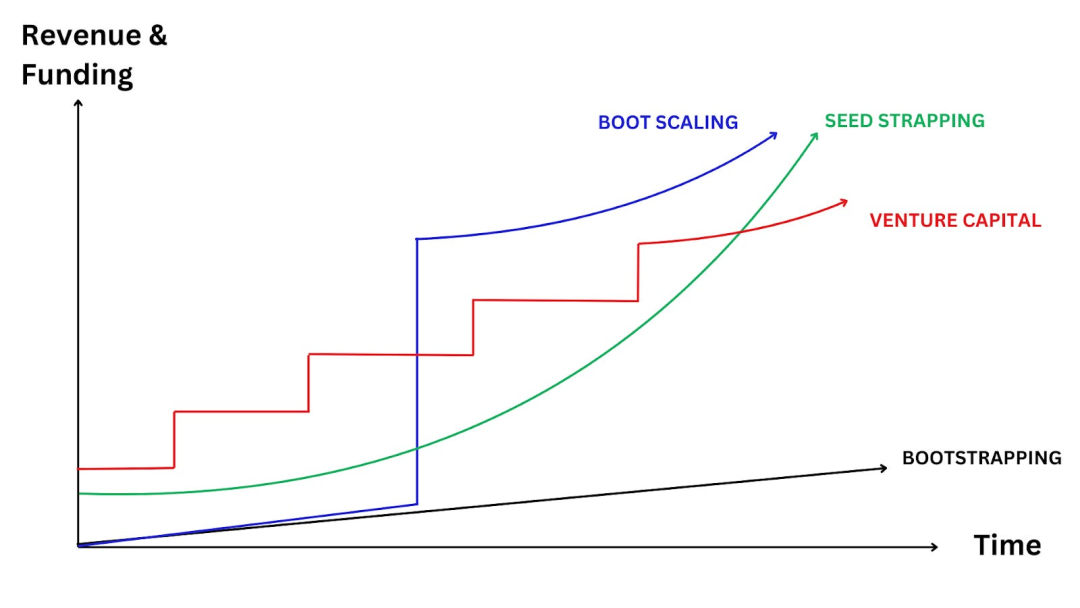

1. Revenue Growth + Financing Trajectory

The Seed-Strapping model combines the advantages of both models: having initial funds to allow founders to freely advance plans without worrying about fund depletion, while not needing frequent fundraising. Compared to pure Bootstrapping, it enables faster growth while maintaining a sustainable economic model.

