Source: Bitrace

For the Web3 industry, 2024 is a milestone year. The market capitalization of Crypto and the adoption of industry infrastructure have reached unprecedented heights, while the criminal industry has begun to optimize its business or create new criminal paradigms using Crypto infrastructure more extensively. This report aims to statistically disclose the scale of major crypto crime types and clarify the impact of compliance facilities on the criminal industry's scale, calling on the industry and government to pay attention to the harm caused by crypto crimes.

Due to space constraints, this article only shows part of the report's conclusions and data. Please visit the Bitrace official website to download the full version.

Cryptocurrency Crime Situation Remains Severe

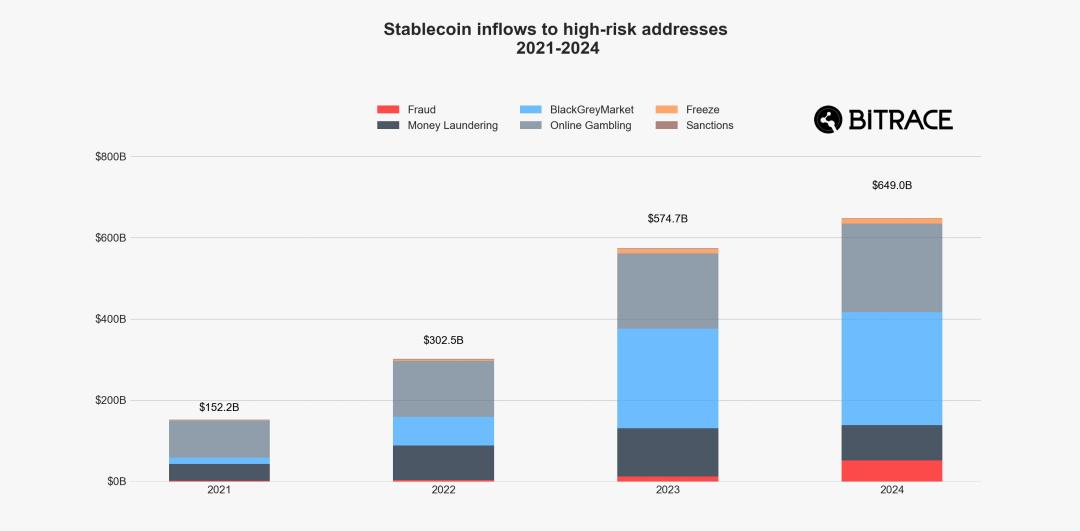

Stablecoin Received by High-Risk Addresses

Considering that risk activities mainly occur on Ethereum and Tron networks, Bitrace defines blockchain addresses used by illegal entities to receive, transfer, and store stablecoins (erc 20 _USDT, erc 20 _USDC, trc 20 _USDT, trc 20 _USDC) as high-risk addresses. In 2024, the total receiving scale of such high-risk addresses reached $649 billion, slightly higher than the previous year.

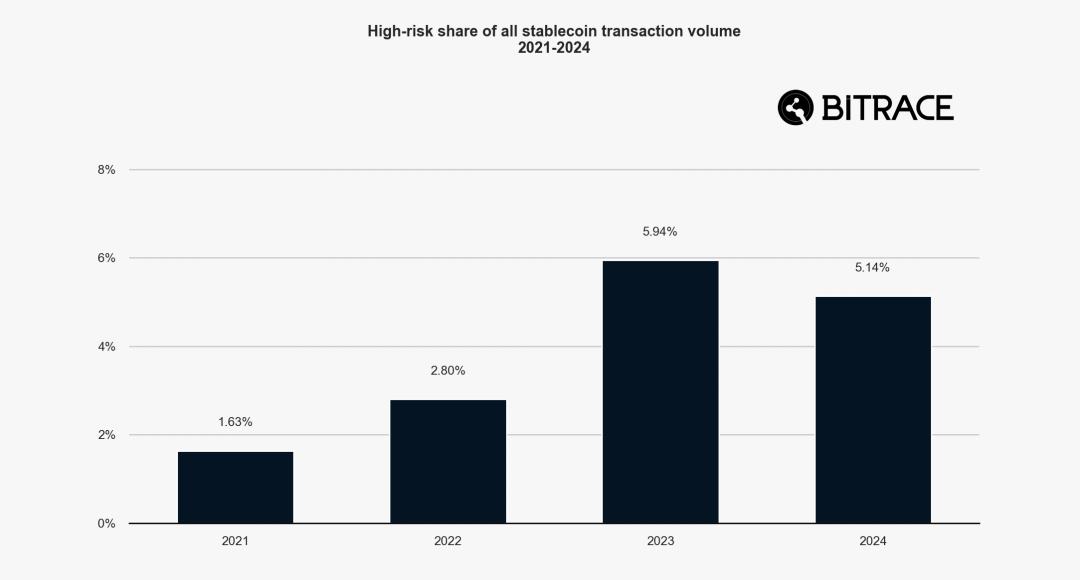

Proportion of High-Risk Activities in Total Stablecoin Transactions

Calculated by transaction volume, these high-risk activities accounted for 5.14% of the total stablecoin transaction activities that year, decreasing by 0.80% compared to 2023, but still significantly higher than in 2021 and 2022.

