Author: arndxt, Crypto Researcher; Translation: Jinse Finance xiaozou

Why I No Longer Recommend Friends to "Learn Crypto Knowledge First"

Last month, I tried again to guide an outsider friend into the crypto world. Just ten minutes later, when the process reached "choosing a wallet" and 'now needing to pay gas fees with another token', her eyes began to look bewildered. This made me suddenly realize: We are facing not a knowledge gap, but a design gap.

A cruel reality has become very obvious: Speculation brought the first wave of users, but it cannot bring the next billion users. True popularization begins when crypto products become "invisible" - when people benefit from them without seemingly being aware they are using crypto technology. From the rise of stablecoins to the popularization of institutional staking, and the increasingly important role of AI in shaping the digital economy, the foundation for mass adoption is being laid. But to realize this future, we must stop expecting users to learn crypto knowledge and instead start building products that make them unaware they are even using crypto technology.

Here are eight narrative directions and related projects I believe are worth paying attention to:

1. The Winning Path for Next-Generation Wallets: Doing One Thing Extremely Well

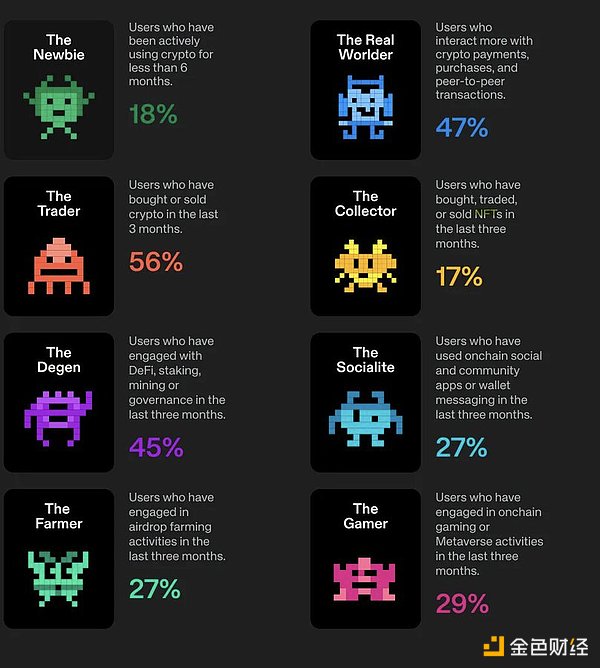

We are witnessing a major structural transformation: Users are forming usage habits around two complementary wallets: one that feels like a fintech app "daily wallet", and another like a bank app "vault wallet".

Wallet experiences are diverging. Those developers trying to cram all functions into a single interface will ultimately be defeated by combination solutions focusing on (a) frictionless onboarding experience and (b) high-security storage solutions.

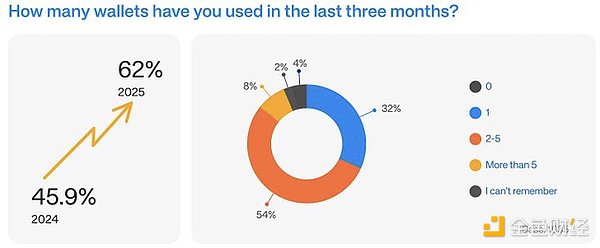

Currently, over half of users are using 2-5 wallets simultaneously, with nearly 48% stating this is because each network still lives in its own walled garden.

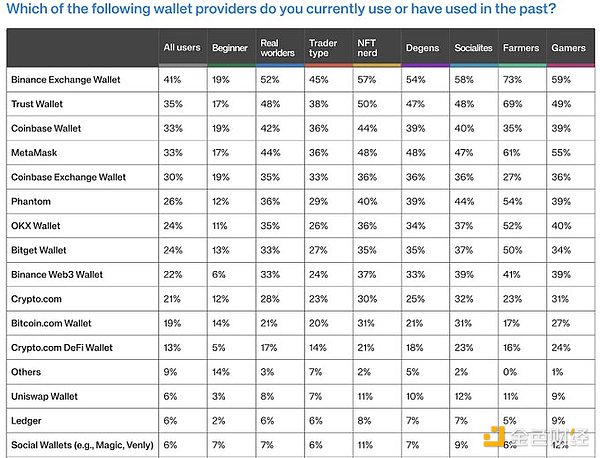

Head concentration phenomenon is obvious:

Among users with over 2 years of experience, 54% are concentrated on using Binance, Coinbase, MetaMask, or Trust Wallet.