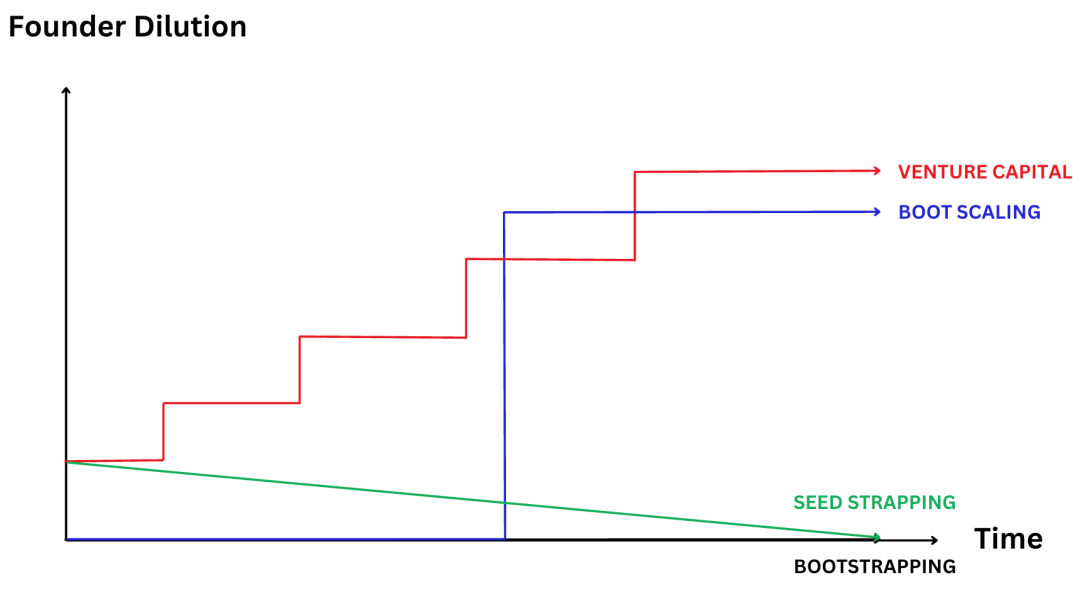

2. Founder Equity Dilution and Control

The Seed-Strapping model is the only model where founders can potentially increase their shareholding percentage over time through continuous stock repurchase. Entrepreneurs can obtain funding support through investment without falling into the endless equity dilution dilemma as in the VC model. In this model, entrepreneurs can firmly grasp the strategic control of the company's development, achieving a perfect balance between ownership and leverage.