Stablecoin Classification Received by High-Risk Addresses

Calculated by stablecoin type, USDT has occupied the main share in the Tron network from 2021-2024. However, in 2024, the share of USDT and USDC in the Ethereum network has increased.

Online Gambling Scale Continues to Grow

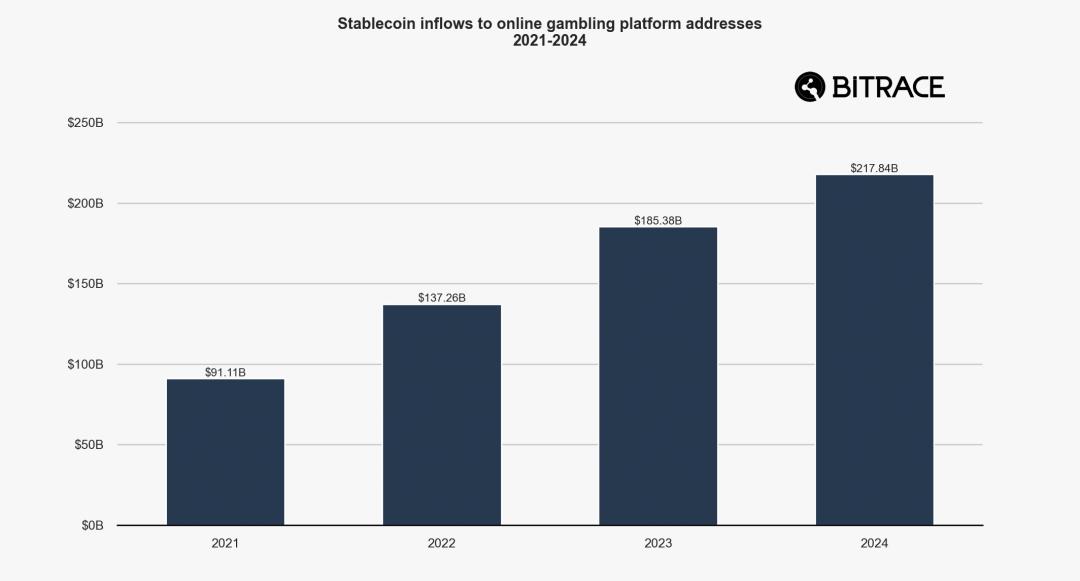

Stablecoin Received by Online Gambling Platforms

In 2024, the fund scale of online gambling platforms and payment platforms providing deposit and withdrawal services reached $217.8 billion, increasing by over 17.50% compared to 2023.

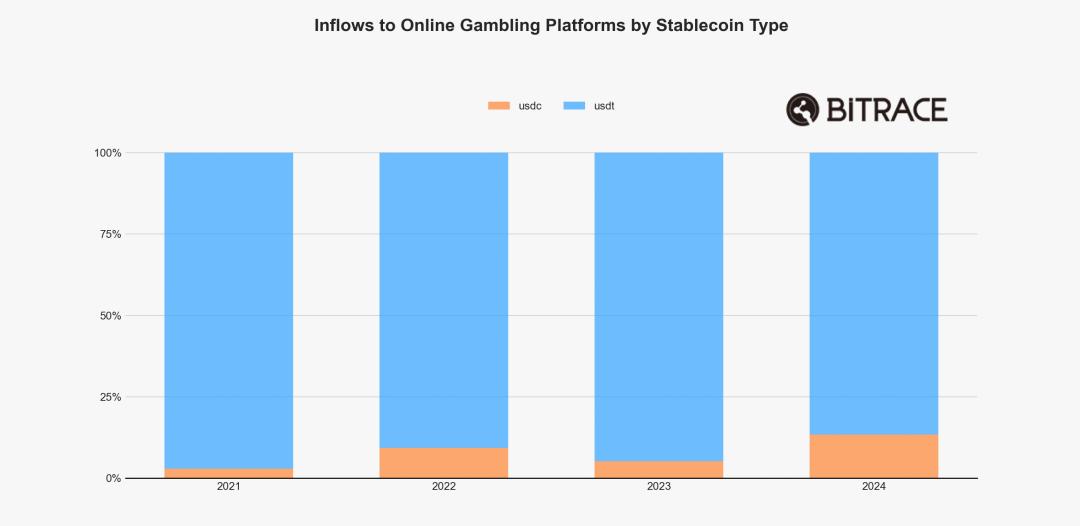

Stablecoin Classification for Online Gambling Platforms

Statistically, the proportion of USDC in online gambling platforms increased significantly in 2024, reaching 13.36%, far higher than 5.22% in 2023. This indicates that as USDC's market share increases, its adoption in online gambling has greatly improved, despite being issued and regulated by compliant entities.

