President Trump once again calls on Fed Chairman Jerome Powell to cut interest rates, but the crypto community seems to no longer care. The interest rate cut appears unlikely, but the market has new price increase stories.

Amid the US-China trade deal, new investors and technological advances, recession fears seem to have left the crypto market.

Trump Continues to Push for Interest Rate Cuts

As Trump's tariffs threaten to disrupt the global economy, the crypto industry has pinned its hopes on a price increase story: US interest rate cuts.

The US President continuously criticizes Jerome Powell, even threatening to fire him before conceding, but Powell and his allies remain steadfast: this will not happen. Trump continues to request, calling on Powell again today:

Throughout this process, the crypto industry has continuously called for more interest rate cuts, believing that the "money printer" will prevent economic collapse.

Trump recently asked Powell to cut interest rates, but the latest FOMC meeting reaffirmed the status quo. How did crypto react to this? So far, it seems to have understood the message.

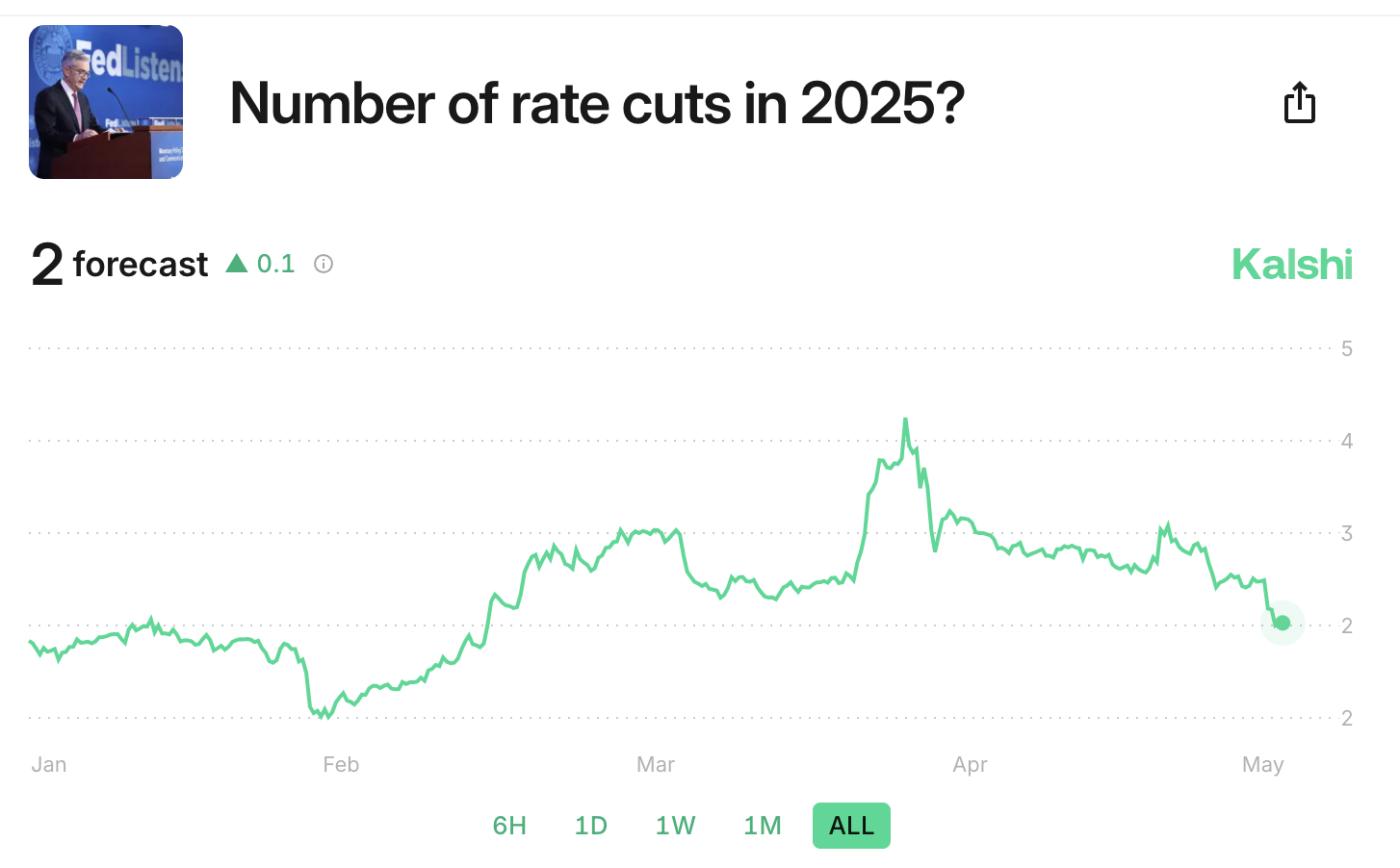

Crypto-related prediction markets like Kalshi have consistently provided optimistic rates about Trump's interest rate cuts compared to TradFi assessments like CME Group. For example, the last time Trump made this request, Kalshi predicted three cuts this year.

At that time, this would mean cuts at half of the remaining FOMC meetings this year. In March, Kalshi even predicted four cuts! Meanwhile, CME placed over 98% probability of no cuts in May.

In reality, this scenario has occurred, and Kalshi has lowered its expectations. Currently, they predict only two cuts for the rest of the year, more in line with other companies' predictions.

How many interest rate cuts in 2025? Source: Kalshi

How many interest rate cuts in 2025? Source: KalshiWhat can crypto conclude from this? The community seems to have realized that Trump cannot force interest rate cuts. However, things are still going well.

A US-China trade deal pushed Bitcoin above $105,000, investors are returning en masse, and technology is advancing. Fear has largely left investor calculations. Who needs interest rate cuts anymore?

All of this is to say that Trump's interest rate cut proposal is just a way to potentially boost crypto investment. If Powell unexpectedly changes his mind today, it would be a good signal, but currently, the crypto market is gradually moving away from these macroeconomic factors.