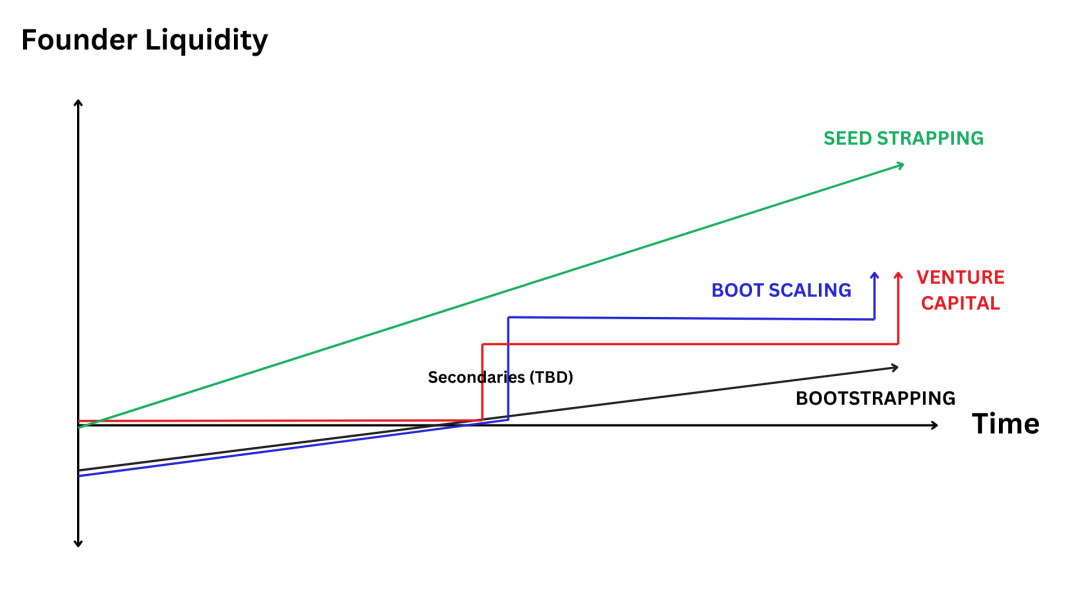

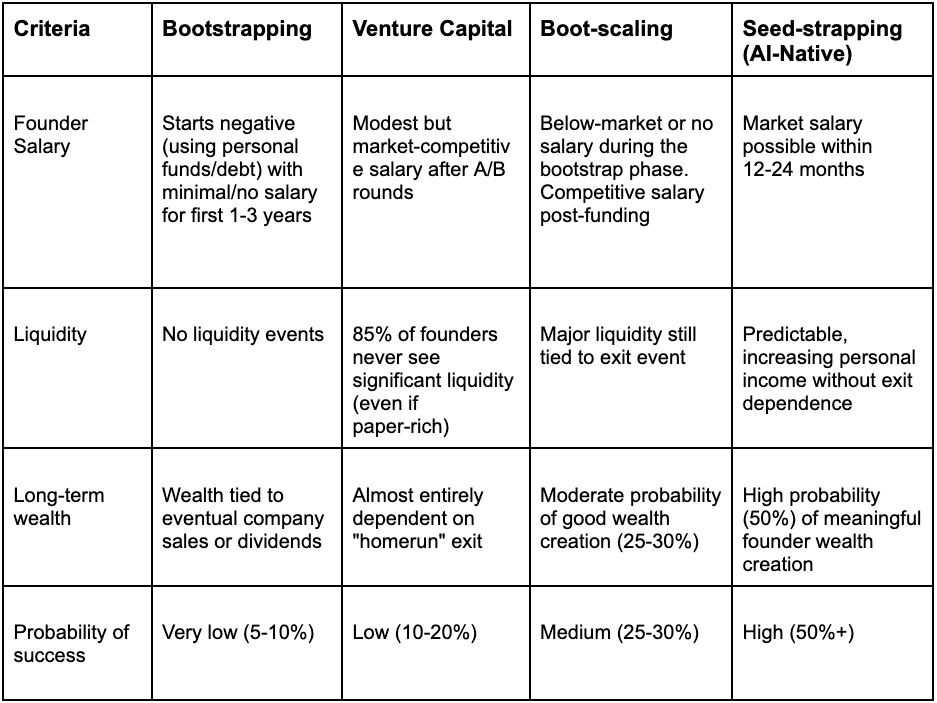

3. Founder Financial Liquidity (Money in Pocket)

The Seed-Strapping model is the only model that always prioritizes putting funds into the founder's pocket, even in the early stages of entrepreneurship. While other founders spend years hoping for a potentially never-realized unicorn exit, entrepreneurs using the Seed-Strapping model have accumulated considerable personal wealth through profit distribution year after year. This is a financial freedom that does not require selling the company or relying on going public.