(Translation continues in the same manner for the rest of the text)Despite regulatory measures by government departments having a massive impact on sanctioned entities' businesses, they have little effect on criminal groups engaging in illegal activities through these infrastructures, as the anonymity and permissionless nature of crypto technology make such entities difficult to sanction and highly replaceable. Regulatory bodies should conduct more in-depth investigations into crypto crimes and take corresponding law enforcement actions against criminal groups.

Regulation Brings Positive Impact to Hong Kong

2024 is a year of accelerated compliance for the crypto industry. From a global perspective, major regulatory agencies have shifted from a wait-and-see attitude to more active involvement, driving the industry towards a more standardized and transparent direction. Taking Hong Kong as an example—

Hong Kong's compliance policies have constructed a safer and more controllable crypto ecosystem through clear legal requirements, customer fund protection, combating illegal activities, attracting institutional funds, and aligning with international standards. This not only reduces direct financial losses from hacker attacks, platform bankruptcies, or legal penalties but also lowers indirect risks by enhancing market trust and stability. For crypto entities, while compliance costs increase in the short term, they significantly reduce the possibility of funds being exposed to uncontrollable risks in the long run.

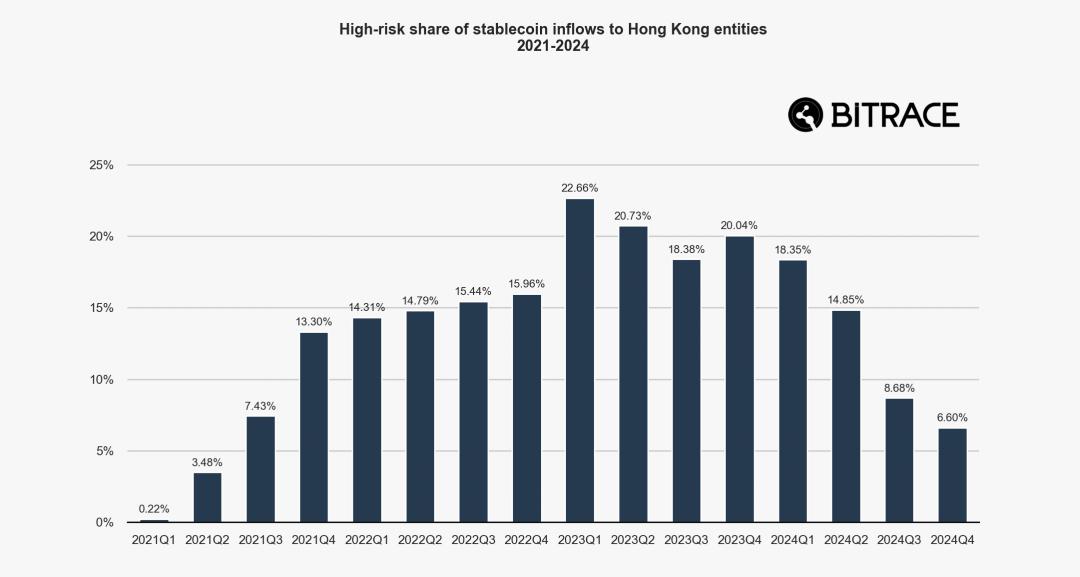

Proportion of High-Risk Funds in Stablecoins for Hong Kong Web3 Entities

By analyzing funds for VATP and VAOTC addresses primarily serving Hong Kong customers, data shows that the proportion of risk stablecoins flowing into the local market drastically decreased after the third quarter of 2023, indicating that local stablecoin trading activities related to risk activities have been effectively suppressed following the release of compliance policies and several landmark crypto-related cases.

Summary

2024 is a year of comprehensive industry revival and a crucial year for major economies to seriously address the industry. Although the scale of crypto crimes remains unchanged, top-down compliance and regulatory policies, along with bottom-up industry self-regulation, have already brought positive impacts to the crypto industry in some countries and regions.

The industry will embrace a safer and more trustworthy future, which we believe is self-evident.