In the newcomer group, no single wallet has reached a market share of 20%.

However, self-custody remains intimidating for most users. Interestingly, Binance's own self-custody solution Binance Web3 Wallet only attracted 22% of users, indicating that even within a familiar brand ecosystem, users are still hesitant.

Multiple wallets are a last resort.

After months of observation, I understood one thing: People don't want to manage multiple wallets simultaneously. They do so because they have no choice.

Clearly, the "seamless multi-chain future" we've been discussing has not truly arrived. 48% of users maintain multiple wallets primarily to access different blockchain ecosystems.

44% of users now intentionally split wallet usage for security reasons, higher than last year's 33%.

This tells me two things: The industry has failed to achieve true interoperability and is transferring operational complexity to end-users; meanwhile, these users are becoming smarter - they no longer blindly trust a single wallet to handle all scenarios.

Phantom -- Popular wallet on Solana and Ethereum.

[The translation continues in the same professional and accurate manner for the rest of the text, maintaining the specified translations for specific terms.]Non-Fungible Token will become the default interaction layer for consumer-grade applications: Loyalty points, badges, membership privileges - all of these will increasingly be presented on-chain in the form of Non-Fungible Tokens. Ownership will enable cross-platform transfer and trading, releasing secondary market value for users and opening new profit channels for brands. Imagine Starbucks' loyalty program running on-chain: points earned in one app can unlock benefits across the entire partner service network.

The rise of cultural capital as currency: Non-Fungible Tokens are rapidly becoming the mechanism for users to display identity and cultural belonging in digital space. As social platforms integrate on-chain assets, Non-Fungible Token ownership will evolve into the primary form of digital self-expression, just like wearing brand clothing in the real world.

Evaluation criteria will shift from floor price to user retention: The era of judging Non-Fungible Tokens by speculative value is ending. The new metric is user retention and engagement: How frequently do users interact with the assets? Are these assets linked to continuous experiences, content, or rewards? Builders should design Non-Fungible Token ecosystems that encourage repeated participation, achieved through unlockable content, dynamically evolving token attributes, and real-world benefits.

AI + Non-Fungible Token will launch a new wave of personalized dynamic assets: AI-generated Non-Fungible Tokens tied to user behavior, emotions, or community events are imminent. These dynamic assets will evolve with user participation, creating depth of personalization and emotional connections that static assets cannot achieve.

Treasure DAO -- Non-Fungible Token infrastructure with MAGIC token

Mocaverse Non-Fungible Token -- Infrastructure connecting Animoca brand ecosystem (MOCA token) Rodeo Club -- Non-Fungible Token interaction platform NFP -- AI-generated Non-Fungible Token platform (NFP token)

Finalbosu -- Popular series on Abstract chain

Good Vibes Club -- Emerging series with active community

Onchain Heroes -- Well-known series on Abstract chain

Hypio -- Series with rapidly growing trading volume

steady teddys -- Popular series on Berachain

Pudgy Penguins -- Leading Non-Fungible Token brand with mainstream adoption (Walmart sells physical toys, PENGU token)

Bored Ape Yacht Club -- Iconic series (powerful community and APE token)

CryptoPunks -- Historically significant original Non-Fungible Token series

Azuki -- Anime-style series (ANIME token, strong brand influence)

doodles -- Colorful series (recently launched DOOD token on Solana)

Milady Maker -- Cultural phenomenon project (CULT token, powerful community)

6. Bitcoin as a Macro Asset Class

Bitcoin has evolved from a speculative asset to a financial instrument at the macro level.

A parallel transformation is unfolding: driven by the maturation of Layer 2 ecosystem (especially Lightning Network and emerging protocols like Ark and Fedimint), Bitcoin is quietly becoming the transaction layer for global settlement.

As a hidden settlement layer, Bitcoin is powering the next generation of cross-border payments, institutional finance, and sovereign digital reserves.

Bitcoin's macro correlation: From hedging tool to strategic reserve asset: Countries facing de-dollarization challenges are quietly incorporating Bitcoin into sovereign reserve diversification strategies. Institutions and even sovereign actors are viewing it as an essential insurance policy against systemic financial risks.

Layer 2 protocols unlock Bitcoin payment utility: Lightning Network has evolved from a technical experiment to a scalable real-world payment layer, enabling near-instant, low-cost cross-border transactions. New solutions like Fedimint and Ark are addressing Bitcoin's user experience and privacy limitations, making it a truly viable transaction currency in emerging markets. Builders should focus on developing Layer 2-based payment solutions and cross-border financial products, especially for remittance corridors and regions struggling with currency devaluation.