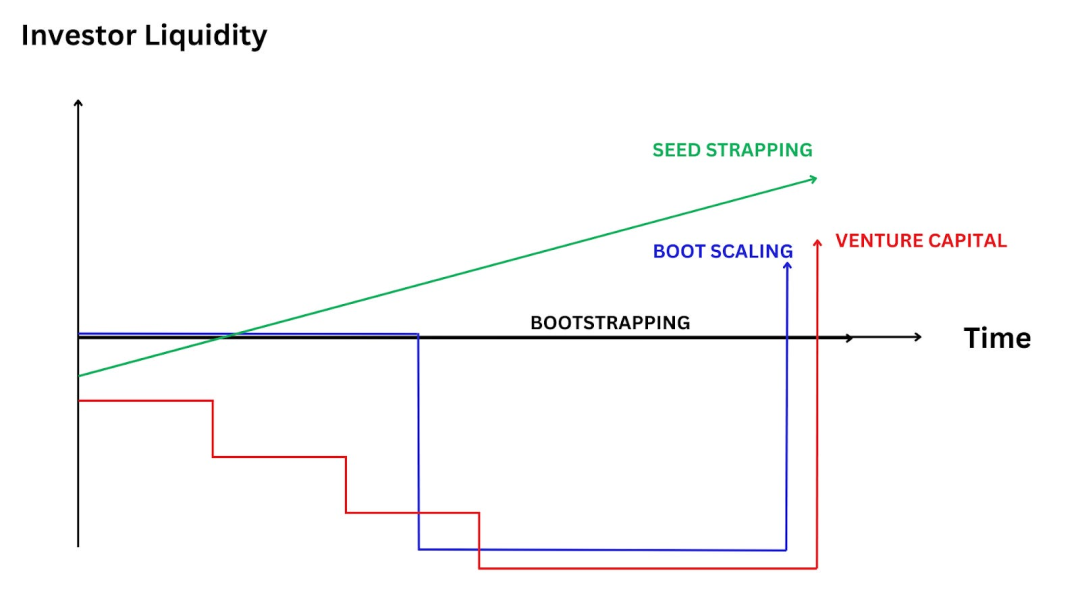

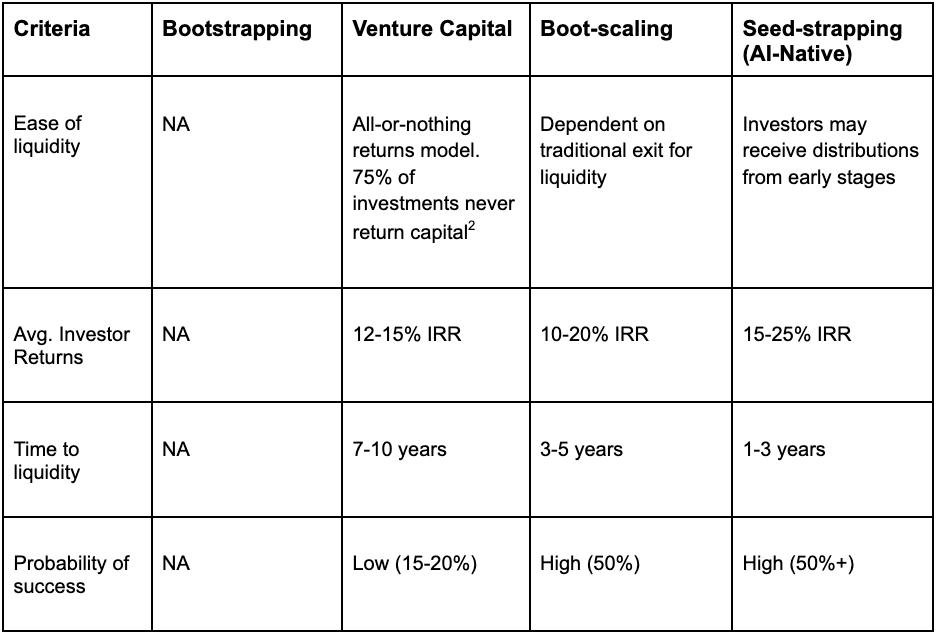

4. Investor Returns and Liquidity

The Seed-Strapping model builds a win-win situation between founders and investors that other models can hardly achieve. Investors do not need to wait for ten years to obtain uncertain illiquid returns, but can instead receive early and continuous liquidity returns. The stability of these returns means that investors will support the sustainable growth of the enterprise, rather than pushing for premature exit or unnecessary financing (their interests are truly aligned with the entrepreneurs).

Five. Summary of Four Models:

Six. Psychological Aspects

Beyond the numbers, there are psychological differences:

Bootstrapp founders often feel constrained by their "success", creating jobs they cannot escape from.

VC-supported founders face the most pressure, constantly pursuing growth while worrying about running out of funds.

Entrepreneurs using the Boot-scaling model describe it as like riding a "roller coaster", first experiencing initial difficult struggles, then facing pressure to prove themselves to investors.

Seed-Strapping model entrepreneurs state they have the highest satisfaction, freedom, and sense of control, while maintaining flexibility and having multiple subsequent options (such as generating cash flow, selling the company, raising VC, etc.).

Seven. The Path Forward for AI Native Enterprises

For entrepreneurs in AI native enterprises, the "Seed-strapping" model provides an ideal balance:

Having sufficient funds to effectively utilize AI tools.

Minimal or no equity dilution, thus retaining founders' ownership of the company.

Ability to quickly achieve personal profitability.

No need to exhaust oneself in the VC model, yet capable of achieving compound growth effects.

As obstacles to enterprise scale expansion gradually disappear, having the opportunity to build a "billion-dollar single-person company".

Flexibility, with multiple subsequent options (such as generating cash flow, selling the company, raising VC, etc.).