Bitcoin as collateral - Rise of institutional lending and funding strategies: Mainstream institutions are beginning to use Bitcoin not just as passive investment, but as productive collateral in structured financial products. Bitcoin-backed credit tools, fund management solutions, and derivatives seamlessly integrating with traditional financial markets are expected to proliferate.

Emerging global settlement network: As geopolitical friction intensifies, demand for neutral, censorship-resistant settlement channels will grow. Bitcoin has a unique advantage as a global clearing layer for trade settlement, complementing rather than competing with fiat currencies. Infrastructure that abstracts Bitcoin transaction complexity for end-users and enables seamless settlement at the underlying level will drive Bitcoin adoption beyond the crypto-native sphere.

Solv Protocol -- First on-chain Bitcoin financialization and Bitcoin banking solution (SOLV token)

Stacks -- Leading Bitcoin smart contract Layer 2 (STX token) Alpen Labs -- Bitcoin Layer 2 solution Babylon Labs -- Bitcoin cross-chain bridging solution (BABY token)

Zeus Network -- Cross-chain communication platform (ZEUS token) corn -- Ethereum Layer 2 Bitcoin solution (CORN token)

Runes ChainaI -- Bitcoin Layer 2 solution (RUNIX token)

7. Institutional Staking: New Paradigm of Strategic Fund Allocation

As Bitcoin establishes its status as a macro asset class and core component of modern funding strategy, institutional investors naturally begin to consider the next question: How to generate returns from these assets?

While retail investors are still chasing speculative returns through meme coins and high-risk trading, institutional funds are quietly and steadily flowing into structured, yield-generating crypto assets - especially through Ethereum and Solana's staking ecosystems.

While Bitcoin may remain the primary macro hedge, staking is rapidly becoming the bridge for institutional funds to enter productive on-chain capital.

New Institutional Strategy:

Bitcoin shifting from value storage to productive capital: With the emergence of native Bitcoin staking mechanisms (such as through Babylon protocol and upcoming BTC Layer 2 solutions), Bitcoin is beginning to enter the realm of yield generation strategies without compromising its core monetary attributes.

The real opportunity lies in infrastructure, not validators: The next billion-dollar institutional fund inflow will come from platforms providing institutional-grade custody, compliance reporting, and risk-managed staking products.

Yield diversification in uncertain macroeconomic environments: As interest rates peak and traditional fixed-income products lose attractiveness, staking returns become a new risk-adjusted return category. This is particularly attractive for corporate funds seeking diversified allocation, wanting to escape cash holdings and low-yield bonds while avoiding speculative crypto asset volatility.

Core DAO -- Self-custodied BTC staking solution (CORE token)

BounceBit -- Institutional staking platform (BB token) TruFin Protocol -- Institutional-grade liquidity staking Archax -- Regulated institutional-grade exchange (supports HBAR staking)

8. Regulation, Stablecoins, and AI: Next Growth Entry Points

Compliance will unlock stablecoin channels → Cheap, instant global payments create real daily touchpoints → Verifiable on-chain traceability becomes the trust layer for AI-generated value. Payment is just the beachhead of this transformation.

Regulatory optimism: 86% believe more explicit rules will accelerate adoption, only 14% think it will hinder innovation.

Stablecoin growth momentum: Ownership has doubled year-on-year to 37%, already becoming the default payment channel in over 30 Stripe markets.

AI synergy: 64% believe AI will at least accelerate crypto industry development, with another 29% expecting a bidirectional flywheel effect.

WLFI -- Stablecoin pegged to 1 USD (WLFI token)

Ripple -- RLUSD stablecoin (using XRP as gas token) Ethena Labs -- USDe stablecoin (upcoming token for traditional finance) OpenEden -- Yield-generating USDO stablecoin Syrup.fi – SyrupUSDC -- Institutional-grade yield solution (10% annual yield on stablecoin) cap -- Stablecoin protocol providing trusted financial guarantees

Conclusion: UX 2.0 Era - Evolve or Be Eliminated

Users are no longer mesmerized by the "web3" halo. What they expect is: Web2-level ease of use, Web3-level ownership control, and AI-level intelligent experience - all of which are indispensable.

Those teams that can achieve "chain selection imperceptibility", eliminate gas fee pain points, and build-in predictive security mechanisms will transform the crypto realm from a speculative paradise into the connecting link of the on-chain internet. The next billion users may not even realize they are using web3 products - such "imperceptible experience" will be the ultimate victory of user experience.